Gold Price Seeks Direction as USDX Slips / Commodities / Gold & Silver 2020

As of Wednesday (Dec. 30) morning,gold is range trading and remains more or less flat as it seeks momentum. As wewait for the precious metals to act on a catalyst, let’s also take a look atthe Euro’s relation to the U.S. Dollar and how both impact gold.

Over the last 24 hours, the preciousmetals market did more or less nothing, despite the new daily decline in theUSD Index. The latter is now testing its monthly and yearly lows, while the PMsare not. PMs – as a group – are not reacting to what should make them rally,and this is yet another bearish sign for the preciousmetals market.

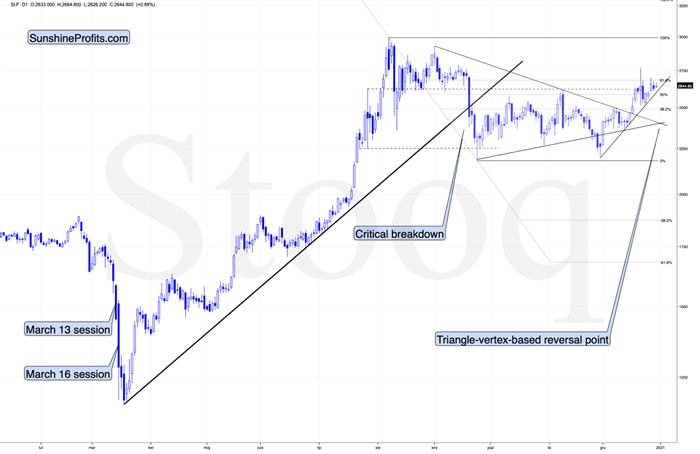

Figure1 - USD Index (Sept – Dec 2020)

The USDX is at its monthly and yearlylows and at the same time…

Figure2 - COMEX Gold Futures (Jan – Dec 2020)

Gold is about $30 below its monthly high,and about $200 below the yearly low.

After a temporary breakout, gold is backbelow its 2011 high. The breakout above the latter was clearly invalidated.

Figure3 - COMEX Silver Futures (Jan – Dec 2020)

Silver is not even close to its 2011high, and while it’s relatively strong compared to gold and miners on ashort-term basis, it’s not at its December high right now. It’s also a fewdollars below its yearly high.

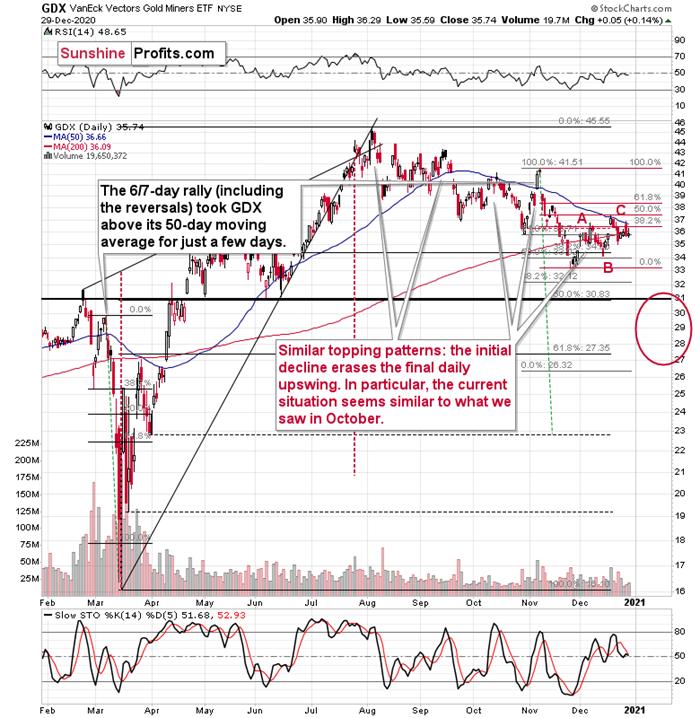

Figure4 - GDX VanEck Vectors Gold Miners ETF (Feb – Dec 2020)

Miners remained relatively quiet onTuesday (Dec. 29).

We see that the GDX ETF moved lower onceagain despite the intraday attempt to rally. During Monday’s (Dec. 28) session,miners once again moved back to their 50-day moving average and… Once againverified it as resistance. The implications are bearish.

Let’s get back to silver once again. Onits chart, you can see a triangle-vertex-based reversal at the end of the year.Before the price moves close to the reversal, it’s relatively unclear what kindof implications a given reversal is likely to have. Well, including today’s(Dec. 30) session, there remain only two sessions until the end of the year, sowe’re likely to see the reversal shortly.

Based on the likelihood that the next bigmove is going to be to the downside, it would fit the overall picture more ifthe upcoming reversal was a top, not a bottom. A bottom would imply a rally inthe following days or weeks, and the relative performance (as described above)along with other factors continues to favor a bigger decline.

This means that we might not see a meaningful decline for a fewmore days, and we might even see one final move higher before the top isformed. This could be something that takes place in silver only, or somethingthat we see in gold and miners as well. Still, I don’t expect it to be reallysignificant in case of the latter. They are underperforming the metals, afterall.

Before summarizing, let’s discuss the USDIndex’s main part – the EUR/USD currency pair in greater detail. After all,this pair often moves in tandem with gold.

EUR/USD Decouples from Fundamentals

JohnMaynard Keynes once said, “Markets canremain irrational longer than you can remain solvent.”

And right now, EUR/USD is putting histheory to the test.

Because the euro accounts for nearly 58%of the movement in the USD Index, its rise (and likely fall) will determine if/whenthe war is won.

But brimming with confidence andunwilling to wave the white flag, the EUR/USD has been green for five straight days and hasrallied during nine of the last 12 trading days. And while sentiment andmomentum are warriors that don’t die easy, the euro is losing fundamentalsoldiers left and right.

Please see the chart below:

Figure5 - European Central Bank (ECB) Balance Sheet

Another weekly update shows the EuropeanCentral Bank’s (ECB) money printer continues to work overtime. And as Imentioned on Monday (Dec. 28), the ECB’s total assets now equal 69% of Eurozone GDP – nearly double the U.S. Federal Reserve’s (FED) 35%.

And why is this necessary?

Because the Eurozone economy is infree-fall.

Remember, currencies trade on a relativebasis. Thus, a less-bad U.S. economy is good news for the U.S. dollar.

Please see below:

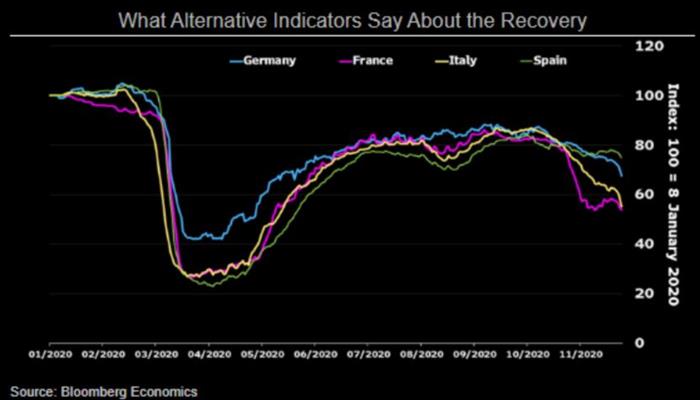

Figure6 - 2020 Economic Indicators for Germany, France, Italy, Spain

Across Europe’s largest economies – Germany , France, Italy and Spain – economic activity is rolling over (To explain thechart, alternative economic indicators are high-frequency data like credit cardspending, indoor dining traffic, travel activity and location information.)

And underpinning the irrationality, thedeceleration is happening as the euro is strengthening.

Makes sense?

Well, considering Spain’s retail salesdipped further into negative territory on Monday (Dec. 28) – coming in at –5.8% vs. – 5.3% expected – the data speaks for itself.

Figure7 - Spain Retail Sales Constant Prices (Source: Bloomberg/Daniel Lacalle)

The bottom line is: the euro bulls arefighting a war they’re unlikely to win. And as the fundamental data worsens,it’s analogous to a platoon losing more and more soldiers. Eventually, theinfantry runs out of reserves and it’s time to wave the white flag.

And then what happens?

Well, then history tries to explain howit all went wrong.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the target for gold that could be reached in the nextfew weeks. If you’d like to read those premium details, we have good news foryou. As soon as you sign up for our free gold newsletter, you’ll get a free7-day no-obligation trial access to our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.