Gold Mining Stocks: A House Built on Shaky Ground / Commodities / Gold and Silver Stocks 2021

It’s tempting to say that miners areshowing strength compared to gold based on the GDX’s performance, but othermining proxies say otherwise.

Just because a house is standing doesn'tmean its foundations are solid, and that's exactly the case with the miners.

There’s one extra thing that I would liketo point out about mining stocks’ technical picture today (Apr. 8), and that’stheir performance relative to gold.

Some investors might say that miningstocks are showing strength compared to gold as the GDX to gold ratio brokeabove its declining resistance line.

However, I don’t think it’s fair to sayso. I think that seeing a breakout in the GDX to gold ratio is not enough for one to say that the miners togold ratio is breaking higher.

After all, the GDX ETF is just one proxyfor mining stocks, and if miners were really showing strength here, one should also see it in the case of other proxies forthe mining stocks when compared to gold.

For instance, the HUIIndex to gold ratio, the XAUIndex to gold ratio, and the GDXJ ( juniormining stocks ) to gold ratio.

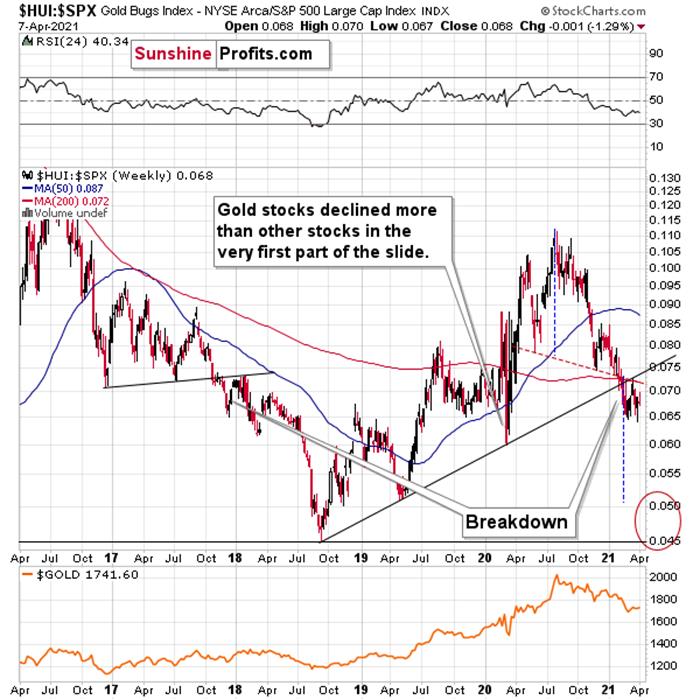

There is no breakout in the HUI to goldratio whatsoever. In fact, the ratio is quite far from its declining resistanceline. Even if we chose other late-2020 tops to draw this line, there wouldstill be no breakout.

There is no breakout in the XAU to goldratio either. The previous attempts for the XAU to gold ratio to rally abovetheir 2020 high marked great shorting opportunities, which is very far frombeing a bullish implication.

But the most bearish implication comesfrom gold’s ratio with another ETF – the GDXJ.

The GDXJ to gold ratio actually providesa sell signal, as the tiny breakout above the declining resistance line wasalready invalidated.

Five out of five previous attempts tobreak above the declining resistance line failed and were followed byshort-term declines. Is this time really different?

It seems to me that the five out of fiveefficiency in the GDXJ to gold ratio is more important than a single breakoutin the GDX to gold ratio, especially considering that it was preceded by asimilar breakout in mid-March. That breakout failed and was followed bydeclines.

Taking all four proxies into account, itseems that the implications are rather neutral to bearish. Especially whentaking into account another major ratio - the one between HUI and S&P 500is after a major, confirmed breakdown.

All in all, the implications of mining stocks’relative performance to gold and the general stock market are currentlybearish.

Thankyou for reading the above free analysis. It’s part of today’s extensive Gold& Silver Trading Alert. We encourage you to sign up for our free goldnewsletter – as soon as you do, you'll get 7 days of free access to our premiumdaily Gold & Silver Trading Alerts and you can read the full version of theabove analysis right away. Signup for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.