Gold Sits And Waits For Direction

Gold trades in a range after falling below $1300 in mid-April.

The Fed provides little bullish news for gold.

The dollar fails again after a new high.

Three issues that can propel gold higher.

Buying the dip with gold mining stocks.

The price of COMEX June gold futures closed 2018 at $1297.60 per ounce after trading to a low at $1189.30 in mid-August. After trading to a high at $1356 on February 20, the price of the yellow metal has been making lower highs and lower lows reaching its most recent bottom at $1267.30 on May 2. At $1282.90 on June futures on May 6, gold is higher than its low for this year but is a lot closer to the bottom than the top for 2019. To end the pattern of lower highs and negate the bearish trading pattern, the yellow metal will need to trade above $1314.70 per ounce which is the first level of technical resistance and the high from April 10. Since then, a new high in the dollar has weighed on the price of the yellow metal as has the more hawkish tone by the US Federal Reserve last week.

Meanwhile, central banks continue to have a large appetitive for the yellow metal with China and Russia inhaling all domestic production and purchasing gold in the London market. Gold always looks awful when it is in a bearish trend, but there are signs that the yellow metal has found a bottom and could begin to make progress in a challenge that would break the negative price pattern that has been in place over the past two and one-half months.

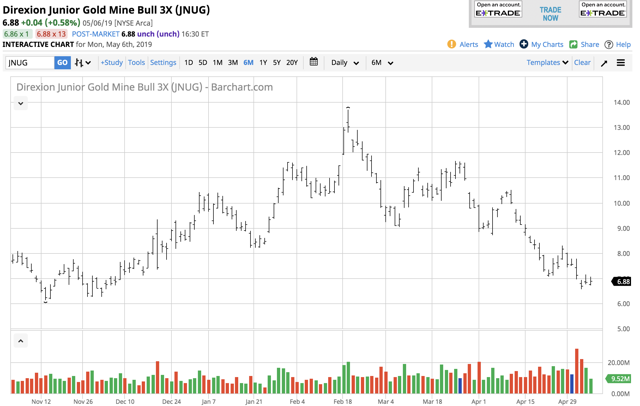

Gold mining stocks have underperformed gold on the downside and typically outperform the precious metal on the upside. If gold is preparing to recover, the Direxion Daily Junior Gold Miners Index Bull 3X Shares (JNUG) could be the perfect tool to take advantage of a rebound on a short-term basis.

Gold trades in a range after falling below $1300 in mid-April

The gold futures market ended a pattern of higher lows and higher highs in February as the bull became a bear and the yellow metal fell back below the $1300 per ounce level.

Source: CQG

As the daily chart of June gold futures highlights, the price of the yellow metal declined to its latest low at $1267.30 per ounce on May 2 but was trading at just over $1282 on May 6. Since April 17, the price has been in a range between the low and a high at $1290.90 on the June contract. Both price momentum and relative strength indicators on the daily chart are in neutral territory, and daily historical volatility has ticked higher to just over the 7.5% level over recent sessions. However, open interest which is the total number of open long and short positions in the futures market dropped significantly since mid-March when the metric rose to a high at 541,737 contracts. Gold has been under pressure which caused open interest to decline to 440,217 contracts as of May 3, a decrease of 101,520 contracts or 18.7%. In futures markets, a falling price that accompanies declining open interest is typically not a validation of an emerging bearish trend. The metric was close to its lowest level in 2019 at the end of last week which is a sign that frustrated longs have exited risk positions and speculative shorts are not increasing their positions in the gold futures market as gold has been trading in a $23.60 range.

The Fed provides little bullish news for gold

The latest decline in the gold market to its lowest level of 2019 and since December 2018 came as the US Federal Reserve turned a bit more bearish at their most recent meeting. With GDP growth strong and unemployment at the lowest level since 1969, any hopes of a cut in the Fed Funds rate appears to have gone up in smoke. Moreover, the latest two candidates for an appointment to the Fed Board, Herman Caine, and Stephen Moore who both favored a lower Fed Funds rate recently asked President Trump to withdraw his nominations.

The Trump administration has repeatedly blamed the Fed for slowing down the economy because of four rate hikes in 2018 and the program of balance sheet normalization. However, the President's picks of Caine and Moore did not have enough support for confirmation as the House and the Senate viewed the candidates as political appointees to an apolitical body.

When the Fed told markets that they would not hike rates and will end their program of quantitative tightening in September 2019, the market had expected that the next move by the central bank would be to cut the Fed Funds rate. However, recent economic data and comments by Chairman Jerome Powell seem to have made any hopes of a rate cut to dissipate. Higher interest rates tend to weigh on the price of gold and other commodities for two reasons. First, a tighter environment for credit increases the cost of carrying long positions and inventories. Second, and perhaps more importantly, higher rates provide support for the value of the US dollar versus other world currencies.

The dollar fails again after a new high

Over recent weeks, the dollar index rose to a new and higher high which weighed on the price of gold.

Source: CQG

As the weekly chart of the US dollar index illustrates, the dollar has made a series of higher lows and higher highs since February 2018 when the index found a bottom at 88.15. Technical resistance for the dollar index was at the December 2018 peak at 97.705. In early March, the index rose to 97.665, just shy of a new high before selling took it back to 95.17, but during the week of April 22, the index finally rose to 98.085 before correcting to 97.285 on May 6.

