Gold, Silver, and Miners Just Can't Jump / Commodities / Gold and Silver Stocks 2021

Let’s face it, the metals are nothaving an easy time breaking out. Short-term rallies end up going nowhere andbearish signs are still in abundance.

Yesterday’s session was once again quiteinformative, and so is today’s pre-market trading. In yesterday’s analysis, Iemphasized the importance of the relative weakness that we just saw in miningstocks, so let’s start with taking a look at what mining stocks did yesterday.

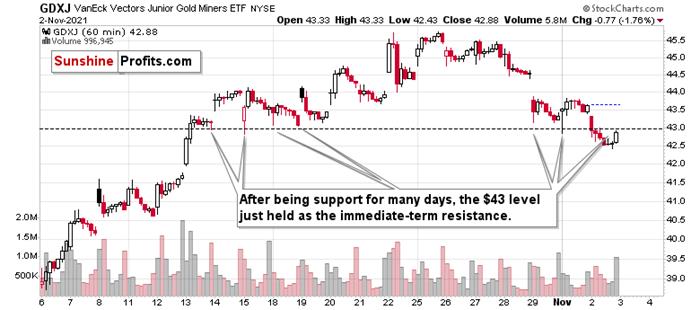

At first glance, yesterday’s performancemight look like a bullish reversal, but zooming in clarifies that somethingelse was actually in the works. Let’s take a look at the GDXJ 1-hourcandlestick chart for details.

Yesterday’s “reversal” was actually abreakdown below the previous (mid-October) intraday lows along with theverification thereof. The GDXJ moved below the above-mentioned lows and – whileit moved back up – it ended the session below them.

This is a bearish type of session.

Also, if you were wondering about thehigh volume in the final hour of trading – that’s relatively normal as that’s when bigger trades tend to take place.

And while mining stocks were busyverifying the breakdown, gold tried to break above its declining, redresistance line, and verify that breakout.

While yesterday’s session didn’t bringmuch lower goldprices (and the invalidation), today’s pre-market trading makes itclear that the attempt to break higher failed. Justlike I had indicated yesterday.

This time the rising short-term supportline is not there to prevent further declines as the breakdown below it wasalso confirmed.

What does it mean? It means that gold islikely to fall, and quite likely it’s going to fall hard.

Besides, silverprice is after a major short-term breakdown, too.

After a powerful short-term rally, silverhad reversed, and now it broke below its rising support line. That’s yetanother bearish indication. Please note that at first silver was reluctant todecline while mining stocks moved decisively lower, which was normal during theearly part of a given decline. Silver did some catching-up action yesterday,but since miners are not showing strength, I’d say that we’re getting to theregular part of a short-term move, not close to its end.

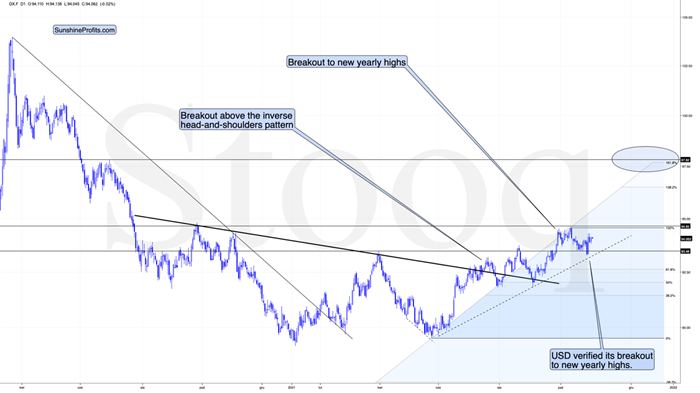

And the move lower is likely to continue,just as the move higher is likely to continue in case of the USD Index.

The USDX is after a verification of thebreakout to new 2021 highs and after an about monthly consolidation above them.This is a perfect starting point for a major upswing, and we’re likely to seeone soon.

All in all, while the outlook for theprecious metals sector is very bullish for the following years, it’s verybearish for the following weeks.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.