Gold Stocks' Remain Exceptionally Weak Even as Stocks Rise / Commodities / Gold & Silver Stocks 2024

Calm before the storm, anyone?

Turning Points Ahead

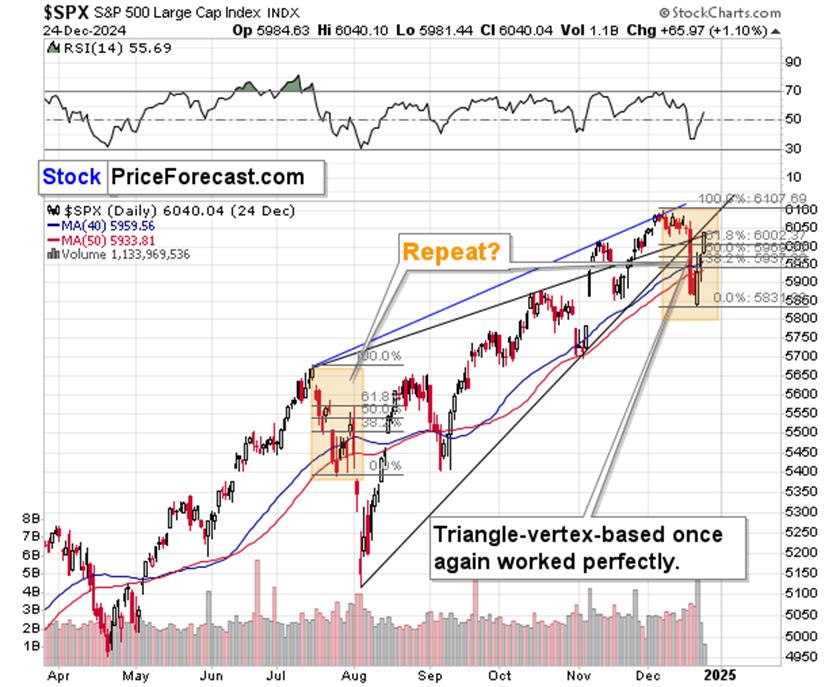

So far, this week has been calm.However, as you read in my previous analysis, the turning points are near andwe still have four more sessions before the end of the year. Bitcoin justfailed to move above $100k again, and it is declining in the pre-markettrading, and S&P 500 futures are down as well. Time will tell if that wasthe beginning of a bigger downturn, or will we still have to wait for it tostart.

The calmness of the week means that Ihave nothing new to report in case of the outlook for GDXJ, [new asset where wehave a profitable short position], and FCX. And the same goes for gold, silver,and the USD Index.

All three of the assets where we haveshort positions have paused recently, and since it happened after a sizable move lower, it’s a completely naturalphenomenon.

In the case of the FCX, it’s after abreakdown below the head and shoulders pattern, which means that the currenttiny move us is perfectly in tune with the likely post-H&S pattern action, and it only confirms the very bearishoutlook.

In the case of the GDXJ (and GDX), we seethe back-forth movement is taking place below their November lows, which means that the breakdown belowthem was just verified.

In the case of the [new asset where wehave a profitable short position], we have the same thing, with the additionalnote that it is much weaker as it fell well below its November lows andcurrently didn’t manage to move closer to them.

Also, please note that all the above ishappening (or actually, not happening), while the general stock market movedhigher recently.

This means that all the above-mentionedshares are NOT following stocks higher right after they DID follow them lower,magnifying their declines. This is aconfirmation that we correctly chose the proxies to profit from the declines inin stocks and in the precious metals sector.

Having said that, I think it would be agood time to revisit the weekly chart (based on weekly candlesticks) featuringgold and GDXJ to put things into perspective. It’s just one chart, but it’svery rich in signs and clues.

Impending Move Lower

All right, where do we begin…

Let’s start with the breakdowns. Both:gold and GDXJ broke below their rising red support lines. It wouldn’t be asimportant as it is if it wasn’t for the verifications of those breakdowns. Inboth cases, we saw prices move back to the rising support lines, verifying themas resistance and then declining once again. This is a powerful indication thatthe trend changed and it’s now down.

Another clue is the generalunderperformance of mining stocks compared to gold. It’s obvious even at thefirst sight – while gold is hundreds of dollars above its 2022 high, minersjust invalidated their move above it. On a short-term basis, we see that minersbroke below their November lows, while gold didn’t do so (yet).

This is a sign suggesting that:

This might also mean that some peoplemight prefer a strategy where they own gold (and perhaps makepassive income on it), but short mining stocks to hedge the aboveposition (just my opinion, not investment advice).

One interesting thing is that minersmoved up strongly relative to gold right at their top. This is a very specificexception from the rule that confirms it that is known to few. Namely, minersare weak before the trend changes, but right before that happens theirvolatility increases once again. We saw that at the 2016 bottom, where minerswere first strong and held up well, but when they finally broke to new lows itwas a bear trap.

What we saw at this year’s top was likelya bull trap.

The next thing is the way in which goldtopped recently and at the yearly top. In both cases, it was a clear reversal.This meant tops multiple times in the past, and I marked that on the chart. Moreover,the most recent reversal took place on a relatively big volume, which confirmedthe bearish outlook.

So yes, a bigger move lower is coming inthe case of the precious metals market and GDXJ and [new asset where we have ashort position] (and FCX, due to its own reasons) are poised to declineprofoundly based on it. The first targets are as I’ve been outlining them, butit’s likely that all they will manage to do is to trigger a correction, not anew big rally.

Ifgold moves to $2,500 during this short-term decline, I’ll be leaning towardopening a long position then, but it’s too early tosay with 100% certainty and to say which instruments I’ll use. During theprevious long trade, I used GDX (weentered on Nov. 14 and tookprofits on Nov. 21, and we entereda short position in GDXJ on the next day) , which may or may not bethe case this time.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.