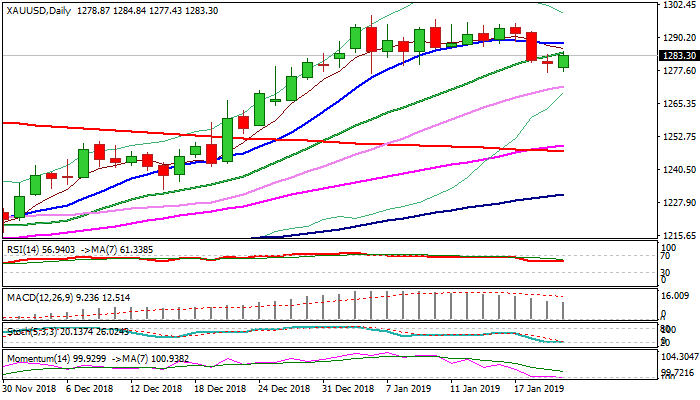

Gold Outlook: Reversal pattern is forming on daily chart but 20SMA limits recovery

January 22, 2019 / www.fxstreet.com / Article Link

GOLD

Spot gold regained traction and bounced from Asian low at $1277, as renewed risk-off mode on IMF downgrade of global growth forecast increased safe-haven demand. Fresh gains struggle to return above rising 20SMA ($1284), close above which is needed to complete Doji reversal pattern on daily chart and shift near-term focus towards $1287 (10SMA) and $1292 (Friday's high). Flat momentum and slow stochastic on daily chart obstruct recovery for now and the downside would remain vulnerable on today's repeated close below 20SMA. This would keep pivotal supports at $1276/73 (Monday's low / Fibo 38.2% of $1232/$1298 upleg) exposed, with stronger bearish signal to be expected on break here.

Res: 1284; 1287; 1292; 1295 Sup: 1281; 1276; 1273; 1265

Interested in Gold technicals? Check out the key levels

R3 1288.85 R2 1286.24 R1 1281.12 PP 1278.51 S1 1273.39 S2 1270.78 S3 1265.66Recent News

Immediate trigger for crash was new Fed Chairman pick

February 02, 2026 / www.canadianminingreport.com

Gold stocks slump on metal price decline

February 02, 2026 / www.canadianminingreport.com

Is the gold market starting to turn 'irrationally exuberant'?

January 26, 2026 / www.canadianminingreport.com

Gold stocks explode up as equity markets languish

January 26, 2026 / www.canadianminingreport.com

Gold stocks outpace flat large caps

January 19, 2026 / www.canadianminingreport.com