Gold Price To Re-Test $2,700 / Commodities / Gold & Silver Stocks 2024

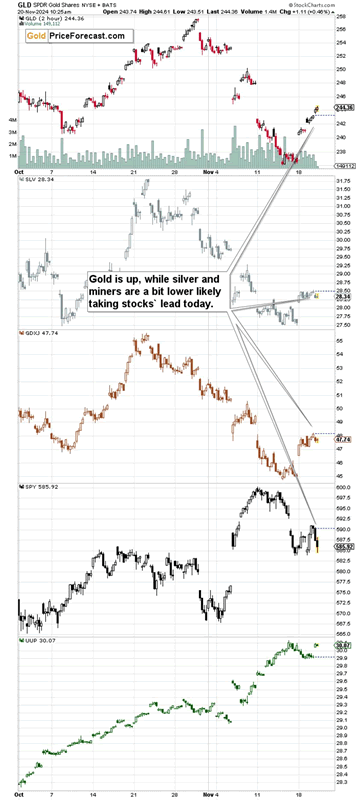

That’s an interesting situation that wehave today. Gold us up, but silver and miners are down. What gives?

That’s an interesting situation that wehave today. Gold us up, but silver and miners are down. What gives?

In short, it’s almost certainly all about the temporary impact from the stock market. The S&P 500 Index is downtoday. Not significantly, but enough to make the parts of the precious metals marketmore linked to it underperform.

MiningStocks: Strength in the Current Setup

GDXJ is down by 0.95% so far todaywhile the GDX is only down by 0.65% - and that’s perfectly normal given stocks’move lower. After all, junior miners are more linked to stocks than seniorminers are. This is also the reason as to why I’m currently writing about beinglong GDX and not GDXJ, while it will be GDXJ that I will focus on shortingsoon.

On a side note, the GDX is up by 6.08% sofar this week while the GDXJ is up by 5.81% - it seems that my selection of theproxy for going long was correct.

Are stocks done rallying here? This might be the case, but I get the feeling that we’ll see another quick move up soon andthat we’re going to see the opposite in the USD Index. The latter is the reasonfor both. After all, cheaper dollar means more competitive exports for the U.S.economy.

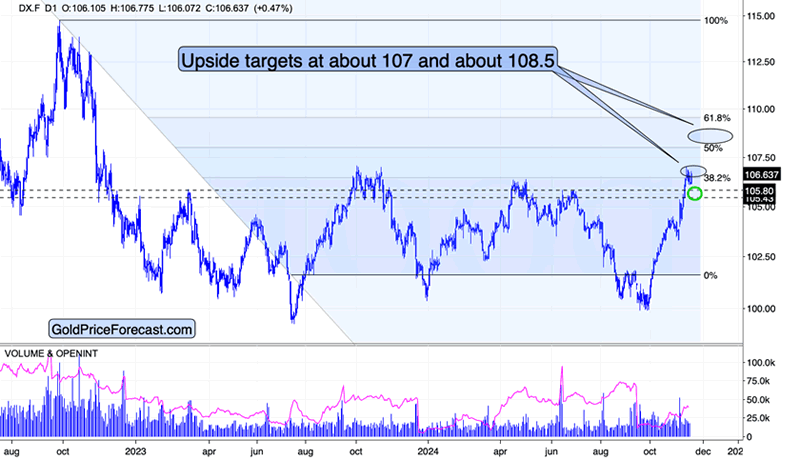

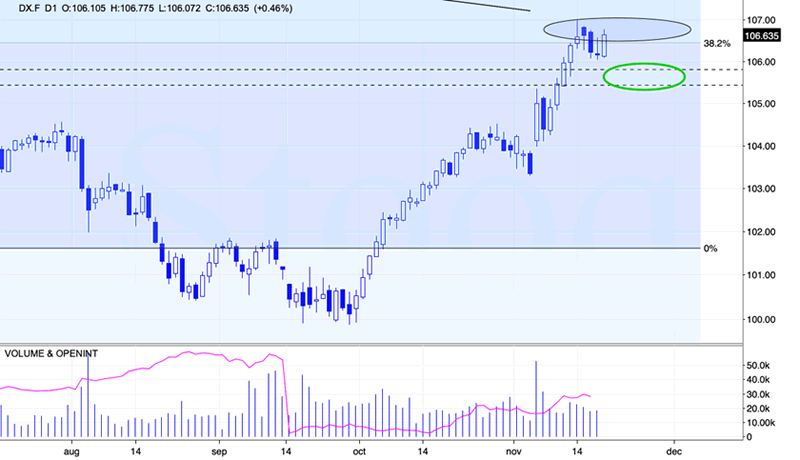

The USDX is after reaching my firstupside target, but it didn’t correct to the green buy area yet.

Today’s rally might be the B part of theABC (zigzag) decline. Please note that we saw the same thing at the beginningof this month. The USDX rallied visibly for one day and then it continued tomove lower with the bottom forming two trading days after the daily rally.

The history rhymes, so we could seesomething like that in the following days as well.

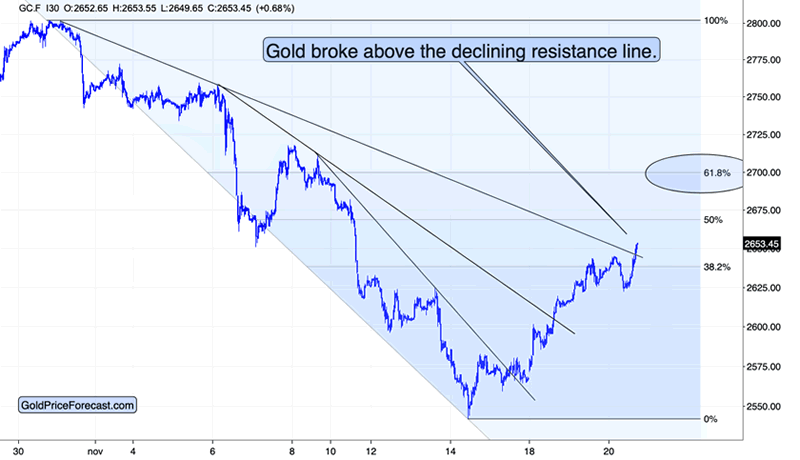

Also, today’s gold-USD reaction (gold isup despite a move higher in the USD) makes me think that the rally in theformer is not over yet even though it is already within my previous targetarea.

Based on today’s breakout above thedeclining, short-term resistance line and the above-mentioned gold-USD link, itseems that gold can really move all the way up to $2,700 (which is also its61.8% Fibonacci retracement for this correction) before the top is in.

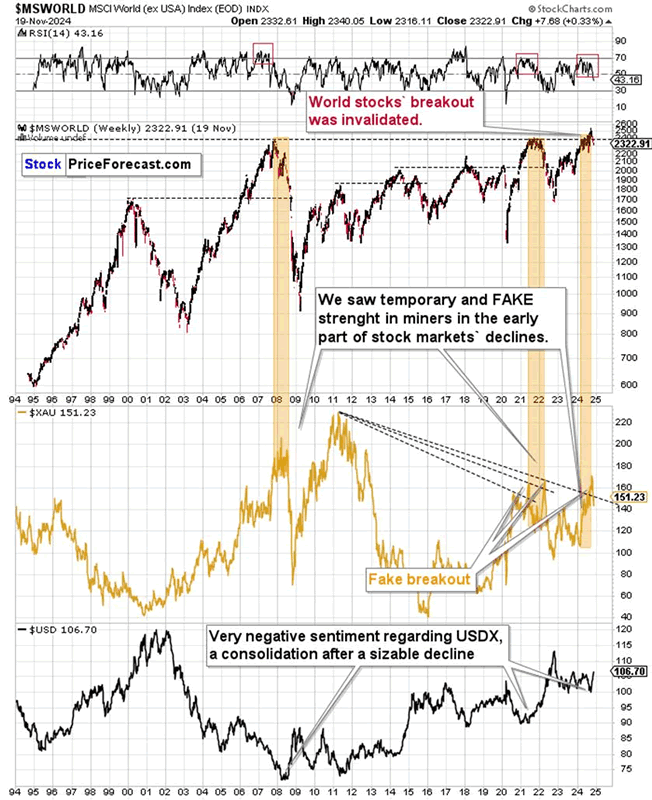

The near-term outlook is bullish and nowit’s clear that the bottomindeed formed when I wrote about it on Thursday. Of course, thefocus is on the “near term” here, and the below chart featuring world stocksshows why this should be the case.

First of all, we saw an invalidation ofthe move above the previous highs in world stocks.

Second, we saw that when the USD Indexstarted to rally after being severely beaten up and when the sentiment for itwas very bad (and everyone and their brother kept repeating various reasons for“de-dollarization”).

The latter is important because it showsthat it’s not “just a decline from the same price levels” that makes thecurrent situation like the 2007/2008 and 2022 tops.

