Gold Prices Are Still Likely To Melt

Gold moves inverse to bond rates and to the dollar.

As the fear of recession dissipates, rates will rise.

As rates start to rise, gold will drop.

The situation today is similar to the summer of 2016, just before gold dropped 20%.

This article explains why we think the price of gold will continue to trend lower.

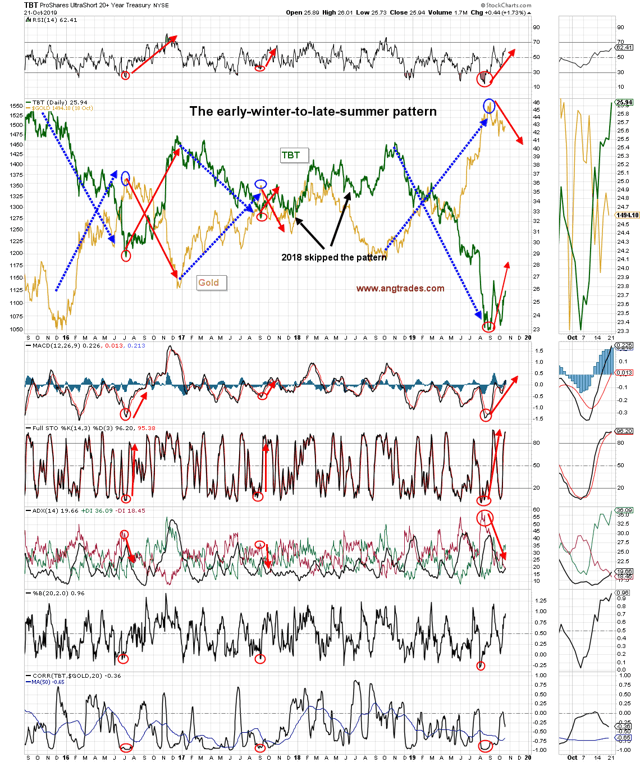

There is an "early-winter-to-late-summer" inverse pattern between gold and the ProShares UltraShort Treasury ETF (TBT) where gold starts rising, and TBT starts dropping in December, and then the reverse happens in September (chart below). The late-summer drop in the gold price started right on time this September and should last another six weeks until December (for a more detailed explanation of the bond/gold interaction, see fellow SA author Alan Longbon's article here).

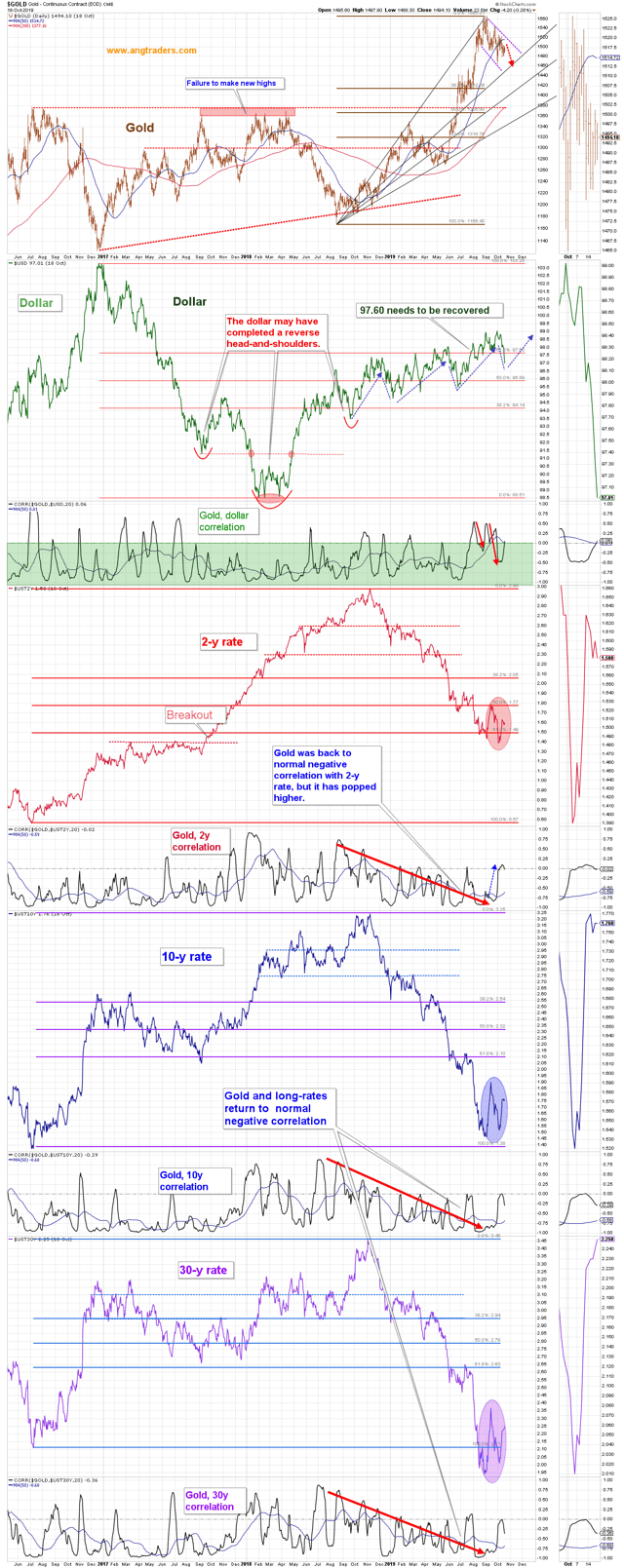

The dollar and interest rates have, on average, a negative correlation with gold. The dollar experienced serious weakness last week, even as long rates continued to rise (the short-end did move slightly lower), and its correlation to gold moved into the positive, but, in the past, this has proven to be temporary. With long-term rates still at levels not seen since the summer of 2016, just before gold suffered a 20% fall in price, we continue to expect lower gold prices (chart below).

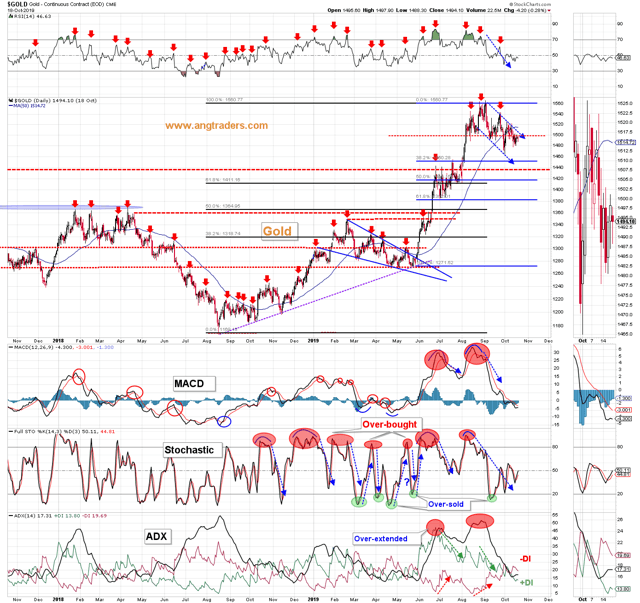

Technically, gold's position continues to be weak:

RSI remains below the 50 level. MACD is bear-diverging. Stochastic, although moving higher, is still below 50. ADX, -DI is above +DI, but is converging on the +DI.The gold price has been making lower-lows and lower-highs as it follows a downward-sloping channel. For the second week in a row, gold closed below both the 50-dMA and the psychological $1,500 level. We expect gold to make its way down to the $1,450-$1,460 area over the next couple of weeks (chart below).

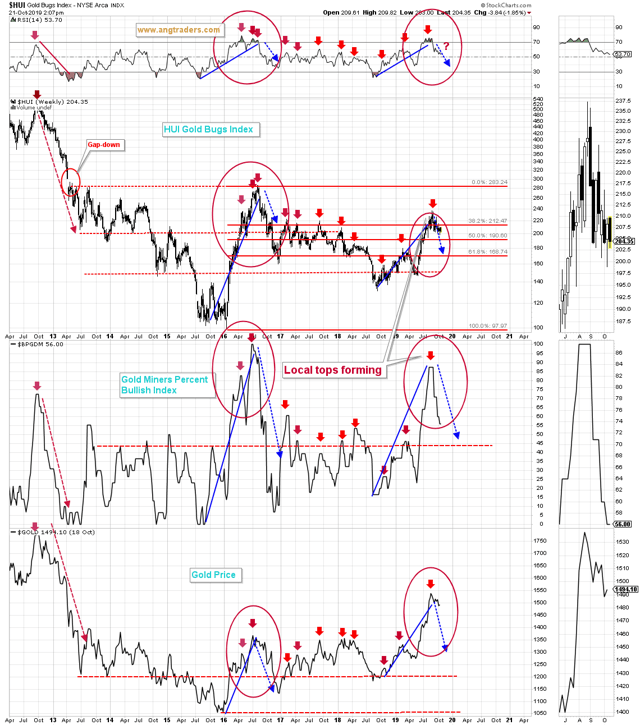

The HUI Gold Bugs index and the Gold Miners Percent Bullish index are both continuing to replicate the bearish pattern from the summer of 2016 (dashed blue arrows below). This implies weakness in the mining equities (chart below).

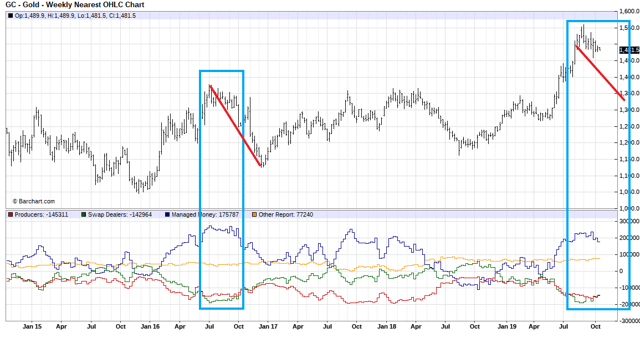

The commitment of gold futures traders has reached an elevated level similar to July of 2016. The managed money (momentum players) are maximally long, while the producers and swap dealers (the experts in gold) are maximally short. Each time these maximums were reached in the past, downward pressure on gold developed soon after. Again, the similarities with the summer of 2016 show up here as well (chart below).

Gold continues to maintain an elevated level because of the fear trade that has sent investors into the classic safe havens of bonds and gold. As the realization that we are not falling into a recession - thanks to the deficit spending of the Treasury - starts to sink in, we expect gold to weaken significantly.

During the 2018 correction, our analysis showed that we were not at the start of a new bear market and that the bull market was not in the process of ending. As a result, our subscribers avoided the herd mentality of panicked-selling and the losses it created.

"Happy ANG subscriber here. I believe them to be the best broad market analysts on seeking alpha."

"...paid for the service on first trade."

"Best here in seeking alpha... @ANG Traders. Best of the best!"

Take advantage of our 14-day free trial and stay on the right side of the market and Away From the Herd.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow ANG Traders and get email alerts