Gold Rally Is Not Over Yet

Explanation on what has caused this jump on gold, and what is the future for this commodity.

Historical overview to explain movements.

Reasons why we still are bullish on Gold.

It's been two months of intense stress for the financial markets. We assisted at one of the worst December performance in recent history, driven by uncertainty around China and USA trade deals, and some question marks on the Brexit deal. During the same timeframe, Gold spiked from $1200/Oz level on November 13th to $1320/Oz on January 31st. History teaches us that investors tend to buy and hold on gold during time of financial turmoil and uncertainty. Certainly 2018 was a stressful year for the financial markets, which caused a spike in volatility , and an appreciation in the gold price. In this article I will review what drives the price change in gold, and will make my claim why gold is still bullish for us in 2019.

Data by YCharts

Data by YChartsGold, Interest Rates, and USD correlation

Before diving into possibile scenario for this commodity in the near future, it is important to understand what causes the move in gold. Gold is inversely correlated with the US dollar. When the US dollar gets stronger, gold usually declines, and when the US dollar gets weaker, gold usually raises. Below a picture of the dollar index $DXY, which will compare to the above picture of gold. (Barchart)

(Barchart)

As we can see from the two charts, $DXY and gold tend to move in an opposite way. Analyzing the timeframe that goes from 2006 to 2012, we can see that the USD started to decline because the economy entered a recession phase where the Federal reserve started to lower interest rates. It is important to notice that interest rates and the US dollar are directly correlated. When the fed decides to lower interest rates, the UDS depreciates, there reason for this is that lower interest rates is a sign of a weak economy, the central bank is trying to stimulate the economy, which leads foreign investor to diverge their investments to other opportunities, leading to a weak currency. On the other hand, in a period of economic boom the US dollar appreciates , and attracts investors because there is a strong economy and a stronger demand for US products, which indeed leads the currency to appreciate. At this point we can also argue that Gold and interest rates are also inversely correlated, as previously shown.

Going back to the main argument of comparison, during the recovery phase gold continued to increase because the United States kept interest rates at close to zero in order to fully recover from the financial crisis. Once the economy finally stabilized, interest rates started to increase, and this attracted foreign investors, which led to an appreciation of the USD. During the same time, gold started to depreciate because investors believed that the US fully recovered from the recession and a new expansion phase started.

After this explanation one can deduct two things from this correlation. The first is the gold price is driven by economic factors, such as demand and supply and financial turmoil, the second one is that gold price is also determined by psychology. For psychology I intend human reaction to events or circumstances that have not happened yet, but that may happen in the near future. An example of this is the November to January's rally that we have just assisted. Gold started to appreciate quickly in this last two months because tensions between China and USA and a possible trade war started to raise, and uncertainty in the global economy posed some question marks to the investors, who diverged to gold.

Lastly, the Federal Reserved announced in their December meeting, and also in their January meeting, that there is a possibility to stabilize interest rates or to actually lower interest rates in the near future. This shows that they believe the economy is ready for another expansion phase, after retracting during the last quarter of 2018. This news led to gold to spike , and it was a major catalyst of the last raise in gold price.

News, Events, Future outlook

On Wednesday the Fed left the rate unchanged between 2.25 percent and 2.50 percent.Yields were pressured after Fed policymakers said the central bank would be patient when making decisions about future monetary policy. The Fed also removed references to "further gradual increases" to the federal funds rate in its monetary policy.

The drop in U.S. Treasury yields helped make the U.S. Dollar a less-attractive investment sending gold prices sharply higher. As of a result, gold spiked and gained 1% on Thursday.

Currently the Fed chairman Jerome Powell is paying lots of attention at the financial markets. In an interview on CNBC, DoubleLine Capital Chief Executive Jeffrey Gundlach stated :"Powell is basically saying, I am going back into a foxhole and then decide what the next move is. Powell said 'I dont want to say anything and I dont want to get pinned down as I did before.' Because it got embarrassing." He also asserted that one major indicator is currently signaling a possible turmoil in the next year future. "The most recessionary signal at present is consumer future expectations relative to current conditions. Its one of the worst readings ever," Gundlach tweeted on Tuesday (CNBC).

Consumer confidence fell sharply more than expected for the second straight month. While consumers' assessment of the current situation were nearly unchanged and historically strong levels, their expectations for the future fell sharply, hitting the lowest level since October '16, prior to the presidential election.

Historically this index has been really useful in determining the current status of the economy. For example on October '08, Consumer Confidence Index plummeted to 38 the lowest since its inception in 1967. Also the research reported that the Consumers' optimism about the short-term future was more pessimistic in January. The percentage of consumers expecting business conditions will improve over the next six months decreased from 18.1 percent to 16.0 percent, while those expecting business conditions will worsen increased from 10.6 percent to 14.8 percent (conference board).

The risk of a recession in the near future has not vanished yet, even after an amazing month of January. There are still too many factors that can impact the stock market in 2019, like trade war, Brexit.

China and USA are set to meet again in February. Talks still continue, but the March 1st deadline is approaching, and even tough the two parts seem to be closer, there still question marks on the actual result.Myron Brilliant, the head of international affairs at the U.S. Chamber of Commerce, who has been briefed on the talks, said China had shown some willingness to make reforms on market access and intellectual property. However, China has been highly reluctant to budge on sensitive subjects such as technology transfer and subsidies of state-owned enterprises. For that reason, there are significant gaps between the two sides. As a result of this continue uncertainty in the deal, we should be cautious in analyzing this January rally. It certainly looks like the FED wanted to calm down the financial markets, and reassure in investors in response of uncertainty in the near future. Our economy is still strong, companies like $AMZN, $OTC:APPL, $FB reported outstanding earnings, and the latest Nonfarm Payrolls reported better than expected data, registering an increase in 304k more jobs in this last month compared to the expected consensus of 165k.

At the moment it looks like the stock market is impacted more on outside events than actually fundamentals. This is what Fed chairman hinted in the last meeting. Investors need to pay attention to what is going on overseas , especially in Europe.

Brexit deal was rejected by the British parliament, Theresa May was able tough to win the fiduciary vote. Currently there is lots of uncertainty in the final result of Brexit. Theresa May is set to propose a new Brexit deal to the parliament on February 13th,the European Commission has warned. has warned Britain must pay the ?39 billion Brexit bill even if it leaves the EU without a deal. Currently there is really no clue on what the result of this event will implicate to the financial markets, it will heavily depend on what terms the European Union and Britain will agree on.

Gold will play a major role once everything is settled. As previously showed, investors tend to refuge on Gold when the market is hit by unexpected outcome or wild outcome. The only example we have on Brexit is when it was voted on June 24th 2016. As of a result of the unexpected vote on the referendum, Gold soared as much as 8 percent the day after the shocking vote result. Currently nothing has changed, the two parts are still looking for a deal by March 29th. If nothing changes EU laws will not apply to the UK, and millions of European workers in the Great Britain will need a permit to work there. We should see a drastic swing in Gold price as a result in this hypothetical scenario, if nothing changes.

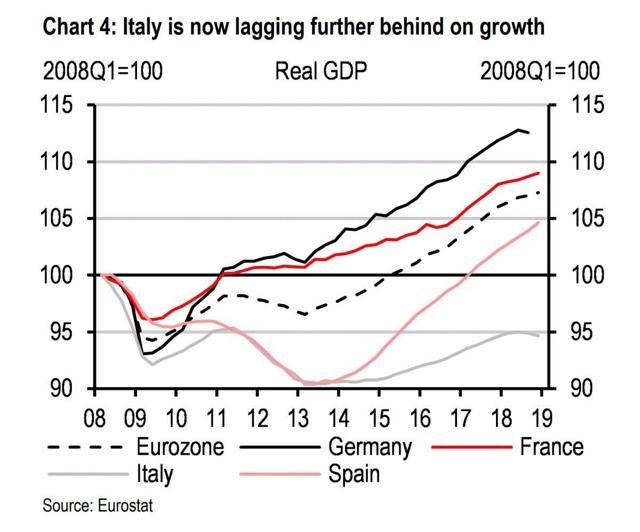

Brexit is not the only event that European are worried about. European banks reported unsatisfactory results on February first. Deutsche Bank, major German lender, disappointed investors with an eighth consecutive decline in quarterly revenues. In addition , Italy registered two consecutive quarters of negative GDP, which technically put the country in recession. Italy was also a major concern in 2018. Italian politics has registered a serious of brief governments ,which didn't bring serenity to Italian economics. Last turmoil was created by a coalition of two extremist parties, Five Stars Movement and League Party, who heavily insisted on new immigration regulations, and a possible scenario where the country could also leave Europe. Tensions between those this populist government and the European commission have escalated quickly to the point the EU declared that many intervention by the new Italian government were "irresponsible".In Italy, the government's debt load is one of the highest in the world. A prolonged economic slump would significantly add to the risk of default, with global repercussions.

In the past the ECB initiated purchases of governments bonds to attract foreign investors, a procedure that helped to assure buyers for also the Italian government debt. At the moment it looks like the ECB is trying to get out of the market as there is a weaker economy momentum, hinting for less room of mistake for new policies. The populist government has been heavily criticized by other European governments, especially for the foolish new proposals that are directing Italian people in spending less. The Italian government led by Prime Minister Giuseppe Conte reacted to the result by saying that the numbers were the results of the previous government actions, stating that policy like the unemployment program still need to become effective. In the meantime the Italian spread BTP/BUD, a benchmark that compares Italian bonds with Germany's bond spiked to 260 from 248 after the news.

Europe has showed some sign of slowing economic growth led by China and USA trade war, Brexit, disappoint 2018 for the European banks, and now Italy's economy continues to aggrevate the current situation.

European situation will be key to watch in 2019, there will be an handful of major scenarios to pay attention to, which can lead investors to move on from the stock market and invest in bonds. Investors piled into bonds in the past week and pulled billions of dollars from U.S. and European stocks as they sought safety in assets seen as less risky in times of economic uncertainty, Bank of America Merrill Lynch (BAML) said on Friday (Reuters). As investors are moving away from European stocks, they are also betting on gold. A large number of European investors have cited gold as the best investment opportunity over the next 12 months, according to a Legg Mason survey (europe funds).The survey, which polled the views of over 16,000 investors globally, found that about a quarter of those polled in Germany, Italy, Switzerland and the UK identified gold as an investment opportunity.

In the UK, gold was seen as better than equities, bonds, cash and alternatives over the next year.

Gold has become more popular than last year among UK investors, with the total number favoring it up from 22%, the firm said (funds Europe).

Final Notes

In this article I proposed my case for Gold to keep its bullish trend even in 2019. I heavily focused on the major factors that can impact the price for this commodity. Major economic indicators are showing signs of uncertainty in the market. The latest statement by the Fed on Wednesday confirmed that the future direction of the economy is unclear, stating that events such as Brexit and the resolution of the Trade war with China are still unclear. I also underlined how important is to pay attention to other countries, especially the European situation where banks are reporting negative results, and how it can lead investors to diverge their investment to other sources such as Gold. Lastly I wanted to recommend two ETTs, $JNUG and $NUGT , both are 3x ETF mostly recommended for short term investing who have recently surpassed key moving average level

Disclosure: I am/we are long NUGT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Riccardo Zerilli and get email alerts