A significant factor when it comes to the value of one currency versus another is the yield paid for holding a foreign exchange instrument. The dollar, euro, and yen are the reserve currencies of the world. With short-term US rates at 2.25-2.50% and euro and yen rates at negative forty basis points, the differential of 2.65-2.90% favors a stronger dollar and has been responsible for the bullish trend in the US currency. The dollar and gold have a long-standing inverse relationship, so the new high in the dollar index weighed on the price of gold. The latest high in the dollar came on April 26 which continued to keep the pressure on the yellow metal.

Three issues that can propel gold higher

Three factors facing the world have the potential to quickly turn the golden bear into a bull in the blink of an eye. The low level of open interest could mean that the gold market has run dry of selling which limits the downside and could bring buyers back quickly over the coming days and weeks.

The first issue is the ongoing trade dispute between the US and China which caused selling in the stock market on May 6 after President Trump told markets that tariffs would increase to 25% on Friday, May 10. The rumor that Chinese negotiators canceled their trip to Washington later this week caused a cascade of selling in the stock market in Asia on Sunday night, but news that negotiations will continue calmed fears and stocks closed on May 6 with minor losses. A breakdown in talks on trade could lead to an escalation of the trade dispute, and the dollar is a tool in both negotiations and if a currency war were to break out. The Trump administration has made no secret of their desire to keep the dollar as low as possible to make US exports more competitive in global markets and take market share away from China. Therefore, it is possible that intervention in the currency markets will send the dollar index lower which would provide support for the price of gold.

The second issue that supports gold prices is the increasing tension in the Middle East. A few weeks ago, the Trump administration refused to extend exemptions to those nations purchasing crude oil from Iran. The US also designated the Iranian Revolutionary Guard as a terrorist organization. In a retaliatory move, Iran declared that all US troops in the Middle East are terrorists and the theocracy in Teheran has been threatening military action against the US or American interests in the region. At the same time, around 20% of the worlds crude oil travels through the Strait of Hormuz each day. The Strait is a strategic chokepoint for Iran. On May 6, the US dispatched the USS Abraham Lincoln Carrier Strike Group and bomber task force as a warning to Iran. As tensions build in the region, gold is likely to find support and buying if the temperature continues to rise leading to any form of hostilities.

Finally, political divisiveness in the US continues to put the House of Representatives against the Trump Administration. After refusing to release an unredacted copy of the Mueller report to the House Judiciary Committee, Chairman Jerold Nadler is preparing to hold Attorney General Barr in contempt of Congress. With the 2020 Presidential election season shifting into high gear, uncertainty about the political future of the US could weigh on the dollar and support gold prices over the coming weeks and months.

Aside from those three factors, North Korea has begun to test missiles again, and China and Russia continue to build their gold reserves providing an underlying bid for the yellow metal.

Buying the dip with gold mining stocks

While it is possible that gold could retest the recent low or fall to the $1250 level or lower, I would view any price weakness as a buying opportunity in the yellow metal given the issues facing the world and the long-term trend in the yellow metal against all three reserve currencies. Gold has been rallying against the dollar, euro, and yen since the turn of this century which is a sign of declining faith in fiat currencies and supportive of the price of the precious metal. Central banks around the world continue to hold gold as a reserve asset and as a significant percentage of their foreign exchange reserves which provides validation for the precious metal as a means of exchange. Gold has been a monetary asset for thousands of years which is a lot longer than any of the currency instruments around the globe.

Gold mining stocks tend to magnify the price action in the gold market on a percentage basis. The leading gold mining companies typically move more than the yellow metal, and the minor gold companies involved in exploration offer even more leverage as they magnify price action in the gold mining companies with larger market capitalizations.

If gold is going to begin to recover, the Direxion Daily Junior Gold Miners Index Bull 3X Shares could become explosive given its leveraged exposure to the junior gold mining shares. The fund summary for JNUG states:

The investment seeks daily investment results, before fees and expenses, of 300% of the daily performance of the MVIS Global Junior Gold Miners Index. The fund invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index includes companies from markets that are freely investable to foreign investors, including emerging markets, as that term is defined by the index provider. It is non-diversified.

As a leveraged product, JNUG is only appropriate for short-term forays into the gold market on the long side. The leverage comes at a price which is time decay. If the junior gold mining shares move sideways or lower, the product quickly loses value and is susceptible to painful reverse splits which eat away at the value of the product. However, on a short-term basis, JNUG can turbocharge percentage gains during bullish periods in the gold market.

Source: Barchart

As the chart shows, JNUG moved from a low at $6.13 on November 13 to a high at $13.70 on February 20, an increase of 123.5%. Over the same period, June gold futures moved from $1215 to $1356 or 11.6%. GDX, the large-cap gold mining company ETF product moved from $18.26 to $23.70 over the same period or 30% higher, and GDXJ, the junior gold mining ETF product rallied from $26.04 to $35.04 or 34.6% over the period. At $6.88 per share on May 6, JNUG continues to outperform gold and large-cap gold mining shares on the upside and underperform on the downside. While it is possible that a 10-1 reverse split is in the cards for JNUG shortly, a rally in the gold market would propel the triple leveraged product higher and would turbocharge percentage gains for those who time the market well.

Gold is sitting and waiting for direction, and JNUG could be the perfect instrument for those who believe that the current period of consolidation will lead to a recovery over the coming days and weeks.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.The author is long gold.

Follow Andrew Hecht and get email alerts