Gold: Potential New Dollar Cycle Could Upset The Apple Tart

Dollar rallies hard after Powell's testimony.

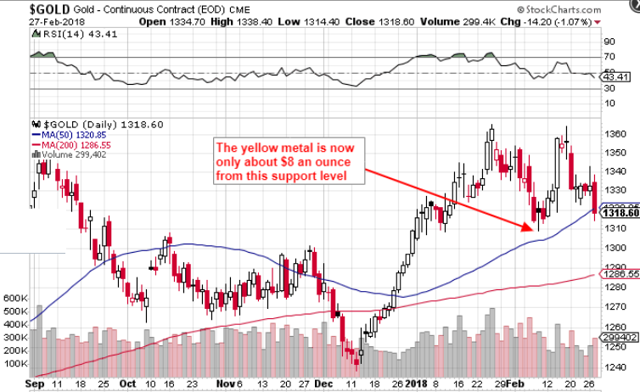

Gold is now at clear risk of breking through its February lows.

If it does, $1,240 is the next support price - almost $80 an ounce away.

The downswing in the gold price (NYSE:GLD) yesterday should definitely put swing traders on alert that lower prices are coming. Gold now is in clear danger of breaking though the lows its printed on the 9th of February last which was clearly a daily cycle low in my opinion. Why? Well the present intermediate cycle kicked offed proceedings on the 11th of December last year. Therefore the 9th of February last was 2 calendar months or roughly 30 to 40 trading days (which is typical daily cycle length) since the intermediate bottom back in December.

At present we are only about $8 an ounce from taking out these lows. (see below) If we break these lows over the next few days, the odds would be high that an intermediate cycle has begun. Intermediate declines are usually very aggressive in nature and almost always occur well below the most recent daily cycle low. If this scenario turns out to be the case, the next support point would be last December's lows of around $1,240 an ounce which I expect would hold due to gold continuing its pattern of higher highs

With gold now well over 10 weeks into this intermediate cycle, it is kind of caught in no man's land at present. The highs of this cycle took place on the 24th of January which were only 6 weeks or so into this intermediate cycle. If these lows are not taken out in the near term, early highs in an intermediate cycle almost invariably lead to lower lows. We saw this pattern in the last intermediate cycle where gold printed highs very early also in that particular cycle. This meant lower lows were a result and many traders unfortunately got caught in the downswing.

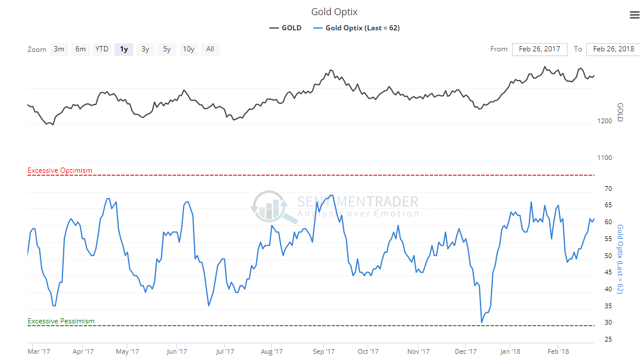

Furthermore long term sentiment (see below) in gold doesn't illustrate that the bullish argument should be pushed hard here. Despite the recent sell-off in the yellow metal, sentiment readings are actually not that far away from other intermediate tops. In fact the January highs in this cycle were only a whisker away from sentiment readings recorder back in August of last year which was the last clear intermediate high. We use sentiment readings as a contrary indicator which means when we have high optimism in this asset class, we usually are not in this market. Furthermore we don't usually short an asset class that is making higher highs as surprises in bull markets usually happen to the upside.

Source : Sentimentrader.com

Silver (NYSE:SLV) and especially the miners have once again been rather weak in this cycle. In fact, the mining ETF has already traded below its previous hard lows of last December which is worrying for the whole complex as a whole. With gold struggling to stay above support, it would have some help if silver and the mining complex were taking on the baton but that certainly doesn't seem to be happening. Now gold usually leads this sector so mining could easily rebound 180 degrees if gold prices rally from here. Any long positions I feel though should be non-leveraged to control bot fear and greed.

Therefore caution is warranted at present. The big up day in the US dollar yesterday could mean the start of a brand new rally in the greenback. Swing changes are usually defined by strong directional changes and that is what the dollar gave us yesterday after Powell's testimony. Is a trader still must be long the precious metals sector right now, I would only recommend an un-leveraged position in the mining complex or silver as sentiment in both of these isn't as high as gold. The next week or so will tell us the state of affairs in this asset class.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.