Gold Seeker Report: This Week in Mining Issue #3

Chris Marchese

Chief Mining Analyst, GoldSeek & SilverSeek

Week Ended March-6, 2020

$AUN.v $BCM.V $CALDAS $EQX $FSM $GOLD.TO $GORO $HIGH.V $MAG $MMX $SAND $SMF.TO $SILV $WM.TO

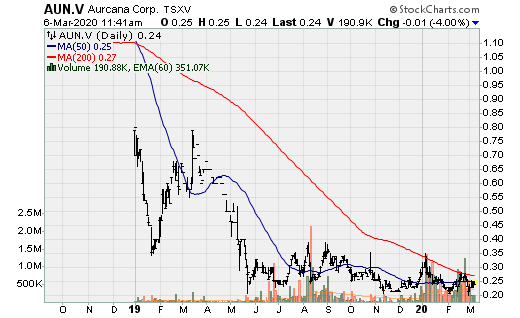

Aurcana: Increased the previously announced non-brokered private placement from $4m to $5.76m and completed the second tranche. This will go toward underground development (and in turn, reducing cap-ex) to bring its principle asset (Revenue-Virginius) into production and ideally, the remaining capital investment will be funded via debt or at least in large part. While it is difficult to generate positive operating cash flow in the current silver price environment, due to the higher grade nature of the deposit and in turn AISC/AgEq oz. is sub-$10.75/oz. (or $8/oz. Ag), due in part to a resource grade >1k g/t, this shouldn't be an issue. The asset currently has a relatively small resource base of 21.2m oz. (2P), 29.9m (M&I inclusive of 2P), and an additional 13.2m oz. (Inferred). This asset, while small, will also derive the vast majority of revenue from precious metals: silver (71%) and gold (9%).

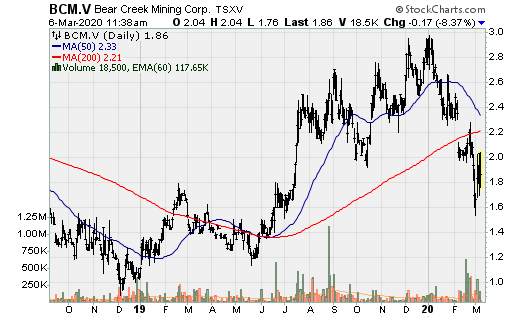

Bear Creek Mining: The company announced some very exciting news, that being it is nearing a production decision at its large Corani silver-lead-zinc project in Peru which, in all likelihood, will see a construction start before year end. The 2019 Corani feasibility study (FS) illustrated improved economics with the NPV up +31% and IRR up +52% with a 33% reduction in payback period, increased average annual output, and lower all-in sustaining costs (AISC) relative to the 2017 FS. LOM AISC has fallen 9% to $4.55/oz. and average annual silver production (LOM) has increased 20% from 8m oz. annually to 9.6m oz. annually (as a result of increased throughput - but with similar initial cap-ex).

Bear Creek Mining has engaged BNP Paribas and Societe Generale to arrange a US$400m senior secured credit facility. While this is far short of the $550m required (although the company will want to have closer to $600-650m in funding for working capital requirements, cash burn prior to production (as it will be a 3-year construction period), and flexibility to engage in additional exploration, especially if the silver price follows gold (which is very likely). In my opinion, it should look to raise the $180-$200m+ gap by selling a relatively small silver stream to the likes of Wheaton Precious Metals (i.e. 7.50%-12.50% silver stream) without hampering the economics as the on-going per ounce purchase price should be around, if not higher, than AISC. This, or a combination of stream and equity is highly preferable to avoid massive dilution as the cost of equity is very high currently just resort solely to raising the remaining required capital via equity.

