Gold Price Closely Tracks Debt-to-GDP Ratio / Commodities / Gold & Silver 2020

Thedebt-to-GDP ratio is an important metric economists use for comparing acountry’s total debt to its gross domestic product (GDP).

The percentagearrived at by dividing the country’s total GDP by its total debt indicates thecountry’s ability to pay back its loans. The higher the percentage, the higherthe risk of a country being unable to pay the interest on its debt, andtherefore defaulting on its debt. (countries with high debt-to-GDP ratiostypically have trouble paying off debts. Because they are a higher risk topaying loans back, creditors demand higher interest rates. If a country’sdebt-to-GDP ratio becomes too extravagant, creditors may stop lending to italtogether)

While debtdefaults are rare, they can and do happen. In 2010 the European Union faced acrisis when Greece threatened to default, potentially causing a domino effect,of highly leveraged nations like Spain and Italy doing the same, which likelywould have destroyed the European Union.

To avoiddefault, the EU loaned Greece enough to continue making payments on its loans. According to The Balance, since the Greek debt crisis began in 2010, variousEuropean authorities and private investors have loaned the country nearly 320billion euros, in exchange for austerity measures that kept Greece mired inrecession until 2017. According to ratings agency Moody’s, since 1998 at least16 sovereign bond issuers have defaulted. Latin America leads in sovereigndefaults during the modern era; Venezuela and Ecuador have each defaulted 10times, Brazil, Costa Rica and Uruguay have all defaulted on nineoccasions.

Thedebt-to-GDP ratio tends to rise during periods of unrest, because when aneconomy is contracting, a central bank’s usual response is to facilitateincreased borrowing, to stimulate growth and reverse falling demand. If GDP isdropping at the same time that public debt is rising, the ratio goes up.

Apart from tellingus which countries are good and bad credit risks, the debt-to-GDP ratio canalso help in predicting the price of gold. The chart below, by the Federal ReserveBank of St. Louis, compares total US public debt as a percentage of GDP, to theLondon Bullion Market gold fixing price.

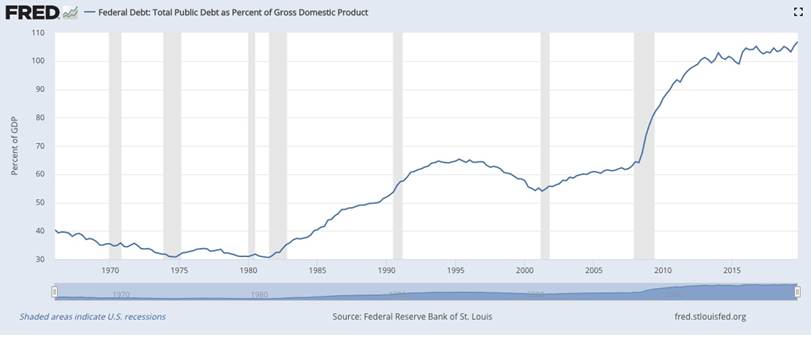

The next chartis simply the debt-to-GDP ratio, over the same period.

And the goldprice since 1975.

We see a positive, though fairly weak, correlation between gold(the red line in the first chart) and the US debt-to-GDP ratio (the blue line)from 1970 until 2008. A significant aberration occurs during the 1980-81recession, when GDP falls and the debt rises, reflected in the blue linereaching close to 5%. This is also a bullish period for gold, with the goldprice change in dollars per ounce reaching $400/oz in 1981, or as shown in thegold price chart, nearly $700/oz.

The red line gold price change flattens out in 1985 andcontinues to trade that way for about 20 years, until the financial crisis hitsin 2007. Notice that during the 1990s, a decade of strong economic growth, lowinflation and a surging stock market, gold (in the yellow chart) hardlydeviates from a range between $200 and $400 an ounce. With the economy doingwell, there is weak rationale for the central bank to increase the debt, andwith GDP growth during the ‘90s peaking at 4.8% in 1999, the debt-to-GDP ratioactually falls, reflected in the diving blue line in the first chart (1991 to2000) and the downward curve of the “hump” in the second chart.

Then comes the 2001 recession, presaged by the September 11attacks. Between 2001 and 2004, the ramp-up of defense spending to fight theWar on Terror pushes the debt-to-GDP ratio from 55% to 60%. The blue line inthe first chart goes from almost -5% in 2000, to +2%, around 2002-03.

But the really big move in these charts, and the period webelieve is most relevant to our current situation, occurs during the financialcrisis of 2008-09.

Faced with a crisis in the banking system caused by excessivelending and a severe depreciation in the US subprime mortgage market, manycentral banks around the world turned to an unconventional monetary policy thatcame to be known as quantitative easing. In QE, a central bank purchaseslong-term securities on the open market in order to increase the money supplyand encourage consumers and businesses to borrow. The policy also serves tolower interest rates by bidding up the prices of long-term bonds, and greatlyexpands the central bank’s balance sheet.

A key point about QE, is that when the Fed buys US Treasuries,to stimulate the economy, it is monetizing US debt. The Balance explains how the processworks:

When the U.S. governmentauctions Treasuries, it's borrowing from all Treasury buyers, includingindividuals, corporations, and foreign governments. The Fed turns this debtinto money by removing those Treasuries from circulation. Decreasing the supplyof Treasuries makes the remaining bonds more valuable.

These higher-valueTreasuries don't have to pay as much in interest to get buyers, and this loweryield drives down interest rates on the U.S. debt. Lower interest rates meanthe government doesn't have to spend as much to pay off its loans, and that'smoney it can use for other programs.

This process may make itseem as if the Treasuries bought by the Fed don't exist, but they do exist onthe Fed's balance sheet, and technically, the Treasury must pay the Fed backone day. Until then, the Fed has given the federal government more money tospend, increasing the money supply, and monetizing the debt.

During the rounds of QE conducted by the US Federal Reserve,starting in 2008, the Fed increased the money supply by $4 trillion. But therewas also a massive fiscal stimulus package launched to get the economy movingagain. Bailing out the banks cost $250 billion and the American Recovery andReinvestment Act added $242 billion to budget deficits in 2009 and $400 billionin 2010.

Turning back to our charts, we see the debt-to-GDP ratio in thesecond chart jump from 62% in 2007 to 83% in 2009, 90% in 2010, and it has keptclimbing ever since.

Gold, being a hedge against inflation, which typically riseswhen the money supply increases, has done very well under periods ofquantitative easing, when central banks literally “print money” to purchasesovereign debt instruments (like US Treasuries) and mortgage-backed securities(MBS).

We see the red line in the first chart spike above $400/oz,within a couple of years of the blue line, the US debt-to-GDP ratio, in 2009reaching a 50-year high of 15% change in debt-to-GDP ratio. The same patternshows up in the second and third charts, where the debt soars to between 100and 110% of GDP between 2012 and 2019 (2020 is not yet reflected in the firsttwo charts) and the gold price rockets from about $800 an ounce in 2008 to anall-time high of $1,900/oz in 2011.

By now we hope you are beginning to notice the same trend weare: as the debt-to-GDP-ratio rises, either because of a drop in GDP due to arecession, or a jump in government borrowing that piles up debt, or both, thegold price reacts.

Turning to our current crisis situation, we have somethingsimilar to what occurred in 2008-09, but it’s different in some remarkableways.

The similarity is that once again, the Fed and Congress haveopened the floodgates to massive stimulus. To deal with the 10 millionAmericans (at last count) left jobless by the covid-19 pandemic, Congress andPresident Trump signed into law a $2.2 trillion emergency stimulus package.Included are a one-time $1,200 payment to most Americans who make under $75,000a year, a $500 billion fund to help hard-hit industries including $50 billion forthe airlines, and$350 billion in loans for small businesses.

Also, like in 2008, the Federal Reserve cut interest rates tozero percent, and made $700 billion in asset purchases, ie. it launched anotherQE.

However, while consecutive rounds of quantitative easing duringthe financial crisis were fairly circumscribed, with lots of debate around howmuch debt to add and how far to cut interest rates, this time around, the USgovernment, the Fed and central bankers around the world are signaling they arewilling to intervene much more in the financial system.

Reuters states: The G20 said on March 26 it would injectmore than $5 trillion into the global economy to limit job and income lossesand "do whatever it takes" to tackle the pandemic.

Indeed theFed’s balance sheet - the amount of assets it has purchased in the name ofkeeping the flatlined economy on life support - has risen to an unprecedented$5.25 trillion - way beyond anything it did in the months and years followingthe financial crisis.

And it’s not only the US central bank that is printingmoney and buying up bonds and MBS like there’s no tomorrow. The EuropeanCentral Bank has added 120 billion euros to its existing asset-purchase programof 20 billion euros a month, bringing the total to 1.2 trillion euros. The ECBalso scrapped a cap on how many bonds it can buy from a single EU country, andcut interest rates to -0.75%, paving the way for more stimulus.

