Gold Resource: A Clear Winner

Gold Resource reported earnings of $0.10 per share on revenue of $32.15 million compared with an earning per share of $0.08, on revenue of $24.34 million in 1Q'17.

Gold Resource owns a near-term gold production in Nevada called the Isabella Pearl project, which has the potential to increase the company production by 120%.

Thus, I recommend adding GORO regularly on any weakness.

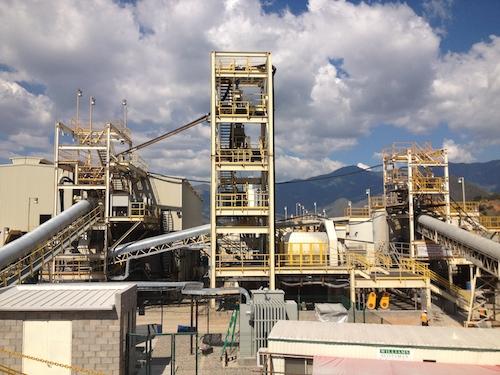

Image: The Aguila mill, Mexico.

Investment Thesis

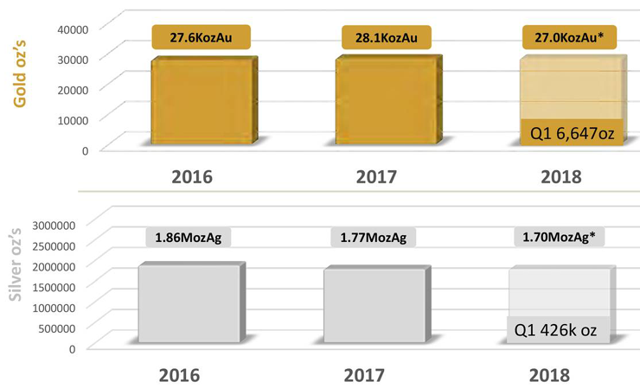

Gold Resource (GORO) holds a 100% interest in a significant property position consisting of six properties in Oaxaca, Mexico, including the producing Arista Mine and Aguila Mill at the El Aguila Project. It hit its annual production targets last year, producing 28,117 gold ounces and 1,773,263 silver ounces in the 12 months ended December 31, 2017. First quarter production is 11,909 Au Eq. Oz.

The company has an excellent balance sheet and is run by prudent management, which is consistent with a long-term investment profile.

Gold Resource owns a near-term gold production in Nevada called the Isabella Pearl project, which has the potential to increase the company production by 120%. Targeted output ranges 20,000 to 30,000 oz. Au the first year and 30,000 to 40,000 oz. Au after that, offering great potential for growth. The mine is awaiting final EA permit.

Source: GORO Presentation

Thus, I recommend adding GORO regularly on any weakness.

GORO - Balance Sheet and Production in 1Q'2018. The raw numbers

| Gold Resource | 2Q'15 | 3Q'15 | 4Q'15 | 1Q'16 | 2Q'16 | 3Q'16 | 4Q'16 | 1Q'17 | 2Q'17 | 3Q'17 | 4Q'17 | 1Q'18 |

| Total Revenues in $ Million | 23.27 | 19.44 | 21.62 | 17.40 | 26.20 | 21.37 | 18.26 | 24.34 | 21.39 | 31.12 | 33.31 | 32.15 |

| Net Income in $ Million | 0.81 | ?^'0.47 | ?^'2.33 | 0.80 | 5.61 | 1.59 | ?^'3.61 | 4.38 | 0.86 | 4.58 | ?^'6.84 | 5.46 |

| EBITDA $ Million | 3.42 | 2.30 | 4.74 | 3.63 | 13.25 | 5.77 | ?^'1.48 | 10.45 | 6.48 | 11.67 | 16.05 | 13.03 |

| Profit margin % (0 if loss) | 3.5% | 0 | 0 | 4.6% | 21.4% | 7.5% | 0 | 18.0% | 4.0% | 14.7% | 0 | 17.0% |

| EPS diluted in $/share | 0.01 | ?^'0.01 | ?^'0.04 | 0.01 | 0.10 | 0.03 | ?^'0.07 | 0.08 | 0.02 | 0.08 | ?^'0.10 | 0.09 |

| Cash from operations in $ Million | 8.60 | 5.03 | 5.67 | 3.73 | 7.82 | 5.94 | 0.41 | 9.00 | 5.02 | 9.48 | 12.13 | 13.96 |

| Capital Expenditure in $ Million | 7.01 | 9.89 | 4.85 | 5.69 | 4.59 | 2.36 | 2.50 | 6.06 | 4.76 | 9.56 | 5.05 | 7.33 |

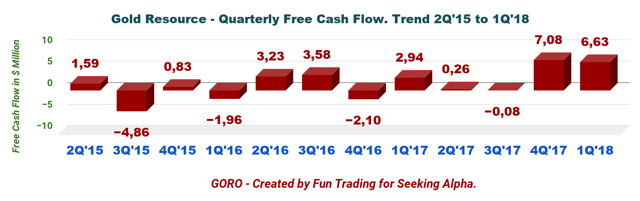

| Free Cash Flow in $ Million | 1.59 | ?^'4.86 | 0.83 | ?^'1.96 | 3.23 | 3.58 | ?^'2.10 | 2.94 | 0.26 | ?^'0.08 | 7.08 | 6.63 |

