Gold Stocks Forced Capitulation / Commodities / Gold and Silver Stocks 2018

The gold miners’ stockssuffered a rare capitulation selloff over the past month or so. Selling cascaded to extremes as stop losseswere sequentially triggered, battering this contrarian sector toexceedingly-low levels. While verychallenging psychologically, capitulations are super-bullish. They rapidly exhaust all near-term sellingpotential, leaving gold stocks wildly oversold and undervalued which birthsmajor new uplegs.

The gold miners’ stockssuffered a rare capitulation selloff over the past month or so. Selling cascaded to extremes as stop losseswere sequentially triggered, battering this contrarian sector toexceedingly-low levels. While verychallenging psychologically, capitulations are super-bullish. They rapidly exhaust all near-term sellingpotential, leaving gold stocks wildly oversold and undervalued which birthsmajor new uplegs.

Capitulations are quiterare which makes them inherentlyunpredictable. The vast majority ofselloffs end normally well before they snowball into capitulation-gradeplummets. But very seldomly heavyselling just continues to intensify rather than abate like usual. The word capitulation means “the act ofsurrendering or giving up”. That’sexactly what happens in these extraordinary selling events, traders stampedefor the exits.

Exceptionally-bearishsentiment definitely plays a major role in capitulations. As serious selling mounts, the resultingtechnical carnage leaves speculators and investors alike incrediblydisheartened. The pain is so great thatall but the most-hardened contrarians give up and sell low. But forcedselling is equally if not more important in fueling capitulations. That likely played a bigger role thansentiment over this past month.

All prudent tradersprotect their capital deployed in stocks with stop-loss orders. They are essential in a sector assuper-volatile as gold stocks, as significant-to-serious individual-company andsector-wide risks always lurk. Stoplosses are typically set loose enough to weather any normal volatility. But when selling grows severe, stock pricesare bashed low enough to trigger stops unleashing a vicious circle of selling.

The lower stock pricesfall, the more stop-loss orders are tripped. That adds to the selling pressure and pushes prices lower still, hittingeven more stops. So even themost-rational traders grounded so deeply in fundamentals that nothing scaresthem contributed to the capitulation plunge via mechanical stop-loss selling. We are in that camp, suffering quite a fewstoppings in our trades despite no emotional distress.

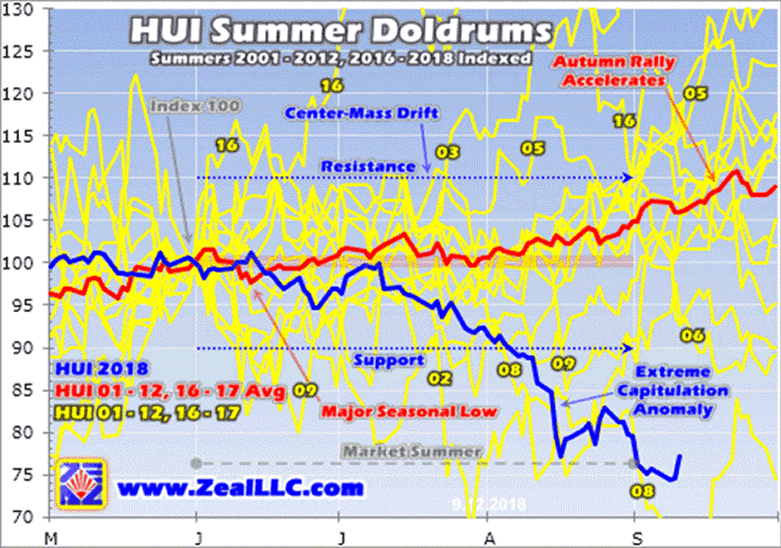

The resulting cascadingtechnical carnage was extreme by any measure. This first chart is updated from my early-June essay on gold’s summer doldrums. It shows how gold stocks have behaved insummers of all modern bull-market years as rendered by their flagship HUI NYSEArca Gold BUGS Index. Every year isindividually indexed to 100 as of May’s final close, with all gold-stock actionrecast off that common base.

This approach leavesgold stocks’ summer trading perfectly comparable in percentage terms regardlessof prevailing gold-stock price levels. The yellow lines show how the HUI performed in the summers from 2001 to2012 and 2016 to 2017. They are allaveraged together in the red line, which reveals this sector’s normal summertendencies. Typically gold stocks areflat to weaker until late July, then start rallying again.

But the recent extremecapitulation anomaly made the summer of 2018 one of the worst on record for the gold stocks, as the blue linedivulges. Gold stocks usually have acenter-mass drift in market summers running 10% from May’s final close. But at worst in mid-August, the gold stockshad plummeted a nauseating 22.8% summer-to-date! That was way beyond even the weak seasonalnorms of market summers.

So realize there wasnothing normal or foreseeable about gold stocks’ recent brutal plunge,everything about it was exceptional. Again very few selloffs keep on cascadinginto full-blown-capitulation territory. When such events rarely and surprisingly arise, all speculators andinvestors can do is hunker down and ride them out. Understanding what odd confluence of eventsfueled them clarifies what is likely coming next.

This next chart shiftsto the leading GDX VanEck Vectors Gold Miners ETF, the most-popular gold-stockinvestment vehicle. Gold miners’ stocksare ultimately leveraged plays on the gold price, which directly drives theirprofits. Gold itself actually remains ina bull market birthed in mid-December 2015, so the gold stocks are too stillconsidered to be in bull-market mode despite this recent extreme capitulationanomaly.

After hitting a fundamentally-absurd all-time low in GDX terms in January 2016, gold stocks skyrocketed in apowerful new bull. GDX soared 151.2%higher in just 6.4 months, driven by a parallel 29.9% new gold bull! Then a normal and healthy bull-marketcorrection from those resulting wildly-overbought levels was greatlyexacerbated. After Trump won thepresidency, stock markets surged dramatically which hit gold hard.

Gold is the ultimatecontrarian investment, tending to rally when stock markets weaken. When stocks are powering to seemingly-endlessnew record highs, gold investment demand really wanes. Thus gold and the stocks of its miners weretrapped in long consolidations as stock markets surged over the past coupleyears or so. GDX settled into ameandering consolidation basing trend between $21 support to $25 resistance.

That held rock-solidfrom late December 2016 to early August 2018, a long 19.3-month span. Before this recent extreme capitulationanomaly, GDX’s key $21 support was challenged no less than 5 times in thattimeframe. It held every single time, soon bouncing gold stocks back up higherinto their consolidation trend channel. These long-term pre-capitulation technicals offered little warning of animpending breakdown.

While gold stocks hadcarved lower highs in the first half of 2018, that had happened before in thefirst half of 2017. Yet out of theirsummer-doldrums lows that July, gold stocks surged dramatically in their usual autumn rally whichdrove GDX above its $25 resistance. Pretty much everyone was bearish on gold stocks leading into August2018, but that’s normal when they’re low in their trend during market summers.

So there was nothingunusual technically or sentimentally leading into gold stocks’ latestcapitulation plummeting. I’ve intenselystudied and actively traded this sector for decades now, and still can’t findany way to divine when normal selling will suddenly snowball intocapitulation-grade selling. I sure wishthese exceedingly-rare events were predictable, but the sad truth is they’renot. Capitulations are incrediblyanomalous.

But they can definitelybe understood after the fact. The goldstocks were actually faring reasonably well for most of this past summer. GDX and the HUI entered June at $22.34 and180.1, relatively-low levels reflecting the bearish sentiment plaguing goldstocks. In mid-June then early-July,they closed as high as $22.66 and 182.2 then $22.68 and 179.7. Gold stocks were flat in the middle of their consolidation basing trend.

Gold itself peaked at$1302 in mid-June, faring really well for the early summer doldrums. But then out of the blue sellingignited. Gold price action is dominatedby gold-futures speculators, whichuse extreme leverage to wield outsized influence. On June 14th the European Central Bankannounced it would finally wind down its massive quantitative-easing campaign at year-end. That oddly hammered theeuro 1.8% lower.

While ending QE moneyprinting was inarguably hawkish, the ECB tried to mitigate that blow bytapering a final time and promising no rate hikes before the summer of2019. The latter was a surprise. As the euro accounts for over 4/7ths of theUS Dollar Index’s weight, the dollar surged on that falling euro. Overnight gold-futures speculators soldaggressively on the strong dollar, hammering gold 1.7% lower the next day.

That unleashed theevents that would ultimately snowball into the gold-stock capitulation over thenext couple months or so. The rallyingUS dollar spawned extreme short selling in gold futures, which forced gold lower. The falling gold prices combined with strong stock markets motivatedinvestors to flee as well. This pressuredthe world’s leading gold ETFs led by GLD to spew much physical gold bullioninto the markets.

That bashed gold priceslower still, leading gold-futures speculators to press their advantage witheven more short selling. The more theysold short, the more gold fell. The moregold fell, the more they sold short. This culminated in speculators’ gold-futures short positions soaring to record extremes far beyondanything ever witnessed before! My essaylast week explained all this in depth, it’s critical to understand.

With spec gold-futuresshorts skyrocketing and investors hemorrhaging gold in sympathy, the goldstocks remained surprisingly resilient. During the first 5 weeks of this epic gold selling leading into lateJuly, gold plunged 6.1% from $1302 to $1223. Normally gold stocks leverage gold’s downside by 2x to 3x, but GDX andthe HUI only slid 4.8% and 6.3% in that span! Such relative strength certainly didn’t herald a capitulation.

I suspect the mainreason gold stocks weren’t down a normal 12% to 18% by then was most of theweak hands had long since exited this battered sector. Only the hardened contrarians remained, andthey rightfully weren’t worried about $1225 gold. Why? GDX’s major gold miners were reporting their Q2’18 all-in sustainingcosts, which would eventually average just $856 per ounce. $1225 remained very profitable.

But gold kept driftinglower still into late July as already-record-high spec gold-futures shortsballooned even higher. On August’sopening trading day, gold fell 0.6% to $1216 which was a fresh year-to-datelow. August is normally gold’s 4th-best month of the yearseasonally, enjoying big average gains of 2.2% in modern bull-market years! That mounting disconnect drove GDX and theHUI lower to $21.11 and 164.5.

That was right at GDX’smajor $21 support line that had held strong for over a year and a half, do-or-dietime technically. Complicating matters,GDX and the HUI were down 5.5% and 8.7% summer-to-date at that point. The major gold miners’ stocks were nearinglevels where tight stop losses wereset. Since this sector is so darnedvolatile, I’d define tight to loose as 10% to 25% trailing. Tight stops were within range.

Sectors always lookterrible technically and feel miserable sentimentally when they slide down neartheir major support zones. So even intothe first week of August there was no indication of an impending rare extremecapitulation plummeting. GDX wasstabilizing right around $21, despite gold drifting a bit lower. It closed between $1208 to $1213 in August’sinitial few trading days, and gold stocks largely held steady.

Considering the epicrecord-extreme gold-futures short selling and heavy differential-GLD-share selling,gold was holding up impressively well. As of August’s first Friday, gold had fallen 6.8% since mid-June onroughly 111.0k contracts of spec gold-futures shorting and a 4.1% GLDdraw. Those were the equivalent of 345.3and 33.9 metric tons of selling respectively! GDX and the HUI had only lost 6.6% and 9.6% in that span.

Again that wasrelatively light compared to gold, with gold stocks leveraging its fairly-bigsummer-to-date losses by just 1.0x and 1.4x. With all the information available even at that point, there was noreason to expect an extreme capitulation anomaly. Technicals and sentiment were on a precariousedge, but that’s the way they always look atmajor support approaches. Theyfinally started to give way Monday August 6th.

Gold fell another 0.5%to $1207 that day on speculators continuing to short sell gold futures. That must have been when tight stop lossesstarted to trigger, as GDX and the HUI both fell 1.2% that day. Despite gold bouncing 0.3% the next, thosegold-stock losses accelerated with 1.1% and 1.7% follow-on drops. That pushed GDX decisively under its strong $21 support for the first time, meaningmore than 1% below.

But even after thatsharp lurch lower, gold and the gold stocks again stabilized for the nextseveral trading days. While thecapitulation had started in hindsight, even as late as Friday the 10th it was impossibleto discern in real-time. Unfortunatelyit would hit with full force overnight the following Sunday, the dam of stoplosses breaking as heavy selling triggered them in rapid succession. The catalytic spark was quite odd.

The USDX had surgedstrongly in early August because of a mounting emerging-market-currency crisisled by Turkey. Month-to-date by Mondaythe 13th, the Turkish lira had cratered bynearly half! Turkey’s central bankwas getting desperate, so at 1am EDT it released a statement promising it would“take all necessary measures” to defend the lira. Among other things, it said it was ready torelease $3b worth of gold.

At $1209 that wouldrepresent 77.2t, a big slug of gold to hit markets fast. It wasn’t clear whether that central bankactually sold any gold or not, but within minutes heavy futures selling slammed gold. It plunged 1.5% to $1193 that Monday, breaking below $1200 for the firsttime since mid-March 2017. That isimportant technical and psychological support for gold, so seeing it falterunleashed serious gold-stock selling.

That day GDX and theHUI plunged 2.8% and 3.4% on stop losses being triggered. That continued the next despite a slight goldbounce, with additional 1.1% and 1.3% losses. Then on Wednesday the 15th at peak vulnerability, another 1.5% gold selloff on speculators’ extreme gold-futuresshorting hammered it down to a 19.3-month low of $1176. GDX and the HUI plummeted another 5.9% and6.1% that brutal day!

