Gold's Major Reversal to Create the "Handle" / Commodities / Gold & Silver 2020

Gold just closed the month and quarter and itsperformance on the final day of both was very encouraging for the bulls. What’sgoing on and what changed?

Let’s start with the big picture.

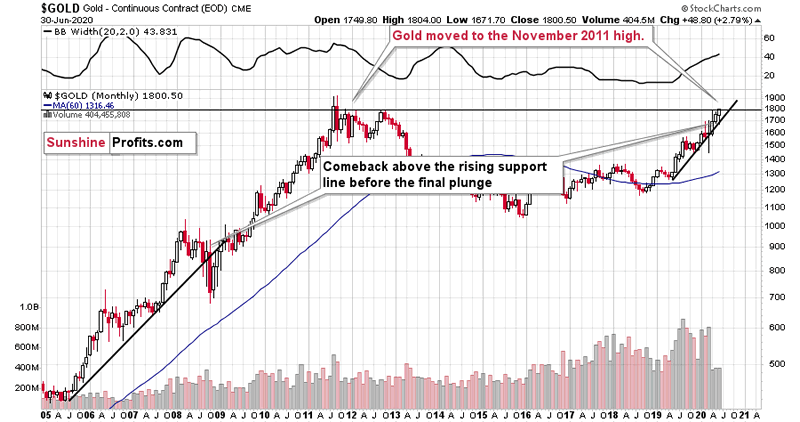

Gold just moved to the November 2011 high and intoday’s pre-market trading it even moved above it. The volume on which goldmoved up last month was relatively small, which doesn’t support the bullishcase, but a confirmed breakout above the November 2011 high would be an importanttechnical development, nonetheless.

The key word here is “confirmed”. The November 2011high was $1,804.40, and at the moment of writing these words, goldfutures are trading at $1,805.15 – that’s less than $1 above theabove-mentioned high.

The way in which gold moved between 2012 and 2020created a near-perfect cup from the cup-and-handle formation. Generally, thebigger the base, the stronger the move, and this time the base is huge. Still, the“handle” of the pattern is still missing, and it could take form of a volatileplunge. This would be in tune with how gold reacted to the first wave ofcoronavirus.

The breakout above the November 2011 high is farfrom being confirmed, and in our view it’s unlikely to be confirmed. Why?

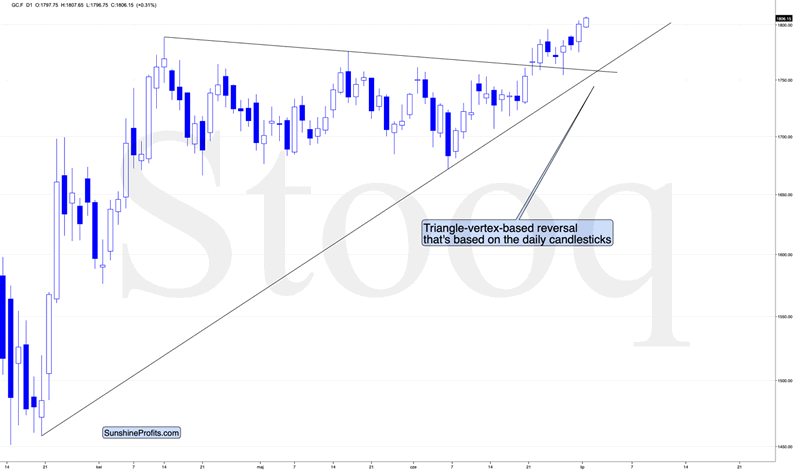

There are multiple reasons for it, but the mostprecise and technical ones are gold’s likelihood to reverse its direction basedon the triangle-vertex-based reversal and the long-term cyclical turningpoint.

Theresistance line, above which gold tried to break and the rising support linebased on the March and June lows cross more or less in the first daysof July. The triangle-vertex-basedreversals have pointed to many important tops and bottoms inthe recent weeks and months.

Wepreviously wrote that the above-mentioned reversal might correspond to a bottomin gold, but as of today, it’s clear that if any reversal is to take place, it’s going to be a top,not a bottom, as gold’s most recent short-term move has been up.

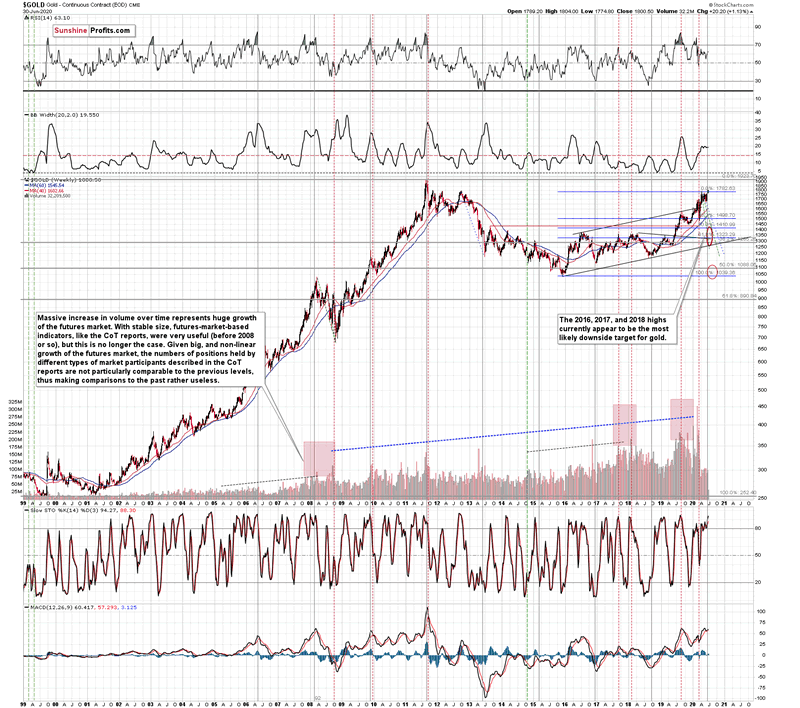

Let'skeep in mind that gold's long-term turning point is here (the vertical grayline on the chart below), which further emphasizes the likelihood of seeing amajor turnaround right now.

The reversals provided by the above-mentioned techniques are actually relatively close to each other given that this is already thefirst week of July, and that the second week of the month starts in just 2trading days (the markets are closed in the U.S. this Friday).

The implications here is clear – don’t count on gold’sbreakout’s success.

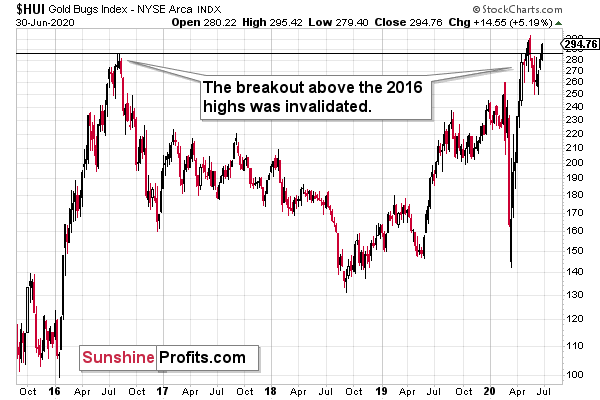

The HUIIndex is once again trying to break above the 2016 high. Although itmight move higher today, we doubt that it would be able to hold its gains for along time, in light of gold’slooming reversal. Instead, another invalidation of the reversal islikely.

And silver?

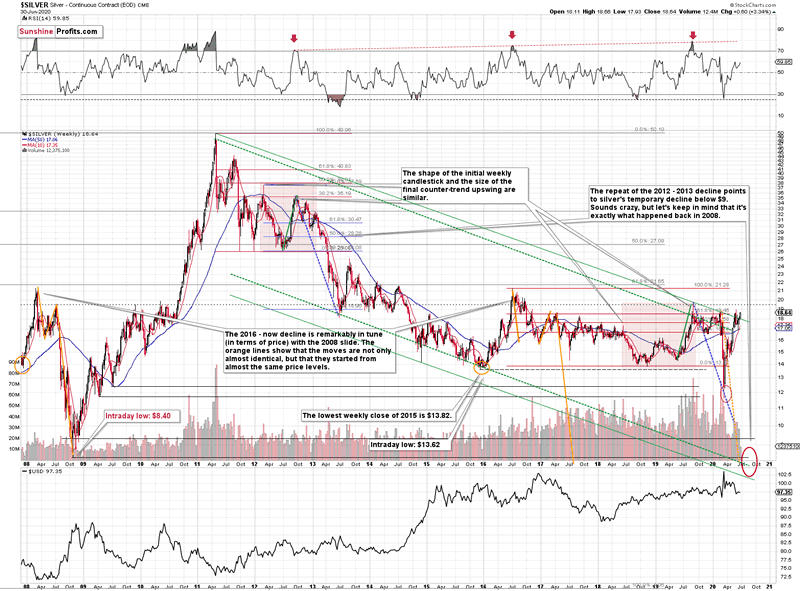

The white metal showed strength as well, rallyingalmost to the previous 2020 highs. As dramatic as it may sound, please notethat silver just a few dollars above its 2015 low and over $30 below its 2011high. Miners are disappointing too – it is only gold that is stealing thespotlight. And it’s doing so on relatively low volume, making its entire“strength” doubtful.

Silver broke above its declining green resistanceline… Once again. This line is based on the 2011 high and the 2019 high. Therewere three previous attempts of the white metal to break above this line andthey all failed. Is this time any different? We doubt that, especially givengold’s reversal indications.

And in particular, given the rising coronavirus cases that initially (!) triggered a precious metals sell-off in March. Thesell-off started when people started really considering the economicimplications of the pandemic and the lockdown,so this kind of thinking is likely to be back once the pandemic preventionmechanisms are going to be re-introduced on a bigger scale.

Summary

Summing up, gold is stealing the spotlight, tryingto break above the $1,800 barrier and the November 2011 high, but it’s unlikelyto be able to confirm this move. Gold did end the previous month and quarter atexceptionally high level, but the monthly volume was low and it was the onlypart of the precious metals market that showed this kind of strength. Silver isjust a few dollars above its 2015 low and over $30 below its 2011 high, whileminers are trying to get above their 2016 high – well below their 2011 high.Given the above and gold’s looming reversals, I think that a big decline is inthe cards for the entire precious metals sector.

Thank you for reading today’s free analysis. Its full version includes details ofour currently open position as well as targets of the upcoming sizable moves ingold, silver and the miners. We encourage you to sign up for our free goldnewsletter – as soon as you do, you'll get 7 days of free access to our premiumdaily Gold & Silver Trading Alerts and you can read the full version of theabove analysis right away. Sign up for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.