Gold Price and Gold Stocks' Loud Silence / Commodities / Gold & Silver 2023

What a beautiful nothing! Nothingreally happened on the markets on Friday, but due to the context of theprevious days’ actions, it was profound.

The thing is that it was a day whenmarkets took a breather and verified their previous moves.

Some price moves are accidental ortriggered by geopolitical events. Sometimes, the markets pretty much “have to”move in a certain direction because the only rational thing to do is given theevent that is happening. For instance, if a war breaks out in Europe, goldrallies. But it doesn’t mean that it’s going to stay up for long. If the rallywas simply reactive and not based on a broader trend, then the rally is goingto be invalidated.

Importance ofVerification

That’s why verification of breakoutsand breakdowns are so important. That’s one of the ways to tell if a givenprice move was temporary or “do the markets really mean it”.

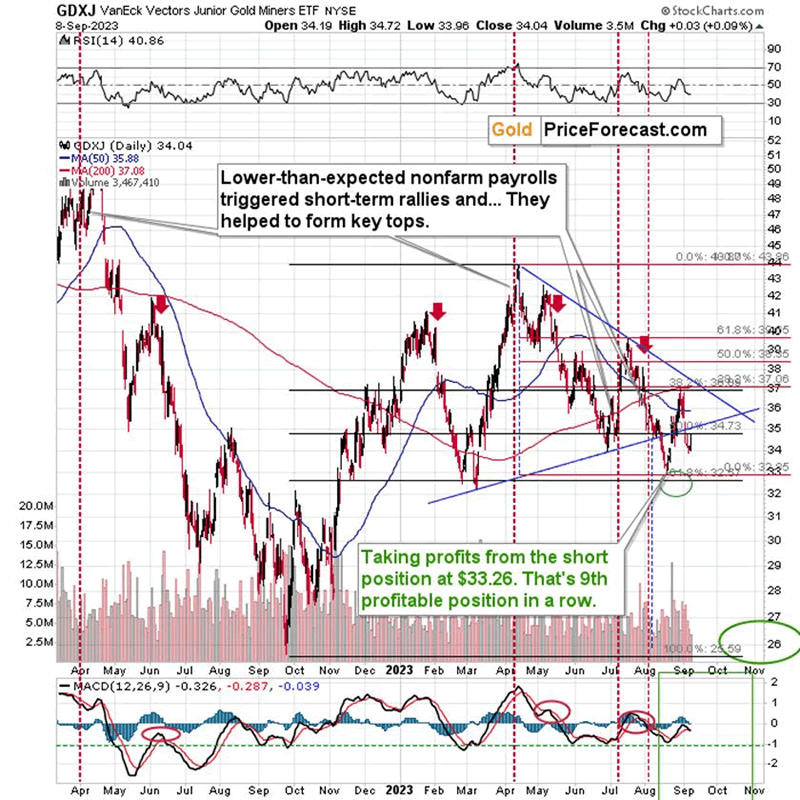

What (not) happened on Friday tells usthat the markets really mean what theydid recently. Let’s take a closer look, starting with junior mining stocks.

Can you see the comeback above the risingsupport line?

No, you can’t because the GDXJ had simplymoved close to this line, and then it declined once again, ending the sessionpretty much unchanged.

Zooming in allows us to see that juniorminers also tried to close the week back above the late-August low.

That didn’t happen, and the move belowthis low was just confirmed – even in terms of weekly closing prices.

Here’s how it looks if we zoom in. Theattempt to move higher was sharp, but it didn’t change anything. The breakdownwas confirmed, and the implications are very bearish.

One could say that this was accidentaland that junior miners – as just one market – don’t mean that much. That mighthave been the truth if it wasn’t for the fact that…

We saw the same kind of action in gold,silver, USD Index, and the S&P 500 index. So not only in key parts of theprecious metals sector but also in the case of its key drivers. This means thatour profitable position in junior mining stocks is likely to become much moreprofitable and that my comments from Thursday remain up-to-date:

“Interestingly,from the daily point of view (the above chart is based on the dailycandlesticks), we saw a verification of the move below the rising blue supportline. The GDXJ moved back to this line and then it declined once again.

Thismeans that it’s now ready to move lower. Probably MUCH lower. Once juniorminers move below their 2023 lows – and that move seems to be just around thecorner – they are likely to truly plunge.

Thereis no significant support all the way down to the $26 - $28 area. Just as themove up from those levels was fast, the same is likely to be the case for themove lower.

Thedifficult part of making money on this move lower might be not to get out tooearly. People have tendency to let losing positions grow, while cutting thewinners too early. Please keep the above note about support levels in mind, asthe GDXJ slides to new yearly lows. It’s really likely to slide substantiallybefore correcting in a meaningful manner.”

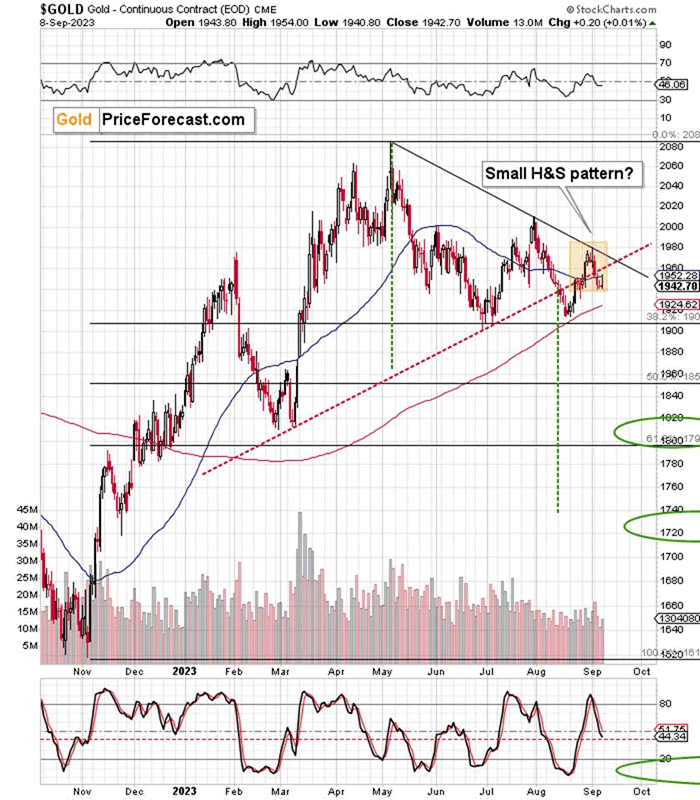

Gold price moved up and then down, justlike miners did.

Gold closed the week below the rising redsupport line, and it seems to have formed a small head and shoulders pattern(marked with orange).

The sell signal from the Stochasticindicator (lower part of the chart) remains in place.

Implications andBearish Signals

In other words, nothing bullishhappened on Friday, and the intraday reversal was bearish. This brief gold priceanalysis points to lower gold prices in the following weeks.

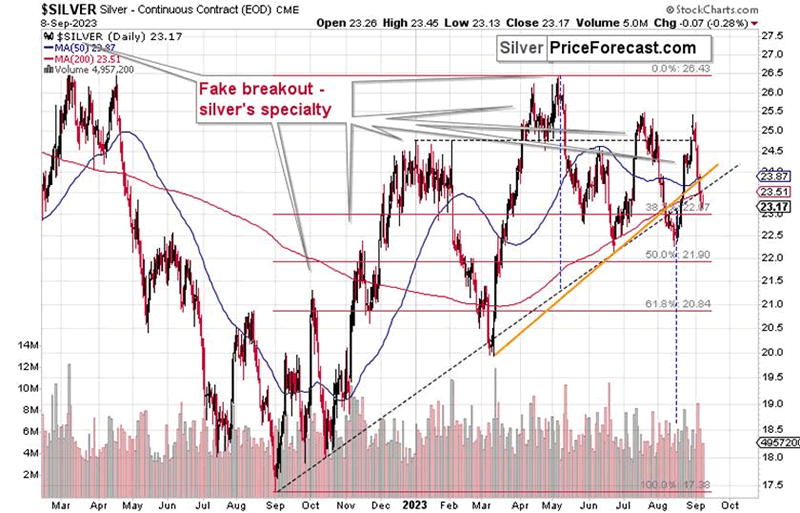

Silver price also formed an intraday reversal, and it even closed the day in the red.

Most importantly, though, silver closedthe week below its rising support lines, which spells trouble for the followingweeks.

