Gold Seeker Report: This Week in Mining Issue #14: A Quiet Week on the Mining Front

Chris Marchese

Chris Marchese

Chief Mining Analyst, GoldSeek & SilverSeek

Week Ended May-24, 2020

$AGG.V, $AGGFF, $CGC.V, $ALLXF, $CXB.TO, $CXBMF, $F.V, $FIOGF, $ELY.V, $ELYGF, $EQX, $KNT.V, $KNTNF, $KTN.V, $KOOYF, $MUX, $NEE.V, $NHVCF, $SVM, $GUY.TO, $WM.TO, $WLBMF, $AUY

With most mining operations ramping production back-up, preparing to ramp-up, or already operating "normally", the news-flow has died down considerably in the last week, though given what's going on the macro-economy, this is unlikely to last for any prolonged period of time. While a major theme for over the next 12-18 months, will be M&A, it could take breather for a while, primarily as result of mining teams unable to complete its due diligence on prospective assets or companies to acquire because of travel restrictions from CV19. This is not to say M&A won't continue in the near future, just that it will be less than would otherwise be the case.

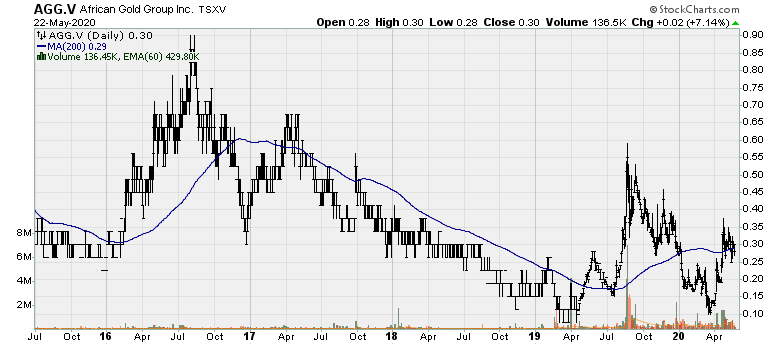

African Gold Group: The company has put together an accelerated construction development timeline. Highlights from development pipeline include:

Fast-Tracked schedule reduces construction from 23 months to 19 months Detailed design completed on the majority of the process plant Initial infrastructure completed on main camp and construction campThe company is advancing a feasibility study as a final step before commencing construction activities. The FS should show much improved economics and a larger production scale relative to earlier technical reports. This has to two with continued high-grade drilling results, discovery of expansive gold shear zone at its Kobada project. It also reported the highest-grade intersection to date as mineralization extends to the North. Beyond successful exploration efforts and that which remains, the company has been able to significantly improve gold recovery rates from 80% to 96%. Further, previous technical reports envisioned an operation smaller than 100k oz. p.a. The contractor for the FS has completed the engineering assessment on an expanded throughput scenario at Kobada gold project in Mali. The expanded scenario could exceed the FS target of 100k oz. Au p.a.

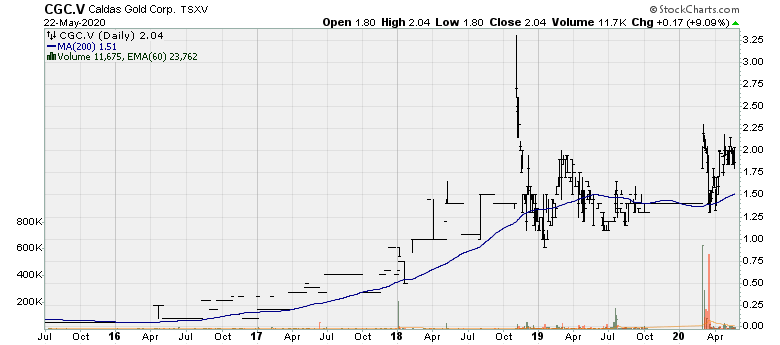

Caldas Gold: The company has entered into a definitive arrangement whereby Caldas will acquire all of the issued and outstanding shares of privately-held South American Resources (SARC). SARC is party to an acquisition agreement pursuant to which SARC will acquire certain minimum exploration assets in Northeastern Ontario ("Juby Acquisition") held by Lake Shore Gold, a wholly owned subsidiary of Pan American Silver Corp. The exploration assets comprise a 100% interest in the Juby Project.

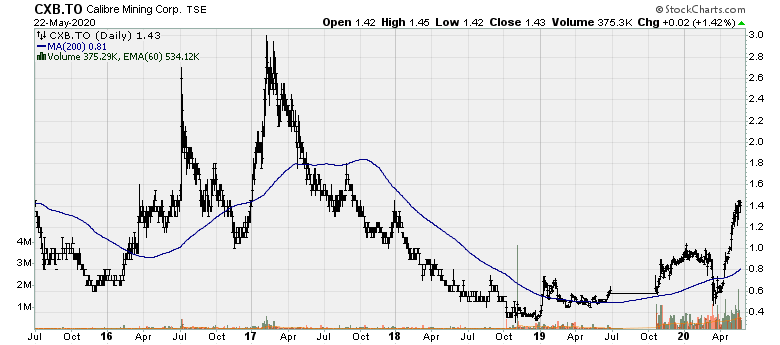

Calibre Mining: The company continues to report excellent drill results at Libertad. Exploration activities will recommence upon the restart of mining operations, with an increased scope o 60k meters, a 30% increase from the initially announce 47k meters. The number of drill rigs will go from six to ten in Q4, with four scheduled at Limon, four at Libertad and two at Pavon. Drilling continued at the Panteon and Limon Norte deposits, with the focus on: Tranca, Jabali Central and Jabali West, and follow up drilling at the Amalia prospect. Drill highlights are as follows:

Jabali West Underground Deposit:

3.3m @ 23.46 g/t Au 3.9m 2 10.27 g/t Au 2.1m @ 9.78 g/t AuTranca Gold Prospect:

4.5m @ 3.92 g/t Au 4.6m @ 1.62 g/t Au 4.7m @ 2.09 g/t AuAmalia Gold Prospect:

1.9m @ 19.99 g/t Au 6.7m @ 5.24 g/t Au 3.1m @ 3.86 g/t AuPanteon Gold Deposit:

2.1m @ 4.25 g/t Au 6m @ 2.08 g/t Au

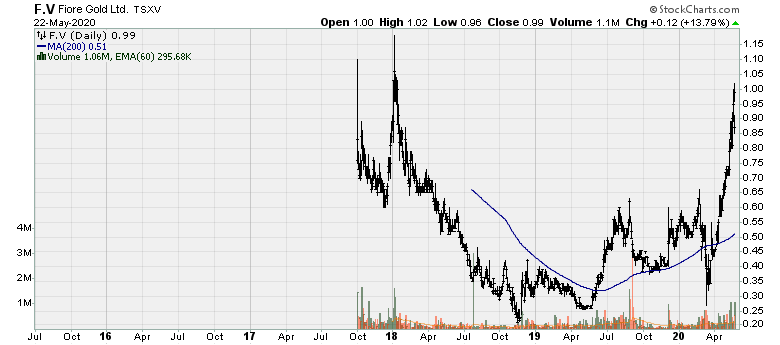

Fiore Gold: Reported 2m oz. M&I at its Golden Eagle Project, Washington State, USA. Using a slightly higher cut-off grade [0.48 g/t Au] vs. [0.34 g/t Au] has resulted in M&I gold resources of 2.018m oz. @ 1.38 g/t Au plus 154k oz. @ 0.896 g/t Au Inferred. This is in addition to 9.4m oz. of M&I silver resources @ 6.44 g/t Ag plus 765k oz. @ 4.43 g/t Ag Inferred.

The company also reported record fiscal year Q2 gold output and cash flow generation. The company produced 12k oz. Au, a 38% increase over the prior period. The company generated $4m in operating cash flow. The company ended its fiscal year quarter with $9.1m in cash. Mine site AISC of $1,099/oz., while consolidated AISC [with corporate G&A] was $1,196/oz.

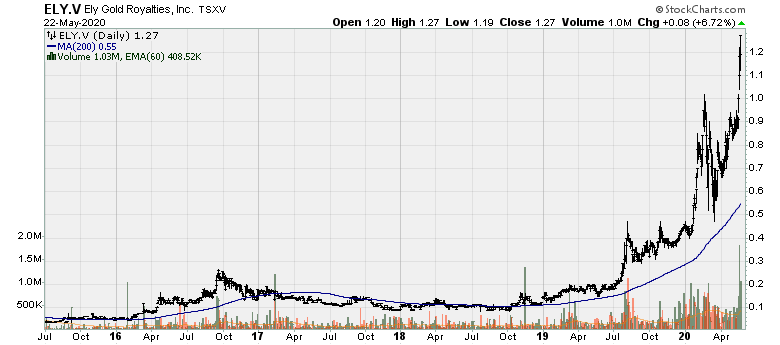

Ely Gold Royalties: Among the junior royalty companies, Ely Gold Royalties has been rather busy over the last year, building up its royalty portfolio, recently closing the purchase of an important Nevada royalty portfolio. This portfolio consists of five properties which are being leased by the likes of Barrick and SSR Mining. Ely Gold is acquiring 50% of this portfolio which also include minimum royalty payments and a carry a 3.0% NSR royalty with no buy-downs on four of the properties. VEK, which was purchased by Ely (or subsidiary thereof) which purchased 50% of the leases and royalties. In the past, VEK sold 50% of its 1.50% NSR royalty on Marigold to Franco-Nevada, leaving Ely with a 0.75% NSR. All of the following leases have advanced royalty payments and come with a 1.50% NSR royalty to Ely: REN, Marigold (0.75% NSR), Lone Tree, Pinson, Carling Trend. The advanced royalty payments made in 2019 totaled $695.5k.

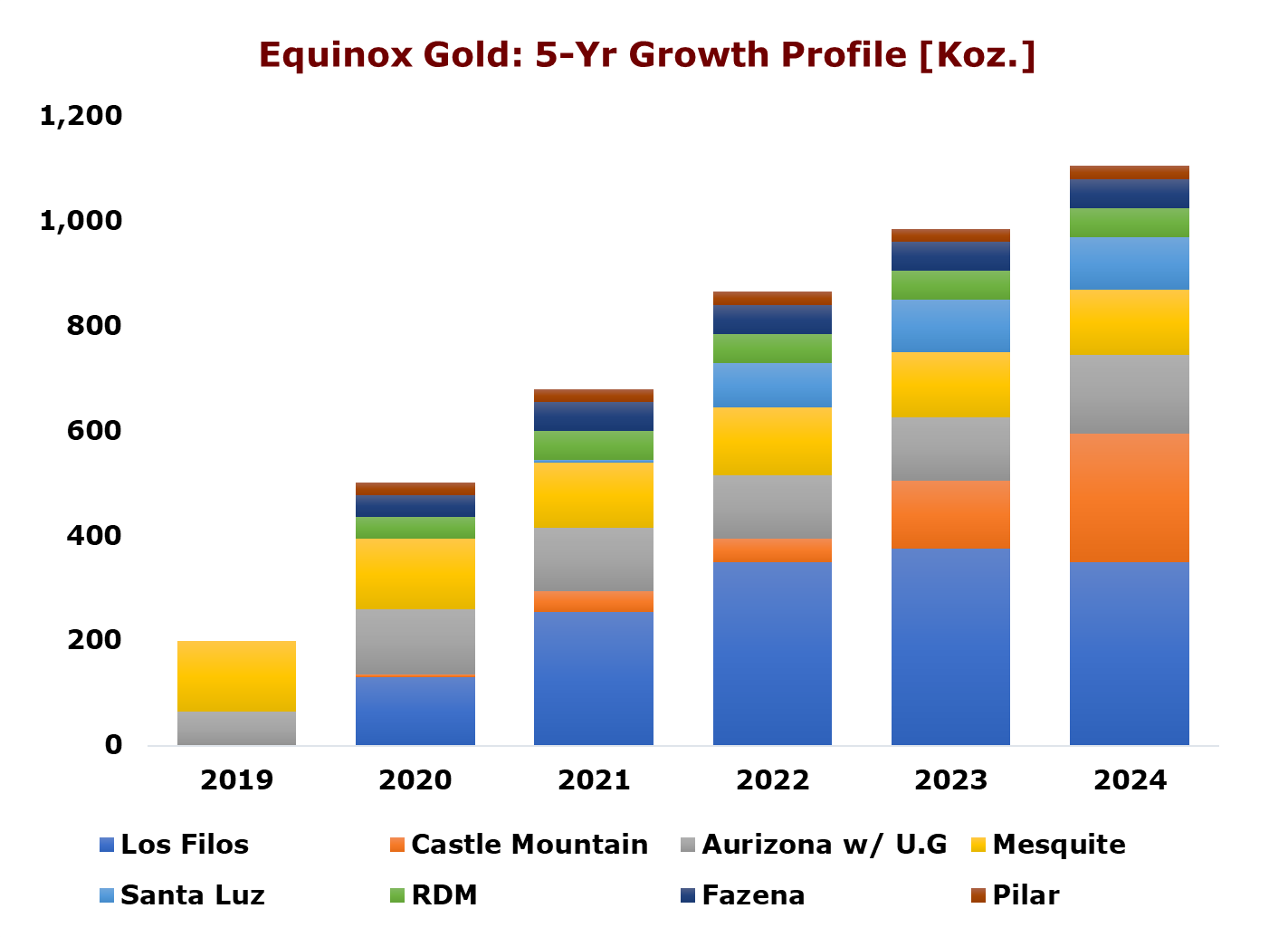

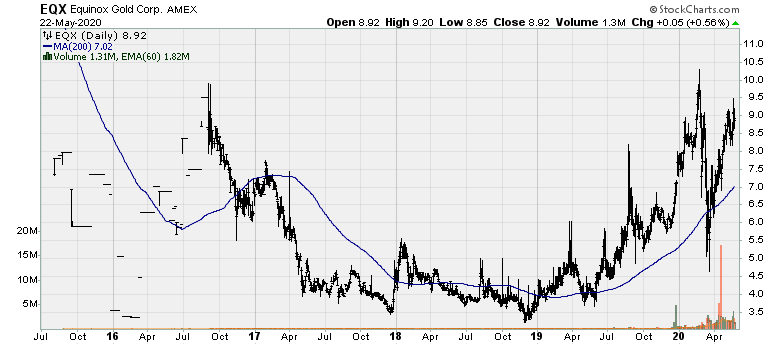

Equinox Gold: Reported a relatively strong Q1 2020 operating and financial results. It is worth noting that the quarter only included 20-days of the Leagold integration [which closed on March 10th 2021], so this is not at all representative of the true earnings and cash flow potential that will be illustrated most notably in Q3 [following the temporary shutdowns of Los Filos - its largest asset through April and May]. Q2 will be much better relative to Q1, on the back of higher output and higher gold prices partially negated [most likely] by higher costs.

The company has $350m of cash on hand and its growth initiatives are fully funded. Castle Mountain Phase I is currently 75% complete. The Los Filos expansion and the Santa Lux restarts project are expected to significantly output over the course of 2021 [Castle Mountain Phase I] and 2022 [Full year of Santa Luz], following by Castle Mountain Phase II [2023/2024] and the Aurizona underground expansion [2024].

