Gold Price Trend Validation / Commodities / Gold and Silver Stocks 2019

So who is on First,or Are we there yet ?

So who is on First,or Are we there yet ?

Either addresses the current CUT 2CHASE question.

Blind faith can be good or bad, buttempered with some evidence, might be a good thing. Lets look at several categories of evidence concerning the position and trend ofGold and Gold Stocks.

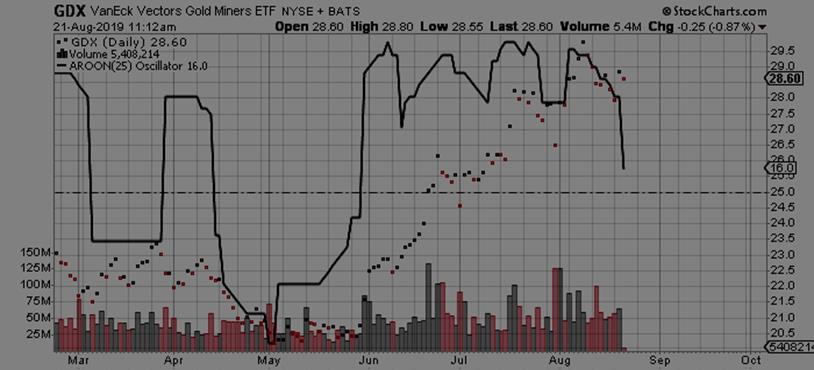

Abovethe GDX is shown in a 2+ year chart.

Underneath it starting in June is its 30 week Moving Average.

It is bracketed in Blue by an upper andlower limit which define the upper and lower limits of this advance, plus acenterline as a tripwire to determine direction of price

Thus this criteria ispositive

Next are OSCILLATORs

Directional Oscillators are next, to help usdetermine direction. The solid line, Aroon Oscillator, is helpfulin determining trend direction, and in this case, climbing down, is indicatinga correction down to support is going on now.

3. Confirmation Measures help us gaugewhether two values are in sync. Like theDJ Industrial and the DJ Trans stay in sync, helps us accept their moves. Same for Gold, the Metal and Gold Miners, theStocks.

In this case, the Mutual Fund OUNZ which can deliver REALGOLD, and the more conservative Gold Miner Index XAU, are shown together onecan see that they are in sync with each other. What that does NOT mean, is that they cannot go down, as they CAN alsogo down together. It shows this move isvalid.

What this analysis leaves me with isthe possibility of a sharp drop to fill the gap created on Jun 20, with anIntra-day spike down to the 24.03 level to fill that gap and then a reversalday to the upside, either that day or the next.

That leaves me with HOLDING the stocks I bought in May andJune and taking profits in issued without solid relative strength. In any case, the drop will be temporary. Using other measurements, I suspect thegap-filling moves will result in a bounce of the base, and a reversal to theupside between September 1 and October 1.

As an add-back to my Recco's, I remove the AVOIDfrom CCO.To and add it back to Reccos,(CCJ also) as well asadding Denison Mines, DML.To, (DNN), as it seems some Uraniumissues have come back to life.

WHEN the GDX or HUI JUMPS the 31-32 gap,( TheStraits of Hell ) there will be an amazing show of strength giventhe Government corruption of theMonetary System. Whether it JUMPS theGAP or merely wades thru it are not as important as WHEN it breaks above the GDX 32 / HUI 300, whichhas not been seen since July 2013.

Please visit our BLOG at https://denaliguidesummit.com/

CLICK HERE

ONCE A month, our DGS Letter,gives simple and plainly wordedsummations of the current Analysis with NO Technical Terms, just BUY – SELL – or – HOLD. UniqueSTOPS and TARGETS with each Recco, and Update as necessary.

Recommendations,Buy or Sell as they happen.

By Denali Guide

http://denaliguidesummit.blogspot.ca

To the thecharts involved, go here, to my Public Stock Charts Portfolio, and go to thelast section. All charts updateautomatically. http://stockcharts.com/public/1398475/tenpp/1

© 2019 Copyright Denali Guide - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.