Caldas: The company completed a reverse takeover (RTO) transaction with Caldas Finance Corp., which is essentially a spin-out of the Marmato asset by Gran Colombia which currently holds a 72% interest. In 2019, Gran Colombia released an impressive PEA to develop an underground mine at Marmato. Further, it recently announced that recent drilling was successful in extending the recently discovered New Zone (NZ) down-plunge in excess of 200m. The down-plunge extension was intersected at 544m elevation and has continuous high-grade mineralization down to an elevation of 460m. The zone remains open at depth. Assay results from this hole include 87.15m @ 3.9 g/t Au and 1.7 g/t Ag (including 16.43m @ 7.2 g/t Au and 2.5 g/t Ag) and 18.1m @ 6.3 g/t Au and 2.6 g/t Ag. While early stage, this bodes well for expanding mineralization outside of the Main Zone. The company is fast tracking development with a pre-feasibility (PFS) expected 1H 2021.

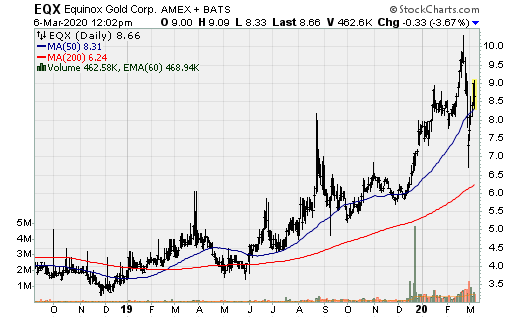

Equinox: 2019 kicked off a significant multi-year growth phase, which was evident especially in Q4. The company sold 80.33k oz. Au at a realized gold price of $1,481/oz. with AISC of $848/oz. This was as result of Aurizona ramping up production (first gold pour in Q2). In Q4, the company generated upwards of $39m in operating cash flow and ended the year with $83m in cash and equivalents ($15.3m of which is restricted). Q4 really transformed the company, due to a combination of things such as a new sizeable mining operation coming online and ramping up (Aurizona) and the announcement of the acquisition of Leagold. In other words, in Q2 2019, Equinox was a large junior producer and by year end, the company became a large mid-tier producer, uniquely positioned to become a senior gold producer by 2022-2023. It has an excellent asset base highlighted by Los Filos, Aurizona, and Castle Mountain. FY 2019, Equinox sold 196.8k oz. Au at an average realized gold price of $1,431/oz. at AISC of $931/oz. and generating nearly $60m in operating cash flow.

In addition to supplementing current production with the four producing gold mines from Leagold, Castle Mountain Phase I will add additional production beginning in Q3-Q4. Looking at Equinox over the next couple of years, current production will be augmented by completion of the Los Filos expansion (+330k oz. Au from +200k oz.), Castle Mountain Phase II (+200k oz. Au), advance a potential underground mine at Aurizona, and an additional +100k oz. p.a. production from Santa Luz (which is a quality moderately sized asset with low capital costs and a short-build out time).

I don't believe Equinox is done growing via M&A, and this would likely focus on adding a cornerstone asset or large development project. Further, I hope to see the company divest either the Pilar mine and/or the Fazenda mine which should be the natural progression as Equinox upgrades its overall portfolio (there are a couple high-cost, low output mines in the Leagold deal and companies are generally managed more efficiently by focusing on its core assets). This is because Ross Beaty has publicly said, that he'd be willing to invest up to an additional $500m and because this is likely his last hurrah in the mining industry. He has his eyes set on building a premium senior producer and he and the company has executed upon this goal in very short order.

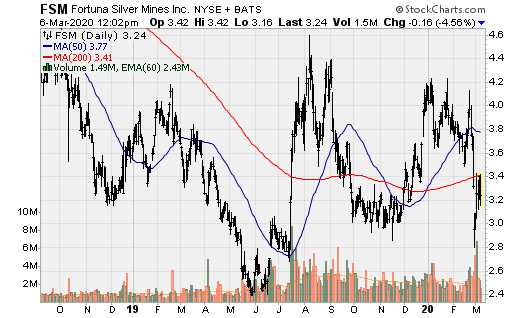

Fortuna Silver: The company was granted a permanent stay of execution in the on-going royalty dispute with Direccion General de Minas (DGM) until a resolution by the court is reached on the legality of the cancellation procedure. From what we know, the supposed DGM royalty shouldn't exist as it failed to comply with the change in mining laws (and royalty process) in the 80's.

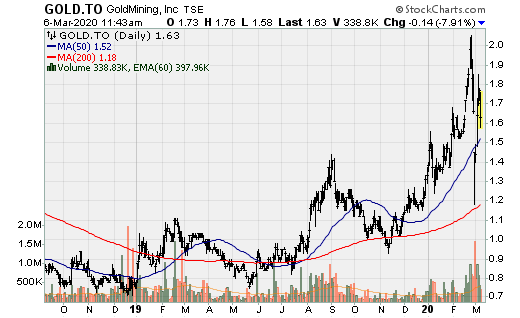

Gold Mining: Completed the acquisition of the Almaden Project from Sailfish Royalty Corp for a total purchase price of $1.15m. Gold Mining continues to be one of the best "optionality vehicles" in the space as it made several high-quality acquisitions at depressed precious metals prices, adding value through resource expansion.

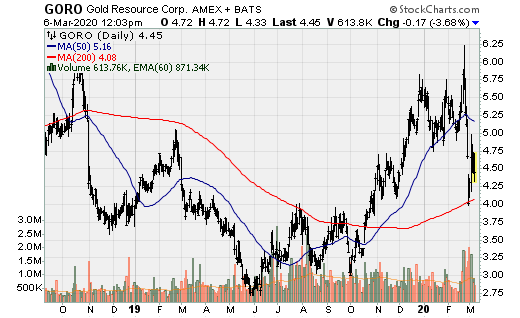

Gold Resource Corp: 2019 Production totaled 40.3k oz. Au and 1.73m oz. Ag, generating $5.8 in net income and $26.8m in cash flow from operations. Due to higher gold production at higher prices, the company doubles its annualized dividend from $0.02/share to $0.04/share. 2020 production guidance is for a 20% increase in gold production (+50k oz.) and a slight reduction in silver output (+1.7m oz.).

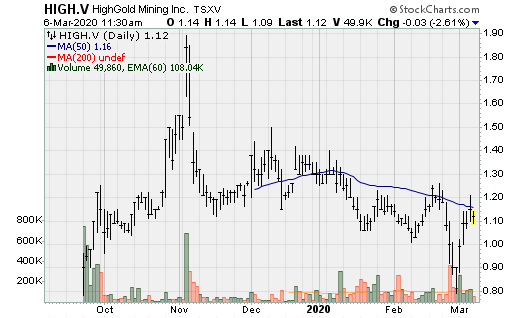

HighGold Mining: Reported it has started the 2020 winter drill program on its three high-grade properties in Timmins. It will consist of 5,000m of diamond drilling utilizing two drill rigs on the Munro-Croesus, Golden Perimeter, and Golden Mile properties. It will target known high-grade gold mineralization, areas of surface geochemical and geophysical anomalies, and potential intrusive related gold prospects. While this is early stage and a small initial drill campaign, I expect drilling to confirm high-grade mineralization, particularly at Munro-Croesus. Past diamond drilling by the previous owners intersected 4.1m @ 18.8 g/t Au.

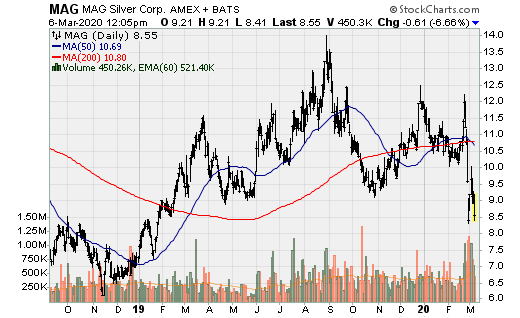

MAG Silver: Announced Valdecanas 2019 infill drilling results and discovery of two new veins. Two notable drill holes (and discovery hole) were 5.7m @ 3,884 g/t Ag, 8.4 g/t Au, 8.40% PB, 9.70% Zn, 0.30% Cu and 1.2m @ 279 g/t Ag and 0.70 g/t Au. Other highlights include 0.70m @ 1,216 g/t Ag and 3.6 g/t Au, and 2.5m @ 918 g/t Ag and 1.80 g/t Au. With only about 5% of the property explored, there should continue to be exciting exploration developments over the next decade.

