Gold Price Outlook: The Inflation Chasm Between Europe and the US / Commodities / Gold and Silver 2021

With inflation more than two timeslower in Europe than in the US, the divergence between the economic zonesdeepens day by day. How might it impact gold?

QEInfinity

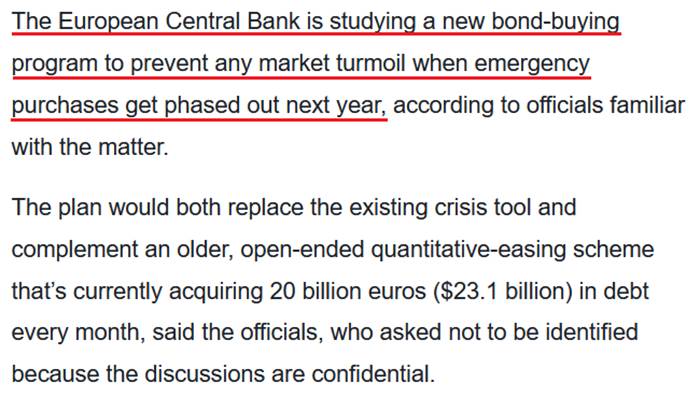

While I’ve warned on several occasionsthat the Fed and the ECB are worlds apart, thelatter now wants to provide more QE once it concludes QE. To explain, withthe ECB’s PEPP program set to expire at the end of March 2022, the central bank isincreasingly worried about a bond market sell-off. And with sluggish Eurozone growth, exorbitant sovereign debt and a lack of fiscal impulse increasing theECB’s anxiety, officials are studying “alternatives” to suppress interest ratesin the Eurozone’s most debt-riddencountries.

Please see below:

Source: Bloomberg

For context, I’ve been warning for monthsthat the ECB would disappoint euro bulls.

I wrote on Apr. 27:

Recentwhispers of the ECB tapering its bond-buying program are extremely premature.With the European economy still drastically underperforming the U.S., it’sactually more likely that the ECB increases the pace of its bond-buyingprogram. Case in point: while the EUR/USD ignores the reality, last week’s PEPPpurchases (€22.2 billion) by the ECB were the highest since June 2020. Moreover,since its March meeting, the ECB has increased its average daily PEPP purchasesper week from €2.90 billion to €3.60 billion.

To that point, with reality in fashiononce again, the EUR/USD closed at a new2021 low on Oct. 6 and sunk to its lowest level since July 2020. Forcontext, the EUR/USD accounts for nearly 58% of the movement of the USD Index,and the performance of the currency pair is material.

Please see below:

Furthermore, with the Fed closing in on a taper announcement and the ECB searching fornew ways to extend QE, the divergence is profoundly bullish for the U.S. dollar.To explain, rising Eurozone inflation (which pales in comparison to the U.S.)underwrote misguided optimism for a hawkish shift. However, ECB PresidentChristine Lagarde reiterated her dovish stance on Oct. 5, saying that “weshould not overreact to supply shortages or rising energy prices, as ourmonetary policy cannot directly affect those phenomena.”

TheInflation Divergence Is Profound

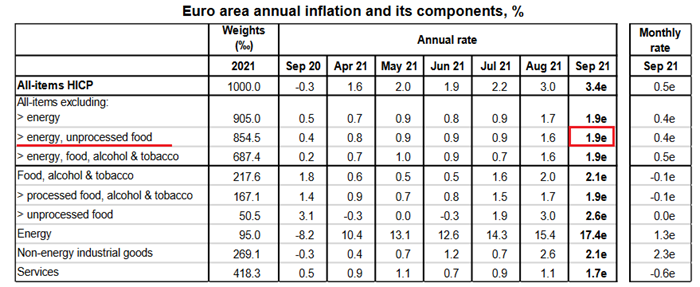

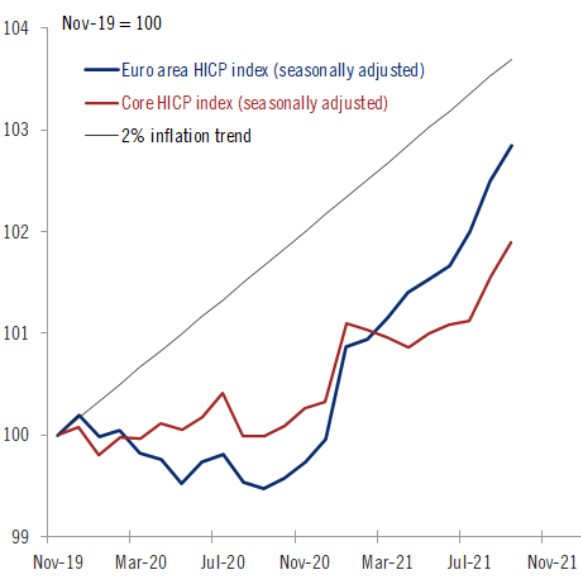

Moreover, while the Eurozone headlineHarmonized Index of Consumer Prices (HICP) increased by 3.4% year-over-year(YoY) in September (released on Oct. 1), the U.S. headline HICP surged by 6.77%in its latest print (released on Aug. 18). Even more revealing, if you exclude the inflationary impacts offood and energy prices, the Eurozone core HICP only increased by 1.9%YoY in September.

Please see below:

Source: Eurostat

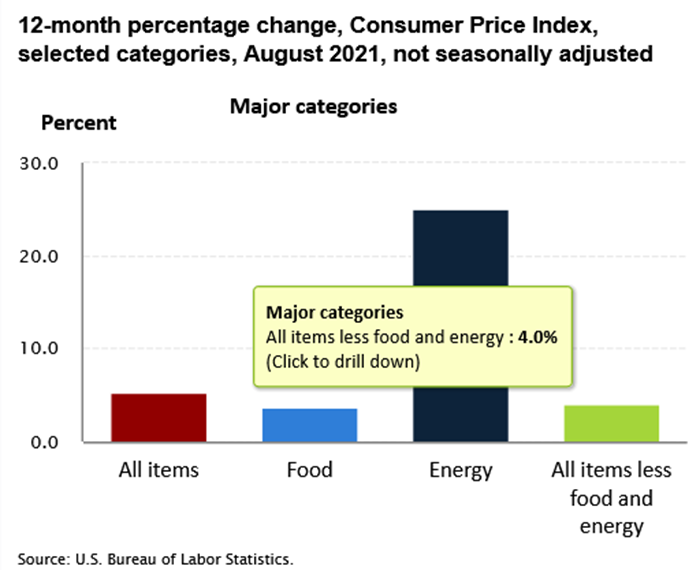

In stark contrast, the U.S. core ConsumerPrice Index (CPI) – which also excludes the inflationary impacts of food andenergy prices and the latest release is more current than the U.S. HICP –increased by 4% YoY in August (released on Sep. 14).

Please see below:

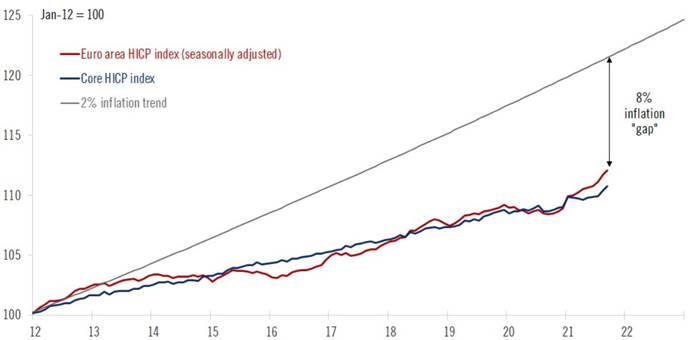

In addition, while the Eurozone headlineHICP at 3.4% YoY is still higher than the ECB’s 2% annual inflation target,it’s important to keep things in perspective. For example, since Lagarde hasbeen leading the ECB, the Eurozone headline and core HICP have trended 0.8% and1.7% below her annual targets. What’s more, when indexed from the beginning of 2012, Eurozone headline HICP isstill 8% below the ECB’s 2% annual inflation trend.

Please see below:

Source: Frederik Ducrozet

To explain, the red and blue lines abovetrack the index levels of the Eurozone headline and core HICP, while the grayline above tracks the index level assuming the ECB has been meeting its 2%annual inflation target since the beginning of 2012. If you analyze thematerial gap on the right side of the chart, you can see that the ECB is farfrom achieving its objectives.

Likewise, if we zoom in on the roughlytwo-year chart, both the Eurozone headline and core HICP are still trackingmaterially below the ECB’s annual inflation targets.

Please see below:

Source: Frederik Ducrozet

CyclicalSlowdown Ahead?

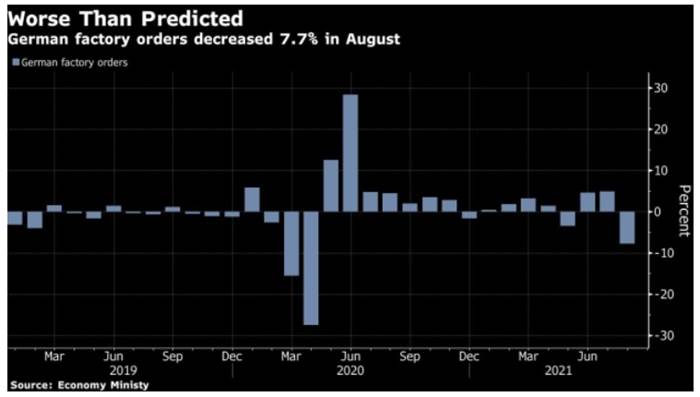

Furthermore, while the ECB studies“alternatives” to prevent interest rates from spiking in high-debt countrieslike Greece, Italy and Portugal, Germany – Europe’s largest economy – hassuffered a significant economic setback. To explain, Germany is amanufacturing-heavy economy and exports are an important component of GermanGDP. However, with German factory ordersplunging by 7.7% on Oct. 6 – withforeign demand down by 9.5% and domestic demand down by 5.2% – it was thesharpest month-over-month (MoM) decline since April 2020. For context, theconsensus estimate was for a 2.1% decline.

Please see below:

Piecing it all together, with interestrate anxiety merging with a cyclical slowdown in Europe, Danske Bank expectslower-for-longer ECB policy to contribute to a lower-for-longer EUR/USD. TheDanish bank’s strategists told clients:

“There has been no shortage of calls forEUR/USD to 1.30, of pieces written on a regime shift having happened in fiscalpolicy, oversubscription to social bonds and much more. However, narrativeschange…. Stagflation, rapid cyclical slowdown, rising interest rates and acorrection in valuations may prove to be a very negative capital shock to theeuro area and its asset prices. Wetarget 1.13 in spot EUR/USD in the next year but if stagflation, cyclical slowdown and rising rates becomedominant themes, then there seem to be clear downside to such estimate.”

Adding to the bearish euro thesis, withU.S. nonfarm payrolls scheduled for release on Oct. 8, a strong print couldusher the EUR/USD even lower. For example, ADP’s private payrolls came in at568,000 vs. 428,000 expected on Oct. 6. And though ADP’s data is an extremelypoor predictor of U.S. nonfarm payrolls, Nela Richardson, chief economist atADP, provided the following context:

“The labor market recovery continues tomake progress despite a marked slowdown from the 748,000 job pace in the secondquarter. Leisure and hospitality remains one of the biggest beneficiaries tothe recovery, yet hiring is still heavily impacted by the trajectory of thepandemic, especially for small firms. Current bottlenecks in hiring should fadeas the health conditions tied to the COVID-19 variant continue to improve,setting the stage for solid job gains in the coming months.”

And expecting those “solidjob gains” to materialize sooner rather than later, J.P. Morganstrategists told clients that “we are looking for a 575,000 gain in jobs [onOct. 8]. The driver for an above-consensus forecast is the expected rebound inthe leisure and hospitality sectors.” For context, the consensus estimate isfor 500,000 jobs added.

The bottom line? While the EUR/USD isfinally starting to reflect fundamental reality, more downside shouldmaterialize in the coming months. With the Fed accelerating its hawkishrhetoric (and Chairman Jerome Powell’s shift the most noteworthy), the ECB isheaded in the opposite direction. And while I’ve been warning for months thatthe Eurozone’s economic recovery is much more fragile than the U.S.’, the seedsare now sown for a profound divergence in central bank policy.

Moreover, while U.S. nonfarm payrolls mayor may not accelerate the timeline on Oct. 8, it’s important to remember thatthe medium-term implications remain intact: the Fed should taper at a much faster pace than the ECB and theliquidity drain should pressure the FED/ECB ratio and the EUR/USD in the comingmonths. More importantly, though, with the EUR/USD’s pain the USD Index’sgain, the latter’s strong negative correlation with gold, silver and miningstocks should result in further downside for the PMs over the medium term.

In conclusion, the PMs were mixed onceagain on Oct. 6, though silver, was the worst performer of the bunch. Moreover,with the USD Index recapturing 94, and the front-end of the U.S. yield curverallying as well, a recovering U.S. labor market should add more upwardmomentum to the PMs’ fundamental villains. As a result, the precious metals’current consolidations will likely give way to sharp drawdowns in the comingmonths.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.