Gold Prices Taking A Breather Or Something Worse?

We are now of the opinion that there will be no rate hikes this year and there is the possibility of a rate cut.

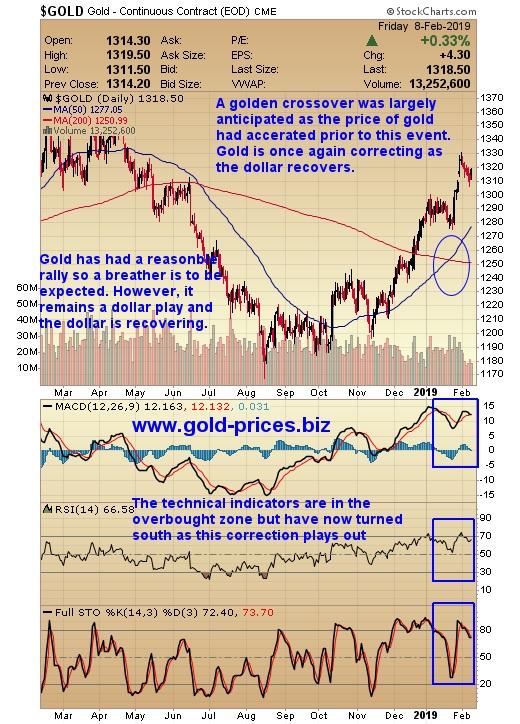

The technical indicators for gold are in the overbought zone but have now turned south as this correction plays out.

The situation for the PM sector could get worse but longer term we expect this sector to outperform all others.

Background

I first traded gold back in 1980 and have been active in this sector of the market ever since then. However, as a Gold Bug at heart I am not a Perma-Bull and at different times I have been long or short in this space via the options market to generate profits.

Being a Perma-Bull or Perma-Anything makes no sense to me as the market goes up and comes down. It is all about being positioned on the right side of a market sector, being with it and not against it. If you have to be a bear at times so be it, it is better than losing your shirt.

Preamble on Gold and Silver

As we understand it, in 2018 Central Banks bought 651 tonnes of gold and are showing a renewed interest in the precious metals sector, which if true, is very good news for the demand side of this commodity. We have also read a number of articles by some of the big banks who are predicting higher prices for gold going forward. If their research could be relied on and assuming that they didn't want to see the price go higher in order to unload some of their holdings, then this would also be good news for gold and silver.

We don't see gold going much higher without silver also coming to the party and so we need to keep an eye on the silver market. The Silver Institute Press Release, regarding Silver market trends for 2019 published on 5th February 2019 in Washington D.C. suggested that in 2018 there was a 0.3% increase in total supply whereas demand contracted 3% for various reasons. This year, the expectation is that sentiment will be more supportive for the silver market. In 2019, the U.S. Mint sold 12% more American Eagles in January compared to January 2018. The Institute also expects silver to be a beneficiary of the slowdown in number of rate hikes in the US and point to the gold/silver ratio at around 82 also being positive for silver prices.

I can agree that a reduction in rate hikes will be less supportive of the US Dollar and therefore gold and silver should move up, but as for the gold/silver ratio, well it has been high for some time now and may well stay that way at least in the near term.

A quick look at Gold's chart

The technical indicators for gold are in the overbought zone but have now turned south as this correction plays out. A golden crossover was largely anticipated as the price of gold had accelerated prior to this event. Gold is once again correcting as the dollar recovers. Gold has had a reasonable rally, so a breather is to be expected. However, it remains a dollar play, and the dollar is recovering.

A quick look at the US Dollar's chart

We are now of the opinion that there will be no rate hikes this year and there is the possibility of a rate cut. The dollar is now recovering from an oversold position capping gold's progress. The chart also shows that the dollar is standing at 96.42 and will soon face strong resistance at the 97 level, which it couldn't hold late last year.

Conclusion

We expect gold to take a breather and the dollar to reach the 97 level. Should the dollar break through this resistance level and gain some traction, then we could see gold drop back to test the $1300.00/Oz level and possibly trade as low $1280.00/oz.

We do expect the global economy to weaken and therefore central banks will resist rate hikes and give some consideration to rate cuts which would help the precious metals enormously.

Acquiring gold stocks in the short term may be a tad premature as cheaper entry points may become available in the medium term.

The situation for the PM sector could get worse but longer term we expect this sector to outperform all others.

The big picture hasn't changed as the dollar will trade lower over time and gold and silver and their associated mining stocks will be the winners.

Got a comment, then please fire it in whether you agree with us or not, as the more diverse comments we get the more balance we will have in this debate and hopefully our trading decisions will be better informed and more profitable.

If you are not already a Follower and wish to see our posts on gold, silver and the associated stocks, then please hit the follow button in order not to miss out.

Take good care

Disclaimer: www.gold-prices.biz makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is neither a guide nor guarantee of future success.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Bob Kirtley and get email alerts