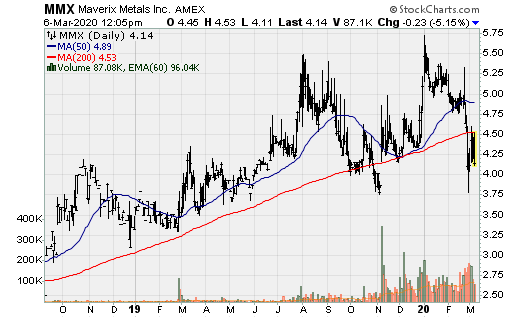

Maverix Metals: Announced record financial and operating results for 2019. The company reported record attributable production of 26.67k AuEq oz. Cash Flow from operations were $27.7m ($31.3m excluding changed in non-cash working capital). Maverix trades with similar multiples relative to Wheaton Precious Metals, Osisko Gold Royalties, Royal Gold (at time), and Sandstorm Gold Royalties which makes little sense given the relative quality and life of its assets (and being of much smaller scale when accounting for growth), but this goes to show the superior NAV and cash flow multiples royalty and streaming companies trade with relative to mining operators.

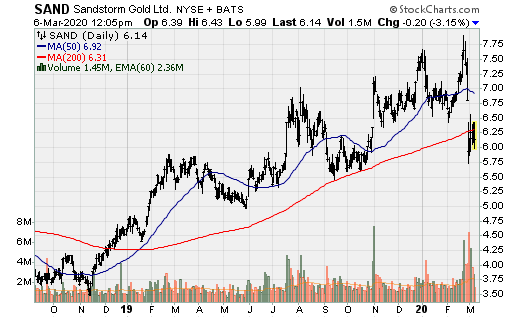

Sandstorm Gold Royalties: Announced early warrant exercise incentive program to raise up to $50m. 15m warrants expiring October 27, 2020 with a strike of $3.50 will be exercisable instead at $3.35/unit if done between April 16, 2020 and April 27, 2020. This does two things: it removes a potential overhang of a large block of in-the-money warrants and gives the company significant capital to complete additional royalty and streaming deals. Combined with its cash on hand, investment portfolio, on-going free cash flow generation, option and warrant money inflow, and roughly $280m available via its credit facility, leaves the company ideally positioned to execute potentially transformative deals. Assuming the November warrants are also exercised (they will be given the $4/share strike), the company will have a pro-forma liquidity position upwards of $475m by year end.

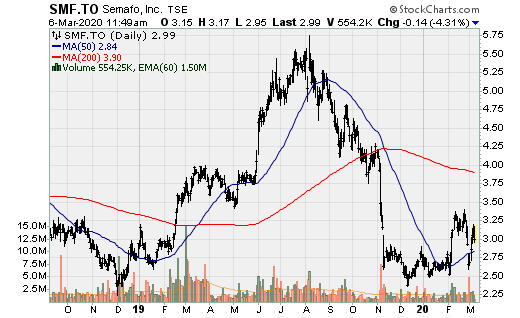

Semafo: Reported strong Q4 and full FY 2019 operating results, for this African focused gold company. For the FY 2019, production increased significantly over 2018, totaling 341k oz. Au (+39%) at AISC of $724/oz. (-24% vs. 2018). Operating cash flow before changes in non-cash working capital increased to $247m or $0.75/share. Semafo saw first production from Siou underground and closed the acquisition and successful integration of Savary Gold's Karankasso properties to the Bantou Project. Bantou Inferred mineral resources increased to 2.2m oz. Au. Further, in 2019, the company announced the results of a preliminary economic assessment (PEA) for the Nabanga with after-tax NPV of $100m using a $1,300/oz. gold price deck.

In 2020, the Boungou plant will be restarted will initial 3-mont production of 42-46k oz. expected from processing of stockpiles at AISC of $530-$560/oz. Phase II of the Boungou plan includes a Q4 mining restart for production of between 88-104k oz. at AISC between $745-$795/oz. Mana (Semafo's flagship asset) is expected to produce 185-205k oz. Au from Siou underground and the Siou and Wona open pits. Semafo's 2020 guidance will be in the neighborhood of that seen in in 2019 albeit with AISC +$120-$165/oz. higher. Over the medium and longer-term, Semafo is setting itself up for mine life extensions at Boungou and Mana and advancing growth initiatives in the Bantou and Nabanaga development. The company is also on the lookout for accretive acquisitions. While not likely, but possible, Semafo may also be a possible takeover target by the likes of Endeavour Mining or another Africa focused gold producer.

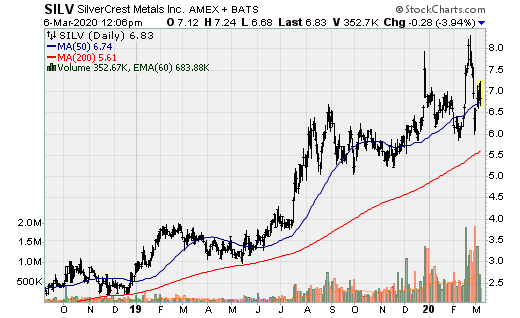

SilverCrest Mining: Good news continues to roll in for the company as it nears completion of its feasibility study (inclusive of trade-off studies to determine ideal throughout) as it announced improved recovery rates (which were already high). After nine months of extensive metallurgical work, the results show an increase of recoveries to 96.1% Au and 93.90% Ag (or 95% AgEq). This shows a 3.40% increase over previous metallurgical test results presented in the PEA. SilverCrest, along with MAG Silver continue to be the most exciting silver development projects in the world.

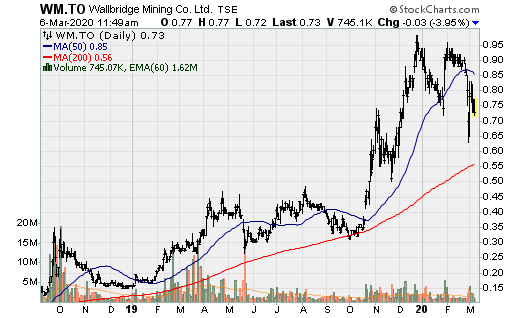

Wallbridge: With a flurry of news flow this week, it started with the announcement it would be acquiring Balmoral Resources in an all-stock transaction. This was a smart strategic deal as it will expand its sizeable land position along the Detour Gold Trend. The implied equity value of the transaction is equal to C$110m (or US$82m), representing a 46% premium to the volume weighted average price of the trailing 20 trading days. The company also announced that it continues to extend intervals of gold mineralization characterized by wide intersections of 1-2 g/t Au with narrower zones of high-grade material within Area 51 vein in the immediate hanging wall to the Tabasco/Cayenne sheer on its Fenelon property. Wallbridge also announced further high-grade intersections in the Lower Tabasco and Cayenne zones, expanding the high-grade portion of the Tabasco Zone to 500m strike and 500m down dip extend with intervals such as 32.5m @ 4.31 g/t, 19.5m @ 5.71 g/t Au, and 43.7m @ 3.37 g/t Au. Drilling in 2020 has significantly expanded the known extents of the Tabasco and Cayenne Zones along strike and depth. The Cayenne Zone is showing strong gold mineralization at depth such as 15.6m @ 4.61 g/t and 11m @ 17.58 g/t Au.

Chris Marchese for the Gold Seeker Report

Chief Mining Analyst at GoldSeek & SilverSeek

Chief Mining Analyst with GoldSeek and SilverSeek. Previously he was the Senior Mining Equity and Economic Analysis at The Morgan Report. He was a Co-Founder and Director of Lemuria Royalties, before it was acquired in March 2018. He also co-authored The Silver Manifesto with David Morgan in 2015.

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto. Fortuna Silver Mines is not a sponsor of this, or any other related, websites. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.