Gold Stock Traders Know Something Gold Investors Don't

The failure of the XAU index to rise is a potential warning sign for gold.

Mining stock traders apparently aren't convinced gold is ready to rally.

Silver continues to lag gold, as both metals face serious obstacles.

Despite a recent attempt at bottoming, gold's revival attempt has been hindered by a serious lack of confirmation from its peers. Specifically, gold's "sister" metal silver has shown significant relative weakness while gold mining stocks have also failed to rally. As we'll discuss in today's report, informed participants in the gold mining stock arena are sending an unequivocal message that gold isn't ready yet for a sustained rally. I'll also make the case that gold's short-term rally prospects are mainly tied to a weak outlook for the U.S. equity broad market.

Gold was lower last week, falling in three of the last four trading sessions in response to a number of unfavorable developments. Gold also failed to overcome the widely watched $1,300 level last week, which is making traders nervous. Gold's failure to extend last week's rally is a reflection of gold's fading turnaround prospects in the face of relentless strength in the U.S. dollar and extreme weakness in the silver price.

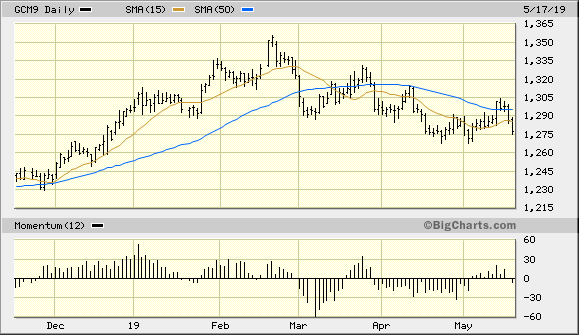

Shown here is the daily graph for June gold futures. Not only did June gold fail to finish the latest week above its 15-day moving average, it also failed to close above its more widely followed 50-day MA (blue line). As I've emphasized in past reports, a failure to close above the 50-day MA on a weekly basis suggests that gold's intermediate-term trend is still weak and the metal is subject to residual selling pressure.

Source: BigCharts

A weekly close above the 50-day MA would also give the bulls a boost in confidence heading into the second half of May and would strengthen the odds of another short-covering rally for the metal. As it now stands, a lot more is needed to improve gold's rally prospects beyond the immediate-term outlook.

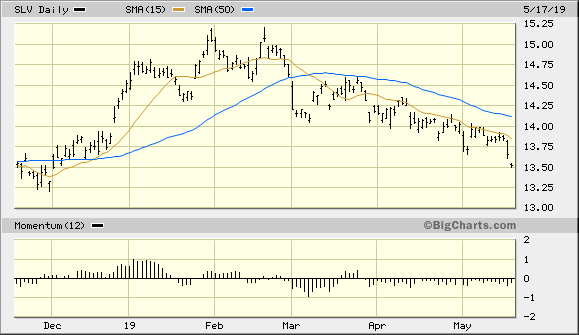

One of the biggest hindrances for gold's intermediate-term (3-6 month) outlook is the failure of the silver price to confirm gold's latest rally. Shown here is the iShares Silver Trust (SLV), which is my favorite silver trading vehicle. As you can see, SLV has just broken down to a new low for the year to date as of May 17 and needs to reverse its weakness quickly if gold is to have any staying power beyond the very short term.

Source: BigCharts

As it now stands, whatever rally prospects gold may have from here is strictly tied to investor uncertainty over the U.S.-China trade tariff dispute. Days on which the U.S. stock market is weak have also been clearly favorable for gold, and the last two weeks have provided ample examples of gold's inverse correlation with stocks. Based on gold's month-to-date performance a case can be made that without equity market volatility, gold would have little in the way of psychological support or safe-haven demand. Silver's weakness is certainly a sign that outright investment demand for the precious metals is currently lacking.

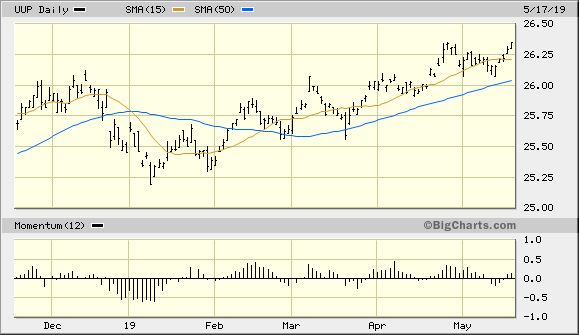

There is also the currency factor to consider. Gold's latest pullback occurred after the U.S. dollar rose on the back of strong U.S. economic data last week. Gold's recent attempts at rising above the psychologically significant $1,300 level and overcoming the 50-day moving average have been stymied by the dollar's stubborn strength.

Below is the Invesco DB U.S. Dollar Index Bullish Fund (UUP), which is an excellent proxy for the dollar index. By closing at a new yearly high on May 17, the dollar ETF has renewed an immediate-term breakout signal. More importantly, the dollar's latest surge is creating additional headwinds for the yellow metal due to its being priced in dollars. Until the dollar shows significant weakness, conservative gold investors are justified in holding off in initiating new long positions in the metal and should hold some cash until a better entry point presents itself for buying gold.

Source: BigCharts

Adding further pressure to bullion, recent economic data has been unfavorable for gold investors. In particular, the University of Michigan consumer sentiment index for May rose to 102.4, which represents its highest reading in 15 years. The latest data also showed that U.S. housing starts increased more than expected in April, rising 5.7%. Meanwhile, U.S. unemployment benefits fell more than expected last week, which in turn points to increasing labor market strength and a stronger domestic economy. These are factors which normally weigh against gold's safe-haven demand factor. Collectively, the upbeat economic news on the domestic front is providing investors with one more reason to not be heavily exposed to the metal.

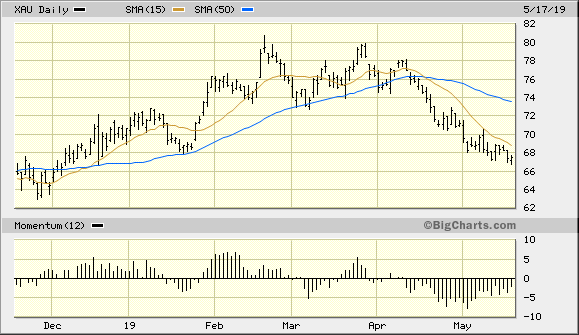

Before we have an all-out buy signal for bullion, we also need to see a reversal of the weakness currently reflected in the gold mining shares. Shown here is the PHLX Gold/Silver Index (XAU), which fell to its second lowest closing value of 2019 on May 16.

Source: BigCharts

Historically, the strongest and most sustainable gold price rallies have occurred when the XAU has been rising along with physical bullion. Right now, however, the XAU index is sending a divergent signal suggesting that the gold miners aren't in harmony with the physical metal's recent turnaround attempt. The negative divergence in the XAU index compared with gold is another reason for continuing to favor cash over gold right now.

Based on the XAU's lagging performance it would appear that informed participants in the mining stocks are aware of an unfavorable development for the gold price outlook, otherwise we would have seen a sympathy rally in the XAU index earlier this month. Smart traders always buy gold stocks to leverage a gold rally; their failure to do so this month is a tell-tale sign that something critical is missing for a sustained intermediate-term gold rally.

Meanwhile on the ETF front, the SPDR Gold Trust (GLD) said holdings fell 0.4% to 733.23 tons on May 15. Holdings are now near their lowest levels since Oct. 9 in a sign that demand is at low ebb right now. Consequently, my gold ETF portfolio is currently in a cash position and I'm still waiting for the above mentioned improvements before making a new recommendation in the iShares Gold Trust (IAU), the trading vehicle I use in this report for tracking purposes.

In conclusion, in order for a decisive buy signal for gold to occur we need to see a revival in silver's near-term strength, as well as a reversal of the weakness currently plaguing the actively traded gold mining shares. Accordingly, a continued defensive stance is recommended due to the cross-currents in the precious metals sector.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts