Gold Price Gann Angle Update / Commodities / Gold & Silver 2020

Golds bullish trend has worked well in 2020, so what is next over the immediate 3 to 6 months? Will we continue to see a golden future.

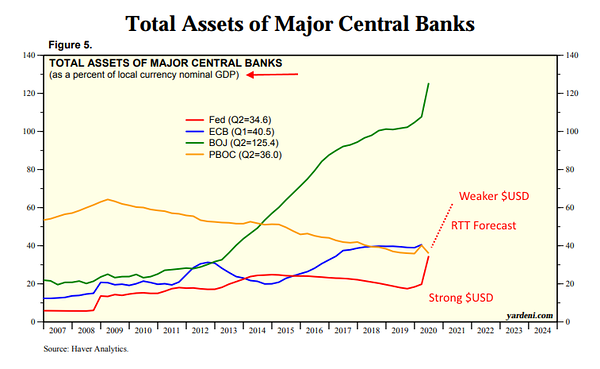

The US dollar had been strong into COVID 19, since then the FED has printing a lot of money, and they are also considering YCC (Yield Curve Control), last seen during WW2. [Note YCC lasted 9 years over WW2. WOW, that is a lot of money printing.]

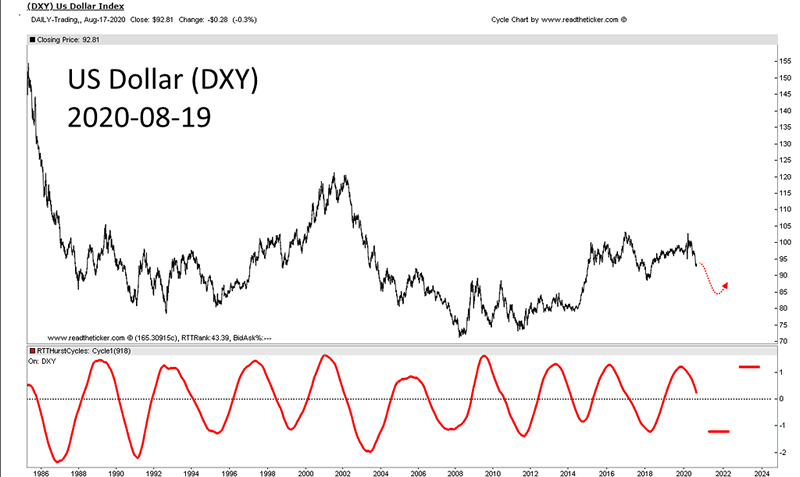

The FED is now forecast to over take competing central banks balance sheets in size, and the release valve will be a falling US dollar. Therefore we should continue to see the US dollar maintain is slow leak down over the next 3 to 6 month, say on the DXY 82 to 88.

Also, US election worries will add to the weakening of the dollar. Of course extreme chaos in Washington will accelerate the US dollar decline.

FED forecast

The US dollar continues to follow its time cycle (re posting of chart).

US dollar

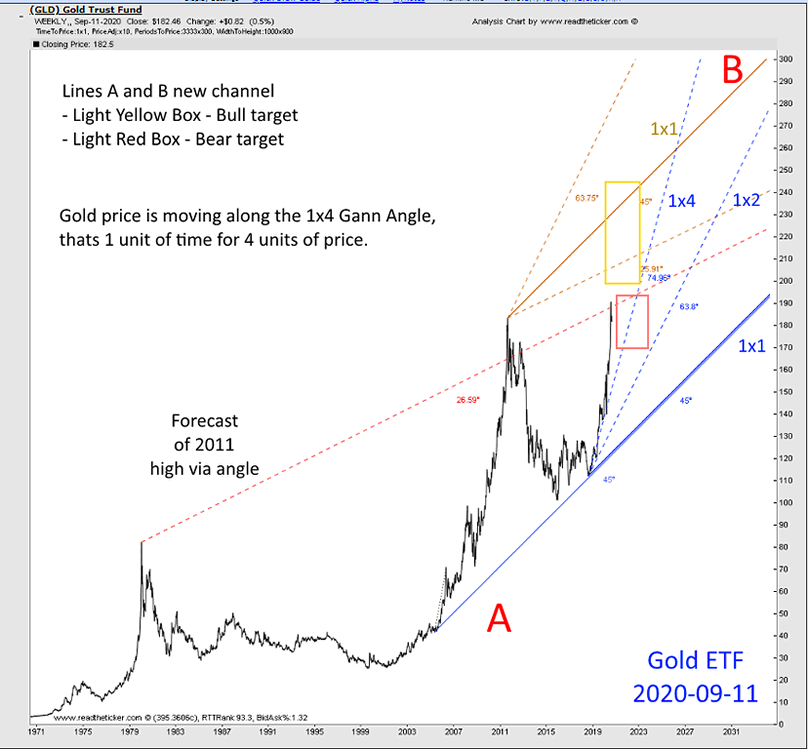

These Gann Angles on gold (GLD ETF) high light the BULL and BEAR plays. If the US dollar continues to fall then the light yellow box should be considered as a target to take profits.

GOLD

Fundamentals are important, and so is market timing, here at readtheticker.com we believe a combinationof Gann Angles, Cycles, Wyckoff and Ney logicis the best way to secure better timing than most, after all these methods have been used successfully for 70+ years. To help you applying Richard Wyckoff and Richard Ney logica wealth of knowledge is available via our RTT Plus membership. NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.netInvesting

NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net

Readtheticker

My website: www.readtheticker.com

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2020 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.