Gold Should Heed Mining Socks Warning / Commodities / Gold and Silver Stocks 2023

While geopolitical conflict has keptgold afloat, mining stocks’ weakness signals trouble ahead.

EconomicRecession Looms

While risk assets attempt to breakfree of their bearish corrections, gold’s relative outperformance hasthe yellow metal shining bright. Despite that, we’ve booked 11-straightprofitable trades, and our 12th (currently open) remains in the green. As aresult, our success highlights why mining stocks are often better tradinginstruments than the yellow metal.

Furthermore, while gold has largelysidestepped the recent risk rout, arecession is bearish for nearly all assets, and gold should suffer mightily if(when) the economic pain unfolds.

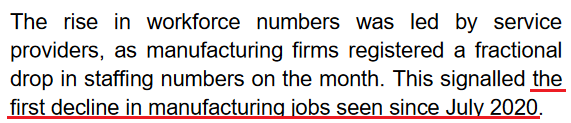

For example, S&P Global released itsU.S. Composite PMI on Oct. 25. And while the headline results were decent andit outperformed expectations, weakness was present beneath the surface. Anexcerpt read:

“Although some service providershighlighted a pick-up in customer numbers, many continued to note that highinterest rates and challenging economic conditions weighed on client demand.Some mentioned smaller and less frequent orders being placed by customers. Assuch, service sector new business fell for a third month running.”

In addition:

“The rate of charge inflation eased tothe weakest since June 2020 and was slower than the long-run series average.Firms were reportedly keen to pass through any cost savings made to customersin a bid to drive sales.”

Thus, while 2021 and 2022 (to a lesserextent) were filled with demand-driven inflation, those days are long gone.With firms increasing discounts to move inventory, consumer demand hassuffered, and the weakness should continue in the months ahead.

More importantly, the “rate of employmentgrowth was only marginal overall,” as firms remain concerned about costs andfuture demand conditions. Therefore, the economic backdrop is heading in thewrong direction, and silver could be a major casualty ifthe trend continues.

Please see below:

Car Trouble

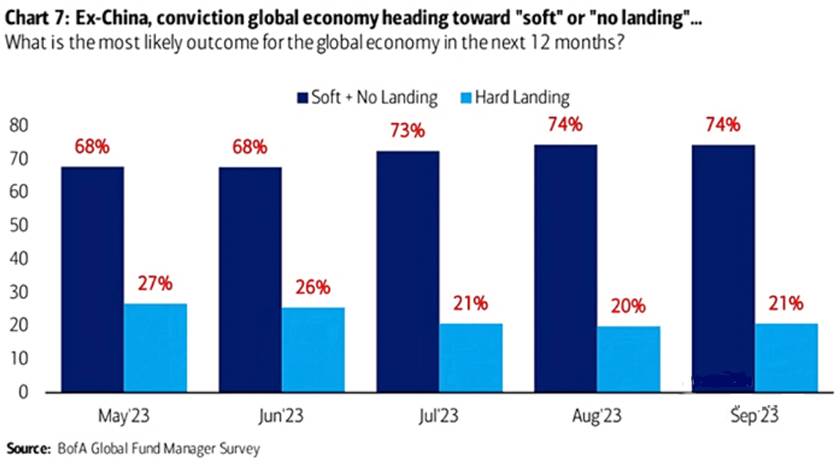

With the crowd ignoring the ominousimplications of rising long-term interest rates, the consensus assumes arecession is highly unlikely. For context, we wrote on Sep. 29:

Toexplain, Bank of America’s latest Global Fund Manager Survey shows that only21% of respondents expect a “hard landing” (the light blue bar) for developedmarkets over the next 12 months. Conversely, the majority expect a “soft” or“no landing” scenario to occur, which is a fairytale, in our opinion.

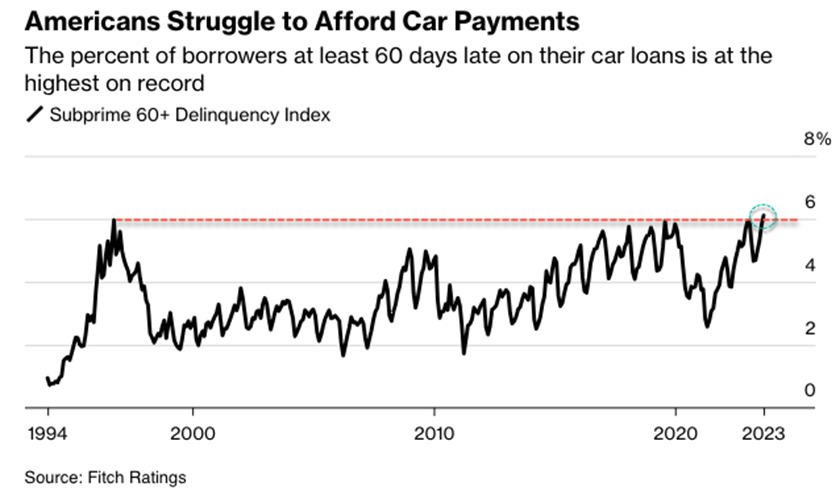

To that point, with auto-loan delinquencies hitting an all-time high, the problems should only intensify thelonger rates remain elevated, and this is bad news for oil andthe PMs. Bloomberg noted:

“The percent of subprime autoborrowers at least 60 days past due on their loans rose to 6.11% in September,the highest in data going back to 1994, according to Fitch Ratings.”

Please see below:

To explain, the black line above tracksthe delinquency rate for subprime auto loans. If you analyze the right side ofthe chart, you can see that higher long-term interest rates are impacting thereal economy.

Remember, the average auto loan length is72 months, which means that financing rates are highly sensitive to themovements of the U.S. 5-year and 7-year Treasury yields. And with both risingsubstantially over the last few months, the scars should continue to show.

As another ominous sign, we warned theresumption of student loan repayments would further suppress consumers’wallets. And with this occurring alongside higher borrowing costs and lowerwage inflation, Americans have less disposable income.

So, with U.S. toymakers sounding thealarm on Oct. 26, shares of Hasbro and Mattel sunk as consumers shunned holidayspending.

Please see below:

Moreover, we warned that darker days wereon the horizon, and heightened volatility is bullish for the USDIndex. We added on Sep. 29:

Withless money to allocate to discretionary items, the current backdrop is muchdifferent than 2021/2022, in our opinion.

Pleasesee below:

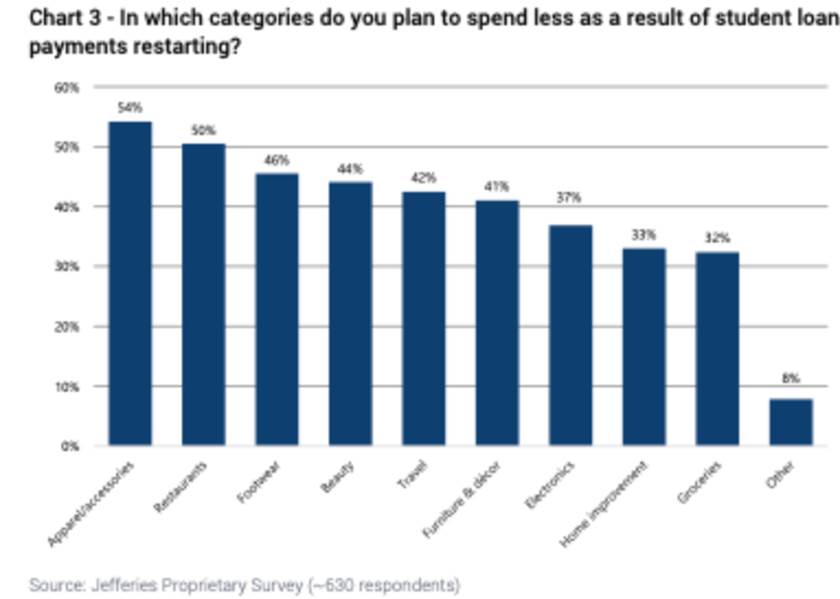

Toexplain, Jefferies surveyed student loan borrowers and found that roughly 40%to 50% plan to cut their spending on things like electronics, travel andapparel. As such, a confluence offactors has collided, making the economic outlook extremely unfriendly, and a Minsky Moment shouldhelp push the USD Index to new highs.

Overall, the S&P 500 has suffered,and the rout has not helped the GDXJ ETF. And with both assets decliningalongside lower interest rates on Oct. 26, the results highlight how economicuncertainty often leads to liquidations across several risk assets. Incontrast, Treasury bonds and the USD Index are the primary safe havens.Consequently, more of the same should occur before the miners’ bear marketends.

For a deeper understanding of ourinvestment thesis, subscribeto our premium Gold Trading Alert. We closed out our 11th-straight profitable trade recently, and our 12th made money again on Oct. 26.Furthermore, the technicals are essential for managing risk, as thefundamentals are not the best timing tools. As a result, becoming a premiummember equips you with everything you need to succeed.

By Alex Demolitor

Alex Demolitor hails from Canada, and is across-asset strategist who has extensive macroeconomic experience. He hascompleted the Chartered Financial Analyst (CFA) program and specializes inpredicting the fundamental events that will impact assets in the stock,commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Alex Demolitorand SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Alex Demolitorand his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingAlex Demolitorreports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Alex DemolitorSunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.