China is set to unleash trillions worth of its yuan currency, topursue infrastructure investment. The People’s Bank of China lowered its primelending rate, cut the amount of cash reserves banks are required to hold, toencourage lending, and made it easier for small and medium-sized businesses toget loans.

Japan announced 430.8 billion yen of extra spending, and will soonkick off a stimulus package that could be worth 10% of its GDP.

The Canadian government passed an C$82 billion emergency stimulusprogram that includes $27 billion direct aid to workers and low-incomehouseholds, and $55B in tax deferrals for businesses and families.

The Bank of Canada also cut its overnight interest rate to 0.25%,and plans to purchase C$5 billion per week in a “made in Canada” quantitativeeasing program that follows the US Federal Reserve’s playbook.

So how does the correlation between gold and the GDP ratio help topredict what could happen to gold during and after the coronavirus crisis?Well, the first thing to understand is that, as the crisis continues toprevent businesses from opening, and people from getting out from their homesand spending money in the economy again, GDP will fall, likelydramatically.

According to Bloomberg Economics’ new GDP tracker, we were already in recession in March. Itshows the global economy contracting at an annualized 0.5%, compared to 0.1% inFebruary and 4.2% in January.

That’s the first part of a rising debt to GDP ratio - a fall inGDP. The second part is an increase in debt. A Bloomberg article states the Federal Reserveis “poised to spray trillions of dollars” into the US economy, made possible bya $454 billion fund in the aid package to backstop lending by the Fed:

That’s money the centralbank can leverage to provide massive amounts of financing to a broad swathe ofU.S. borrowers.

“Effectively one dollar ofloss absorption of backstop from Treasury is enough to support $10 worth ofloans.” Fed Chairman Jerome Powell said in in a rare nationally-televised interview early Thursday morning. “When it comes to this lending we’re not goingto run out of ammunition.”

Combined with an unlimitedquantitative easing program, the Fed’s souped-up lending facilities are set topush the central bank’s balance sheet up sharply from an already record high$4.7 trillion, with some analysts saying it could peak at $9-to-$10 trillion.

Wow. Consider what a $10 trillion Fed balance sheet will do tothe debt-to-GDP ratio. Already at 108%, a level not seen since World War II,it’s not inconceivable for the ratio to spike to $150%, or 200%. That wouldmean for every dollar the US economy produces, it has to borrow $1.50, or$2.00. That’s insane.

Now think about what this could mean for gold. Historically, weknow that as the percentage of debt to GDP rises, so does gold. For a reminderof how this works, look at the chart below, just a 5-year version of the 30-yearchart above.

Moribund for five years, as the commodities boom of the late2000s ran out of gas and led to a bear market for most metals, we see the goldprice coming back to life in 2016 when it rose above $1,300 and has kept goingto its current ~$1,600 an ounce. This corresponds to rising debt and fallingGDP. In 2016 US defense spending was $736 billion, in 2016 it rose to $767B,and in 2017 Congress raised the debt ceiling, allowing the ratio to climb to103%. The Trump administration’s $1.5 trillion tax cut later that year bumpeddebt up to 104% of GDP in 2018. Record-level defense spending in 2020 of $956billion is projected topush the debt this year past $24 trillion, or 108% of GDP, thehighest ever.

All of this was before the coronavirus crisis prompted emergencystimulus measures that includes at a minimum, $2 trillion in new spending, andpossibly doubling the Fed’s balance sheet from its current $4.7T to $10T.

The longer stimulus measures continue, including a creepingexpansion of the Fed’s balance sheet and negative realinterest rates (interest rates minus inflation) which are always bullish forgold, we see no reason to doubt that gold will keep climbing. In the chartabove, where the blue line flattens at the end of 2019, we expect it to make avery sharp turn upward, as truly awful first and second-quarter economic datacome in, global GDP crashes, and worldwide government debt, which was expected to hit $53 trillion this year, (again this was beforecovid-19) soars.

Meanwhile gold’s red line which shows volatility at the farright side of the chart, reflected in the stock market convulsions inFebruary-March owing to the pandemic, could very well begin a steadily upwardtrend, similar to what happened in 2008-11, possibly meeting and beating gold’srecord $1,900/oz.

Want toknow what happens to gold in future? It’s not that hard. Between following realinterest rates and the debt to GDP ratio, we have a pretty good idea of wherethe precious metal is headed.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.