Gold Stocks Approaching Cross Roads

Gold stocks have become over-extended and overheated in recent days.

Expect the rate of change in the new highs-lows to soon slow down.

Investors should prepare for a potential XAU pullback in early July.

June has seen one of the best single-month performances for the actively traded gold mining shares in years. The PHLX Gold/Silver Index (XAU) has gained 21% so far this month and shows no signs of stopping anytime soon. When we peer below the market's immediate surface, however, there are signs that the gold stocks are approaching a potentially critical juncture. Specifically, the mining sector will soon face the problem of a reversing rate of change in the number of gold stocks making new highs minus new lows. Just as the increasingly bullish rate of change in the new highs-lows last month paved the way for higher gold stock prices, a reversal in this important measure of demand will soon have a negative impact on the mining shares. We'll discuss as well as the possible timing of the next pullback in the XAU index in today's report.

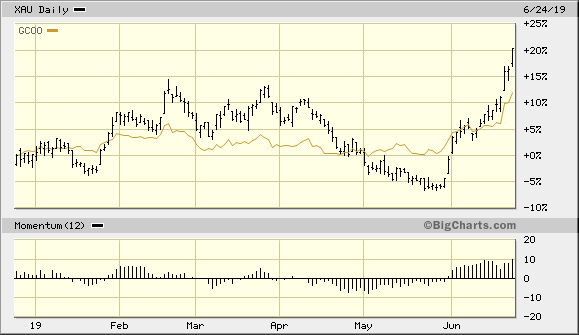

One of the things I predicted would happen this month before the upside run in the gold stocks ends is that the XAU index would eventually eclipse the performance of physical gold. For the month of May, gold mining stocks conspicuously underperformed gold bullion, as can be seen in the following graph. This was an unusual state of affairs, and it was all the more unusual when the gold price turned around in explosive fashion late last month. I reasoned that given the extent to which gold prices were rallying, the actively traded gold mining shares should eventually catch up to - and even exceed - the gold price due to the historical tendency for gold stocks to outperform gold in bull markets. This is because investors, institutions and individuals alike, like to buy gold stocks in order to leverage a sustained gold price rally.

Source: BigCharts

Clearly the XAU index has surpassed the gold price in the last two weeks and now trades at a significant premium compared to the continuous contract gold price (GC00), as shown above. From this observation naturally arises an important question, viz. "Have the gold stocks become overbought and therefore vulnerable to a sharp pullback?" By most technical measures, including several price-based oscillators, the XAU can be regarded as being in an overheated condition right now. But that doesn't necessarily mean that a pullback is imminent; indeed, markets have been known to become overbought and stay overbought for extended periods of time when hot-money inflows are responsible for a rally.

This appears to be the case now for gold and gold stocks as investors are flocking to the safety of the precious metals sector in the wake of trade war concerns and the latest spat between the U.S. and Iran. President Trump has announced "hard-hitting" economic sanctions against Iran in retaliation for the downing of a U.S. Navy drone and other recent actions. Gold has long benefited from economic and geopolitical uncertainty, but the mere hint of war has historically served as the one of the strongest catalysts for launching an extended gold rally. Investors are therefore justifiably bullish on the intermediate-term outlook for the yellow metal.

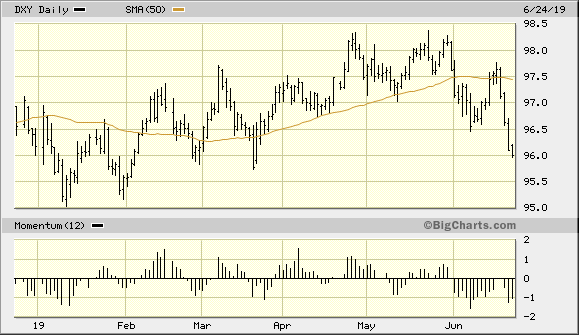

It has also helped gold's bullish intermediate-term case that the U.S. Dollar Index (DXY) remains significantly below its widely-watched 50-day moving average. The 50-day MA is a psychological benchmark of sorts for the greenback, and the further below this trend line the dollar index falls, the stronger becomes gold's currency component. The dollar has seen its worst 4-day performance of the entire year to date and is threatening to test its nearest intermediate-term low from January.

Source: BigCharts

More importantly from a gold investors' perspective, however, is that the weaker dollar has lifted a significant headwind for gold. Indeed, the dollar's persistent strength for most the last few months is what largely held gold back from rallying even earlier this spring. With the dollar now in decline, gold has an additional incentive to continue its bull market into the summer months ahead.

Returning to the gold stock outlook, the actively traded production and exploration shares are still evidently in strong hands with no signs of distribution (i.e. informed selling) anywhere. Moreover, the number of actively traded U.S.-listed gold stocks making new highs continues to expand and there are hardly any gold stocks making new lows right now. The new highs and lows are my favorite way to measure the incremental demand for stocks, and with a rising new high-low differential the near-term path of least resistance for the gold miners can only be considered up.

