Gold & Silver Awaken from Eight-Year Slumber / Commodities / Gold & Silver 2019

Two years ago at a conference during which I both presented andattended, a Keynote speaker, "Rich Dad" Robert Kiyosaki, introducedme to a different way of looking at things. He posed the question, "Howmany sides does a coin have?"

Two years ago at a conference during which I both presented andattended, a Keynote speaker, "Rich Dad" Robert Kiyosaki, introducedme to a different way of looking at things. He posed the question, "Howmany sides does a coin have?"

The correct answer is "three." The front (obverse),back (reverse) and… the edge!

When you think about it, this makes sense. From this angle –uncommon to most observers – a person can begin to look more deeply at a givensubject. From the edge, you are able by definition, to see "bothsides" of the story.

Using Rich Dad's perspective as a research tool helps define andvalidate the premise of this essay… that the price action right now ofgold – and soon silver – are giving us important clues about the direction,strength, and durability of the next price trend.

It's easy and understandable for Norteamericanos tobecome fixated on the price of gold and silver, expressed in their domesticcurrency, the U.S. dollar.

But once in a while, it's important to take a step back andgauge how much people in OTHER countries are paying in their currency when theyexchange fiat for some of the honest money that gold and silver havehistorically represented.

When gold is in an uptrend against other currencies itlets you know that something is going on under the hood that most people aremissing.

When precious metals' buying in these countries continues toincrease in spite of the fact that it has become even more expensive to do so,Mr. Market is letting you in on just one more reason why you should payattention... and either start "stacking" or add to your currentinsurance/investment position.

The Trend is Your Friend

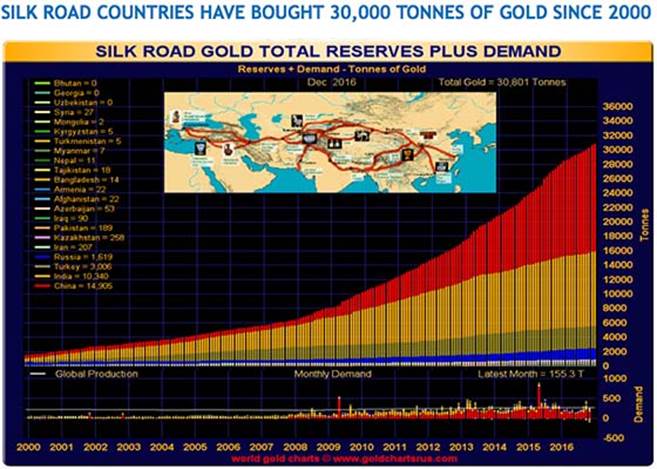

Increased gold purchases by "Silk Road" countries –for going on two decades – have continued unabated in spite of periodiccurrency devaluations and loss of purchasing power to the U.S. dollar. Not tomention that China, which used to export millions of ounces of silver annually,has for some years, not only been keeping all of its internal production,but importing more!

The Shanghai Gold Exchange (SGE) chart demonstrates that thistrend shows no signs of letting up.

Going forward, plan on gold being more challenging to find, anddue to increased regulation along with overall country risk, more complicated,costly and time-consuming to produce. And, not to mention, more expensive tobuy as mushrooming demand across the globe kicks in and continues with avengeance.

Goldcorp was recently bought out by Newmont Mining, creating theworld's largest producer. This is the second recent gold company mega-merger –with others almost certainly to follow – indicating the need these operatorshave for nailing down future ore bodies, as every ounce they produce depletestheir reserves.

Ian Telfer, Goldcorp's Chairman, has said, “If I couldgive one sentence about the gold mining business… it’s that in my life, goldproduced from mines has gone up pretty steadily for 40 years. Well, either thisyear it starts to go down, or next year it starts to go down, or it’s alreadygoing down… We’re right at peak gold here.”

PhysicalSilver Deliveries in Shanghai Are Skyrocketing

After a brief time lag, when gold experiences asustained and robust rise price rise, so does silver.

The directional correlation between gold and silver is close to90%. When you observe the statistical rarity of a gold/silver ratio above 80:1– which happens to be where we are right now – a "reversion to themean" is in the offing.

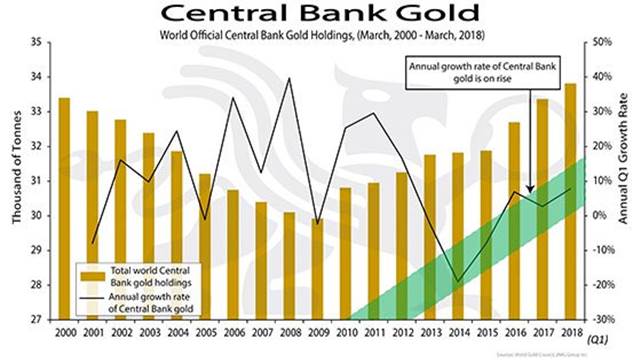

Central Bank Gold Holdings Reveal What “The Man” Is Doing

Even as the new gold secular bull run got underway in 2000,central banks continued to sell gold for nine more years.

However, in 2010 that trend reversed and has continued upwardthrough the present day. From 2015 through the end of 2018, central bank buyinghas noticeably accelerated.

One writer has referred to central banks as "one trickponies with printing presses."

But even as they push out more paper promises, these tricksterscontinue to covet the Midas metal. Former Federal Reserve Chairman, BenBernanke, pressed to answer why they still held gold, replied curtly,"because of tradition."

We'd say there's more to it than his brief reply – a lot more.

CentralBanks Are Stockpiling Gold Once Again (Courtesy World Gold Council)

Way back in 2002, David Morgan made the followingcomment:

“Forthe record, I will state, there will be another, more frenzied, scramble thatwill carry silver prices to highs that will repair all the excess paper moneycreation, price suppression, supply deficit, and bearish sentiment over thepast two decades. This will become known as the Great Silver Crisis.”

Gold, silver and the mining stocks arefinally awakening from an eight-year slumber.

While no one can predict just howfar and how fast prices will rise, the odds of missing out for those whocontinue to look the other way or who hesitate to act, will parallel themetals' upside trajectory.

Then at some point, as surely as thesun rises each morning, many of these same people will decide to step up to theplate and start buying at much higher prices. They will be driven - not bycalm, calculated decision-making, but rather by FOMO - the fear of missing out.

Do yourself a favor. Behave like"Rich Dad." Get up on "the edge of the coin" and take alook at both sides.

Then start "vaulting" goldand silver on a regular basis, while availability is good, and the price is still reasonable.

David Smith isSenior Analyst for TheMorganReport.com and a regular contributor to MoneyMetals.com aswell as the LODE Cryptographic Silver Monetary System Project. He hasinvestigated precious metals’ mines and exploration sites in Argentina, Chile,Peru, Mexico, Bolivia, China, Canada and the U.S. He shares resource sectorobservations withr eaders, the media and North American investment conferenceattendees.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.