Gold Searches For A Directional Catalyst

Still no immediate-term buy signal for gold as sideways trend persists.

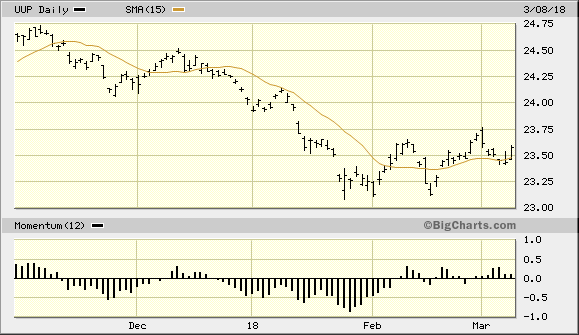

Dollar index refusal to reverse its 6-week trend is the prime culprit.

Gold mining stocks also still under control of the sellers.

Gold prices were slightly lower on Thursday as the equity market strengthened along with the U.S. dollar index. Gold's brief thrust above its 15-day moving average on Tuesday was ephemeral as there wasn't any upside follow-through on the part of the bulls. Gold's 8-week sideways trend therefore continues, and as we'll discuss in today's commentary its leading indicators still haven't signaled an imminent change in this trend.

One of the main reasons for gold's continued lack of immediate-term (1-4 week) directional bias has been the stubborn refusal of the dollar index to resume its established downward trend. The PowerShares DB US Dollar Index Bullish Fund (UUP) shown here provides an example of this tendency for the dollar to stay above its 15-day moving average for most of the last six weeks. More importantly from an immediate-term technical perspective, as long as UUP is above its nearest pivotal low - namely the Feb. 1 closing low of $23.13 - its immediate-term trend is still considered to be sideways-to-higher. More importantly, by remaining above the $23.13 level the dollar ETF has bought itself a respite from its larger intermediate-term (3-6 month) declining trend.

Source: www.BigCharts.com

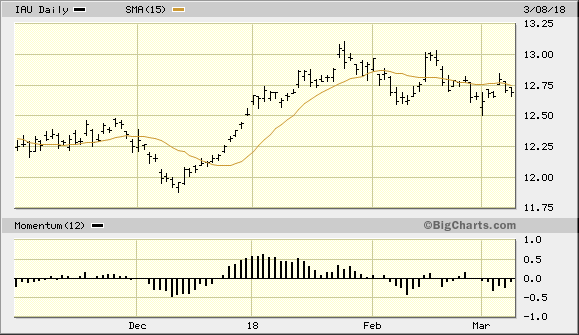

The fact that the dollar isn't getting weaker right now hasn't done any favors for the price of gold. My favorite gold proxy, the iShares Gold Trust (IAU), still reflects the lack of immediate-term directional bias for the gold price. The best we can currently say about IAU is that it's still above its 8-week trading range floor of $12.50, which at least provides a measure of support in the near term. However, should IAU fail to rally again soon it risks establishing a pattern of lower highs since late January, as reflected in the following graph. This in turn could serve as an enticement for renewed selling pressure in IAU on the part of algorithm traders who look for such patterns as an excuse to launch bear raids.

Source: www.BigCharts.com

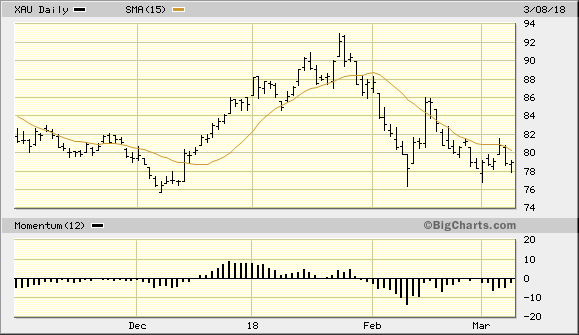

Turning our attention to the gold mining stocks, the PHLX Gold/Silver Index (XAU) had shown increasing strength last week and appeared to be on the cusp of an important breakthrough above its 15-day moving average. It rallied from its Mar. 1 low to touch the 15-day MA (below) on Tuesday, Mar. 6 but wasn't able to close above it. To date, the XAU has failed to confirm an immediate-term buy signal per the rules of my trading discipline since December, which requires a 2-day higher close above the 15-day trend line. This failure to clear the 15-day MA obstacle confirms that the actively traded mining shares are still in the hands of the sellers.

Source: www.BigCharts.com

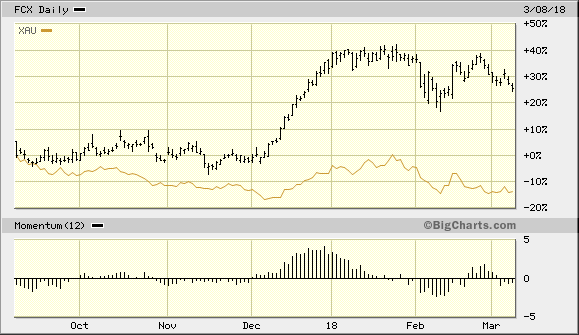

Another sign that the gold mining stocks remain under immediate-term pressure can be seen in the following graph of Freeport-McMoRan Inc. (FCX). FCX has shown itself to be a useful barometer for the intermediate-term direction of the gold stocks as a group. Because of its copper and gold components FCX is sensitive to both aspects of the metals mining sector, and the tendency of copper prices to lead gold prices has long been observed by investors. Thus any pronounced strength or weakness in FCX is of definite interest to gold stock investors and should be carefully considered when evaluating the XAU index.

The following graph compares the intermediate-term price trend of FCX with that of the XAU. You can see here that FCX gave a leading signal for gold stock investors back in late November as FCX was grinding higher even as the XAU was still declining. The subsequent blast-off in FCX's price line in December confirmed that the outlook had turned decisively bullish for the gold stocks. Since peaking in January, however, FCX has been trapped in a lateral trading range and hasn't yet provided any firm directional clues for the XAU. Its price line has established a series of lower peaks since January, though, which is of some concern for the near-term outlook. While it's not too late for FCX to reverse this pattern of lower highs, it should happen soon or else the risk that the-term forward price momentum that FCX generated during its December-January rally will begin to decay (as measured by rate of change indicators) and will in turn lead to a reversal of its interim uptrend.

Source: www.BigCharts.com

In any case, until the XAU confirms an immediate-term bottom by closing two days higher above the 15-day MA I recommend that conservative traders maintain a heavy cash position and refrain from making any new purchases in the individual gold and silver mining shares.

For now I also continue to recommend that conservative gold and gold ETF traders keep their powder dry and wait for the gold price to decisively strengthen before initiating any new trading positions. Longer-term investment positions in gold, however, can be maintained as the fundamentals underscoring gold's two-year recovery effort are still favorable.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.