Gold Price Just Can't Seem to Breakout / Commodities / Gold and Silver 2021

Confirmed, unconfirmed, verified, andinvalidated: breakouts and breakdowns are now ubiquitous. And the implicationsare bearish for gold.

Let’s start today’s analysis with adiscussion of the key market that everyone is interested in – gold.

Gold’sFailed Breakout – A Sell Sign

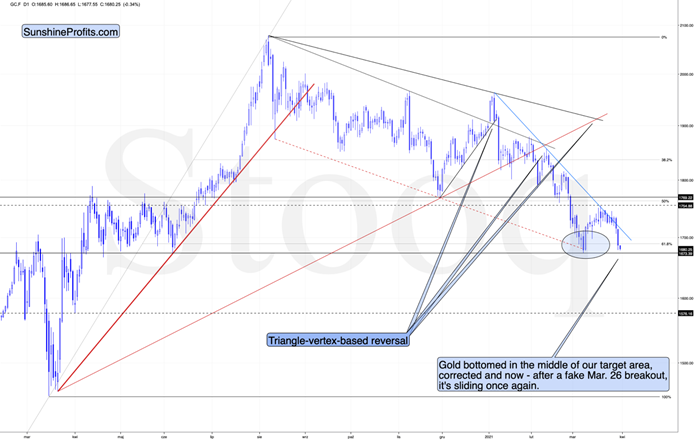

In short, gold just invalidated its smallbreakout above the declining blue resistance line. The previous breakout wassmall and thus it required a confirmation. It never got one, and instead goldplunged, invalidating the move. This is yet another sell sign that we saw.

It also serves as further proof that eversince the beginning of the year, gold permabulls (many people continue to claimthat gold can only go up, even now) were destroying value rather than creatingit. On a side note, we have nothing against checking out the work of otheranalysts, but we encourage you to check if someone was both bullish and bearish on a given market. If they never changed their mind, it seems that you can savesome time by not reading what they come up with, as you already know theoutcome. Besides it’s not like they would prepare you in advance for anydecline (in case of permabulls).

Getting back to the current marketsituation – since gold moved lower quite visibly yesterday (Mar. 30), and even(almost) reached its early-March high, it might be tempting to think that thedecline is over. This seems unlikely in my opinion.

The lessimportant reason for the above is visible right on the above chart. Earlierthis month, gold topped very close to its triangle-vertex-based reversal. Theprevious two triangle-vertex-based reversals also triggered declines. So, ifsomething similar triggered similar moves, then it might be worth checking howbig did the previous declines end up being.

Both previous 2021 declines were followedby quite visible declines. The one that started in early Jan. took gold over$130 lower, and the one that started in mid-Feb. took gold over $170 lower. Thecurrent decline started at $1,754.20, so if the history is to rhyme (as itoften does), gold would be likely to decline to at least $1,584 - $1,624. Thistarget area corresponds quite well to the support provided by the early Mar.and early Apr. 2020 lows.

Themore important reasons due to which it seems likelythat the decline will continue are: the rally in the USD Index and the rally inthe long-term interest rates.

TheUSD’s Rally

As far as the latter is concerned, itseems unlikely that we’ll see the Fed stepping into action with anotherOperation Twist until the general stock market slides. Otherwise, such a bigintervention might seem uncalled for. Consequently, the long-term rates are likely to rally some more. And gold is likely to respond by decliningfurther.

As far as the USD Index in concerned, itjust moved to new yearly highs, and since the nearest strong resistance isrelatively far (from the short-term point of view), it seems that the movehigher will continue with only small corrections along the way.

The USD Index has not only confirmed thebreakout above its Feb. highs, but it even managed to break above the risingred support line. This line, along with the rising black line based on the Feb.and mid-March lows, creates a rising wedge pattern that was already broken to theupside. The moves that tend to follow such breakouts often are as big as thesize of the wedge. I used red, dashed lines for this target-determiningtechnique. Based on it, the USD Index is likely to rally to about 96.65.

The above target is slightly above themid-2020 highs, so it might seem more conservative to set the upside target atthose highs, close to the 94.5-94.8 area. The mid-2020 highs are likely totrigger a breather, but it doesn’t have to be the case that the USD Indexpauses below these highs. Conversely, it could be the case that the USD Indexfirst breaks above the mid-2020 highs and consolidates after the breakout. Infact, that’s what it did with regard to the breakout above the Feb. 2021 highs.

Consequently, I’m broadening the target areafor the USD Index, so that it now encompasses also the more bullish scenario inwhich the USDX takes out the mid-2020 highs before consolidating.

Either way, we’re currently in the “easypart” of the USD’s rally. Even if it’s going to consolidate at or below themid-2020 highs, it’s still very likely to first get there, and this implies amove higher by at least another fullindex point. This means that the goldprice is likely to decline some more before finding short-term support. Thescenario fits very well with the situation that I outlined based on the goldchart earlier today.

SilverLosses

Silver just broke to new 2021 lows.Everyone buying silver (futures) in Jan. / Feb. is now at a loss and in anincreasingly inconvenient situation.

Whywould this be important? Because it means that everyone who jumped into thesilver market with both feet based on just very brief research (“research”?)which in many cases was following instructions provided at various forums is ina losing position right now.

Sometimesthe losses are small – for the very few, who were early, but in some cases, thelosses are already quite visible – especially for those, who bought close to$30.

Whyis this important? Because it emphasizes the need to verify the quality of theinformation that one chooses to act on, and because it’s a tipping point afterwhich the previous buyers are likely to start becoming sellers, thus adding todecline’s sharpness.

The“new silver buyers” losses are not huge yet, but after another move lower, theywill likely become such and the sales from those buyers would likely make thesedeclines even bigger.

Wheneveryone and their brother was particularly bullish on silver a few months ago,I wrote that they might be quite right, but the timing was terrible. So far,the losses for those, who bought silver earlier this year are not that big,but, in my opinion, they are likely to become much bigger in the followingweeks.

Ofcourse, I expect silver price to soarin the following years (well over $100), but not without plunging firstin the short and/or medium term.

TheMiners’ Relative Strength

Let’s take a look at the mining stocks.In yesterday’s analysis , I explained the likely reason behind the temporary strength in the miningstocks, and I emphasized that it’s not likely to last. This explanation remainsup-to-date:

Ultimately,it’s never possible to reply to the “why did a given market move” other thanthat “because buyers won over sellers”. It’s not particularly informative, though.The reason that seems most likely to me is that it was… a purely technicaldevelopment that “needed” to happen for a formation to be complete.

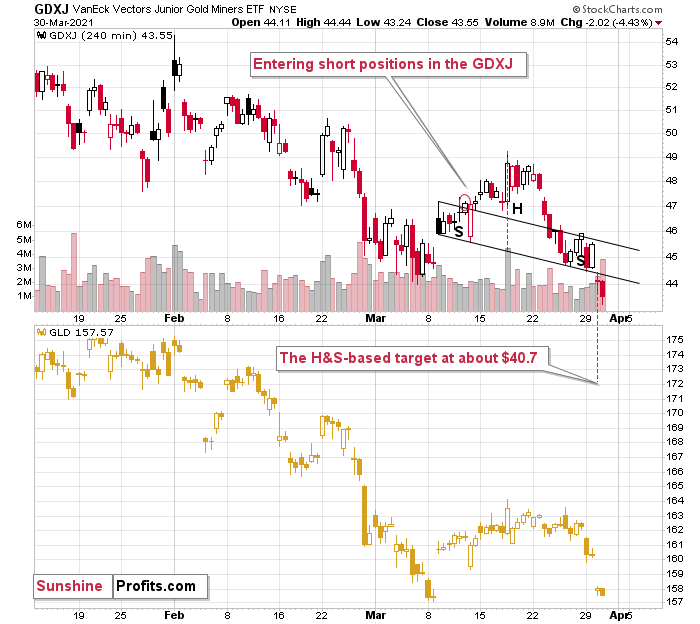

Thishypothesis would explain also one odd thing that happened yesterday. Namely,while the GDX closed the day slightly higher, the GDXJ ended the day lower.This would make sense if the general stock market declined ( junior mining stocks – GDXJ tend to follow its lead more than seniors– GDX) – but the point is that the general stock market ended yesterday’ssession basically flat (declining by mere 0.09% decline).

“Ok,so what kind of formation are miners completing?”

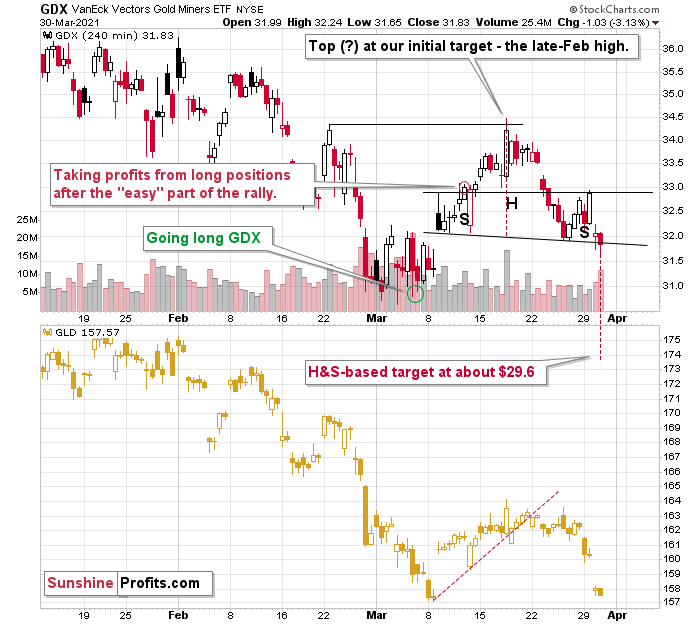

Quitelikely the head and shoulders formations. The reason for yesterday’sunderperformance of the GDXJ would be the fact that in case of this ETF’s head-and-shoulders formation , the neckline is descending much more visibly.These formations are more visible on the 4-hour charts – so, let’s zoom in.

Currently – based on yesterday’s (Mar.30) closing prices – both formations are completed, and while it could still bethe case that both ETFs move back to their previous necklines to verify thebreakdowns, the implications are already bearish for the short term.

The price targets based on thoseformations are $29.6 and $40.7 for the GDX and GDXJ, respectively. However,let’s keep in mind that the H&S-based targets should be viewed as “minimum”targets, not necessarily the final ones.

All in all, the technical picturecurrently favors lower precious metals (and mining stock) prices over the nextseveral weeks. In my view, this is either the middle or the final part of thevery final decline in the precious metals market, before it takes off based onmultiple positive factors of long-term nature.

Thankyou for reading the above free analysis. It’s part of today’s extensive Gold& Silver Trading Alert. We encourage you to sign up for our free goldnewsletter – as soon as you do, you'll get 7 days of free access to our premiumdaily Gold & Silver Trading Alerts and you can read the full version of theabove analysis right away. Signup for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.