Gold Stock Poised to Advance as It Commences Drill Program

Newsletter Update Technical Analyst Clive Maund explains why he believes Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB) is a Strong Buy.

Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB) is a copper-gold exploration company whose stock is in the latest stages of basing and looking poised to advance, especially as it has just commenced a major drilling program.

Before looking at the latest stock charts, we will overview the company using its new investor deck.

The first slide from the deck provides an overview of the company.

The next slide makes the case for buying Aztec stock on just one page, provided that the timing is right, and as we will see, the latest stock charts suggest that it is.

The company has two big projects, one in southern Arizona and the other south of the border in Northwest Mexico, as shown on the following map.

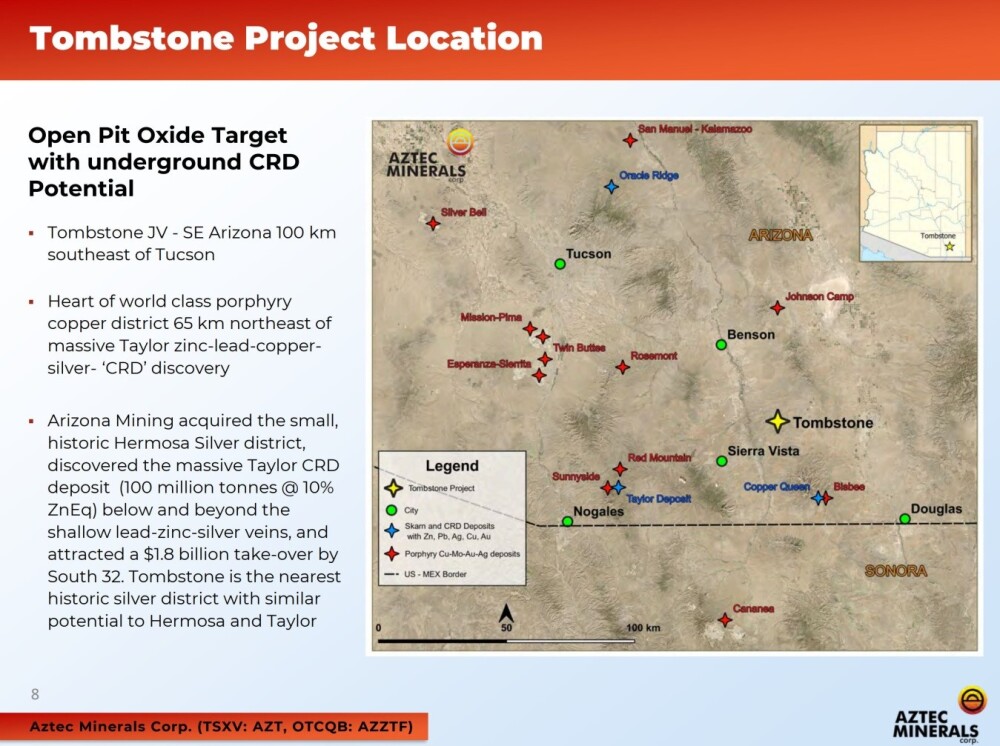

The following slide shows in more detail where the Tombstone, Arizona project is located and how it is in the heart of a world class porphyry copper district and not far from where Arizona Mining acquired the Hermosa Silver district where it discovered the massive Taylor deposit and got bought out by South32 for $1.8 billion.

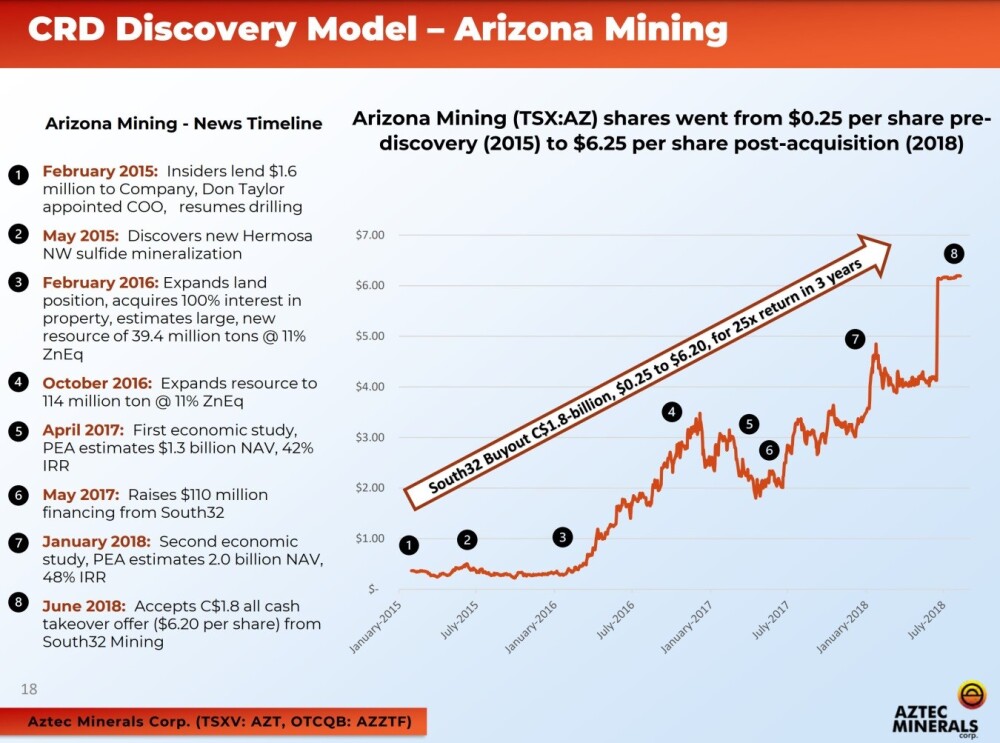

Here is what happened to Arizona Mining's stock as a result:

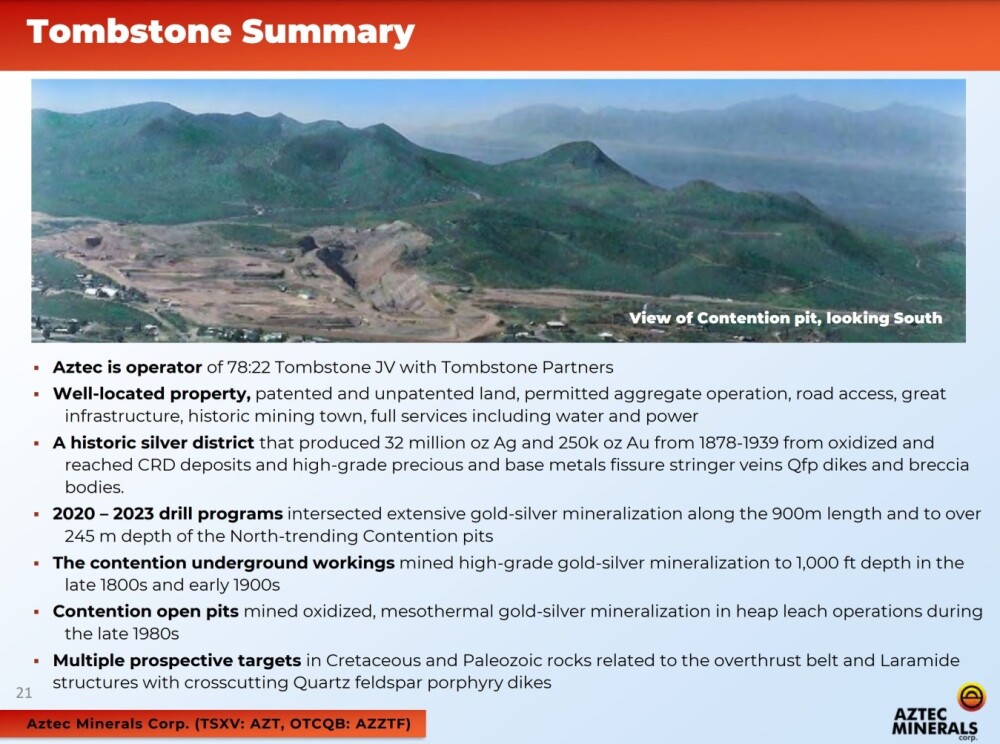

The geology of the Tombstone Project can be reviewed in the investor deck. Here is a summary of the project, which contains the large Contention open pit:

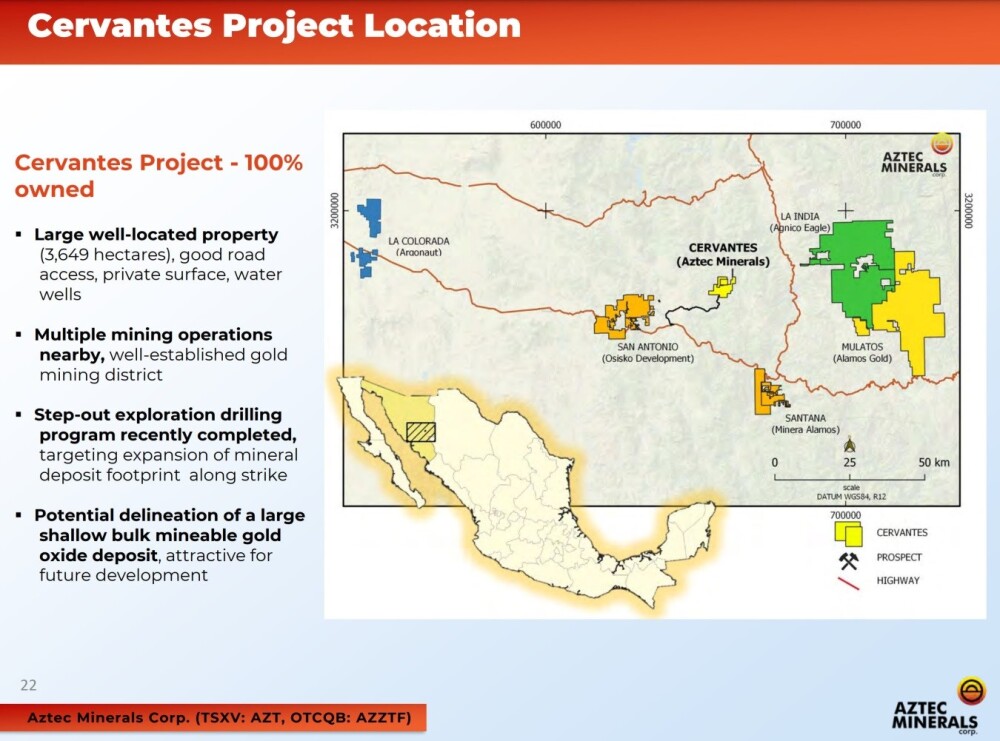

The location and general geography of the Cervantes property in Northwest Mexico can be seen on this slide below.

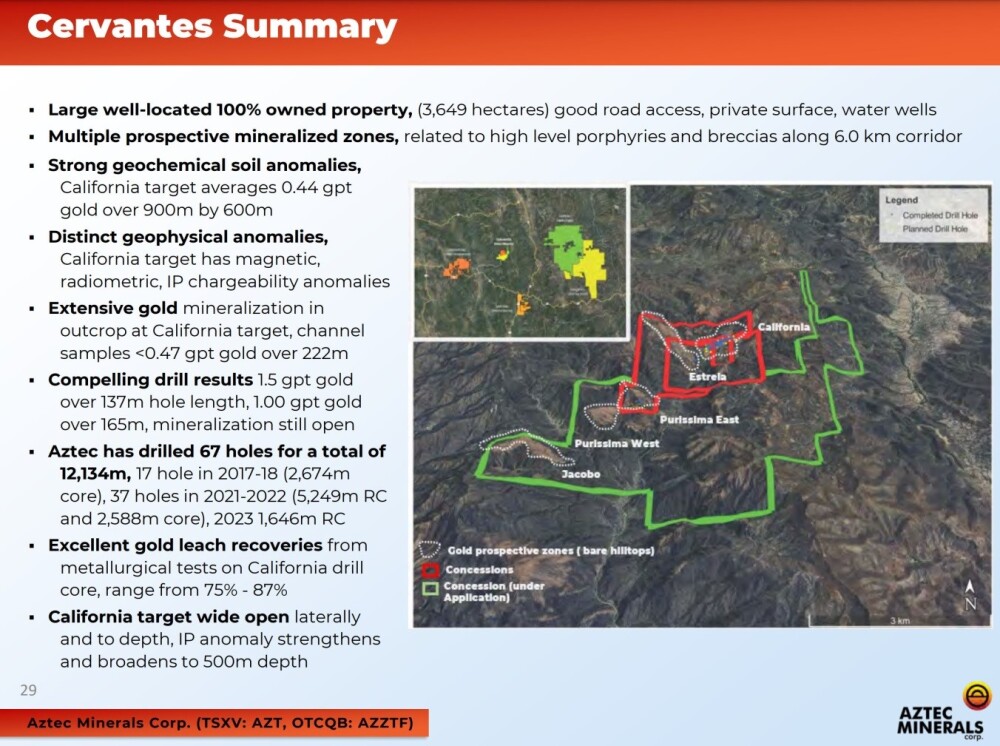

And again, the geology of the Cervantes project may be reviewed in the same deck. Here is a summary of the property below.

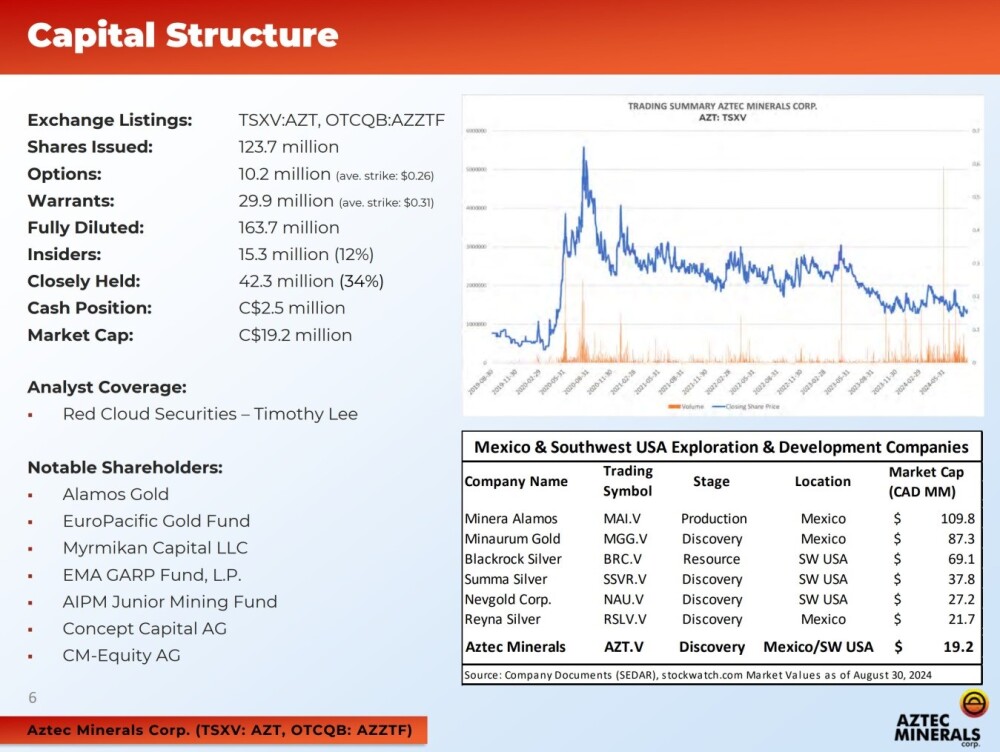

This last slide from the deck shows the capital structure of the company, and it makes clear that a sizeable percentage of the stock is closely held.

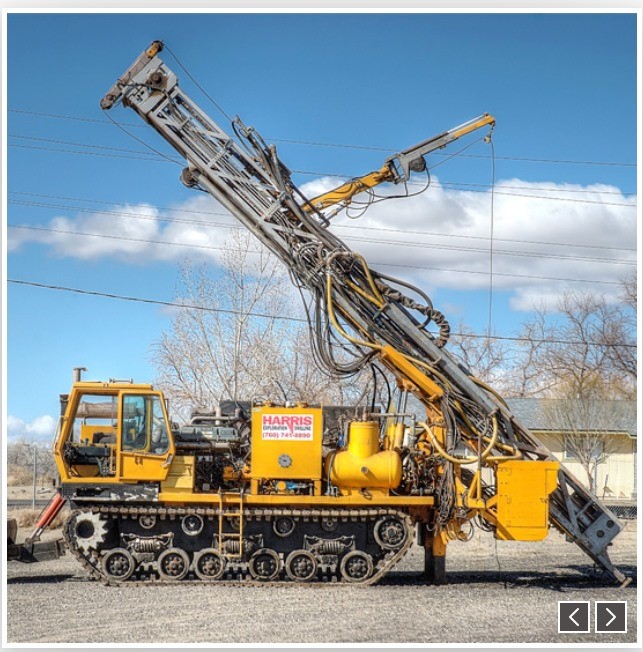

To end our look at the fundamentals, it is worth noting that the company will also be using a go-almost-anywhere "tank drill" during its new drilling program, as shown in the following photo.

Turning now to the charts and starting with a 7-month chart, we see that although Aztec hasn't made net progress since we last looked at it on June 10, its technical condition has continued to strengthen. The first point to note is that the disconcerting intraday plunge that occurred on June 21, when it briefly touched 9.5 cents and then went on to close unchanged on the day, was actually a positive development as it left behind a bullish "dragonfly doji" on the chart that signified the final low of the bear market in force from mid-2020 with this rather dramatic candle being followed by a significant change in trading, for as we can see, thereafter upside volume increased markedly driving the Accumulation line quite steeply higher.

This is clearly bullish volume action that should before long translate into an unfolding uptrend. So, after dropping back to test support in the 14 cent area in August and September the price has started higher again and looks like it is set to run to resistance in the 24 - 26 cent zone as an initial objective.

Moving on, we see on the 2-year chart that, following a quite severe decline from March through October last year, the price has marked out what now appears to be a large Double Bottom above a line of support at 14 cents, whose validity as a base pattern is confirmed by the increase in upside volume and the strong uptrend in the Accumulation line since the bottoming candle in June that we considered above.

The duration of this Double Bottom has allowed time for the 200-day moving average to drop down close to the price, putting it in position to quickly turn up in the event that a significant advance gets underway.

Finally we can see on the 9-year chart that the overall pattern that has formed in the stock since Aztec came to market in 2017 is a giant Cup & Handle base pattern, albeit a rather skewed one with a "droopy" Handle and if this interpretation is correct then the potential gains from here are very substantial and very possible given the discovery potential of the company coupled with the stellar outlook for gold as currencies collapse.

This is, therefore, considered to be a very good point to buy or add to positions in Aztec Minerals, which continues to be rated a Strong Buy here.

Aztec Minerals' website.

Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB) closed for trading at CA$0.175, US$0.1311 on September 30, 2024.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aztec Minerals Corp.Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.