It could be the case that tariffs thatDonald Trump is proposing are being discounted in the price and world stocksfall in result. After all, despite political reasons for them, this issomething that is likely to be bad for the international trade, and thus manyof the world economies could be affected.

And what happened in both above-mentionedcases when world stocks fell? The mining stocks truly plunged. And this, myfriends, is the likely outlook for the following months, despite the currentcorrective upswing.

Still, for now, it seems that the profitsfrom our long positions will increase some more before we close them.

Corrections like the current are usefulnot just because they can be profitable, but because they can tell you whichparts of a given market or sector are likely to fall when the next move lowertakes place.

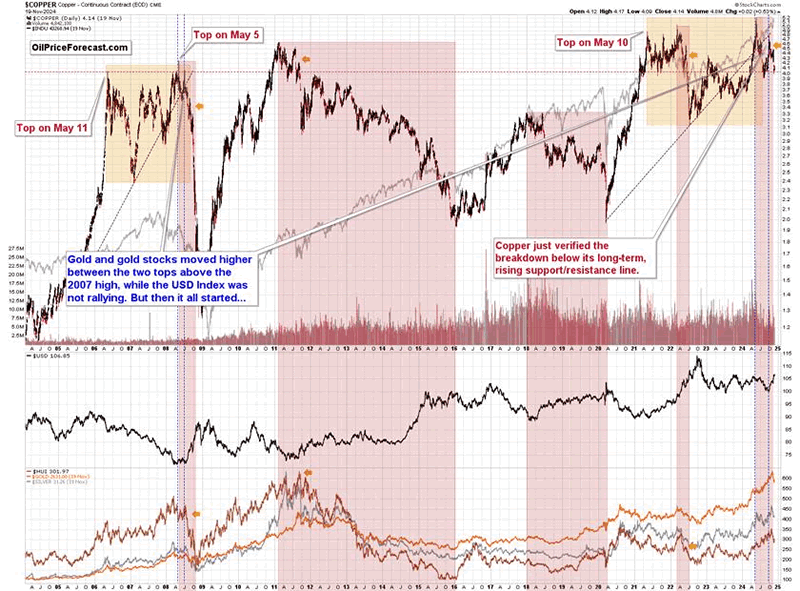

Copper and BroaderCommodities

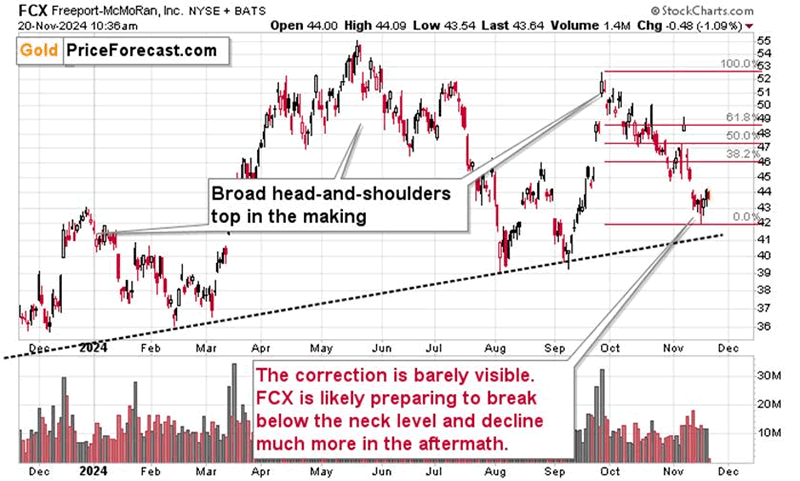

As you know, I’ve been commenting onthe bearish potential of FCX, and given the size of its upswing right now, allthose bearish points remain up-to-date.

Please note how weak the current move upis. It’s not even halfway to the first of the classic Fibonacci retracementlevels – the 38.2% one.

Once we see another move lower in copper(and we’re likely to see it), FCX is likely to break below the neck level ofthe head and shoulders top pattern and then decline in a truly profound manner.

Why am I writing about copper here? Oneis because FCX and copper itself offer great shorting opportunities in my view,but the other is that copper and precious metals tend to be aligned during thereally big moves and given that copper is on the verge of invalidating the moveabove its 2006 high, it seems that the decline that is going to follow will notbe minor.

In the near term both: copper and FCXcould move higher, though. The same is the case with crude oil which might formthe inverse head-and-shoulders pattern here (as Anna discussed in today’sOil Trading Alert, which we’re making free for you as a courtesy).

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.