Gold Stock Bulls Flex Their Muscles

Gold market heats up again in response to a weaker U.S. dollar.

Fed's reversal of tight money policy will also benefit gold price.

Gold mining stocks are showing relative strength versus bullion.

It has been a long time in coming for traders, but finally the precious metals market is starting to show signs of life again. In the last few days we've seen the gold and gold stock prices perk up with the December gold futures contract closing two days higher above a key short-term trend line. Based on purely technical considerations, this suggests that the bulls are finally taking advantage of a weaker U.S. dollar and making a move to "run" the gold shorts. In this report, we'll review the main technical and fundamental indicators as I make the case that the long-awaited Q4 bullish move for gold and the gold miners should soon be underway.

Gold stock traders haven't exactly been brimming with confidence, yet there are definite signs that the bulls are chomping at the bit and wanting to force a short covering-type move higher with the gold price. That there's a fair amount of short interest within the gold market can be inferred by the tendency of hedge funds and speculators to go short whenever news relating to the U.S.-China trade war takes on an optimistic hue. With progress reportedly being made in trade negotiations between both nations - and with a corresponding migration back into risk assets clearly visible in recent days - gold bears have an obvious incentive to sell short.

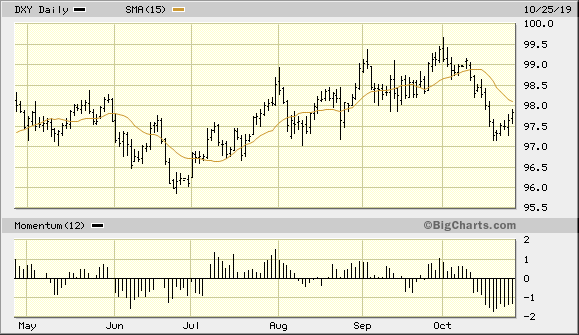

Yet to sell gold at these levels based solely on the return of risk aversion among retail investors would itself be to incur great risk. To start with, gold's currency component has shown marked improvement in the last few weeks. The U.S. dollar in which gold is priced has diminished in value this month, as can be seen in the following graph of the U.S. Dollar Index (DXY). A weaker dollar typically results in a higher gold price, although the lag between the two can sometimes be pronounced.

Source: BigCharts

One of the reasons behind the dollar's latest downside move can be ascribed to the reversal of quantitative tightening (QT) on the part of the Federal Reserve. The Fed's announcement earlier this month that it would begin buying $60 billion per month in Treasury bills essentially reverses the QT that occurred starting last year when the Fed began shrinking the size of its balance sheet. This resulted in a rather conspicuous decline in bank reserves, which in turn put some upward pressure on the dollar. Now that the Fed has admitted its mistake and is expanding its balance sheet, investors should expect to see a weaker dollar - or at least one that is less strong than it has been for most of 2019 - in the coming months. This in turn will allow gold to accrue strength based on the improvement in its currency component.

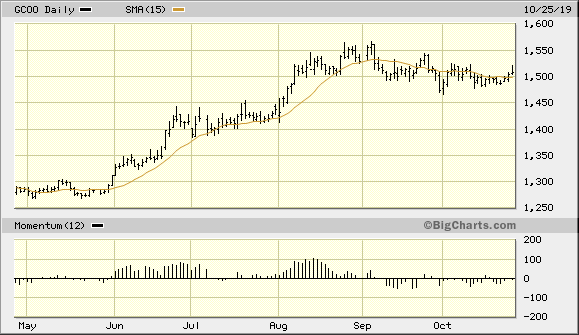

That gold is beginning to respond positively to the weaker dollar can be seen in the following graph featuring the gold continuous contract. Gold penetrated ever so slightly above its key 15-day moving average last week, though it hasn't yet shown the conviction that would be expected of it given the extent of the dollar's recent decline. I attribute the halting nature of gold's latest upside move to the fact that the equity market is stealing some of its thunder right now. However, sooner or later, participants will recognize the value offered by gold in relation to a weaker U.S. currency. When this realization sets in, gold will quickly benefit given its current technical condition and proximity to its yearly high.

Source: BigCharts

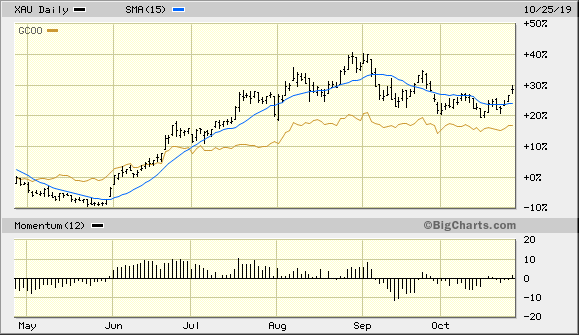

Meanwhile, the gold mining stocks are also showing signs of improvement. This is ideal from a gold investor's perspective since a failure of the gold stocks to confirm gold's rallies is usually a sign of underlying weakness for the bullion price. Shrewd investors recognize that when gold is truly worth buying, gold mining stocks are purchased in order to leverage the anticipated move higher in the physical metal's price.

As of Oct. 25, the XAU has closed two days higher above its 15-day moving average, albeit tepidly. A higher close for the Oct. 28 session, however, will seal the deal as far as confirming an immediate-term breakout for the XAU. Note also in the following graph that the XAU is showing relative strength when compared to the gold price. This is another positive factor which supports higher prices in the leading gold mining shares in the coming weeks.

Source: BigCharts

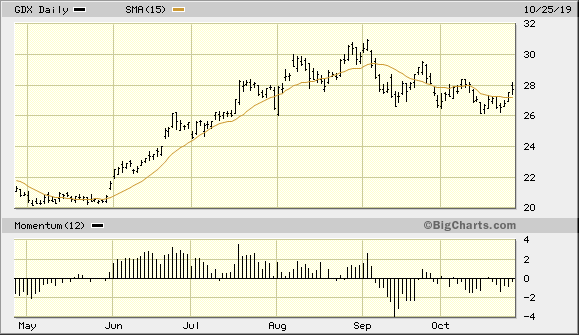

Let's now briefly turn our attention to my favorite gold stock tracking vehicle, the VanEck Vectors Gold Miners ETF (GDX). GDX closed two days higher above its 15-day moving average as of Oct. 25 to send a preliminary breakout signal per the rules of my technical trading discipline. If it looks like GDX will close above the 27.52 level (the pivotal Oct. 24 initial close above the 15-day MA) on Monday then the breakout signal will be confirmed. I'll then return to an immediate-term buy signal for GDX and will plan to use the 27.00 level as the initial stop-loss on an intraday basis for the trade.

Source: BigCharts

My proposed stop-loss of 27.00 is admittedly conservative. But in my estimation, a failure of GDX to quickly rally after confirming a breakout signal this week would suggest hesitation on the part of the bulls. Given the precarious state of the 4-week gold stocks new highs-lows indicator (discussed in the previous report), a failure to rally from here would also afford the bears with a fresh opportunity to regain control of the immediate-term trend of GDX. Accordingly, I see the next few days as crucial ones for the gold stock bulls.

In conclusion, gold's outlook for the four quarter of 2019 is an encouraging one. Based on gold's currency component and the Fed policy factor, the metal should benefit from recent improvements in both areas. The relative strength being reflected by the leading gold mining stocks versus the physical metal is also encouraging from a bull's perspective. In view of the combined evidence reviewed here, investors are justified in maintaining intermediate-term (3-6 month) long positions in bullion and gold mining stocks.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GDX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts