Gold & Silver Gaining on US Dollar Weakness / Commodities / Gold & Silver 2020

The US economy is nowherenear recovering from the lockdown measures imposed by cities and states duringthe covid-19 pandemic, and that is weighing on the US dollar, which has fallensharply since March.

The beneficiary, asexpected, has been gold (and silver), which normally moves in the oppositedirection as the greenback. Year to date, spot gold has risen 16% to $1,811/oz,while the US Dollar Index (DXY), a measure of its value against a basket ofcurrencies, has slumped 6% to 96.60.

It’s hardly surprising tosee such a dramatic reversal of fortune for DXY, which on March 20 hit a17-year high of 102.82, amid a global shortage of dollars. As the viraloutbreak prompted economic lockdowns in February and early March, investors,companies and households hoarded cash.

The buck’s retreat isdirectly correlated to America’s failure to control the virus, whose case loadsare growing daily while in other countries, including Canada, they are falling.

States that reopened tooearly are seeing a resurgence of infections that are threatening to overwhelmhospitals and front-line health-care workers.

However, there must beother factors at play in the dollar’s demise. In this article we tackle the question,why is the dollar dropping and what are the consequences for gold andsilver?

The second wave

I’ve said all along thatthere would be a resurgence of covid in the United States. Reopenings there area jumble, with each state doing its own thing and the federal governmentoffering only guidelines not rules. A failure to adequately test and contacttrace have made it worse. How do you stop the virus from spreading if you don’tknow where it is?

In fact I believe therewill be three waves of coronavirus: The first wave that happened in mid-March,a second wave of cases returning due to states and cities reopening too soon,and a third wave in the fall, after warm weather gives way to coldertemperatures and the virus is allowed to infiltrate human hosts – a lethal mixof covid and flu.

The House Energy andCommerce Committee confirmed there is likely to be a surge of cases in fall andwinter, coinciding with flu season.

Despite all 50 statesbeing in various stages of reopening, the United States is still being ravagedby covid-19. Cases are climbing in 40 states, several of which have re-imposedrestrictions such as closing beaches, bars and restaurants. The US continues tolead the world with a case tally of 3.0 million.

Donald Trump, thescience-denying, conspiracy-believing US President, has the blood of nearly133,000 American dead on his hands, for failing to anticipate and properlymanage the pandemic.

He and his vice presidentregularly avoid wearing masks even when in hospital settings and others arewearing them. Many Americans are following their “lead”, citing infringement ofcivil liberties as a reason for failing to “mask up” in public places. InAmerica, medical masks have turned into a blue versus red political/ culturalissue.

A recent report fromGoldman Sachs states that a national face-mask mandate could save the USeconomy from a 5% hit to GDP, and could partially substitute for renewed lockdowns.It cites data indicating that countries that didn’t impose masking protocolssaw increases in both infections and number of deaths.

During the July 4th longweekend, Trump sought big crowds at his events including a fireworks display atMount Rushmore Friday night, despite the Centers for Disease Control warningthat such gatherings present a high risk of the virus spreading.

Rather than expressing sorrowat the number of people who have died, Trump in his Fourth of July speech vowedto “safeguard our values” from enemies within, referring to the recent protestsover police brutality and racial inequality following the death of a black manby a white police officer in Minneapolis. He did not mention the coronavirusdeaths.

"We are now in theprocess of defeating the radical left, the anarchists, the agitators, thelooters, and the people who, in many instances, have absolutely no clue whatthey are doing," Trump said on the SouthLawn of the White House, Saturday. “We will never allow an angry mob to tear down ourstatues, erase our history, indoctrinate our children.”

Economic pain

The connection betweenthe pandemic that continues to rage, and a declining dollar, are the measuresbeing taken to contain the economic fallout from covid-19, ie., low interestrates and record-high fiscal stimulus spending, which is racking up debt.

On June 9 DXY fell to athree-month low, after the US Federal Reserve announced there would be nopolicy changes, meaning a continuation of rock-bottom interest rates (thebenchmark federal funds rate sits at a range of 0.25% to 0%) and assetpurchases aimed at stabilizing the American economy.

In their regular meeting,the Federal Open Market Committee said in a statement they project a 6.5%decline in gross domestic product in 2020 and a 9.3% unemployment rate atyear’s end. The committee also promised to maintain bond purchases at thecurrent pace of $80 billion per month in Treasuries and $40B per month inmortgage-backed securities.

The Fed’s dovish responseto the pandemic has had a predictable effect on the country’s currency unit.Back in April, economists were forecasting the buck would test new lows by the endof the year, due to the Fed cutting US interest rates deeper than othercountries.

Before the pandemic, UShad the highest sovereign-debt yields among developed countries, whichsupported the dollar, as foreign investors sold currencies with negative ratessuch as the euro, to buy dollars in order to profit from higher yields.

However, that advantagewas eliminated when the Fed imposed two emergency rate cuts, as well asannouncing interventions in the markets for US Treasuries, mortgage-backed securities,commercial paper and corporate debt. (a central bank’s policy of buying up debtto introduce liquidity into the financial system is called quantitative easing,also known as printing money)

In a matter of months,the Fed’s balance sheet has grown from around $4 trillion to $6 trillion.

The US government andpolicymakers around the world have no choice but to unleash massive stimulusprograms to help their citizenries to deal with the worst economic downturnsince World War II.

According to Bank ofAmerica, via Zero Hedge, the amount of globalfiscal and monetary stimulus has already reached an astronomical US$18.4trillion in 2020, consisting of $10.4 trillion in government spending and $7.9trillion in central bank asset purchases, “for a grand total of 20.8% of globalGDP, injected mostly in just the past 3 months!”

The IMF predicts thepercentage of global public debt to rise from 69% of national income last yearto 85% in 2020.

That poses a problem forcountries that borrowed in dollars, but now face a tough time repaying thosedebts. American policymakers can only let the dollar strengthen so muchfurther, to avoid massive debt defaults.

At home, racking up somuch of its own debt means the United States has to keep interest rates low, toprevent onerous borrowing costs.

The country’s publicsector deficit is set to nearly triple, while public debt will rise to 107% ofGDP, according to the IMF.

“The U.S. is being themost aggressive with easing and government spending and as a result we expectto see the biggest deterioration in public finances there,” The Financial Postquotes Mathieu Savary, a strategist at BCA Research.

As an example ofexplosive monetary stimulus via money printing, consider: at the end of 2019,the Fed’s balance sheet as a percentage of GDP was 19%; six months into 2020,it has already doubled, to 39%.

Question is, is all ofthis stimulus working? The economic data coming out of the United States isn’tpromising, although to be fair, the June figures are better than previousmonths. The economy regained 4.8 million jobs last month, but 45 millionAmerican workers have filed claims for jobless benefits. The surge incoronavirus infections threatens to throw the recovery off course.

Without paychecks, a lotof people are having trouble paying their bills. According to the WallStreet Journal, payments have been skipped on more than 100 million loanssince the pandemic washed up on American shores.

Fully 30% of Americans didn’tmake their housing payments for June. During and shortly afterthe 2008-09 financial crisis, more than a million mortgages were foreclosed inthe US.

On Monday Goldman Sachsdowngraded its US growth outlook for 2020, forecasting that a reimposition ofcovid-19 restrictions will (no doubt) weigh on consumer spending, which ataround two-thirds of GDP is the engine of the US economy. In a note to clients,Jan Hatzius, the bank’s chief economist, says the economy will contract by4.6%, versus a previous forecast of 4.2%. In 2021 a 5.8% rebound isexpected.

Marketwatch reported him saying “Over thelast few weeks, the COVID situation in the U.S. has worsened significantly tothe point where the U.S. is now a notable outlier among advanced economies.”States representing over half the US population now meet just one or zero ofthe CDC’s recommended criteria for reopening, he added.

As we remarked in a previous article, paralyzed by fear anduncertainty about their futures, wage earners are delaying or cancelingpurchases; combined with literally hundreds of thousands of businesses closingshop during covid-19 lockdowns, the crisis has Americans hoarding more moneythan we’ve seen in decades.

During the depths of thevirus, in April, consumer spending declined by a record 13.6%. A disturbingtrend, as far as the economic recovery, is the reluctance of higher-incomeindividuals to return to normal spending levels.

It is unclear whethermore stimulus is coming. Some of the ideas beingdiscussed are an extra check for $1,200, a $2,000 monthly payment untilthe pandemic ends, or tax breaks for businesses instead of directpayments.

What we do know is thatthese measures alone will be insufficient to kickstart the US economy. At bestthey will “keep the wolf from the door”, meaning high savings and low spendingwill be the norm until covid-19 relents and businesses start re-hiring.

Exorbitantprivilege?

In the 1960s Frenchpolitician Valéry d’Estaing complained that the United States and its exportersenjoyed an “exorbitant privilege” due to the dollar’sstatus as the world’s reserve currency. He had a point.

Because the dollar is theworld's currency, the US can borrow more cheaply than it could otherwise (lowerinterest rates), US banks and companies can conveniently do cross-borderbusiness using their own currency, and when there is geopolitical tension,central banks and investors buy US Treasuries, keeping the dollar high.

The dollar is still thereserve currency, but how important is it right now, with all that is going onin the world? Maybe the question should be “how long can the world affordthe US$?

Renowned Yale economistStephen Roach believes that due to the decoupling of trade with its partners,and the rise of China, the dollar’s reign as the king of currencies looksshaky.

Appearing on CNBC’sTrading Nation a couple of weeks ago, the university lecturer forecasts a 35%decline in the US currency against its major rivals, due to the nation’s risingdeficit (it recently tripled) and dwindling savings rate.

“The dollar is going tofall very, very sharply,” he told the business network.

In a Bloomberg op-ed, Roach said the covid publichealth crisis will only amplify the dollar’s woes.

Gold is goinghigher

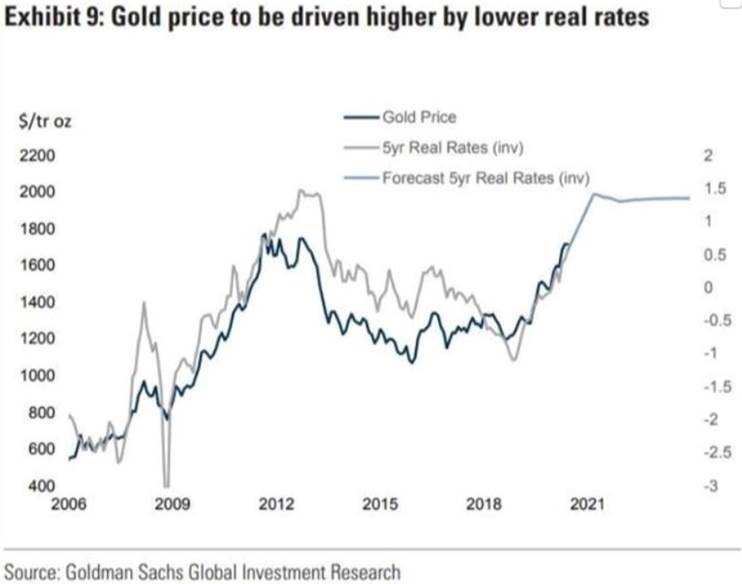

Goldman Sachs believes aweaker dollar will boost the purchasing power of major gold consumers inemerging-market (EM) economies like China and India. In its latest CommoditiesResearch note, the investment bank upgraded the precious metal on “debasementfears”, noting the two main drivers sending gold prices higher will be lowerreal rates (interest rates minus inflation) and higher EM demand:

Our economistsexpect inflation over the next 5 years to average 1.73% vs current marketpricing of 1.02%. Therefore, real rates in the US are expected to continue tofall, increasing debasement concerns and putting upward pressure on gold (seeExhibit 9).

Other analysts agree,there is nowhere for gold to go but up. In his daily note, Adrian Ash, directorof research at BullionVault, wrote, “last week’s swing towards 2011 levels inU.S. dollar terms near $1,800 per ounce is attracting a flood of new interest,piling on top of January-June’s heavy demand. Fear of missing out could spur adramatic spike [in gold] if the economic, health and political news continuesto darken. Heaven forbid we get a hot, angry summer to match 2011. But rarelyhave there been so many tailwinds for gold.”

He also noted, via Marketwatch, “The economic slumpcaused by Covid-19 has spurred record government deficits and central-bankinflation to try and offset it. China’s power grab in Hong Kong is worseninggeopolitical tensions ahead of November’s U.S. election, with the U.K.’slooming no-deal exit from the [European Union] now baked in the crust forDecember.”

Conclusion

The drop in the dollarcan usually be correlated with a rise in the price of gold. The current dollarweakness is directly connected to the coronavirus crisis that continues toplague the US economy, and all the measures being taken to try and limit thedamage, including near 0% interest rates, trillions in fiscal spending,practically unlimited money-printing, debt out the wazoo, and the spectre ofrising inflation.

Until we can say, in abroad sense, that re-openings have succeeded and the coronavirus is beaten,gold is going to continue to do well.

The way we see it, goldhas it made, whether economic growth picks up or it continues to muddle along,still pinned down by the coronavirus. In the current deflationary environment,gold is doing well because of all the drivers that make it such an attractiveinvestment - a high global debt to GDP ratio from the combination of fallingeconomic growth and rising national debts, owing to massive virus-relatedstimulus; growth of the M2 money supply lighting a fire under gold prices;continued low interest rates until at least 2022; a steady flow of safe-havendemand, due to the numerous global hot spots particularly with regard to a morebelligerent China; and social/ economic chaos gripping the United States as itenters a presidential election.

Gold is also poised togain in the likely event that all of this stimulus - at last count $18.4trillion! - leads to inflation.

If inflation goes, say,above 3%, yet interest rates remain near zero, that would create anotherbullish condition for gold - negative real rates (interest rates minusinflation). When US Treasury bond yields turn negative, investors typicallyrotate their funds out of bonds, into gold.

As for silver, we haverecently seen the gold-to-silver ratio decline, from over 125:1, to the current97.5:1, meaning it takes 97.5 ounces of silver to buy one ounce of gold.Historically, the ratio is closer to 60:1, so silver is really undervaluedcompared to gold.

We have the same bullishindicators for silver as for gold, in terms of safe-haven demand incitinginvestors to park their money in silver bullion, silver ETFs or silver miningstocks, and the fact that silver is not subject to inflation like papercurrencies.

Its hundreds ofindustrial applications make silver very responsive to the condition of theglobal economy. Improved economic conditions resulting from countries successfullyreopening from coronavirus lockdowns, would be great for silver explorers, andtheir investors, who know the best leverage against rising metals prices is toown an early-stage junior with a sizeable and scalable deposit in amining-friendly jurisdiction.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.