Gold Price REALly Declines and That's Just the Start / Commodities / Gold & Silver 2023

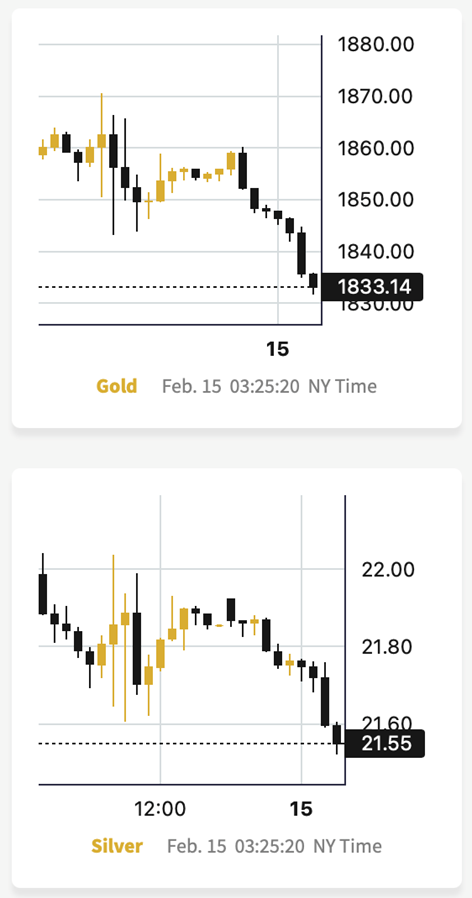

In all likelihood – yes. Then it’slikely to slide more – much more. With this pace (chart courtesy of GoldPriceForecast.com),gold could move below $1,800 in no time.

It’sAll About Interest Rates

But why would it decline at all? Isn’tthe war in Europe a reason for gold to rally? Isn’t inflation declining so theFed can lower rates and thus cause gold to rally?

No – it’s not that simple.

First, gold already rallied due to theRussian invasion – whatever was likely to happen based on that news, alreadyhappened. Interestingly, gold already gave away all those war-tension-basedgains and then declined more (in the following months of 2022). So, no, neitherthis nor other geopolitical events are likely to make gold rally in asustainable manner. In fact, geopolitical events tend to cause only temporary safe-havenrallies in the gold price – and that’s what we saw last year.

Second, gold’s link with inflation is notthat clear. Gold does rally in hyperinflationary scenarios, and it tends toperform well in stagflation. However, in cases of moderate to low inflation, itdoesn’t necessarily rally.

In REALity (pun intended), it’s all about real interest rates, noteither inflation on its own or nominal interest rates on their own.

Putting fancy economic terms aside, itall comes down to whether one can easily gain extra income by lending outcapital at interest or whether this action would make one lose money anyway.

In other words, will the gains (interest)be bigger than the losses due to the declining value of money (inflation)?

If the interest is bigger than inflation,“it’s all good.”

If the inflation is greater than theinterest, then people can expect to lose money (its value) even if they arelending it out to someone else. That’s what they want to be protected against,for example, by buying gold, which is known to have served as money forthousands of years.

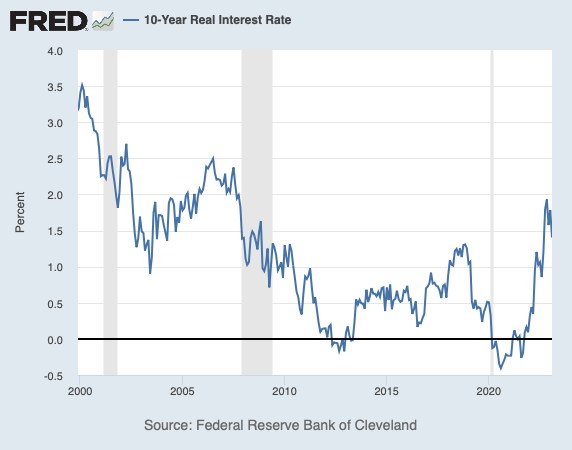

The difference between nominal interestrates and the (expected) inflation rate is the real interest rate. The higher it is and the higher it moves, the lessand less appealing gold ownership becomes.

In contrast, as real interest rates fall,gold ownership becomes increasingly appealing. Does it really work?

You bet!

The 10-year real interest rate had beendeclining for years, just as gold was soaring. And as the rate bottomed inmid-2012, gold plunged.

AYear-Long Delay

Please note that this isn’t a precisetechnical tool that would allow for making short-term forecasts. The ratebottomed in mid-2012, and that wasn’t the final top in gold. The final top ingold formed one year before, but what formed in mid-2012 was the final“good-bye top” before the huge decline started.

When did we see another real-rate bottom,and even an attempt to move well below the previous low? In mid-2020. Thistime, the link was quite precise, as that’s exactly when gold topped, too.

Now, the real rates are up after asizable rally, and they are at their highest levels in over a decade. Golddidn’t decline to its decade-plus low. Is something wrong with the above lineof thought?

Not necessarily. Please note that back in2011 and 2012, gold had approximately ayear-long (!) delay in reacting to the fact that there was a bottom.

Back in 2012, gold still moved higher,but it wasn’t able to show the same kind of strength as before the 2011 top.This is exactly what we sawrecently, during the short-term corrective upswing.

Gold’s delay is significant, but realitywill catch up sooner or later. Probably very soon, because the delay is alreadyhuge.

The most extreme aspect of the precedingis that real rates are unlikely to have peaked. Far from it.

I don’t want to go into details today,but in essence, in order to effectively combat inflation, the nominal rateswould need to overshoot the CPI year-over-year change. The difference betweenthem is about 2% right now.

Let’s recall what real rates are – thedifference between nominal rates and (expected) inflation. The CPI will serveas a proxy for expected inflation here (it’s not perfect, I know, but it’s goodenough). As a result, if the Fed is serious about combating inflation (and itis, because inflation has become political! ), real interest rates are likelyto rise by at least 2% from their current levels.

And it doesn’t really matter if ithappens through higher nominal interest rates or through a lower CPI. Both willprobably take place.

Consequently,gold is likely to decline profoundly based on its reaction to what has alreadyhappened in real interest rates but also to slide because of the upcomingincrease in real interest rates.

Yes, the situation really is extremelybearish (and profitable for those who position themselves correctly – all bigshifts create big opportunities), and yes, most people choose to ignore it (andmost people will not make profits as the situation unfolds). Why? Becausemarkets (=people) are emotional rather than logical in the short and mediumterm. That’s one of the reasons why we have those disparities between whatshould be taking place on the markets and what is really happening. But as timepasses, reality is likely to kick in.

Based on today’s slide, it seems that the“kick” is already working.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.