Gold Needs More Than Safety Support

Gold will remain strong as long as global equity markets are weak.

Gold's relative strength vs. stocks, bonds and currencies is growing.

Without additional dollar weakness, though, gold's upside is limited.

Without the intense fear generated by the global stock market rout, gold would surely be without any meaningful support. To that end, gold bulls can be thankful that gold's safety bid has been revived and the metal now has a good chance of recovering some lost ground. In today's report we'll examine gold's relative strength to other assets while discussing the problem gold still has with currency-related headwinds. I'll explain that while gold temporarily enjoys a benefit from safe-haven demand, this support is ephemeral and isn't strong enough to counteract a strong dollar.

Despite its continued struggles, gold at least got some good news last week. The gold price reached its highest level in three months as investors have lately shown an increased appetite for bullion. Spot gold finished last week at $1,234, its highest level since July. December gold futures finished last week at $1,236. Gold experienced its fourth consecutive week of gains as investors continue to flee global equities in search of value and safety. Gold prices also have gained more than 6 percent for the year to date after falling to a 52-week low of $1,160 back in August.

Indeed, gold is still clearly benefiting from financial market turbulence. At a time when other traditional defensive assets, namely U.S. Treasuries, have offered scant protection from the recent financial market storm, gold has become the de-facto choice for investors seeking protection from stock market volatility. This can be clearly seen in the following graph.

Source: StockCharts

The above chart shows the performance of the gold price compared against the benchmark S&P 500 Index (SPX). Gold's relative strength is undeniable when measured against the poor performance of the general equity market. Gold sports one of the strongest relative strength performances of almost any other asset category right now, a fact which hasn't escaped the notice of money managers and institutional investors. This explains the recent inflows into gold funds, as per our recent discussions.

When compared against the still-strong U.S. dollar index, the gold price doesn't manifest the same level of strength as it does when compared with the U.S. stock market. However, even against the dollar the gold price shows a definite improvement in relative strength. Shown below is the gold/dollar ratio, which has established a pattern of higher lows and higher peaks in recent weeks. This is the best relative strength performance of gold vs. the dollar since April. This is a move in the right direction as gold tries to establish a launching pad for a more meaningful turnaround.

Source: StockCharts

It's also worth noting that gold is outperforming other safe-haven investments such as the Japanese yen when compared against the U.S. dollar. Gold also is conspicuously outperforming longer-term U.S. Treasury bonds, which are widely regarded as the ultimate safe-haven investment during times of market turmoil. For illustration purposes, the following graph compares gold with the iShares 20+ Year Treasury Bond ETF (TLT).

Source: StockCharts

Movement into gold-backed ETFs also has been on the rise in the last couple of weeks as investors have turned to the metal for safety in the wake of the global stock market sell-off. Holdings in the world's largest gold ETF, the SPDR Gold Trust (GLD), have risen to their highest levels since August at 24.1 million ounces. This stands in stark contrast to the period between April and early October, when GLD witnessed a nearly 4.5 million ounce outflow.

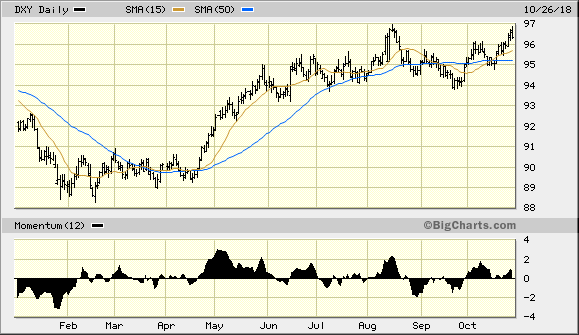

As important to gold's recent strength as the global market weakness has been, this psychological support won't last forever. In fact it could evaporate at any time if equity prices bottom out in November. In order for gold's interim strength to be sustained, gold needs something more than the backing of its safety component. That something else is gold's currency component, which is still weak. The U.S. dollar index (DXY), shown below, underscores this point.

Source: BigCharts

Since gold is priced in dollars, DXY strength typically undermines gold's performance. I've argued in recent reports that a move below the 95.00 level in the dollar index is needed to confirm an immediate-term (1-4 week) trend reversal for the greenback. A break below the DXY 95.00 level would energize the gold bulls and allow them to consolidate their control over gold's immediate trend by forcing additional covering in the overcrowded short trade on the metal. Gold's intermediate erm (3-9 month) prospects are at any rate tied to the dollar's performance, and without a conspicuous pullback in the dollar index it's unlikely the metal's price will be able to sustain a rally beyond the immediate term.

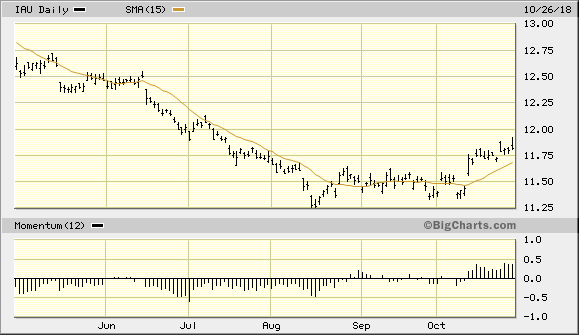

On a strategic note, the iShares Gold Trust (IAU), which I use for trading recommendation purposes in this report, recently confirmed a technical breakout by closing above the pivotal $11.60 level and returning above its rising 15-day moving average. This put me back on an immediate-term buy signal for IAU, where I remain despite the dollar's recent strength. I suggest watching the $11.37 level (the Aug. 23 closing low) closely from here, as this is my recommended initial stop-loss (intraday basis) for this trading position.

Source: BigCharts

In closing, my focus remains on the need for gold to show greater currency component strength. While the safety bid for gold has increased this month due to the stock market plunge, experience has shown that defensively-based demand doesn't last long. A sharp pullback in the dollar index, however, would ensure the viability of gold's recent rally beyond merely the immediate term. For now I recommend that traders maintain a conservative bullish posture on gold (via the gold ETFs) but avoid heavy commitments to the metal until we see deterioration in the U.S. dollar index.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts