Gold Rides Oil's Coattails On Mideast Tensions

Gold has no shortage of investor worries to support its safety demand.

Biggest worry of all is Mideast tensions which have boosted oil price.

Gold should follow oil's impressive rise in the intermediate term.

As if investors didn't have enough to worry about already, Wednesday provided them with yet another one. A strong performance in the crude oil market underscored the ongoing geopolitical tensions which have served to buoy the price of gold lately. In this report we'll look at the growing list of factors which support higher gold prices in the short-to-intermediate term.

Gold prices rose to a one-week high on Wednesday in light trading. Safe-haven demand was still evident even though the U.S. dollar held firm and equities rose. Spot gold was 0.2 percent higher for the day to close at $1,349. June gold futures meanwhile settled up $4, or 0.3 percent, to close at $1,353.The story on Wednesday in the financial press was that strong corporate earnings served to suppress gold while lifting stock prices. While there was definitely a show of strength Wednesday in many NASDAQ-listed stocks, there were also more than a few instances of relative weakness in NYSE shares. For instance, shares of Dow 30 component International Business Machines (NYSE:IBM) fell over 7 percent Wednesday after analysts highlighted the company's shrinking margins after the release of the company's latest earnings results. This dragged down the performance of the Dow Jones Industrial Average (DJIA) for the day, which in turn allowed the gold price to remain buoyant despite the firming dollar.

There was also an undercurrent of weakness evident in the NYSE broad market as more than 55 stocks made new 52-week lows on Apr. 18. Historically, anything higher than 40 new lows is a sign that internal selling pressure is on the rise and in this case it was interest rate-sensitive securities such as municipal bond funds which were subject to selling pressure. This was attributable to the latest rise in Treasury bond yields, which makes owning such assets less attractive.

All of this is to say that gold still has a fair share of factors which can support safety-related buying in the yellow metal among concerned investors. Gold's "wall of worry" is still strong, and this favors higher gold prices in the intermediate-term (3-6 month) outlook.

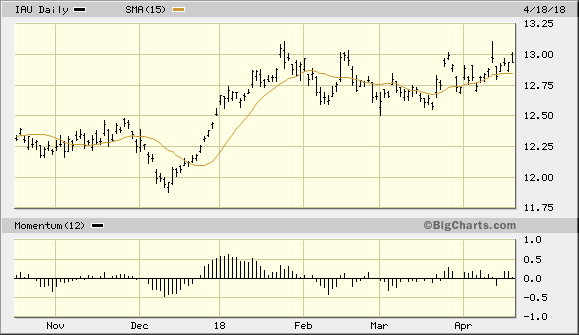

Gold's immediate-term (1-4 week) trend is also still up as measured by its relationship to its nearest pivotal low as well as the 15-day moving average. Shown here is the latest graph of the iShares Gold Trust (IAU), which continues to remain well above its 3-month trading range floor at the $12.50 level. IAU hit an intraday high of $13.02 high on Wednesday, which is just three cents shy of its pivotal high of $13.05 (the closing high from late January). As I've emphasized in recent reports, a breakout above $13.05 would most likely activate major short-covering and allow IAU the chance for a significant rally. For now patience is still in order as IAU's consolidation within its multi-month lateral range continues.

Source: BigCharts

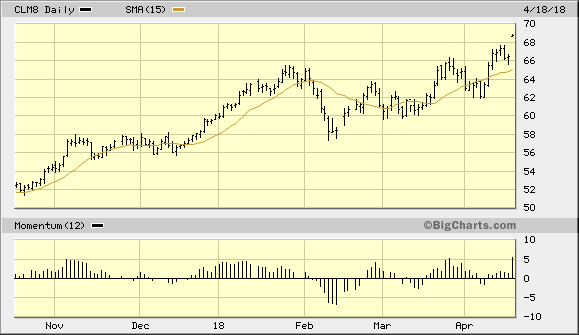

Another very promising market event which occurred on Wednesday also bodes well for the near-term gold price outlook. I'm referring to the 2.9 percent rise in the crude oil price to $68.47. Oil's strong performance of late underscores the increasing demand for inflation-sensitive commodities which should eventually benefit gold. As I've emphasized in past reports, as long as the oil price is strengthening in a sustained fashion it tends to attract institutional buying from fund managers who are conscious of gold's tendency to follow the crude oil price higher.

Source: BigCharts

What's more, a rising oil price in itself is a cause for investor angst at home as well as abroad since rising oil prices will eventually put upward pressure on retail prices, especially at the gas pump. Thus as long as the oil price (shown above) continues its winning ways, expect gold to follow in its path.

Yet another factor which underscores not only the recent gains in the crude oil market but also bodes well for gold is rising geopolitical tensions. Investors continue to be concerned over the potential for military conflict in the Middle East, which has the potential to create oil supply disruptions. Investors are also waiting to see whether President Trump will re-impose sanctions on Iran as a May 12 deadline approaches. Consequently, these geopolitical concerns are feeding into increased safety-related buying of gold among global investors who are looking to hedge against an event which could easily spike commodity prices, particularly oil and gold.

On a strategic note, IAU confirmed an immediate-term buy signal per the rules of the 15-day MA trading method two weeks ago. This signal is predicated on a 2-day higher close above the rising 15-day moving average. I've purchased a conservative trading position in the iShares Gold Trust after it confirmed the immediate-term (1-4) breakout signal on Mar 23. I'm using the $12.55 level as the initial stop loss on an intraday basis for this trade. Meanwhile longer-term investment positions in gold should be maintained as the fundamentals underscoring gold's two-year recovery effort are still favorable.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts