Gold Price Ahead of the Thanksgiving Weekend / Commodities / Gold & Silver 2024

Today we finally see it – the USDX movedlower at last. USD’s breather here is nothing surprising, and it’s not bearisheither.

Today we finally see it – the USDX movedlower at last. USD’s breather here is nothing surprising, and it’s not bearisheither.

It’s simply normal for a market tocorrect after launching a rally as strong as what we saw in October andNovember.

In yesterday’sanalysis, I wrote the following about the above chart:

Yes,while I have been writing about USD Index’s likely strength and bullish outlookoverall, this kind of resilience is surprising even to me. I thought that we’llsee a bigger correction now – after all, the USDX soared by 8 index pointswithout a bigger decline.

Wedon’t see it now, which could mean that it willstill happen in the following days,or that the momentum for the USD is so remarkably strong that it will justconsolidate and trade sideways here instead of really correcting.

Eitherway, after this week, the USDX could be back inthe rally mode due to the monthly turning point (vertical, dashed line). My Monday’scomments on it remainup-to-date:

“Willwe see a correction shortly? That’s quite possible. After all, no market movesup or down in a straight line without periodic corrections.

Willthe correction in the USDX trigger a rally in gold and miners? I wouldn’t saythat’s necessary. The most recent boost that both markets got was based ongeopolitical turmoil (a new type of rocked used by Russia), and those tend tohave only temporary impact on prices. Today’s move lower in gold and USDXconfirms this. So, it is quite possible that we would see a decline in gold andthe USD Index at the same time. “

So, yes, the pullback is taking place,which means that the monthly turning point can play out exactly as I haddescribed it earlier – it could push the USDX higher once again. This wouldlikely contribute to declines in the values of precious metals and miningstocks.

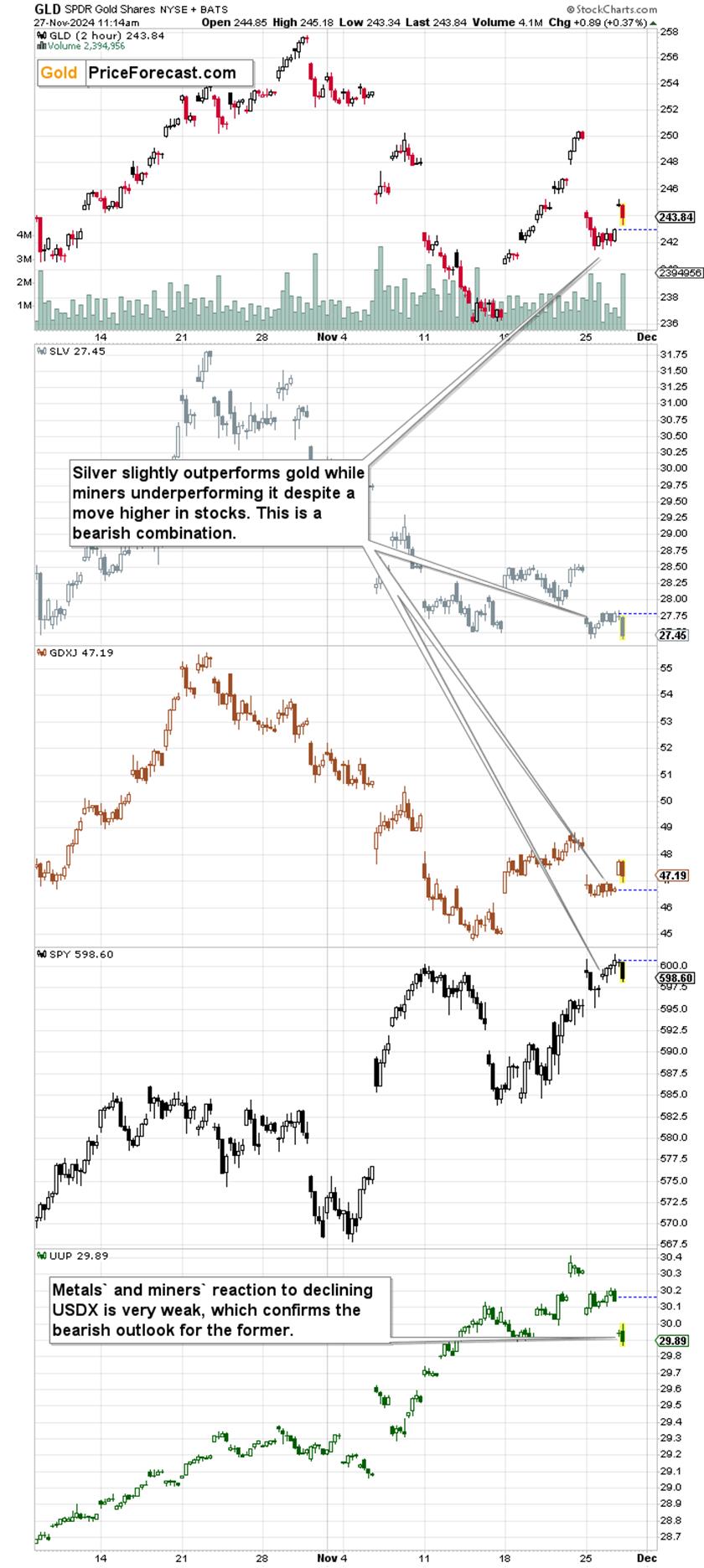

Today’s action in the precious metalssector already confirms this bearish outlook.

After the early move up, gold, silver,and miners moved lower. Overall, gold and miners are up, but not significantlyso. The key thing is that they moved up in an insignificant manner while theUSDX declined in a meaningful way (from a day-to-day point of view only, butstill).

PMs and miners had a good reason to rallytoday – in a big way – and they didn’t. This suggests that they really want todecline in the following weeks. Fortunately, you are already well-positioned totake advantage of this decline. Your profits in the current short position are likely to grow.

Before summarizing, we would like todiscuss one specific thing: gold’s performance around Thanksgiving – during theU.S. presidential election years.

The below text is actually based onsomething that I wrote four years ago. Since it was about an even more distantpast, it remains just as up-to-date as it was back then. Of course, I’ll addcomments on what happened in 2020.

Gold’sPerformance around Thanksgiving

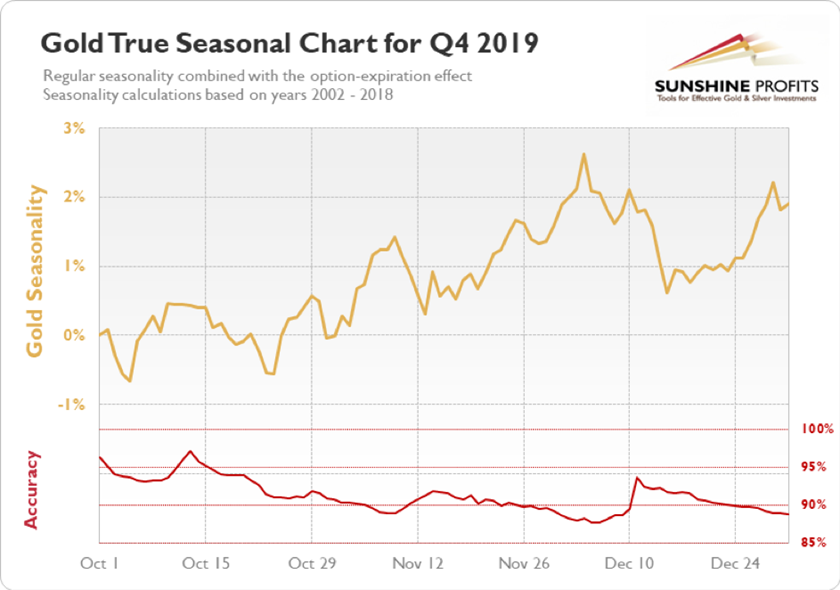

Thanksgiving is on the fourth Thursdayof each November, which means that the holiday always falls between November 22 and28. What’s usually happening to the price of gold before and after this period?Let’s check gold’s seasonality for Q4.

During this period, gold is usually justbefore forming a short-term top and starting the biggest decline within thefinal quarter of the year.

Please note that the accuracy measure asto when the top is likely to be is relatively low, but soars right beforegold’s plunge. This means that while it’s not that clear when gold is likely totop, it’s quite probable that we are going to see some kind of important topregardless of when exactly that takes place. Could it be slightly ahead ofThanksgiving? Yes. Could it be slightly after it? That’s possible aswell.

But this year is not like other years.This year, particularly this November, is special because of the U.S.presidential elections. Therefore, instead of taking into account the averageof the previous periods around all recent Thanksgivings, one should focus onthe Thanksgivings which were concurrent with presidential elections.

Gold andThanksgiving during the Presidential Election Years

Let’s examine the last five cases whengold was already after the 1999-2000 bottom and within its secular bull market.

Starting with the most recent case:

Back in 2020, gold price was after aseveral-month-long decline, and it reversed soon after Thanksgiving. So, it wasan exception from the rule. Perhaps the longer decline preceding Thanksgivingwas something that could have indicated that we’d see a turnaround instead ofdecline’s continuation.

Back in 2016, the decline simplycontinued after Thanksgiving, and gold bottomed in the second half of December.

Four years earlier, in 2012, gold toppedright after Thanksgiving and – just like in 2016 – it bottomed in the secondhalf of December.

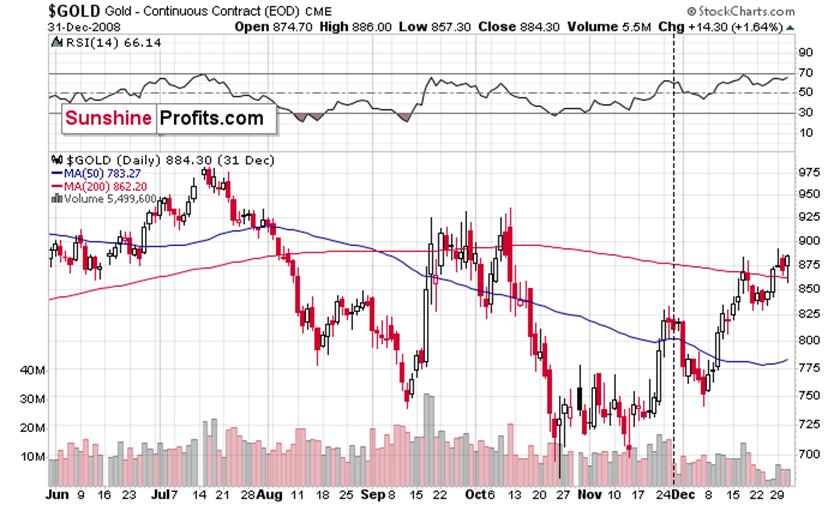

In 2008, gold topped right beforeThanksgiving, and it bottomed in the first half of December.

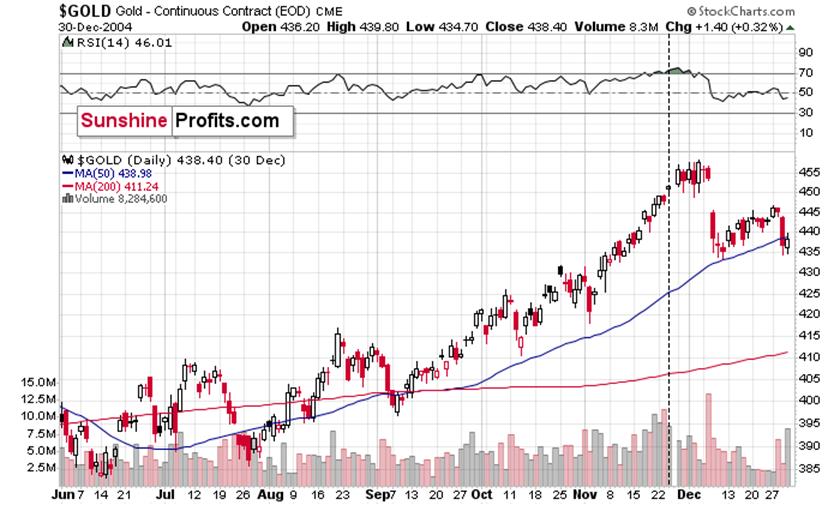

Finally, in 2004, gold topped shortlyafter Thanksgiving, and it formed an initial bottom in the first half ofDecember. However, it then declined once again, further reaching the bottom inJanuary and February 2005 (two separate bottoms).

Consequently, Thanksgiving during theU.S. presidential election year had a bearish follow-up for gold in most cases.

Mostimportantly, the 2016 follow-up was bearish. This analogy seems most importantas that was also the year when Trump won.

This pattern fits in line with my otherthoughts on the gold market. As the USD Index appears to be correcting here –and about to reverse based on its monthly reversal tendencies, it seems thatgold will have more reasons to decline.

All in all, while there remain someopportunities to gain something extra on gold investments in thelong run, the outlook for the precious metals market remains bearish for thefollowing weeks. And the profits from our short position in junior miners arelikely to grow further.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.