Gold Price Slides after US Elections, but before Results / Commodities / Gold & Silver 2020

In Monday’sanalysis , I wrote that the market situation is likely to becomemore specific right before, during, and perhaps shortly after the U.S. presidentialelections . And by “specific”, I mean that the markets could beginmoving against their previous trends.

Well, that’s precisely what we’vewitnessed so far. The overnight volatility is significant as the markets try toestimate the election outcome, with the odds keep changing quickly. Let’s starttoday’s market examination with the USD Index.

Yesterday, I indicated that I wouldn’t besurprised to see a corrective move lower that would trigger a brief move higherin the precious metals and mining stocks. I’ve also indicated that such a movewould only be temporary, and most likely, it won’t last more than several days.

That’s what we have witnessed. Indeed,the USD Index has moved lower, almost touching the previously broken redresistance line. Yes, it rallied back up but then declined once again intoday’s pre-market trading. Given the current political uncertainty, this is arelatively normal post-breakout behavior. The key point is that the USDX didn’tinvalidate the short-term, let alone the medium-term breakout. This means that– as I indicated yesterday – these moves are not a game-changer, but instead,they are a relatively normal uncertainty-based phenomenon.

Gold moved higher yesterday, which erasedthose gains in the last few hours. So, is the uncertainty-based rally alreadyover? It’s unclear. Given how great the uncertainty is, and regardless of theoutcome, it’s likely to be taken to the Supreme Court (or at least heavilyprotested), the uncertainty might not disappear today.

And what about goldminers ?

Miners rallied, almost touching theirdeclining resistance line and the 50-day moving average.

On Thursday, after gold’s significantWednesday decline, I’ve indicatedthe following :

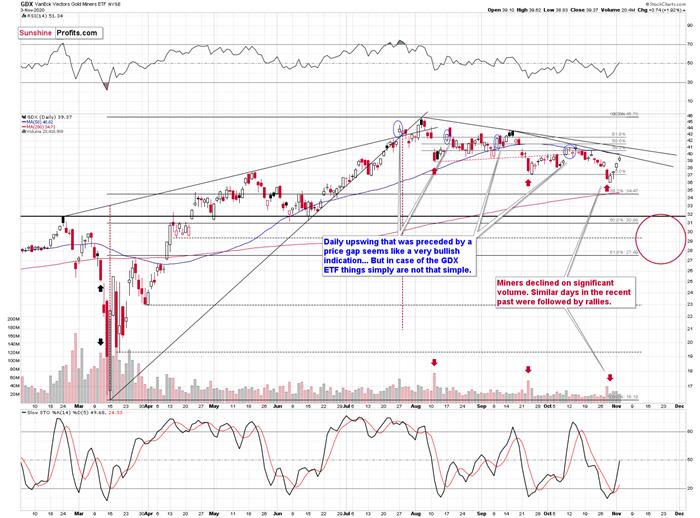

Minershave been undermining gold, which is bearish, and they have also broken belowthe recent lows, which is also bearish. Moreover, miners have just declined onstrong volume after opening the day with a price gap, which at first sight, isbearish.

Thetheory is that such sessions are particularly bearish, as they supposedly showthe bears' strength. But, before applying any tradingtip into practice, it’simportant to check if it had indeed worked on a given market, especially in therecent past. And the aforementioned did work… In the opposite way!

Forthe third time, miners are declining substantially during one day on a strongvolume. We saw the same thing happening in mid-August and late-September. Noneof them were followed by lower miner prices. Instead, we’ve witnessedcorrective upswings that didn’t change the overall downtrend.

So,from here on in, will miners rally or decline? Overall, the very near term(until the elections in the U.S. and a day-two after that) is unclear. At this point, a temporary rebound here would not surprise me at all,and if we see one, I expect it to be followed by a major slide. That’sprecisely what happened right before and after the elections in 2016.

The summary above remains 100% valid.Miners moved higher, and given today’s pre-market move lower in gold, it seemsthat they will decline today. However, given how quickly things are changingregarding the political outlook , it wouldn’t be surprising to see a quick turnaround in gold and a daily rallybefore it finally plunges. So, it’s not a sure bet that miners have formedtheir top yesterday.

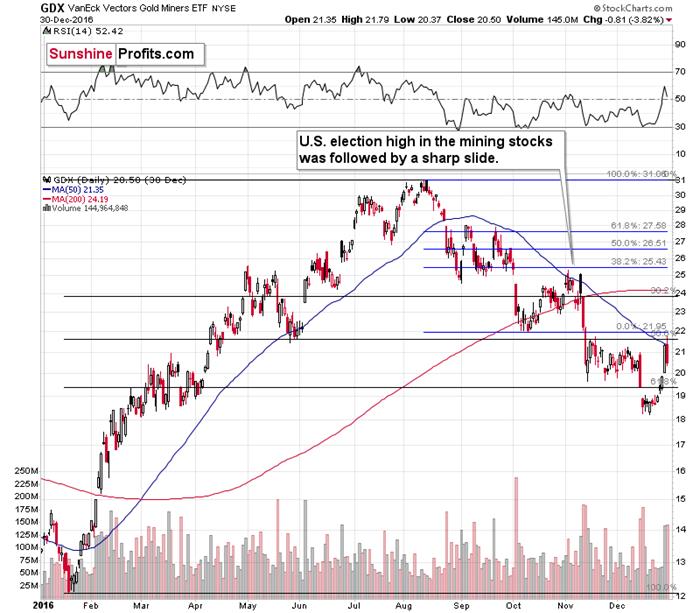

Back in 2016, right after the U.S.presidential elections, miners corrected to almost 38.2% Fibonacci retracementlevel based on the preceding decline, and they moved briefly above their 50-daymoving average. Both levels are close to each other this time as well, with theretracement being slightly higher.

Yesterday’s move to $39.62 was below bothlevels. If GDX is to move above the 50-day M.A. once again, it would have toexceed $40.02, at least temporarily.

Back in 2016, GDX declined from about $25to about $20 (20% decline) in few days. Could this happen again? It seems quitepossible. This time, GDX is close to $40, so if it declined 20%, it would tradeat about $32, which is the upper border of our target are and the Februaryhigh.

There’s one more thing that tells us thatwhile we might have seen the top yesterday, it was not necessarily the case.

Namely, silver didn’t outperform goldyesterday, and miners were not week relative to it (on a day-to-day basis).These are signals that very often herald short-term turnarounds.

Their absence in yesterday’s trading is aclue pointing to the possibility that PMs and miners will move higher beforetopping. To be clear, we’re not talking about weeks here, but rather days, orperhaps hours. If silver comes back up strongly today while minersunderperform, it will be an apparent signal that the short-term top is alreadyin. Of course, the above is not a sure bet, as PMs and miners could declineright away based on their medium-term breakdowns, but it’s not 100% clear thatyesterday was the ultimate short-term top.

Thank you for reading our free analysistoday. Please note that the following is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the downsidetarget for gold that could be reached in the next few weeks.

If you’d like to read those premiumdetails, we have good news for you. As soon as you sign up for our free goldnewsletter, you’ll get a free 7-day no-obligation trial access to our premiumGold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.