Gold price forecast: Short-term bottom in place

Trade war fears have boosted gold price as expected, confirming a short-term bottom, although only a convincing break above the key trendline resistance would allow a sustained a rally to $1,366 (Jan. 25 high) and above.

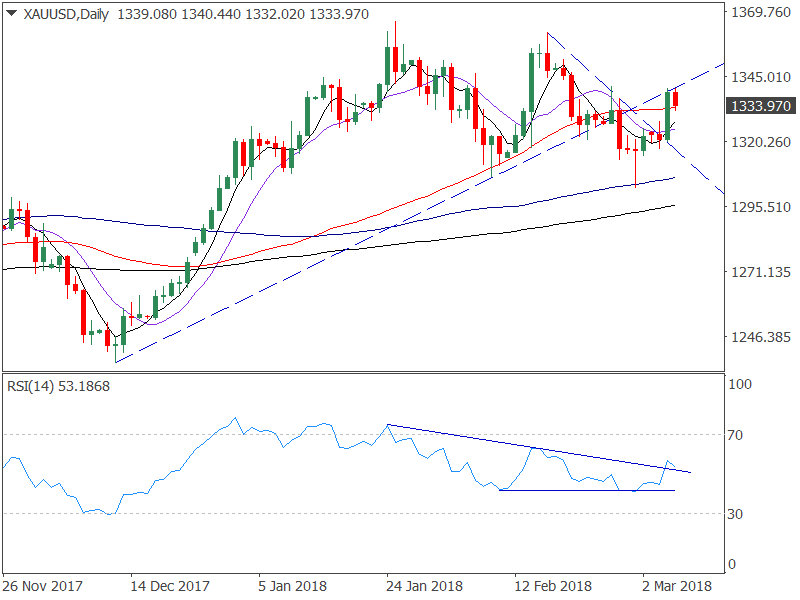

Daily chart

Last Thursday's long-tailed Doji candle followed by a violation of the falling top pattern (marked by descending trendline) and a rise to $1,340 yesterday suggests the sell-off from the Feb. 16 high of $1,361 has made a temporary low. However, only a daily close above the ascending trendline resistance (drawn from the Dec. 12 low and Feb. 8 low) would revive the bullish outlook and open doors for a sustained rally to $1,366 (Jan. 25 high). That said, a bullish triangle breakout as seen on the relative strength index (RSI) favors further upside in gold prices. On the downside, a daily close below $1,320 (previous day's low) would signal bullish invalidation.| Bullish | Neutral | Expanding | |

| Bearish | Oversold | Shrinking | |

| Bearish | Neutral | High | |

| Bullish | Neutral | Low | |

| Bearish | Neutral | High | |

| Updated Mar 7, 06:15 GMT | |||

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these securities. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Forex involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.