Gold Mining Stocks: Which Door Will Investors Choose? / Commodities / Gold and Silver Stocks 2021

With the current situation suggestiveof a Monty Hall problem, investors are clinging to the first, bullish door. Butwhat if a different option is more likely?

The Monty Hall problem is a form of aprobability puzzle, and what it shows is immensely unintuitive. Suppose you areon a game show, and you need to choose one of three doors. Behind one of themis a car and behind the others, goats. You pick a door, and then the host (whoknows what’s behind them) opens one of the remaining doors, behind which thereis a goat. The host now asks: “Do you want to change your door choice for theremaining doors?” So, what do you do?

It turns out that if you change the door,the probability of winning the car increases… two times! You have a 2/3 chance,instead of a 1/3. Tremendously unintuitive, indeed, but what if the same ishappening on the market now? With a bullish prospect representing the door ofthe first choice, and the technicals and fundamentals the host’s help, wouldn’tit be safer to switch the door to win eventually?

TheGold Miners

With investors stuck in their own versionof the Monty Hallproblem , guessing ‘what's behind door No.1’ has market participantsscrambling to find the bullish gateway. However, with doors two and threesignaling a much more ominous outcome for gold, silver and mining stocks, thekey to unlocking their future performance may already be hiding in plain sight.

Case in point: with the analogue from2012 signaling a forthcoming rush for the exits, there are no fire escapesavailable for investors that overstay their welcome. And because those who cannot remember the past arecondemned to repeat it (George Santayana), doubters are likely to lose morethan just their pride.

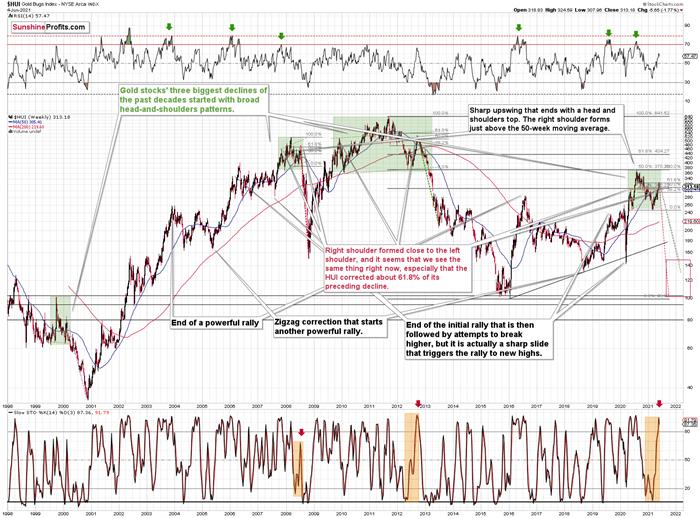

While the most recent price action isbest visible in the short-term charts, it is actually the HUI Index’s verylong-term chart that provides the most important details (today’s full analysisincludes 44 charts, but the graph below is one of the key ones). The crucialthing happened two weeks ago, and what we saw last week was simply a majorconfirmation.

What happened two weeks ago was that gold rallied by almost $30 ($28.60) and atthe same time, the HUI – a flagship proxy for gold stocks… Declined by 1.37. Inother words, gold stocks completely ignored gold’s gains.

That shows exceptional weakness on theweekly basis and is a very bearish sign for the following weeks. And it hasimportant historical analogies.

Back in 2008, right before a huge slide,in late September and early October gold was still moving to new intradayhighs, but the HUI Index was ignoring that, and then it declined despite gold’srally. However, it was also the case that the general stock market declinedthen. If stocks hadn’t declined back then so profoundly, gold stocks’underperformance of gold would likely be present but more moderate. In fact,that’s exactly what happened in 2012.

The HUI Index topped on September 21,2012, and that was just the initial high in gold. At that time the S&P 500was moving back and forth with lower highs – so a bit more bearish than thecurrent back-and-forth movement in this stock index. What happened in the end?Gold moved to new highs and formed the final top (October 5, 2012). It was whenthe S&P 500 almost (!) moved to new highs, and despite both, the HUI Indexdidn’t move to new highs.

