Gold Still Has Plenty Of Room For Recovery

Many participants worry that gold's extended rally has maxed out.

The recent abundance of geopolitical uncertainties suggests otherwise.

Silver is also confirming gold's rally, which is a positive factor.

Has gold overshot its near-term upside potential after its latest Brexit-inspired rally? While some analysts would answer in the affirmative, I would argue that there are still reasons for believing the yellow metal can continue its recent outperformance of other assets. In today's report, we'll review some of the psychological and technical signs pointing to a continuation of gold's upward trend in the coming weeks and months.

It's always nerve-wracking as an investor when the asset you're in has had a long stretch of outperforming other markets without so much as a meaningful pullback along the way. This has clearly been the case for the gold market since November. Yet, despite its extended rally, gold still has an abundance of supporting factors in the near term ranging from investors' concerns over the geopolitical outlook (i.e. the "fear factor") to a weaker U.S. dollar index and a stronger foreign currency outlook.

One of the biggest psychological supports for gold recently has been the contentious debate over Britain's exit from the European Union, the so-called "Brexit." Consider the recent opinion article from a major media outlet which actually suggested there should be more "panicking" over Brexit. The writer of this article further opined that "economic disaster" would likely ensue in the event of a "no-deal Brexit." My aim in mentioning this isn't to criticize the author's opinion but merely to point out that worries over Brexit are fairly mainstream. This, in turn, has bullish implications for gold's fear component.

Another sign that gold's fear component is still strong can be seen in the latest headlines over the ongoing U.S.-China trade tariff dispute. Recent news articles have suggested that the trade talks scheduled to begin on Wednesday may be threatened by the Trump administration's criminal charges against the Chinese tech company Huawei. Investors are still manifesting a decided lack of confidence in the outcome of the trade war and this is good news for gold.

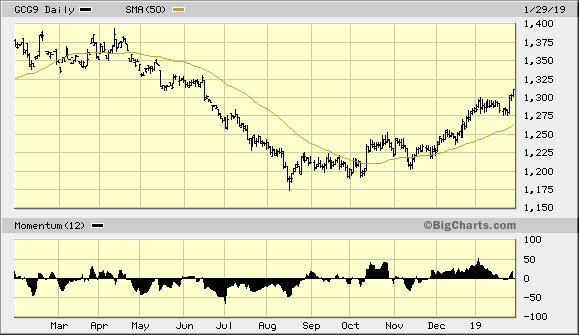

Gold's technical strength also shouldn't be underestimated. For the first time in near a year, gold's 50-day moving average has established a steadily rising trend. This is a relatively rare occurrence for the metal in recent years and it reflects the presence of sustained buying interest. The 50-day MA is one of the most widely watched indicators among traders and investors and is a component in many computer trading algorithms, so its significance cannot be ignored.

Below is the February gold futures price relative to its 50-day MA for illustration purposes. As you can see, gold still has some ground to cover before it regains all its losses since last April. But considering that investors have expressed more worries now compared to a year ago, it can be surmised that gold still has plenty of support from safe-haven demand. Its recovery rally should, therefore, remain intact and I expect that gold will recover all of its losses since 2018 in the coming months.

Source: BigCharts

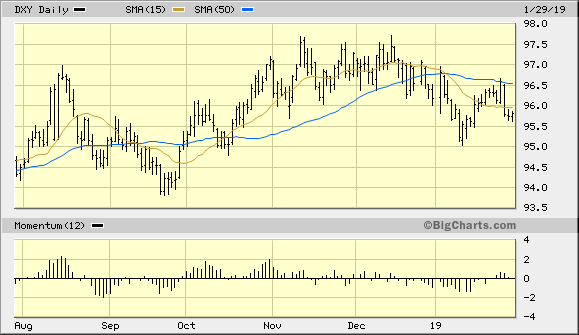

Gold's currency component is arguably its most important supporting factor right now. Shown here is the U.S. dollar index (DXY) which has remained consistently under two of its most technically significant trend lines. DXY is still below the 15-day moving average, which tells us that its immediate-term (1-4 week) trend remains weak. It's also below the widely-watched 50-day MA, which means its intermediate-term trend is also suspect. This more than anything else has removed a significant obstacle from gold's path and has allowed the metal to push higher with relatively little resistance in recent weeks. As long as the dollar index remains under both trend lines on a weekly closing basis - especially the 50-day MA - I consider the near-term outlook to be favorable for the gold price to strengthen further.

Source: BigCharts

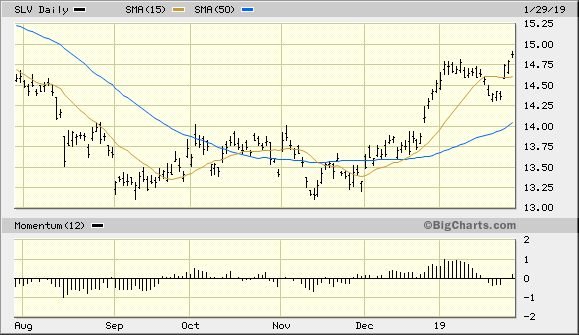

It has been a while since we've looked at silver, but the white metal has also been supportive of gold's recent rally. I've long emphasized in these reports that gold rallies should ideally be confirmed by rallies in the silver market and that has definitely been the case since December. Shown here is the iShares Silver Trust (SLV), my favorite proxy for the silver price. It shows that SLV has established an intermediate-term rising trend and, like gold, remains above its rising 15-day and 50-day moving averages. A negative divergence in the SLV price would be worrisome after gold's latest breakout to a new 6-month high. To date, however, SLV remains supportive of the gold rally.

Source: BigCharts

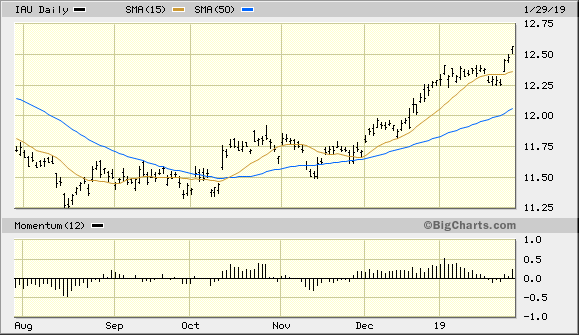

Let's look now at the iShares Gold Trust (IAU), my preferred trading vehicle for gold. The ETF continues to benefit from the weaker U.S. currency as well as the widespread geopolitical worries mentioned above. IAU also remains above its rising 15-day moving average, which technically confirms that its immediate-term trend is still up. I continue to maintain that as long as the IAU remains above its rising 15-day MA on a weekly closing basis, the immediate-term upward trend for the gold ETF is intact.

Source: BigCharts

In view of the factors mentioned here, investors are still justified in maintaining a bullish posture and in assuming that gold's recovery will continue in the coming months. The metal still has an abundance of support in the form of global political uncertainty and foreign currency strength.

On a strategic note, we are still long the iShares Gold Trust after recently taking some profit. I also recently recommended raising the stop loss for the remainder of this trading position to slightly under the $12.25 level on an intraday basis. A violation of $12.25 in the IAU would signal a decisive shift in the gold ETF's immediate-term trend.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts