Gold Pulls Back To Support

Barry Dawes of Martin Place Securities explains his take on the current state of the gold market, and shares some gold stocks he believes are currently very cheap.

Gold has pulled back to support. Gold stocks are holding OK.

Key Points

Gold

Back to supportGold Stocks

Pull back to supportASX Gold Stocks

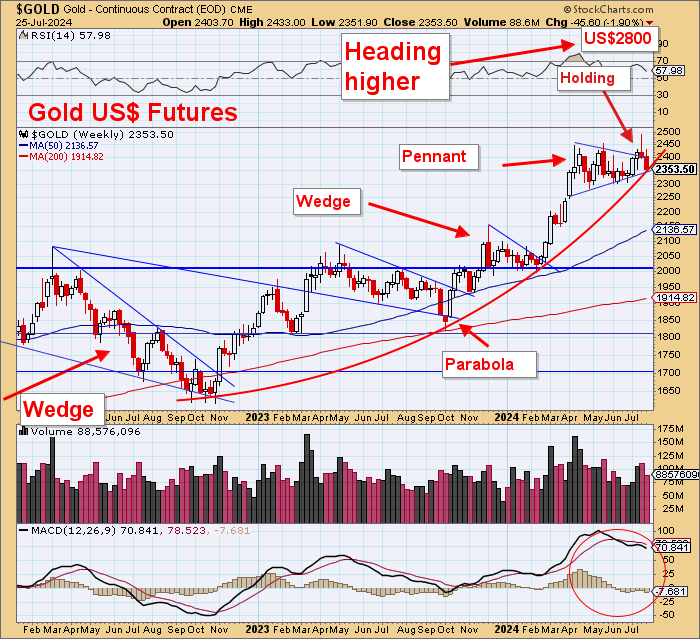

New 45-month high this week.MPS universe of 25 producers on very low valuationsASX XGD about to break downtrend vs A$ goldGold has been weaker over the past few days and has pulled back to support. The technicals are holding together, and this seems to be a normal pull back, but there are some strange actions in the marketplace.

Bonds continuing to decline in yield and we should expect to hear calls for the Fed to cut. As always, the Fed will follow the market not lead it. Take a look at the 5-year bond, which appears to be ready to come much lower.

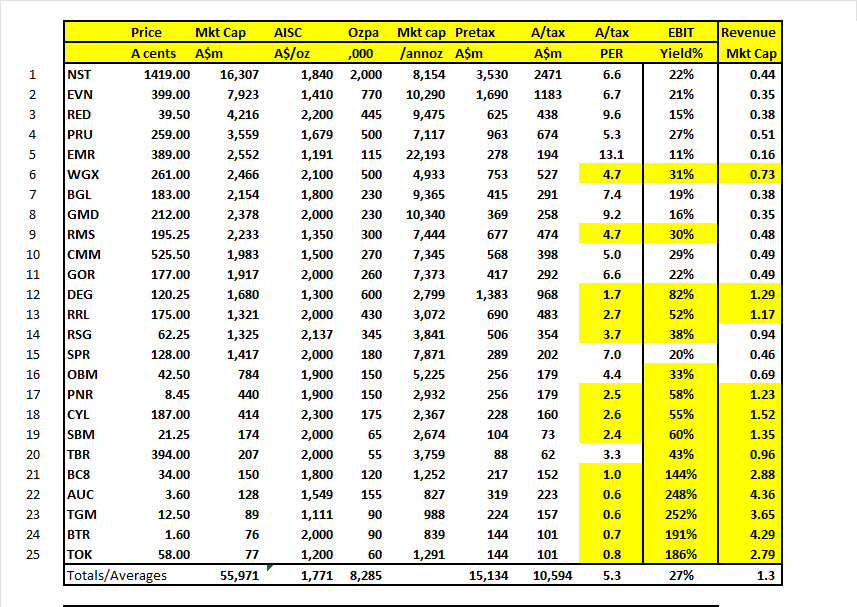

Gold stocks have had a good run and are now pulling back into support. The local market for gold stocks made a new 45-month high and is just consolidating. Take a look at those PE ratios and earnings yields for the 25 companies in the MPs universe.

The sector is generating a very large amount of cash. Watch the quarterlies.

Gold

Almost $100 weaker over the past week despite making a new all-time high.

Gold dropped to the uptrend line here.

And still held the parabola.

Gold Stocks

Pulled back to 145 major long-term support

This ratio is a critical feature of the gold sector.

The very big turn is coming

ASX Gold Sector

Very close to breaking this 16-year downtrend of ASX Gold Index versus AU$ gold.

Some very cheap gold stock here.

Head the markets, not the commentators.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.