The similarity to how the final counter-trendrally ended in 2012 (and to a smaller extent in 2008) ended is uncanny. Theimplications are very bearish for the following weeks, especially given thatthe gold price is following the analogy to 2008 and 2012 as well.

All the above is what we had alreadyknown last week. In that case, let’s move to last week’s confirmation. Thething is that the stochastic oscillator just flashed a clear sell signal . This is important on its own as these signalsoften preceded massive price declines. However, extremely bearish implicationscome from combining both: the sell signal and the analogy of 2008 and 2012.Therefore, we should consider the sell signal in the HUI-based stochasticoscillator as yet another sign serving as confirmation that the huge declinehas just begun.

Thus, if history rhymes, as it tends to,the HUI Index will likely decline profoundly. How low could the gold stocksfall? If the similarity to the previous years continues, the HUI could findmedium-term support in the 100-to-150 range. For context, high-end 2020 supportimplies a move back to 150, while low-end 2015 support implies a move back to100. And yes, it could really happen, even though it seems unthinkable.

But which part of the mining stock sectoris likely to decline the most? In my view, the junior mining stocks.

TheJunior Miners

GDXJ is underperforming GDX just as I’vebeen expecting it to. Once one realizes that GDXJ is more correlated with thegeneral stockmarket than GDX is, GDXJ should be showing strength here, and it isn’t. Ifstocks don’t decline, GDXJ is likely to underperform by just a bit, but when(not if) stocks slide, GDXJ is likely to plunge visibly more than GDX.

Expanding on that point, the GDXJ/GDXratio has been declining since the beginning of the year, which is remarkablebecause the general stock market hasn’t plunged yet. And once the general stockmarket suffers a material decline, the GDXJ ETF’s underperformance will likely beheard loud and clear.

Please see below:

Why haven’t the juniors been soaringrelative to senior mining stocks? What makes them so special (and weak) rightnow? In my opinion, it’s the fact that we now – unlike at any other time in thepast – have an asset class that seems similarly appealing to the investmentpublic. Not to everyone, but to some. And this “some” is enough for juniors tounderperform.

Instead of speculating on an individualjunior miner making a killing after striking gold or silver in some extremelyrich deposit, it’s now easier than ever to get the same kind of thrill bybuying… an altcoin (like Dogecoin or something else). In fact, peoplethemselves can engage in “mining” these coins. And just like bitcoin seemssimilar to gold to many (especially the younger generation) investors, altcoinsmight serve as the “junior mining stocks” of the electronic future. At least theymight be perceived as such by some.

Consequently, a part of the demand forjuniors was not based on the “sympathy” toward the precious metals market, butrather on the emotional thrill (striking gold) combined with theanti-establishment tendencies ( gold and silver are the anti- metals, but cryptocurrencies are anti-establishment in their ownway). And since everyone and their brother seem to be talking about how muchthis or that altcoin has gained recently, it’s easy to see why some peoplejumped on that bandwagon instead of investing in junior miners.

This tendency is not likely to go away inthe near term, so it seems that we have yet another reason to think that theGDXJ ETF is going to move much lower in the following months – declining morethan the GDX ETF. The above + gold’s decline + stocks’ decline is truly anextremely bearish combination, in my view.

In conclusion, once gold, silver and miningstocks’ doors finally slam shut, over-optimistic investors will likely go downwith the ship. And with the most volatile segments of the precious metalsmarket eliciting the most bearish signals, those left holding the bag willlikely wonder how it all went wrong. Moreover, with gold’s relativeoutperformance signaling waning investors’ optimism, the miners – and morespecifically, the GDXJ ETF – will likely suffer the brunt of the forthcomingselling pressure. The bottom line? With the walls closing in on gold, silverand mining stocks, the game show will likely end with investors leftempty-handed.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the target for gold that could be reached in the nextfew weeks. If you’d like to read those premium details, we have good news foryou. As soon as you sign up for our free gold newsletter, you’ll get a free7-day no-obligation trial access to our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.