That extremelargely-mechanical forced selling persistedanother day as well with further 2.4% and 3.0% losses. In just 4 trading days, GDX and the HUI hadcollapsed 11.7% and 13.1%! That was afull-blown capitulation by any definition. The gold stocks hadn’t been lower since early February 2016. And down a catastrophic 18.7% and 22.8%summer-to-date, the great majority of stops had been triggered and executed.

Capitulation climaxes mark major, major bottoms because thoseextreme anomalous selloffs suck in and exhaust all available near-termselling. And that looked like the end ofit since gold and its miners’ stocks all enjoyed solid bounces over the next 4trading days. The radically-oversoldgold stocks soared 5.0% in both GDX and HUI terms in that span! Contrarian traders were increasinglyredeploying stopped capital.

That really should’ve cappedthe capitulation, but unbelievably in late August and early September somethingof an echo capitulation erupted. Gold once again slid under $1200 on specsadding even more shorts to their already-crazy-extreme pile. So over 7 trading days straddling the startof this month, GDX and the HUI plummeted another 7.3% and 8.4% to insane deepnew capitulation lows of $17.61 and 134.0!

Some of this wasnewly-deployed gold-stock trades in the heart of mid-August’s originalcapitulation getting stopped out again. That would mostly be the tight stops too restrictive for thissuper-volatile sector. With bearishnessoff the charts after that first capitulation plummet, there were virtually nobuyers in this echo one. So any sellingin individual gold miners on bad news mushroomed unchecked, it was a bloodbath.

This extremecapitulation anomaly left gold stocks radically oversold and wildlyundervalued, poised for a massive mean-reversion rally higher. SymmetricalV-bounces are common after capitulations, making them among thebest-possible times to back up the truck and buy low. Trading at miserable 2.6-year lows, thesefire-sale gold-stock prices weren’t fundamentally-righteous. Their operations remained very profitable.

At the major GDX goldminers’ average all-in sustaining costs of $856 per ounce in Q2, they were stillcollectively earning strong profits of $339 per ounce at $1195 gold! These are hefty 28% margins that mostindustries would kill for. Yet goldstocks were priced as if they were spiraling into bankruptcy, it was crazy. The major gold miners’ Q2’18 fundamentals were quite strong, so super-low stockprices aren’t righteous.

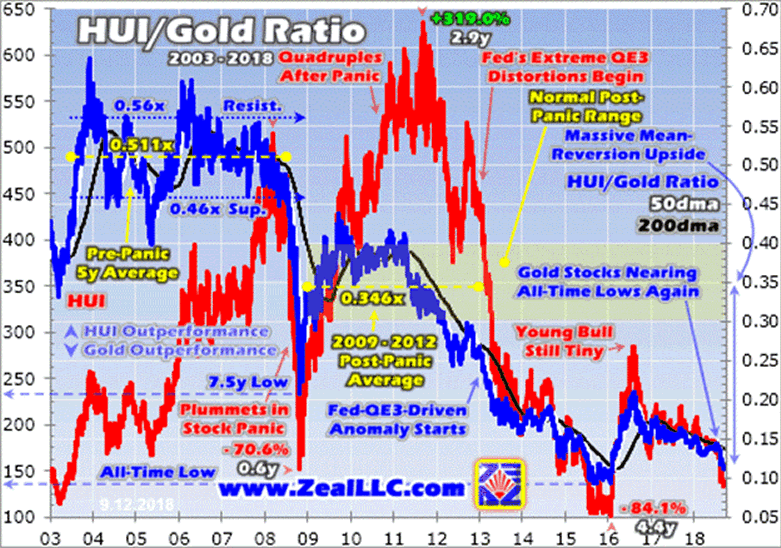

A great fundamentalproxy for gold-stock price levels relative to prevailing gold prices is theHUI/Gold Ratio. It distills down thecore relationship between gold prices, gold-mining profitability, andgold-stock prices. Thanks to thestunning capitulation selloffs over this past month, the gold stocks are nowalmost as undervalued relative to gold asthey’ve ever been. This week the HGRplunged down to just 0.112x!

That’s way below the0.207x seen at worst in late 2008’s first-in-a-century stock panic, themost-extreme fear event of our lifetimes. After that extreme sentiment anomaly that wasn’t justified fundamentally,the gold stocks more than quadrupled. Over the next 2.9 years GDX and the HUIskyrocketed 307.0% and 319.0% higher! Extreme lows in gold-stock prices relative to gold simply aren’tsustainable fundamentally.

The all-time-low in theHGR of 0.093x was last seen in mid-January 2016. That’s actually not much lower than today’scrazy levels. Gold stocks again soaredout of that extreme anomaly, with GDX and the HUI enjoying huge gains of 151.2%and 182.2% in just over a half-year! Onceagain today we are faced with an extreme situation that can’t lastforever. Gold stocks must and will mean revert dramatically higher.

And their potentialupside from extreme capitulation lows is huge. From 2009 to 2012 after that stock panic, the HGR averaged 0.346x inthose last normal years before the Fed’s QE3 levitated the USstock markets. Assuming gold staysaround $1200, that implies gold stocks ought to mean revert far higher toaround 415 in HUI terms. That’s a triple from here, and conservativelyassumes no overshoot or gold rally.

Mean reversions out ofextreme lows seldom stop at the averages, but surge on towards the oppositeextreme. That implies a much-higher HGR the next time goldstocks are really back in favor. Andgold is heading way higher too on the proportional extreme gold-futures short covering inevitable after the epic record shorts that fueled the recent gold plunge. Higher gold prices make for much-greatergold-stock upside.

There’s no sector inthe world more hated and thus more undervalued than gold stocks today. Yet they just like all stocks must ultimatelytrade at reasonable multiples of their underlying earnings. When gold starts powering higher consistentlyagain, likely on long-overdue stock-marketweakness, the gold stocks will start returning to favor. Their prices will rapidly regain groundrelative to gold as investment floods back in.

While it’s hard to buylow after a capitulation when bearishness is suffocating, that’s when fortunesare won. The gold stocks are a coiledspring ready to explode higher again after years of neglect, probably the bestcontrarian investment in all the markets. While inherently-unpredictable capitulations are very hard to weatherpsychologically, their aftermaths areexceedingly bullish since stock prices get dragged so low.

While investors and speculators alike cancertainly play gold stocks’ coming mean reversion with the major ETFs like GDX,the best gains by far will be won in individual gold stocks with superiorfundamentals. Their upside will farexceed the ETFs, which are burdened by over-diversification and underperformingstocks. A carefully-handpicked portfolioof elite gold and silver miners will generate much-greater wealth creation.

At Zeal we’ve literally spent tens of thousands of hours researchingindividual gold stocks and markets, so we can better decide what to trade andwhen. As of the end of Q2, this hasresulted in 1012 stock trades recommended in real-time to our newslettersubscribers since 2001. Fighting thecrowd to buy low and sell high is very profitable, as all these trades averagedstellar annualized realized gains of +19.3%!

The key to this success is staying informed and beingcontrarian. That means buying low whenothers are scared, before undervalued gold stocks soar much higher. An easy way to keep abreast is through ouracclaimed weekly and monthly newsletters. They draw on my vast experience, knowledge,wisdom, and ongoing research to explain what’s going on in the markets, why,and how to trade them with specific stocks. Subscribe today, forjust $12 an issue you can learn to think, trade, and thrive like contrarians!

The bottom line is goldstocks just suffered a brutal capitulation selloff. These extreme anomalies are very rare andinherently unpredictable. Epic recordgold-futures short selling pushed gold low enough to unleash cascading forcedstop-loss selling in the gold stocks, pummeling them to deep lows. But these resulting gold-stock prices areradically-oversold and wildly-undervalued, certainly not justifiedfundamentally.

While very challengingpsychologically, the aftermath of capitulations is exceedingly bullish. They suck in all available near-term selling,leaving nothing but buyers to propel sharp mean-reversion rebounds. The technicals and sentiment spawned bycapitulations are so extreme they usually birth massive uplegs and entire bullmarkets. Contrarians willing to deploycapital when few others will can earn fortunes out of such lows.

Adam Hamilton, CPA

So how can you profit from this information? We publish an acclaimed monthly newsletter, Zeal Intelligence , that details exactly what we are doing in terms of actual stock and options trading based on all the lessons we have learned in our market research. Please consider joining us each month for tactical trading details and more in our premium Zeal Intelligence service at … www.zealllc.com/subscribe.htm

Questions for Adam? I would be more than happy to address them through my private consulting business. Please visit www.zealllc.com/adam.htm for more information.

Thoughts, comments, or flames? Fire away at zelotes@zealllc.com . Due to my staggering and perpetually increasing e-mail load, I regret that I am not able to respond to comments personally. I will read all messages though and really appreciate your feedback!

Copyright 2000 - 2018 Zeal Research ( www.ZealLLC.com )

Zeal_LLC Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.