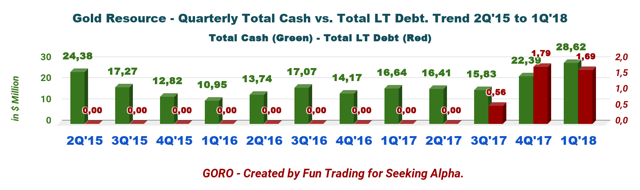

| Cash and short term investments $ Million | 24.38 | 17.27 | 12.82 | 10.95 | 13.74 | 17.07 | 14.17 | 16.64 | 16.41 | 15.83 | 22.39 | 28.62 |

| Long term Debt in $ Million | - | - | - | - | - | - | - | - | - | 0.56 | 1.79 | 1.69 |

| Dividend per share in $ | 0.03 | 0.03 | 0.0217 | 0.005 | 0.005 | 0.005 | 0.005 | 0.005 | 0.005 | 0.005 | 0.005 | 0.005 |

| Shares outstanding (diluted) in Million | 54.18 | 54.18 | 54.43 | 54.27 | 54.67 | 57.60 | 56.13 | 57.99 | 57.38 | 57.46 | 57.53 | 57.94 |

Source: Company filings and Morningstar.

Balance sheet and Production discussion

1 - Gold and Silver Production details

All of the production came from Gold Resource's Oaxaca Mining Unit - a group of six properties in the southern state of Oaxaca, Mexico.

All of the production came from Gold Resource's Oaxaca Mining Unit - a group of six properties in the southern state of Oaxaca, Mexico.

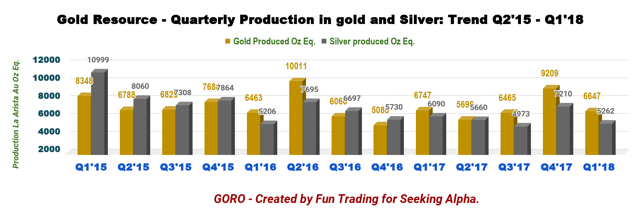

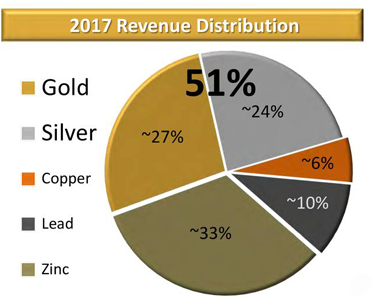

The Aguila mine is the flagship operation including the Arista underground deposit - gold, silver, copper, lead, and zinc - which provided for 90% of the production in 2017, while the open-pit mine at Aguila contributed about 8% of the total output last year. Production for the first quarter was 11,909 Au Eq. Oz, down 7.2% for the same quarter a year ago and 27.5% sequentially. It was a weak quarter in production.

Source GORO Presentation

Gold Resource also has a second underground mine in operation - the Mirador mine at the Alta Gracia deposit, which accounted for the remaining 2% of production.

In a separate release on March 8, 2017, the company updated mineral reserve for Oaxaca, extending substantially Oaxaca mining unit's mine-life of over 4.5 years by increasing proven and probable reserve tonnes by 32%. It is an increase of a full year from the year-end 2016 reserve report.

Proven and probable reserves at Oaxaca stand now at a total of 2.42 million tons grading 1.77 grams per ton (g/t) gold and 136 g/t silver. That likens to 142,400 gold ounces and almost 10.93 million silver ounces.

However, further increases should be coming from the Switchback vein system (not included in the 2017 reserve.) GORO took the last 18 months entering and developing the known bottom of this new vein system. The company looks for future additions in both tonnage and grade as it explores and mine upwards on this sizeable epithermal vein system within the expanding Arista Mine.

For the Isabella Pearl gold project, the company has a total of 2,695 Million tons grading 2.22 g/t and 13 g/t silver (P&P reserves). That likens to 192,600 gold ounces and 1.1291 million silver ounces.

The Isabella Pearl project has the potential to increase the company production by 120%. Targeted output ranges 20K to 30K oz Au the first year and 30K to 40K oz Au after that.

2 - Gold Resource revenues

The gold and silver producer reported earnings of $0.10 per share on revenue of $32.15 million, compared with earnings per share of $0.08 on revenue of $24.34 million in the last year's first quarter.

The company has $28.62 million in cash, an increase of $6.2 million. Gold price realized was 1,342 per ounce ($1,215 / Oz in 1Q'17) and silver price realized was $16.58 per ounce ($17.29/ Oz in 1Q'17).

3 - Gold Resources free cash flow

The company generated $6.63 million in free cash flow during 1Q'18 while paying $1.2 million in dividend annually. GORO passed the FCF test.

The company generated $6.63 million in free cash flow during 1Q'18 while paying $1.2 million in dividend annually. GORO passed the FCF test.

4 - Cash and Long-term debt

Gold Resource has an excellent cash position and no long-term debt which gives extra security from a long-term investment perspective. Total cash was $28.62 million in 1Q'18

Gold Resource has an excellent cash position and no long-term debt which gives extra security from a long-term investment perspective. Total cash was $28.62 million in 1Q'18

5 - Commentary and Technical analysis (short-term)

GORO presents a rare opportunity at the moment even if the stock price has reached a possible intermediate top. The balance sheet is excellent, and the future growth is tremendous with the new project in Nevada called the Isabella Pearl.

GORO is forming an ascending channel pattern. An ascending channel pattern means that GORO may eventually revisit the $4.25 support (Buy flag) unless the stock price can cross the line resistance at $5.45. In this case, the breakout may push the stock price to $7.50 (Double long-term top).

On the other side, GORO could re-test the pattern line resistance at $5.40 on any positive news or a bullish gold price environment.

I recommend accumulating GORO starting at $4.20 with an upper target potential at $7.50 in 2019.

Author's note: Do not forget to follow me on the gold sector. Thank you for your support, I appreciate it. If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Disclosure: I am/we are long GORO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade the stock as well occasionally

Follow Fun Trading and get email alerts