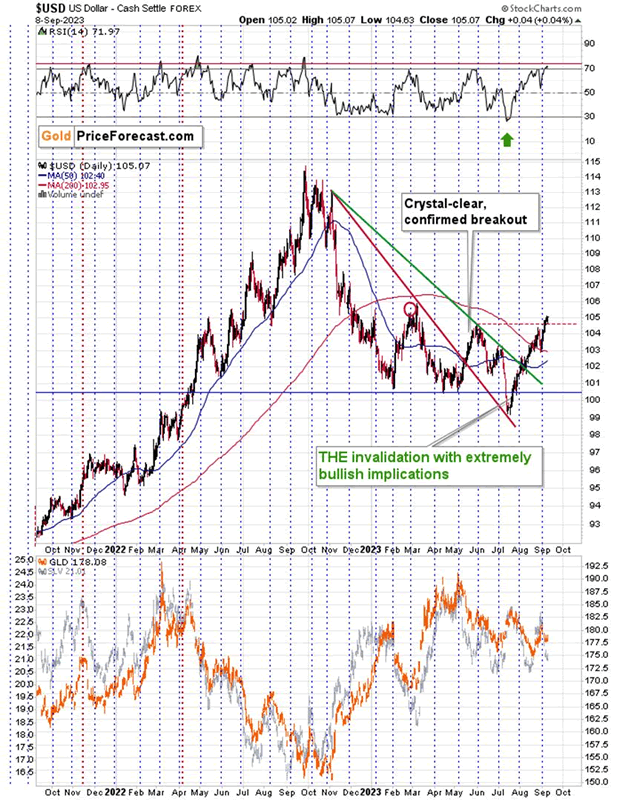

This is in perfect tune with the bullishsituation present in the USD Index.

The USD Index is negatively correlatedwith the precious metals sector, so the bullish verification that we just sawin the USDX is a bearish factor for gold, silver, and miners.

The bullish verification arrived as yetanother daily close and weekly close above the May-June highs.

Yes, the RSI is overbought, but if themedium-term trend is very strong, the USDX can rally as the RSI based on itbecomes even more overbought. I marked two cases when that happened with redvertical lines: Nov. 2021 and Apr. 2022.

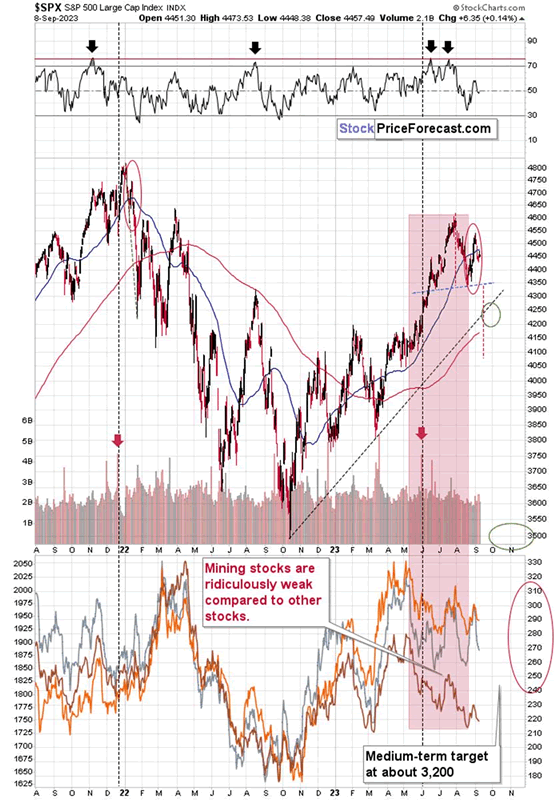

Stocks also took a breather on Friday,and their very short-term trend remains down. Once we see a breakdown below4,350, another bigger slide is about to take place due to thehead-and-shoulders pattern that will have formed at that time.

The target based on the above-mentionedH&S pattern would be at about 4,100, which is well below the rising,medium-term support line. It could be the case that we’ll see a quick movelower, below the support line, and then another move back up to the risingsupport line, which would then be verified as resistance. In other words, wecould see a slide to about 4,100, then a rally to about 4,250, and then anothersizable decline.

Of course, that’s just one of thepossibilities, and whether the situation develops exactly like that doesn’teven matter that much because stocks are so overvalued compared to theirfundamental situation (the interest rates are after a series of hikes,remember?) that they are likely to slide in one way or another. And they arelikely to put enormous bearish pressureon the prices of mining stocks (especially junior mining stocks) – perhaps evensimilar to what we saw in 2008 when the carnage unfolded.

What does it all mean? It means that theprecious metals market is likely to slide, quite likely profoundly so, andjunior mining stocks’ prices are likely to truly slide. While I can’t promiseany specific rate of return, it seems to me that the profits on this declineare going to become astronomical.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.