Gold's Battle to Break the 2011 High / Commodities / Gold & Silver 2023

Between2020 and now, quite a lot happened, quite a lot of money was printed, and wesaw a war breaking out in Europe. Yet gold failed to rally to new highs.

Between2020 and now, quite a lot happened, quite a lot of money was printed, and wesaw a war breaking out in Europe. Yet gold failed to rally to new highs.

Gold Had Chances

Infact, it’s trading very close to its 2011 high, which tells you something aboutthe strength of this market. It’s almost absent.

Truthbe told, what we see in gold is quite in tune with what we saw after the 2011top, and in particular, shortly after the 2012 top. We can also spot similarities between now and 2008. The long-term gold price chart below provides details.

Actually, since gold is now practically just where it was a week ago, my Monday’s description of the belowgold chart remains up-to-date:

Doyou know what levels gold has recently reached? Hint: those are very, very,very important price levels…

Gold just once againreached its 2011 high.

Theone that triggered reversals either immediately or after an additional rally(but it took a war outbreak in Europe to push gold temporarily (!) above thislevel). Therefore, the importance of this long-term resistance can’t beoverstated.

That’sone thing. Another thing is that, given the major fundamental event that Ialready mentioned above (the war outbreak), it’s possible for the technicalpatterns to be prolonged and perhaps even repeated before the key consequencematerialized. Similarly to the head-and-shoulders pattern that can have morethan one right head before the breakdown and slide happen.

Ingold’s case, this could mean that due to the post-invasion top, the entire2011-2013-like pattern got two major highs instead of one. And thus, theinitial decline and the subsequent correction are pretty much a repeat of whatwe saw in 2020 and I early 2021, as well as what we saw 2011 and 2012.

Theparticularly interesting fact (!) about the correction that we saw after the2011-2012 decline (the one that was followed by the huge 2012-2013 decline) isthat during it, gold corrected slightlymore than 61.8% of thepreceding medium-term decline. Consequently, the current situation is justlike what happened back then.

Andif all the above wasn’t bearish enough, please take a look at the reading ofthe RSI indicator based on the weekly price changes. It’s now just below 70,and guess where it was at the final top before the 2012-2013 slide? Yes, it wasexactly there, too.

That’salso approximately, where the RSI was at last year’s top.

Theorange rectangles on the above chart represent the corrective upswings fromapproximately the previous local lows. There are two of them, and back in 2013,there was just one corrective upswing, before gold truly plunged.

However,please remember that history doesn’t repeat itself to the letter – it rhymes.This means that two corrections instead of one are still within the scope ofthe similarity, especially since the first correction wasn’t as big as the 2008one.

Thecurrent situation is truly special, as the rate hikes are something that wehaven’t seen in a long time. The same goes for the level of concern about theinflation that’s “out there.” The latter implies that when faced with adecision about whether to fight inflation or help the economy, the Fed islikely to lean toward the former. That’s bearish for assets like gold.

Looking at gold from the short-term pointof view, reveals that gold is trying to verify the breakout above its 61.8%Fibonacci retracement.

TheBattle for $1,900

Trying, but not necessarily succeeding atit. Even though the rallies above the $1,900 level and the 61.8% Fibonacci retracementlevel were more visible than moves back below those levels, the latter stillhappened.

This, combined with an RSI above 70 –which is a classic sell signal thatconfirmed, e.a., the 2022 top – makes it very likely that “the battle for$1,900” will be lost.

Let’s zoom even further.

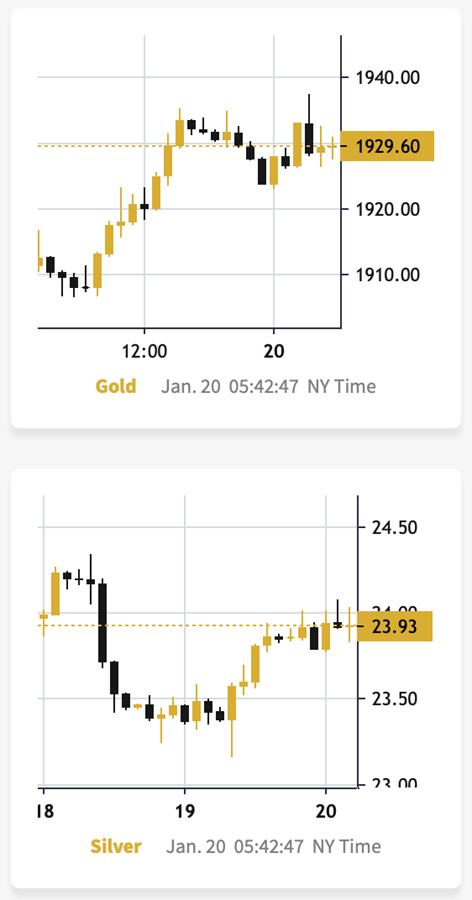

On the chart below (courtesy of https://GoldPriceForecast.com),you can see that while gold made another intraday attempt to move above therecent short-term highs and silver attempted to onceagain move above $24, both moves failed.

This indicates that the rally’s days arelikely numbered.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.