Highlights for the quarter ended March 31st, 2020 is the production of 88.95k oz. Au [82.63k oz. Au sold] with mine site cash costs and AISC of $849/oz. and $968/oz. Operating cash flow totaled $23.3m, though this would have been 100-125% higher if it has a full quarter from the Leagold assets. Full year guidance has been adjusted downward a bit to 540-600k oz. Au with AISC of $1,000-$1,060/oz. By Q3, operating cash flow should be upward of $80-$90m [assuming a $1,700/oz. realized gold price].

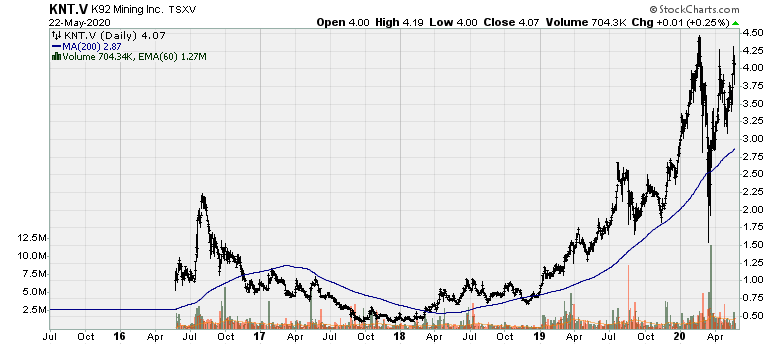

K92 Mining: Reported a significant Resource increase at its high-grade Kora Deposit at its Kainantu gold mine. The deposit continues to grow larger as expected. M&I resource increased 180% from 0.39m oz. in October 2018 to 1.1m oz. @ 10.45 AuEq g/t. Inferred Resources increased 50% from 2.39m oz. in October 2018 to 3.7m oz. @ 9.01 AuEq g/t. Kora North, Kora, and Eutompi deposits now combine to be on continuous deposit, open at depth and open along strike to the south. Kainantu vein has several opportunities to expand resources from a near-mine high-priority exploration areas including Kora strike extension, Kora deeps, and Judd South veins; Judd vein; Karempe vein, and; Arakompa and Maniape. K92 remains one of the most exciting junior producers because of both the production upside and the potential for vast resource expansion.

Kootenay Silver: Reported multiple high-grade intercepts at its Columba Project. This project holds the most promise of all the assets it owns and it has begun delivering [though very preliminary] on such potential. Kootenay has a couple of other marginal deposits [which become far more lucrative at silver prices of $30/oz.] The company has received assay results from the first six of ten holes completed as part of its 2020 drill program. The holes tested the F vein, which is showing continuity in both veining and grades. Highlights from the assay results thus-far include:

2.5m @ 350 g/t Ag 4.3m @ 239 g/t Ag 3m @ 974 g/t Ag 1.4m @ 911 g/t Ag 2.9m @ 689 g/t Ag 15.65m @ 166 g/t Ag Including 4.97m @ 400 g/t Ag

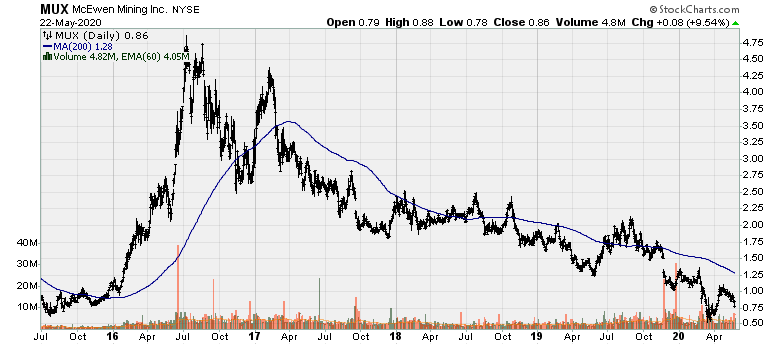

McEwen Mining: The company reported another horrid quarter and managed to lose money despite a significantly higher gold price. Production for the quarter was 29.2k oz. Au and 553k oz. Ag or 35.1k AuEq. The company took an $83.8m non-cash impairment charge as a result of geological interpretation, which resulted in a substantial reduction in expected gold production at its Gold Bar mine. Black Fox saw AISC of $1,339/oz., while San Jose saw AISC of $1,592/oz., The Gold Bar mine saw AISC of $2,177/oz., and El Gallo saw very low production due to residual leaching, with total costs of $1,025/oz. Q2 should be a little better, largely as a result of higher gold prices but a very sub-par quarter nonetheless. Generally speaking, companies report cash flow from operations in press releases but not in this case, and for good reason.

McEwen really needs to think of making some strategic move to improve the overall quality of its portfolio [which isn't hard - given its current portfolio]. It has time to do that, for example if you compare the company to say Equinox, which got started later but already has two cornerstone assets and three tier-2 assets. Now it does have a couple assets that will do much better with further mine development [Black Fox, Grey Fox, Froome] higher silver prices [Project Fenix/El Gallo II], and a full quarter of operations [San Jose]. The Gold Bar mine will likely see costs come down once optimization measures are implemented, but still a very sub-par asset.

McEwen can either continue down this path or either JV Los Azules or sell it outright and acquire an asset or company with one or multiple high-quality gold assets. It can also acquire a single asset company, something like Pure Gold, which is small but will be its most profitable asset. But because the company has an extremely high cost of equity, it will have to turn toward debt or stream/royalty financing. One acquisition that would make a lot of sense would be to acquire Kirkland Lake Gold's Holt Complex. Kirkland isn't looking to hold onto these assets and these would greatly increase the quality of McEwen's portfolio, at least relative to what will likely be the price tag.

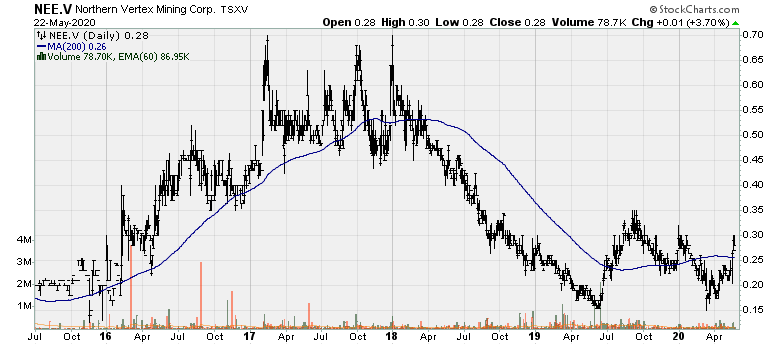

Northern Vertex: Reported $13.1m in revenue and record earnings form mine operations before depreciation and depletion of $5.2m. The company produced 7.38k oz. Au and 58k oz. Ag in Q1 2020. Cash decreased from December 31st 2019 from $3.33m from $2.47m. The company received permitting approval for the Moss Mine Phase III expansion, which allows management to expand the size of the mine which supports the resource updates and a mine life extension. Cash costs and AISC was $862/oz. and $991/oz. The company continues its slow ramp-up for what is a marginal asset, given its lack of scale. The company is a bit more than 50% from achieving its gold production wise, with an objective of producing 50k AuEq oz. p.a.

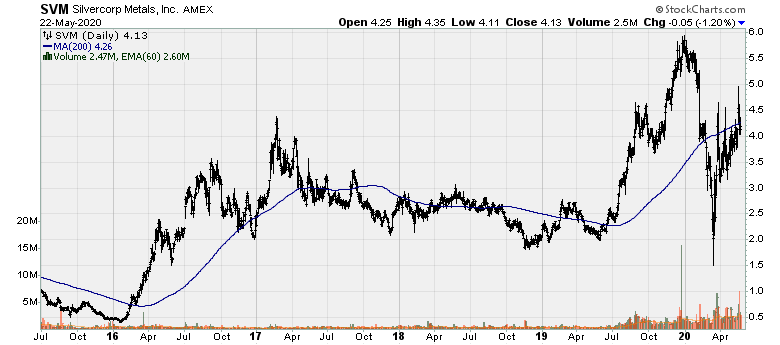

Silvercorp Metals and Guyana Goldfields Enter into Amending Agreements: The pseudo bidding war for Guyana Goldfields has finally come to an end, with the latter choosing to partner up with Silvercorp as opposed to Gran Colombia and Gold-X mining. This is likely due to Silvercorp's more flexible offer [a cash component] and the fact Silvercorp is extremely well financed with over $140-$160m in net cash and about $180-$200m from its interest in New Pacific Metals. Silvercorp did up its offer. Each Guyana Goldfield shareholders will receive C$0.25m in cash and 0.1849 Silvercorp shares, for total consideration of C$1.30/share. Silvercorp currently holdings 16.55m shares of Guyana Goldfields, representing 9.48% of the issued and outstanding common shares. After accounting for Silvercorp's existing shares, the cash consideration of C$0.25 implies a total cash component of C$39.5m, and the share consideration of C$1.05 implies a total share component of 29.2m shares. Based on such metrics, this would mean into existing Guyana Goldfields shareholders owning 14.40% of the new company.

The company also reported its fiscal year 2020 financial and operating results [ended March 31st 2020]. During its fiscal year, the company sold 6.3m oz. Au, 3.3k oz. Au, 65.3m lbs. Pb, and 25.4m lbs. Zn. The company posted $34.3m in net income, but more importantly, $77.2m in cash flow from operations. As a result of slightly lower base metal credits [due to lower prices], cash costs were negative (-$1.91/oz.) compared to negative (-$4.29/oz.) in the prior year. AISC, in turn, was also higher at $6.86/oz. vs. $3.52/oz. in the prior year. The company remains in excellent financial shape with upwards of $300-$325m in cash + equivalents + short-term investments +long-term investments [28.8% ownership in New Pacific Metals]. Once it builds out the Aurora underground mine, it will still continue to have a robust balance sheet. In the near-term, cash flow generation [absent of silver prices of at least $18/oz.] will decrease by a moderate decrease, entirely as a result of low base metal prices [Pb & Zn]. But base metal prices will bounce back, not to where they were, but higher than those at the end of March.

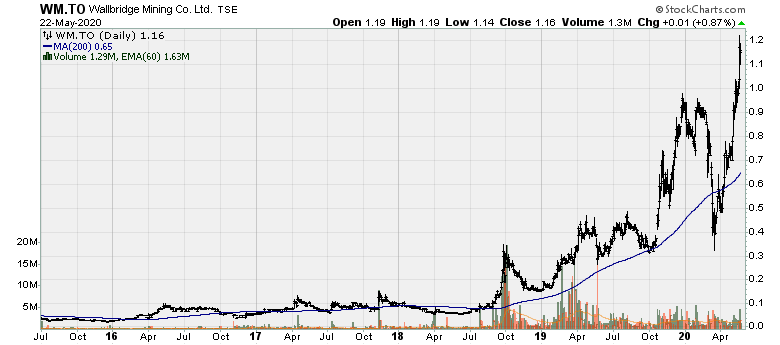

Wallbridge Mining (and combination with Balmoral): The company announced continued successful exploration drilling, highlighted include:

5.35m @ 70.84 g/t Au 7.05m @ 32.36 g/t Au 2.10m @ 51.37 g/t Au. 1.05m @ 35.30 g/t Au. 1.10m @ 29.3 g/t Au 3.25m @ 8.25 g/t AuThe Fenelon property is a very promising exploration stage property. The company is very well financed with $53.8m in cash and no debt as of end of Q1. The ownership is also very encouraging with management and directors holding a 1.80% interest [not all that significant given the size of the company], Kirkland Lake Gold holding a 7.90% interest, William Day Construction holding 7.80%, and Eric Sprott holding a 20.70% interest. The company is trading ahead of the available data at this point in time [though not by much, and not surprising given the gold price environment], although it is clear that there is significant exploration upside both at Balmoral and Martiniere. This is another exciting exploration story to keep track of.

Following this announcement, Wallbridge announced it has expanded the Tabasco-Cayenne Shear Zone gold mineralization at Fenelon. It reported the wide-spaced step out drilling continues to expand the mineralization in the Tabasco-Cayenne shear system along strike and down dip. These new intersections with excellent widths and grade include:

56m @ 4.84 g/t Au 19.15m @ 8.41 g/t Au 8.50m @ 9.76 g/t Au 6m @ 16.93 g/t AuThe shear zone remains open along strike and at depth. The wide-spaced step-out drilling to expand this mineralized system will continue to be the focus of the 2020 exploration drill program.

Other drill highlights from this zone include:

1m @ 99 g/t Au 3.65m @ 41.01 g/t Au 8.2m @ 6.9 g/t Au 25m @ 3.19 g/t Au 2m @ 36.55 g/t Au

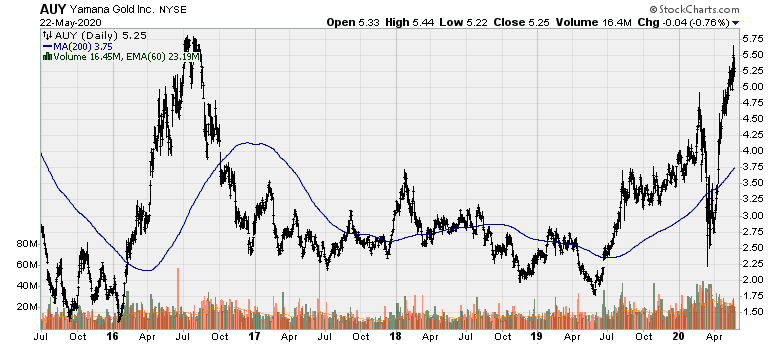

Yamana Gold: The company reported significant exploration results supporting mine life extensions at Jacobina and El Penon, including new secondary veins and extensions of primary vein systems at El Penon. Exploration at Jacobina in the second half of 2019 through the first quarter of 2020 expanded higher grade zones in Canavieiras Sul, both down dip and along strike to the north towards Canavieiras Central, providing significant expansion of the known mineralized zone in the highest-grade sector of the mine.

The exploration results, at minimum, support the extended and expanded mine plan highlighted in the Company's recent announcement on the Phase 2 expansion of Jacobina. Under the Phase II expansion, the after-tax NPV would be a staggering $1.23b using a $1,550/oz. gold price deck. Average annual gold production is to increase to 230k oz. Au, a 31% increase vs. Phase I @ 175k oz. Au p.a. Furthermore, the cost structure improves, with AISC of just $727/oz., a vert low-cost underground mine. Jacobina will become, if it wasn't already, a cornerstone asset for Yamana. Mine life under this scenario is forecast at 14.5 years, however, Jacobina has a long track record of increasing mine life and the latest exploration results underscore the likelihood that mine life will increase further.

Regarding El Penon, The exploration results at El Penon [discovery of a secondary vein along extensions and offshoots of primary veins underscore the potential of the vein system at El Penon] support the Company's view that mine life will exceed current mineral reserves and is at least consistent with the Strategic Life of Mine of at least 10 years. Furthermore, because El Pe??n has excess plant capacity, the discovery of extensions of primary vein structures provides flexibility to process more tonnage at higher grades, which would increase annual production.