Gold Now Has 2 Less Obstacles

Gold investors don't have to worry about higher interest rates for now.

A strong dollar, gold's other foe, is also no longer an imminent threat.

The path has been cleared for a resumption of gold's interim recovery.

Concerns over rising interest rates and a strong dollar have been a source of angst for many investors for much of this year. Now that the fear of higher rates has been relieved with the Fed's latest policy statement, gold investors can now turn their attention to the main drivers of the metal's six-month-old recovery. Among those drivers are a weak global economic outlook and strong safe-haven demand. In this report, we'll discuss the latest evidence which supports a continued push higher in the coming months for the gold price, including a weakening U.S. dollar. As I'll argue here, the dollar isn't a major concern for gold now that a tight Fed policy is no longer a threat.

In what could be construed as a victory for gold bugs, the Federal Reserve held interest rates steady at its latest policy meeting this week. The Fed indicated, moreover, that it will likely leave the benchmark fed funds rate steady for the rest of this year. Among the reasons for holding off on hiking rates, the Fed cited its expectation that U.S. GDP would grow at a 2.1 percent clip for 2019, below its 2.3 percent estimate from last December.

Regardless of the reasons for keeping interest rates steady, gold investors now have another reason to be cheerful for the metal's intermediate-term (3-9 month) prospects. With no imminent threat of competition from higher rates, investors are now free to focus their attention on the other leading factors which determine gold's directional bias. Chief of those factors is gold's currency component, which has been volatile in recent weeks.

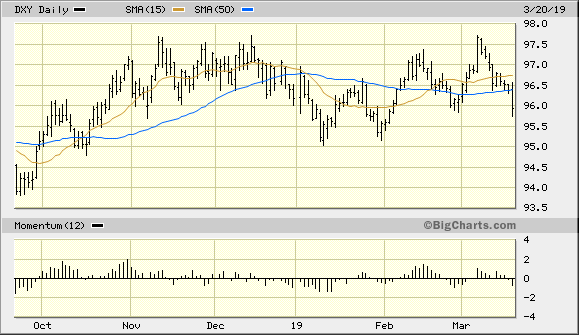

When the Fed announced its dovish interest rate policy on Mar. 20, the U.S. dollar index (DXY) reacted with one of its biggest 1-day drops of this year. DXY fell decisively under its psychologically important 50-day moving average (see chart below), which puts the dollar's intermediate-term trend into serious question. Assuming DXY finishes the latest week under its 50-day MA, it will confirm a shift of the dollar's intermediate trend based on the rules of my technical trading discipline. This in turn would favor a gold price rally since the metal's currency component would be correspondingly strengthened by a weaker dollar. A weak dollar makes it much easier for the gold price to rise.

Source: BigCharts

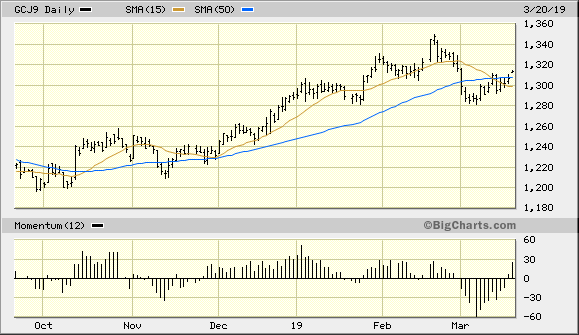

Indeed, gold prices have already shown a bullish response to the dollar's recent weakness. Below is the graph for the April 2019 gold futures contract. Here you can see the gold price is back above its 15-day and 50-day moving averages and has already established a renewed rally over the last two weeks. As I've articulated in previous reports, I expect the gold price to remain above the pivotal $1,280 level while consolidating its strength for another run at its previous peak from last month.

That bullish outlook was strengthened by the U.S. central bank's shift to a more dovish monetary policy stance. This in turn has reduced the safety-related demand for dollars as investors are now less worried of a tightening bias on the Fed's part.

Source: BigCharts

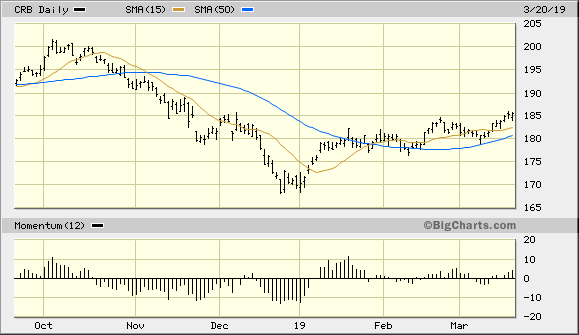

Not only has gold benefited by the dollar's weakness, but other commodities are also getting a boost from the softer currency. The Thomson Reuters/CoreCommodity CRB Index (CRB) is the benchmark for U.S. commodity futures prices in the aggregate, and it has clearly established the beginnings of a rising trend (i.e. higher highs and higher lows) since the start of this year. Its 50-day moving average has begun to curl upward in reflection of the positive reversal in the price momentum for most major commodities, especially crude oil, and this also supports a rising gold price. Gold has historically had its best performances when the CRB Index was rallying along with it.

Source: BigCharts

Elsewhere, global equity price volatility has increased in recent days as economic growth concerns and geopolitical uncertainties proliferate. This has fed directly into gold's fear component, which is another reason why gold should continue experiencing strong support in the months ahead. With the U.S.-China trade war having no immediate resolution and Britain's exit from the EU facing stiff resistance from the British Parliament, the fear factor can be expected to continue to boost gold's safe-haven appeal for months to come. In the absence of fear and uncertainty, gold would be a much harder sell to the world's investors due to the lure of the strong U.S. equity market. But global angst is keeping gold's intermediate-term recovery alive and well.

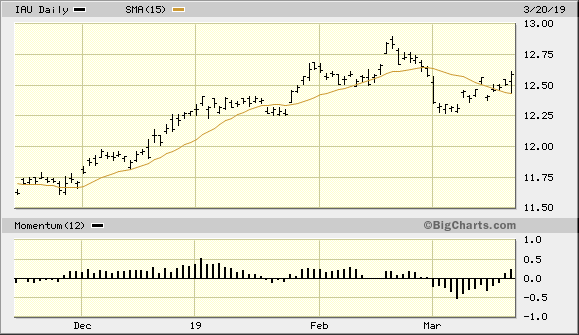

On the gold ETF front, the iShares Gold Trust (IAU) has finally confirmed another immediate-term (1-4 week) buy signal per the rules of my trading system. On Mar. 20, IAU closed above its nearest pivotal high of $12.56 to confirm the latest bottom and re-entry signal. I previously noted that a 2-day higher close above the 15-day moving average would be required to confirm another buy signal for IAU, and now we have it. I recommend that traders who purchase IAU use a level slightly under $12.30 as the initial stop loss for this trade on an intraday basis.

Source: BigCharts

In conclusion, gold now has two fewer major obstacles to contend with. Specifically, the dual threats of higher interest rates and a stronger dollar are no longer major concerns for investors. This should relieve gold of the headwinds which have kept the metal's price stuck in a trading range in the last few weeks. Sooner or later, gold can be expected to respond to the removal of these obstacles by breaking decisively out of its trading range and continuing the rising trend it commenced last October.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts