Gold Price Multiple Confirmations - Are You Ready? / Commodities / Gold & Silver 2024

In my yesterday’s Gold TradingAlert, I wrote that we had some clues regarding the end of thecorrective upswing.

CorrectiveUpswing Nearing Its End

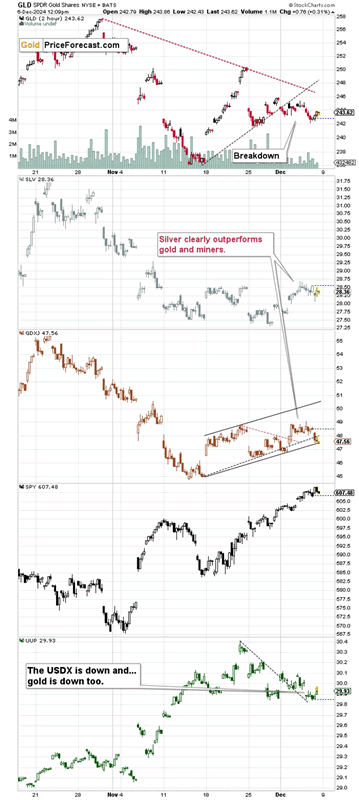

We saw an invalidation in the GDXJ (ofthe tiny move to new short-term highs), and before that silver outperformed ona short-term basis, which was also a bearish indication. Today, we got somemore.

Today, miners are back in theirunderperformance mode. While gold (btw, did you know that you can earninterest in gold – paid in gold?) is pretty much doing nothing, theGDXJ is down. Stocks are not down, so it’s not that weak stock marketperformance would explain this weakness in the GDXJ.

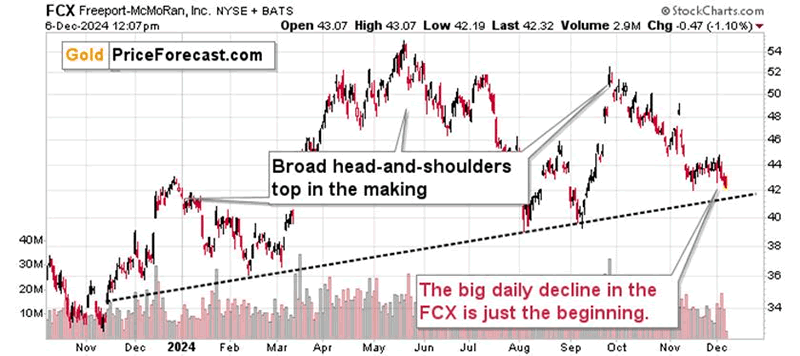

That’s one confirmation. Another onecomes from the copper market, and more precisely from the way FCX (copper andgold producer) is behaving given copper’s short-term (small, but still)upswing.

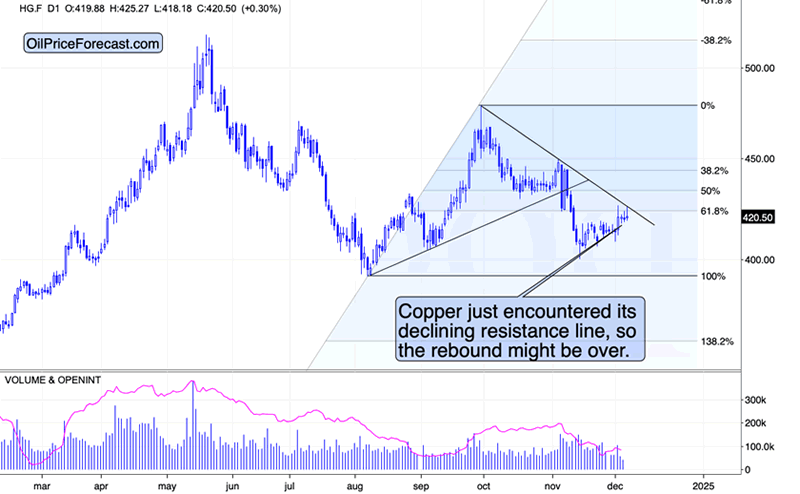

Copper moved higher in the last fewweeks. Not significantly so – it simply launched a nice correction after asharp decline. That’s normal.

Now, one thing suggesting that thecorrective rally might be over is that copper’s price reached its decliningresistance line. The other – that I mentioned earlier – is that despite therecent run-up, FCX, being primarily a copper stock has been performing poorly –also today.

FCX looks like it just can’t wait tobreak below the neck level of the head-and-shoulders top formation. It’salready trading at its November low, even though copper is relatively far fromit.

Gold stocks underperforming gold price indicate lower prices for both.

Copper stocks underperforming copperindicate lower prices for both.

And since precious metals and commoditiestend to move together during big moves (not in each and every case, but quiteoften so), the above points also serve as a bearish confirmation for theprecious metals market.

Bullish Hammer in theUSDX

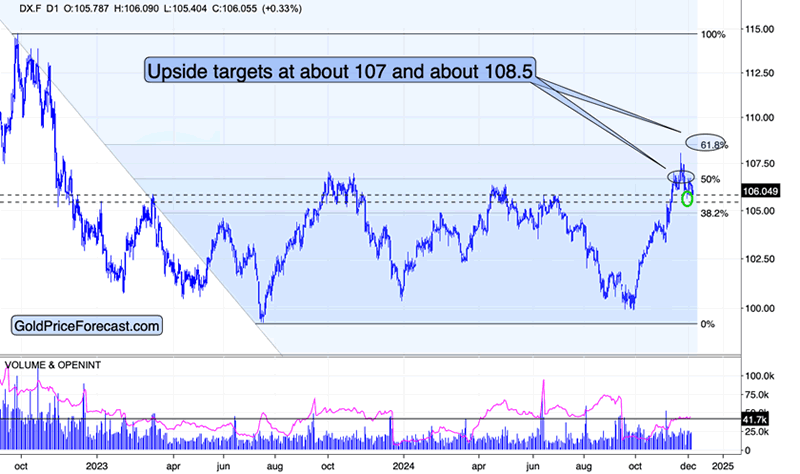

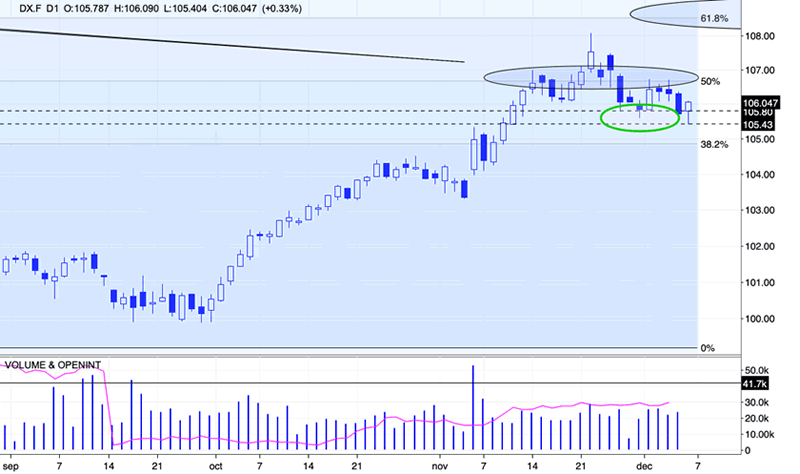

Finally, something interestinghappened in the USD Index. Right after almost completing it (supposedly)bearish headand shoulders top pattern… It rose back up like phoenix from theashes.

Maybe the analogy seems too big for justa daily comeback, but given how sharply USD Index was rallying previously, thisdaily revival could easily turn into another big move up.

Please note how perfectly the USD Indexmoved back up after reaching the lower of the dashed lines (support based onthe previous highs). At the same time, it invalidated the move below thelate-November low.

Also, the session is not yet over, but ifthe USDX closes more or less where it’s trading at the moment of writing thesewords (or higher), we’ll have a daily reversal (bullish “hammer” candlestick),which would be bullish on its own, but also given the analogies to whathappened when we previously saw this candlestick.

We saw it in late September and in theearly November. In both cases, sizable rallies followed. And since the preciousmetals market is once again reacting to USDX’s rallies (by declining), theabove is bearish for the former.

So, yes, we have quite a few additionalreasons to expect the precious metals sector to move lower in the followingweeks, and - quite possibly - days.

Is it better to profit from decliningprices of precious metals (junior miners are likely to decline the most in myview), or from the decline in copper stocks?... Actually, why not both?

All in all, while there remain someopportunities to gain something extra on gold investments in thelong run, the outlook for the precious metals market remains bearish for thefollowing weeks. And the profits from our short position in junior miners arelikely to grow further.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.