Gold Resource: Record Production For The Second Quarter

Production for the 2Q'19 was solid with an estimated 14,859 Oz Au Equivalent, up 36.9% sequentially and up 18.2% compared to the same quarter a year ago.

Those numbers also include 1,678 Au Oz and 972 Ag Oz from Isabella Pearl first production. Future growth is tremendous with the new Isabella Pearl mine.

Gold Resource has an excellent financial position and run by prudent management, which is consistent with a long-term accumulation. My target for 2019 is $6.50.

Source: Mining Journal. Image: Isabella Pearl Site in Nevada.

Investment Thesis

Gold Resource (GORO) holds a 100% interest in a significant property consisting of six distinct locations in Oaxaca, Mexico, including the producing Arista Mine and Aguila Mill at the El Aguila Project.

The Aguila mine is the flagship operation including the Arista underground deposit - gold, silver, copper, lead, and zinc - which provided for ~90% of the production in 2018, while the open-pit mine at Aguila contributed about 6% of the total output.

The production increase is probably coming from the Switchback vein system.

Note: Gold Resource also has a second underground mine in operation in Mexico called the Mirador mine at the Alta Gracia deposit, which accounted for about 2% of the gold equivalent production.

Gold Resource is closed on producing commercially with its Nevada Isabella Pearl mine and said in the recent press release.

Preliminary second quarter production from the Company's Nevada Mining Unit totaled 1,678 ounces of gold and 972 ounces of silver. The Company announced on April 29, 2019 that its Isabella Pearl mine had produced its first dore, and since then the project has produced gold on a consistent basis. The Company continues to ramp up production at Isabella Pearl and expects the project to reach commercial production levels during the second half of 2019.

This production update for the second quarter of 2019 is another milestone in term of production. The Isabella Pearl mine is now showing gold and silver production while the commerciality has not been declared yet.

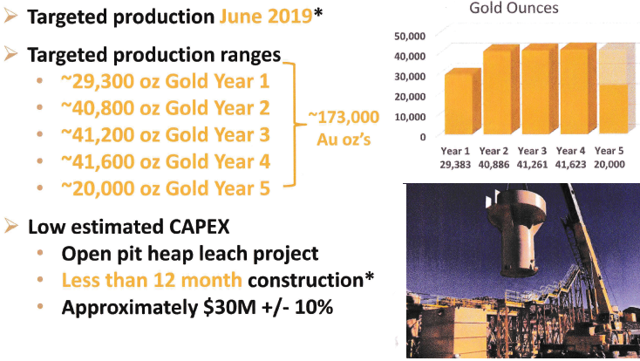

It is essential to understand that future growth is tremendous with the new Isabella Pearl mine. The Isabella Pearl should return more positive cash flow than Arista because it is an open-pit heap leach shallow, which has a lower all-in sustaining cost (AISC) consequently.

The investment thesis remains the same as my precedent article on the company. Gold Resource has an excellent financial position and is run by prudent management, which is consistent with a long-term accumulation.

While it is vital to trade short term about 30% of your position, it is clear that the long-term potential is manifest. Thus, any profit taken on strength should be used to accumulate on weakness.

Data by YCharts

Data by YCharts

Preliminary Gold Production For The First Quarter Of 2019

On July 18, 2019, Gold Resource reported its preliminary production numbers for the second quarter of 2019.

[P]reliminary second quarter production from the Company's Oaxaca Mining Unit totaled 7,881 ounces of gold, 466,512 ounces of silver, 482 tonnes of copper, 2,304 tonnes of lead and 6,054 tonnes of zinc. Through the first half of 2019, the Company's Oaxaca Mining Unit's preliminary production numbers total 14,419 ounces of gold, 831,165 ounces of silver, 915 tonnes of copper, 4,457 tonnes of lead and 11,892 tonnes of zinc. Preliminary second quarter production from the Company's Nevada Mining Unit totaled 1,678 ounces of gold and 972 ounces of silver

How I Calculated The Gold/Silver Ratio?

The second-quarter of 2019 gold and silver prices are based on 63 trading days from April through June. The average price was ~$1,312 per ounce of gold and ~$14.88/Ag Oz.

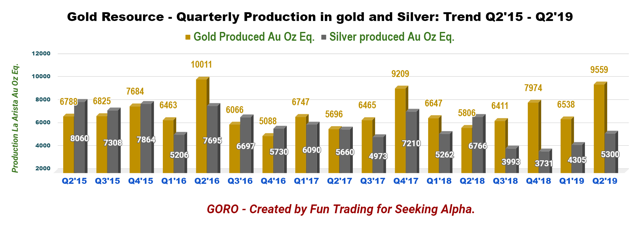

A look at this quarterly production from a long-term perspective starting Q2'15 is showing that the second quarter of 2019 production is the best showing since Q2'16.

A Few Comments About The Preliminary Production Numbers For 2Q'19. Overall, an excellent quarter

1 - Production for the 2Q'19 was solid with an estimated 14,859 Oz Au Equivalent, up 36.9% sequentially and up 18.2% compared to the same quarter a year ago. Those numbers also include 1,678 Au Oz and 972 Ag Oz from Isabella Pearl.

2 - The Company maintains its 2019 Annual Outlook for Oaxaca Mining Unit of 27,000 gold ounces and 1.7 M silver ounces, plus or minus 10% or about 48K Oz Au Equivalent.

Furthermore, "Nevada Mining Unit 2019 annual production outlook is expected to be announced in the near future once the project has reached commercial production levels".

3 - Gold price is approximately $1,312/Oz for the 2Q'19 compared to $1,339/Oz realized in the 1Q'19. Silver is about $14.88/Oz for 2Q'19. The ratio used for Silver/Gold is 88.2:1

I have estimated revenues for the second quarter of 2019 at around $32.0 million.

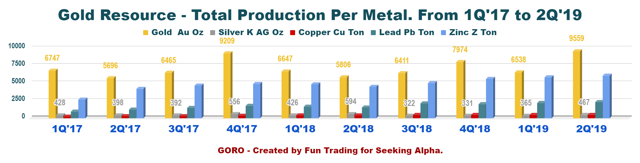

You can see below the historical details per metal produced. The second quarter is showing substantial numbers for all metals.

| Detailed Production | 1Q'18 | 2Q'18 | 3Q'18 | 4Q'18 | 1Q'19 | 2Q'19 |

| Gold Au Oz | 6647 | 5806 | 6411 | 7974 | 6538 | 9559 |

| Silver K AG Oz | 426 | 594 | 322 | 331 | 365 | 467 |

| Copper Cu Ton | 385 | 387 | 434 | 446 | 433 | 482 |

| Lead Pb Ton | 1615 | 1540 | 2119 | 2006 | 2153 | 2304 |

| Zinc Z Ton | 4793 | 4473 | 4970 | 5572 | 5838 | 6054 |

Source: Fun trading

Conclusion and Technical Analysis

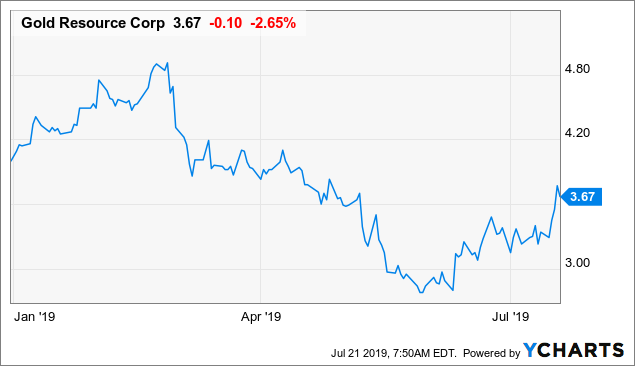

Gold Resource has been unjustly punished since February 2019 and dropped from nearly $5 to about $2.50.

It seems that the market has discounted the potential positive effect of Isabella Pearl mine. Even if it reached production in June, as expected, and will produce commercially in H2 2019.

Isabella Pearl will add about 15K Au Oz in 2019 based on 29.4K Au Oz for the first year of commercial production.

Source: Goro Presentation

The downtrend was aggravated by the early weakness of the gold price, which continued until the end of May.

However, during the last two months, we have experienced an exceptional bullish trend, due primarily to the Fed changing strategy from raising to cutting interest rates. This bullish trend may eventually continue if the Fed decides to reduce by 50 basis points or may retrace a little if the Fed decides on 25 basis points instead.

GORO has experienced recently a decisive positive breakout of its descending wedge pattern with new line resistance at $4.15 (time to take some profit off the table). However, I made already a profit from the sale of 20% of my position, sold at around $3.70. I am waiting now, for any retracement to buyback.

The reason for my decision is that I believe the Fed will cut interest by 25 basis points, which is already too much looking at the US economy. Therefore, the recent gold rally, which pushed the price last week at over $1,440 per ounce, due to a 50-basis point expectation, is unsustainable. My logic is that a retracement below $1,400 per ounce should be the best scenario now. If it happens as expected, a majority of the gold miners will experience a significant selloff before resuming an ascending trend again.

The new potential line support, assuming an ascending channel as a new intermediate pattern, is about $3.50 (I recommend adding from $3.50 and lower). My 2019 long-term target is $6.50.

However, it is vital to invest and trade GORO based on the future price of gold, which is paramount.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Disclosure: I am/we are long GORO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Fun Trading and get email alerts