Gold Mining Stocks: Huge Upside As Premium Valuations Will Return

Gold companies have historically traded at very high premiums compared to your average stock.

The current valuations of these gold mining stocks are far below where they were 10-15 years ago.

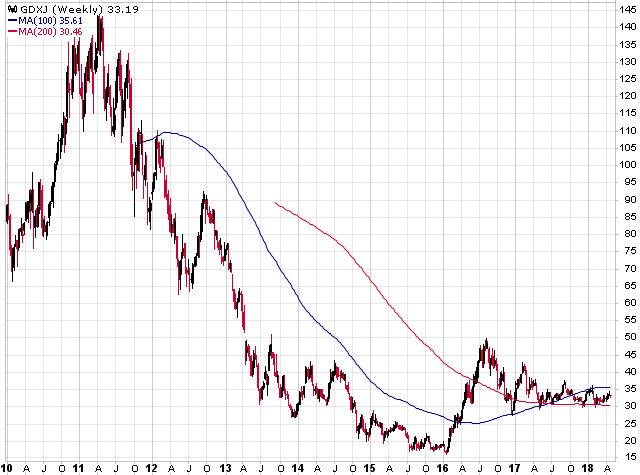

The chart of GDXJ shows that gold miners are on the verge of a return to those premium valuations.

When I first began to heavily research the gold and silver mining sector back in 2003-2004, one of the things I recall most about these stocks was the premium valuations that they commanded. Let me put it in context, though. They weren't grossly overvalued or in a blow-off top phase. In fact, the bull market in precious metals was just getting started, and many of these stocks had just begun to come alive. This was when gold was at $350-400 per ounce - so still very early stages of the prior bull run.

Gold companies have historically traded at very high premiums compared to your average stock. It's justified as well, given that these companies are mining a "precious" metal - which is always going to have far more value and cachet attached to it than your average commodity. I believe the risks that these mining companies take on also partially justifies a premium valuation, as they need to have strong support from investors and analysts in order to raise capital, build new mines and grow their businesses - all in order to keep the worldwide supply of gold high enough to meet demand.

Things have changed drastically over the last 10-15 years. The premiums in this sector have completely vanished, and stocks in this sector are still trading at historically low valuations (despite the surge from the January 2016 bear market lows).

A few examples

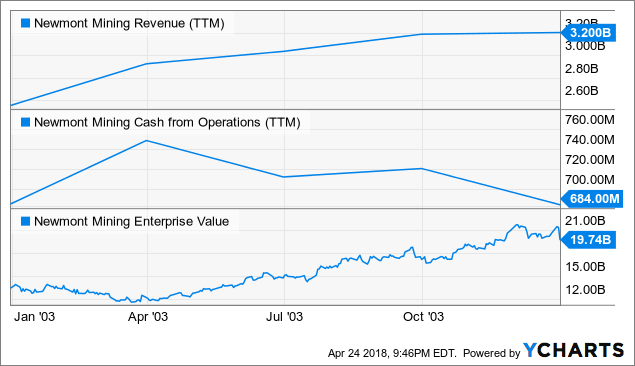

In 2004, Newmont Mining (NYSE:NEM) was the largest gold producer in the world. Revenue at the time had just topped $3 billion for the trailing twelve months, while operating cash flow (OCF) was ~$700 million. NEM's Enterprise Value was hovering around the $20 billion mark at the time.

NEM Revenue (TTM) data by YCharts

NEM Revenue (TTM) data by YCharts

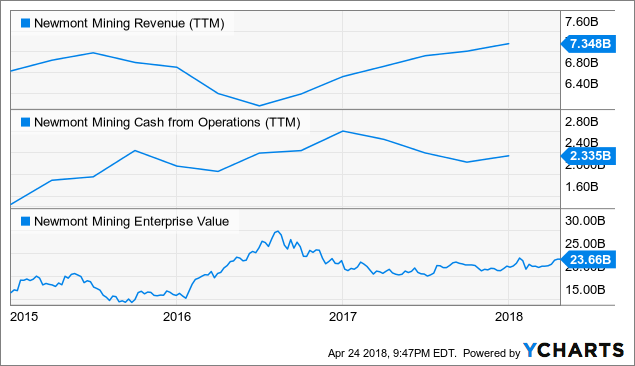

Since then, revenue has more than doubled, OCF has more than tripled, yet Newmont's EV is only slightly higher today than it was back at the start of 2004. In fact, at this time last year, NEM's Enterprise Value was around $20 billion, which is less than the value that it traded at in late 2003.

NEM Revenue (TTM) data by YCharts

NEM Revenue (TTM) data by YCharts

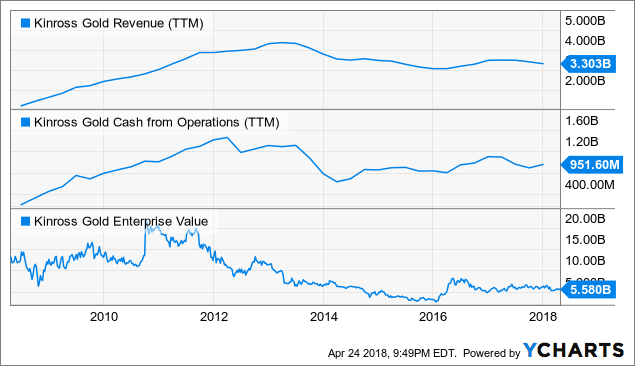

Kinross Gold (NYSE:KGC) has an EV of $5.58 billion. Basically the same valuation that the stock commanded in 2007, when revenue was $1 billion and OCF was around $400 million. Yet today, revenue is over $3 billion and cash flow is almost $1 billion. At one point in early 2008, KGC's EV was $12 billion. That's more than double the current EV, yet revenue back then was only 1/3rd what it is today and OCF was less than half of what it is now.

KGC Revenue (TTM) data by YCharts

KGC Revenue (TTM) data by YCharts

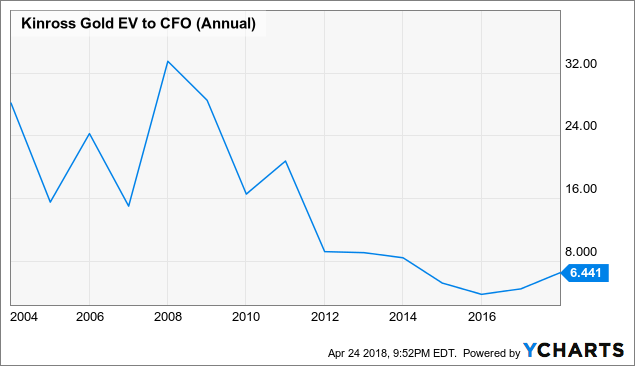

This is the Enterprise Value-to-Cash Flow ratio for Kinross over the years. It's clear that the company's stock doesn't trade at the same premium it used to - not even close, really.

KGC EV to CFO (Annual) data by YCharts

KGC EV to CFO (Annual) data by YCharts

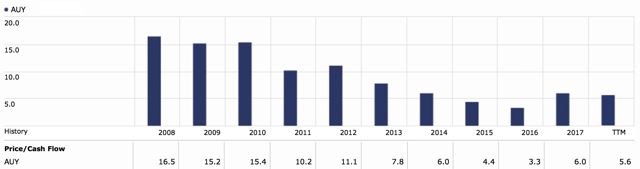

It's the same story for Yamana Gold (NYSE:AUY):

AUY Price to CFO Per Share (TTM) data by YCharts

AUY Price to CFO Per Share (TTM) data by YCharts

(Source: Morningstar.com)

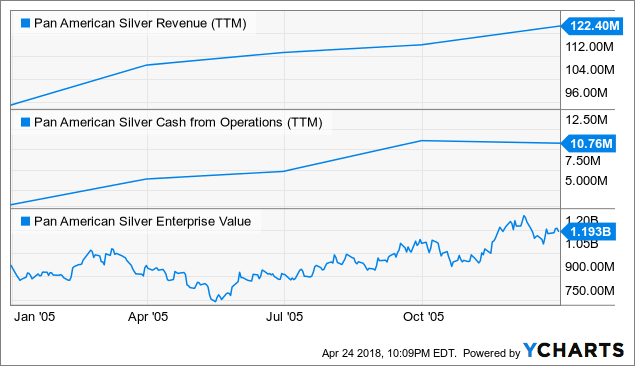

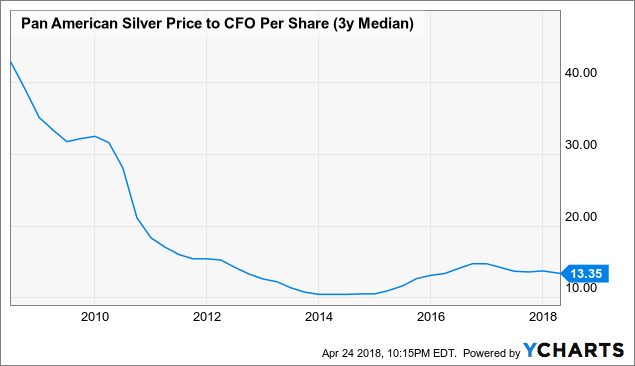

At the end of 2005, Pan American Silver (NASDAQ:PAAS) had an EV of $1.19 billion. Revenue at the time was $122 million and OCF was $10.76 million.

PAAS Revenue (TTM) data by YCharts

PAAS Revenue (TTM) data by YCharts

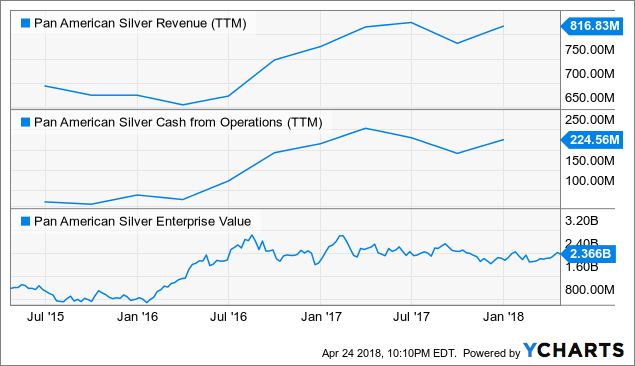

Today, Pan American is generating over $800 million of revenue and $200 million in OCF. You would think the company would be trading at 5x-10x the market value compared to where it was 12 years ago given the significant expansion of those financial metrics. Yet, the current EV is $2.37 billion (less than 2x where it was at in 2005).

PAAS Revenue (TTM) data by YCharts

PAAS Revenue (TTM) data by YCharts PAAS Price to CFO Per Share (3y Median) data by YCharts

PAAS Price to CFO Per Share (3y Median) data by YCharts

There has clearly been a drastic change in how these gold mining companies are being valued today, compared to where they were 10-15 years ago. Even 5 years ago, for that matter.

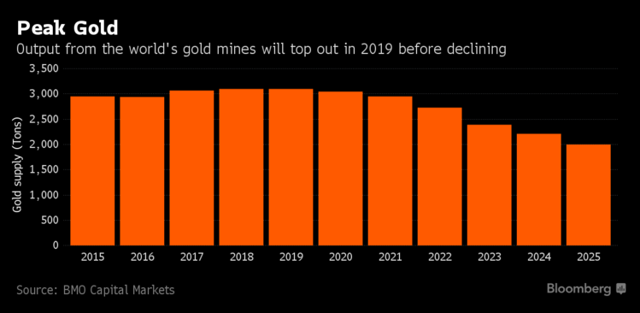

Can this continue? Absolutely, but not indefinitely. The market needs to start rewarding these companies with higher valuations, or the supply of gold is going to drop off a cliff. That will start happening in the next 2-3 years unless we see a rapid change.

(Source: Bloomberg)

As I mentioned at the beginning of this article, given that gold is a precious metal, it needs to be mined and there will always be a strong demand for it. That's why companies in this sector have typically traded at a very high premium. You take away that premium and these miners don't have nearly the same amount of incentive (or wherewithal) to expand production, explore for new mines, or develop large-scale projects.

This has also hampered M&A, as these companies don't want to risk shareholder upheavals - and this industry would benefit greatly if there was some consolidation.

If this situation doesn't resolve on its own, then a significant drop in supply will force a step change in valuations.

Some of my best returns in stocks, assets, or individual sectors have been when things didn't make much sense in terms of valuations. The market at the time was missing a key factor for why those low valuations weren't sustainable. It's no different with these gold and silver miners. Despite the bearishness that still pervades the precious metal stocks, a reversion to the mean will take place. And it looks like we are right on the doorstep for that event.

GDXJ On The Verge

I continue to pound the table on the gold miners as valuations remain severely compressed and the sector appears as if it's on the verge of exiting this lengthy consolidation. While I still favor owning individual miners, as a basket of solid gold stocks will generate far better returns than ETFs, I do believe that something like the VanEck Vectors Junior Gold Miners ETF (NYSEARCA:GDXJ) is a good vehicle to use in order to catch this ride.

The chart of GDXJ also succinctly conveys the situation and the near-term breakout potential of the miners. If GDXJ can climb above $36, then the next phase of this bull market will likely begin, and that's when these gold stocks will start to regain those lost premiums.

(Source: StockCharts.com)

The Gold Edge - 33 Reviews/4.9 out of 5.0 Stars

Soma's analysis is without peer in the space

You'll quickly see this guy's The Real Deal and the subscription is worth every penny

This service is highly recommended for anyone investing in precious metal mining stocks

I have subscribed to several (too many) of the other gold stock analysts in the past and SomaBull's comprehensive offering is the best I have encountered.

Disclosure: I am/we are long KGC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Long Gold And Silver Stocks

Follow SomaBull and get email alerts