Gold Production In South Africa Continues To Collapse - Plummets 85% From Peak In 1970 (VIDEO)

- South African gold production collapsed again in May - down 16%- South Africa production has collapsed 85% from 1,000 tonnes in 1970 to 145 tonnes- Long term, ongoing collapse appears to have deepened- Gold price suppression has destroyed gold mining in South Africa and rest of Africa, impacted African economies, jobs and people- 'Peak gold' or 'plateau gold' production is coming as seen in geological "challenges" while gold demand will remain robust

"When these metal prices are suppressed, it actually badly impacts some of the key industries in South Africa. It impacts people's jobs and pensions and the livelihoods of individuals and families.

It is an important consideration that people do not frequently think about.

In the western world, we are delighted when commodity prices go lower as it means we can consume more stuff and we can buy more things and inflation is kept low.

But for emerging markets, they do not have the product and service driven economies that we have, they are more dependent on the value of their raw materials and their natural resources and therefore it is important they get a far price for them and fair value for them.

If they do, a lot of the poverty in the world that we seen in the world would be greatly alleviated ...

It is one of the key issues in the gold market and we think that it is an important angle to look at ..."

Trump Trade and Currency Wars With China - Goldnomics Podcast

News and Commentary

Gold prices edge up on softer dollar (Reuters.com)

Asia Stocks Trade Mixed; Treasuries Edge Higher (Bloomberg.com)

Gold recovers early lost ground, turns higher for the day (FXStreet.com)

India likely to lose $5.5 billion in Gold medallion, coin exports (ScrapRegister.com)

Gold Attempts To Stabilize While Bitcoin Extends Rally (Investing.com)

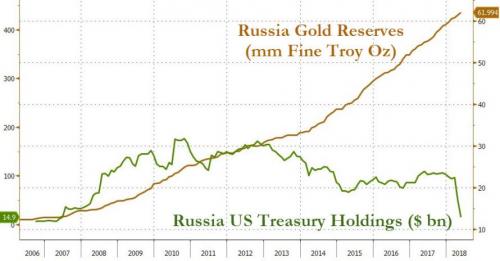

As Russia Dumped Its Treasuries, Here's What It Was Buying (ZeroHedge.com)

Is the Gold Market Being Suppressed? (GoldSeek.com)

Bubble in credit market will tear into stocks - Rosenberg warns (CNBC.com)

Two Giant US Pension Funds Admit There's A Big Problem (ZeroHedge.com)

'F**k business' Brexit could be a gift for Ireland (DavidMCWilliams.ie)

Gold Prices (LBMA AM)

24 Jul: USD 1,224.30, GBP 933.77 & EUR 1,047.63 per ounce23 Jul: USD 1,229.45, GBP 937.21 & EUR 1,050.93 per ounce20 Jul: USD 1,224.85, GBP 940.56 & EUR 1,050.80 per ounce19 Jul: USD 1,217.40, GBP 936.06 & EUR 1,048.79 per ounce18 Jul: USD 1,223.45, GBP 938.02 & EUR 1,052.29 per ounce17 Jul: USD 1,243.65, GBP 938.46 & EUR 1,059.96 per ounce

Silver Prices (LBMA)

24 Jul: USD 15.51, GBP 11.81 & EUR 13.24 per ounce23 Jul: USD 15.49, GBP 11.78 & EUR 13.22 per ounce20 Jul: USD 15.37, GBP 11.79 & EUR 13.19 per ounce19 Jul: USD 15.26, GBP 11.75 & EUR 13.16 per ounce18 Jul: USD 15.44, GBP 11.85 & EUR 13.29 per ounce17 Jul: USD 15.77, GBP 11.91 & EUR 13.46 per ounce

https://news.goldcore.com/