Gold's Quick Reversal and Copper's Major Indications / Commodities / Gold & Silver 2024

Copper is definitely the mostimportant industrial metal out there.

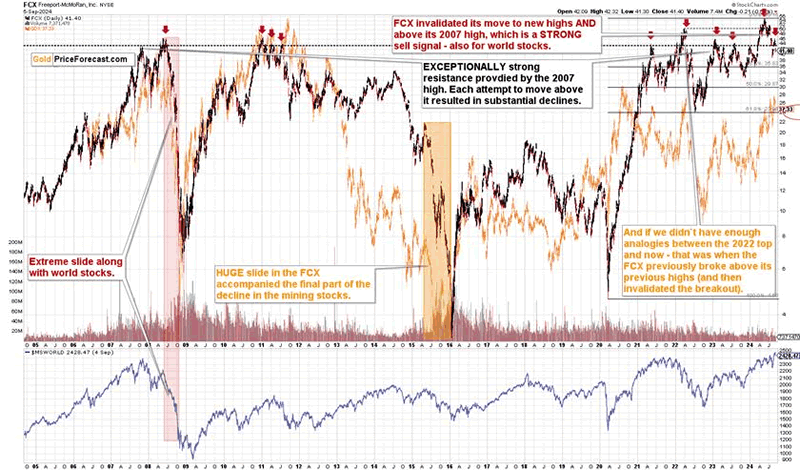

Freeport-McMoRanReflects Market Trends

In the entire commodity sector, onlycrude oil is more widely used. And given the increasing importance ofall-things-electronic, copper is unlikely to be forgotten anytime soon. Thisdoesn’t mean that the only way in which its price can move is up (far from it),but it does indicate that this market is likely linked to multiple othermarkets – also to goldprice.

Before showing you the copper chart, I’dlike to show you one of its producers – the Freeport-McMoRan (FCX) share price,which behaves very specifically at majortops in stock markets around the world. No wonder – with lower demand forcopper (FCX reflects that as well as the overall approach of investors towardcopper and the stock market in general), we get lower copper prices. But lowerdemand for copper also indicates fewer orders for goods (producers order less as they don’t need to produce asmuch), which is a sign of lower industrialproduction and a weaker economy overall.

FCX formed a major top in 2007. It wasmajor not because it was not broken. It was. What is remarkable is that eachtime FCX price exceeded this top, it then invalidated this breakout eithershortly or eventually. I marked those cases with red arrows on the above chart.

It’s remarkable how strong the top frommany years before worked as an impenetrable (at least not on a sustainablebasis) barrier for FCX, isn’t it? Food for thought for everyone writing everynow and then that something from a more distant past can’t affect the current pricesas it was taking place (here: the 2007 top) under different economicconditions, with different geopolitical environments etc.

If you focus on the bottom part of thechart, you’ll see the performance of world stocks. Yes, it was mostly the U.S.stock market that’s been soaring in the recent years, but in the case of therest of the world, we (on average) saw nothing more than a comeback to the 2007top.

Please consider what happened in worldstocks each time when the FCX topped and then invalidated its breakout abovethe 2007 high. Those were the times when the top was either in or when abroader top was starting or ending to form.

The 2008 top… Well, we all remember alltoo well what kind carnage happened then – also in the precious metals sector.

The 2011 top was broad and… It wasfollowed by major top in the precious metals sector.

The tiny 2021 invalidation was early inthe topping process in world stocks, but given the size of the followingdecline, one could say that it was indeed very close to the top. The early 2022 invalidation confirmed thesell signal. Also, both invalidations marked tops / shorting opportunities ingold stocks, which you see (GDX) in the background of the main chart(marked with orange).

The 2023 invalidations resulted in just asmall decline, but it still happened – also in case of gold stocks.

Then comes this year – we saw twoinvalidations of the move above the 2007 high. The first one was also a failureto hold at new all-time highs, and the second one happened very recently. Worldstocks are after a broad consolidation pattern, at their previous highs, whichlooks just like a broad top that we saw in 2021 and 2022, which means that therecent invalidation was just like the final sell signal that we saw in early2022 (compare with what I marked with bold above).

This is a major (with implications forweeks and months, not necessarily days or years) sell signal for both: stock marketsaround the world and gold stocks. And, of course, FCX itself.

On a side note, if one shorted FCX withinthe last few of months, it seems that they are quite happy with that choice.

Given the prices of world stocks, we’re in a situation that’s similar to the 2007 and 2022 tops (already after them). Andthis is profoundly bearish for mining stocks.

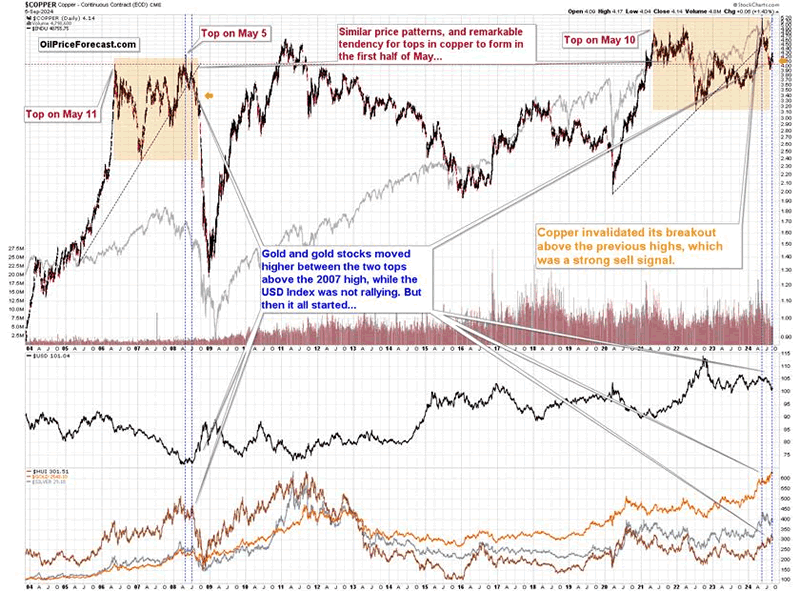

Looking at copper itself, we seesomething similar (although not as precise, which is why I started with FCX).

After topping in May (just like I hadwarned) and invalidating the move to the new all-time high, copper plunged.

On the above chart, we can see asimilarity of the entire broad pattern that I marked with orange, which isadditionally confirmed by the breakdown below the rising, dashedsupport/resistance lines.

Echoes of2008: Major Declines Ahead?

Back in 2008, there were two attemptsto move above the previous (2006) high in copper. The first one was a move toan all-time high, and the second one was lower. It was after a medium-termdecline in the USD Index, and in general, gold and gold stocks moved higherbetween those tops in copper.

We have the same thing today with regardto the same (2006) top. It might be difficult to believe, so I marked it with ahorizontal dashed line. Copper’s all-time high was followed by a decline backbelow the 2006 high, and the recent run-up just took copper slightly above it.The USDX is after a medium-term decline. Gold and gold stocks moved higher betweenthe tops in crude oil.

What’s next based on this link? Back in2008, a massive decline followed, so the implications are – of course – verybearish for all those markets – including world stocks.

Again, this move lower doesn’t have tomaterialize in the next few days and it’s unlikely to last for years, but I doexpect to see lower prices in terms of weeks and months.

And as we see this medium-term movelower, I continue to expect junior mining stocks to perform particularly well,and by well, I mean that they would be particularly weak, providing greatprofits from short positions in them.

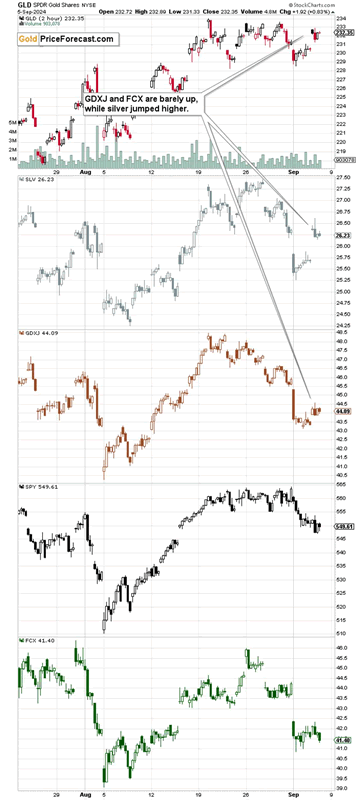

The above chart shows that the GDXJ wasbarely up yesterday (while gold and silver moved visibly higher), and FCXactually declined by 0.5%.

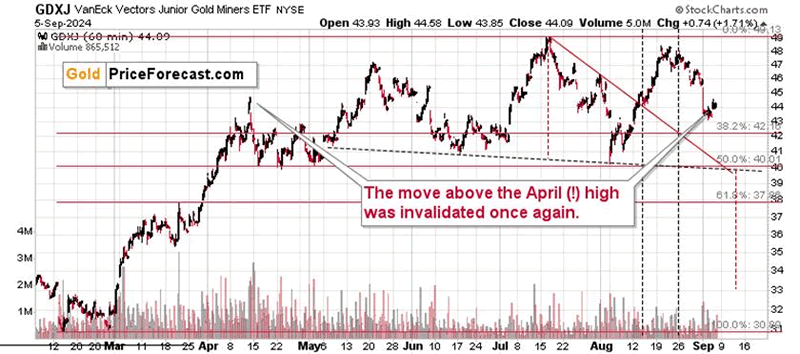

On a very short-term GDXJ chart, we seethat yesterday’s “rally” was just a blip on the radar screen – nothing to writehome about.

Please note that the red decliningsupport line and the dashed support line as well as the 50% Fibonacciretracement intersect at about $40 on Tuesday / Wednesday. If the GDXJ movesthere, we might get some kind of rebound.

On an immediate-term basis, we saw aquick jump up in goldafter the nonfarm payrolls were released which was followed byanother move lower. At the moment ofwriting these words, it’s still before the opening bell (about 22 minutes), andgold is down by $2.50. This reversal has bearish implications as it showsthat the bearish overwhelmed excited buyers. And it makes the scenario from theprevious paragraph (decline today and/or early next week) quite likely.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.