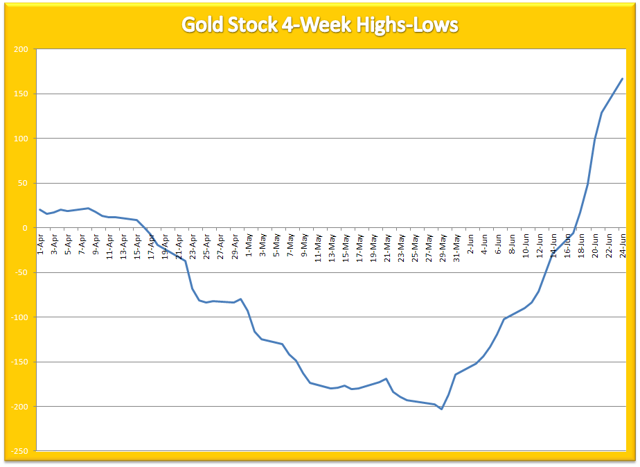

Shown below is my favorite indicator for gauging the overall health of the 50 most actively traded U.S.-listed gold mining and exploration stocks. This 4-week rate of change in the new highs and low has been rising sharply on a sustained basis since May. This was the indicator that gave an advance warning that the gold stocks had rally potential last month and it has been worth its proverbial weight in gold (pun intended). As I've emphasized in past reports, as long as this indicator continues rising, investors are justified in maintaining a bullish posture toward the gold stocks in general.

Source: NYSE

There is a potential storm cloud (of sorts) on the immediate horizon, however. That storm cloud is the fact that the projected rate of change, or momentum, of the new highs and lows for the gold stocks will sharply begin declining sometime in early July. This is based on my forward calculation of the 4-week change in the new highs and lows in the actively traded mining shares. Even if the gold stocks manage to continue rising in July, there is almost sure to be a notable increase in resistance as the current pace of stock price increases simply isn't sustainable beyond a few days. In view of this observation, I plan on taking some profits off the table this week and raising the stop losses on my long positions in this sector. I recommend that conservative investors do the same.

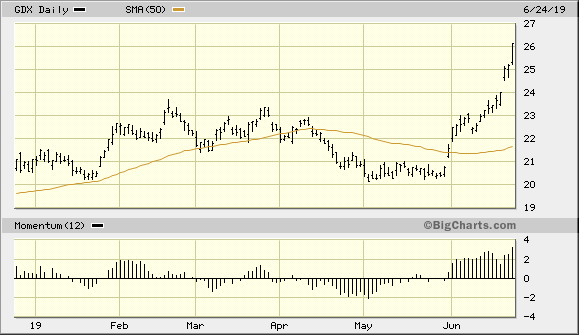

Another potential problem for gold mining investors in the immediate-term (1-4 week) outlook is that the VanEck Vectors Gold Miners ETF (GDX), my favorite gold stock trading vehicle, has greatly over-extended from its 15-day moving average. Normally GDX trades within 1-2 points of its 15-day MA. But when the ETF price line rallies four points or more from the 15-day MA, it becomes increasingly vulnerable to a pullback. The further above the 15-day MA the ETF rallies, the more likely the next corrective pullback is to be a sharp one. Currently, GDX is over four points above its 15-day MA, which is an insane degree of over-extension. It's not likely therefore that GDX will continue its current rising pace without first either consolidating its recent gains or else pulling back to get closer in line with the 15-day moving average. I'm expecting this "corrective" event to take place sometime in early July around the time when the momentum of the gold stock new highs-lows will slow down.

Source: BigCharts

In summary, gold and the actively traded gold mining shares are becoming increasingly vulnerable a pullback as we near the month of July. I mentioned in my last report that gold and the gold stocks may have entered the "manic" phase of its June rally. Many readers misinterpreted this to mean that I believed a top of major proportions was imminent. This was not at all my intention; I assert rather that the market has become too overheated to support much more upside without first consolidating or pulling back on an immediate-term basis. And while gold's near-term outlook isn't as bright as it was a month ago, gold's intermediate-term picture is still promising. One of the biggest reasons for owning gold since last year has been the ongoing U.S.-China trade war. This dispute doesn't look to be resolved anytime soon, and neither is the other geopolitical affairs previously mentioned likely to soon abate. With gold continuing to enjoy demand from risk-hedging institutional and individual investors, its intermediate-term outlook is bullish.

On a strategic note, I'm currently long the VanEck Vectors Gold Miners ETF (GDX). After the latest rally to new yearly highs in GDX, I recommend raising the stop-loss on this trading position to slightly under the 23.00 level on an intraday basis. This is where the technically significant 15-day moving average can be seen in the daily chart above. Participants should also book some profit in GDX after its impressive run of the last few weeks. Investors can also maintain longer-term investment positions in gold and gold ETFs, as previously mentioned.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts