Gold, Stocks & The Pandemic: A Powerful Contracyclical Play In Action / Commodities / Gold & Silver 2020

While the use of gold to protectagainst inflation is well known, it has other investment attributes that arepotentially even more valuable, and this is particularly true in times of crisis.

In this analysis, we will examine therelative performance of gold and stocks (as represented by the S&P 500)between early February and late May, as the coronavirus pandemic and theresulting economic shutdowns transformed global economies and markets.

The short term relationship that wewill find is an almost perfect match with what fifty years of financial historyshows us is perhaps gold's most valuable investment attribute over the longterm, which is its contracyclical relationship with stock prices.

This analysis is part of a series ofrelated analyses, which support a book that is in the process of being written.Some key chapters from the book and an overview of the series are linkedhere.

Creating The Gap

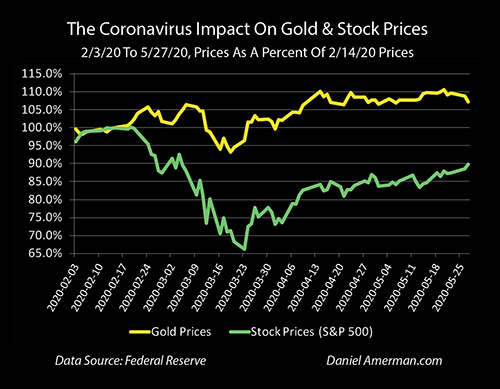

The above graph shows price movementsfor gold and stocks (as represented by the S&P 500) since February 3rd of2020. The prices are in percentage terms, with 100% equaling the market closeson February 14th, which were $1,581 an ounce for gold (London exchange) and 3,380for the S&P 500 index.

Both gold and stock prices wererelatively stable at around 100% until February 24th, when escalating fears ofthe coronavirus pandemic led to a sharp downturn in stock prices. At that exactsame time - gold prices began rising.

The S&P plunged to 2,237 by March23, 2020, a decline of 34%. Gold prices reached $1,748 an ounce by May 20th, anincrease of almost 11%.

The relationship is not perfect on aday to day to basis. But nonetheless, a widening gap appeared - and persisted -between gold and stocks. This gap between the green and gold lines is a veryshort term example of a very powerful long term relationship between gold andstocks, which is not about inflation, and is arguably the single most valuableadvantage to owning gold as an investment.

At the end of February, I was alsojust releasing some new research that was based on detailed study of therelationship between gold and stocks over the fifty years between 1969 and2019. One of the most important things that I found - was a long term graphthat looks a great deal like the recent short term graph of gold and stockprices.

As a starting point, the monthlyrelationship between gold prices and stock prices is not that strong, and evenwhen we look at it on annual basis with historical prices - the relationship isnot compelling.

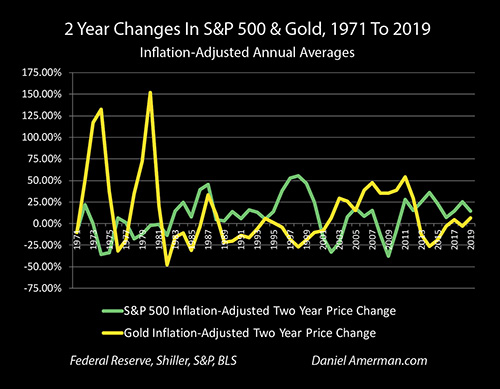

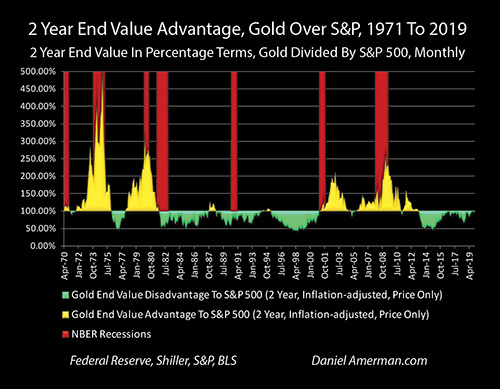

However, when we take six analyticalsteps, as explored one by one in Chapter Nineteen (link here), then avery strong contracyclical relationship between stocks and gold can be found, as shown in the graph above.Two of the most important steps are to strip out inflation from both gold andstock prices, and to move to a longer term, 2 year comparison period (the firstcomparison period in the graph above is the 2 years of 1969 to 1971).

When we take those steps, then aseries of gaps appear - and they usually move the opposite directions. When thegreen line of inflation-adjusted stock prices is moving up - the gold line ofinflation-adjusted gold prices is usually moving downwards, and a gap opens up.When the gold price line is spiking up - the green line of inflation-adjusted stockprices is moving downwards and a gap opens up. So what we are seeing withrecent price movements and the gap opening up as stocks remain down while goldremains up, is a very short term example of strong, fifty year relationship.

Contracyclical Rewards & Penalties

When we look at contracyclical assetssuch as stocks and gold, then which asset class one is invested in, for anyphase of the cycle, is of critical importance.

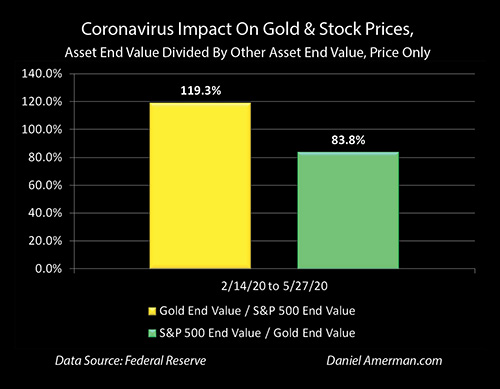

As of May 27th, someone who investedin gold would have had 107.2% of the value of their starting investment onFebruary 14th. Someone who was invested in the S&P 500 would have had 89.8%of their starting investment (price only) - even after the strong stockcomeback that was fueled by a fantastic degree of monetary creation by theFederal Reserve.

So, someone who was in thecontracyclical asset of gold would have been 119.3% better off than if theywere in stocks, the value of their investments would have been almost 20%higher (107.2% / 89.8% = 119%).

Conversely, if someone had chosenstocks over gold, then they would have had only 83.8% of the money they wouldhave if they had made the opposite choice. (89.8% / 107.2% = 84%).

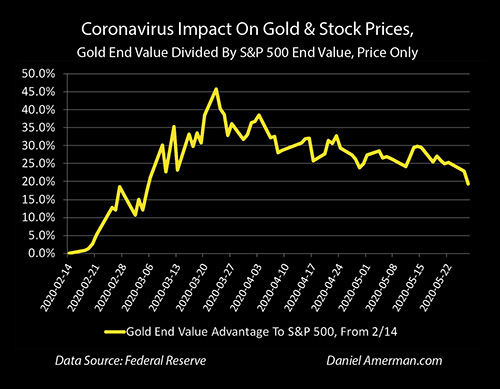

When we track this relative advantageto holding the contracyclical asset of gold over stocks on a daily basis duringa down cycle for stocks, then as shown above, the relative advantage to owninggold over stocks peaked at 46% on March 23rd, the same day that the stock lowfor the period was reached. For that first critical month after the breakbetween the contracyclical assets appeared, someone who held gold instead ofstocks would have had 46% more assets on the peak day.

Again, this is a very short termexample of a much longer term relationship. During this time of dramaticchange, gold and stocks followed their fifty year script very well indeed. Inmore ordinary times, when there aren't major changes, then daily and weeklychanges can look almost random.

So what the extraordinary events ofFebruary to May did was to cast an intense spotlight on a very strong long termrelationship, and make unusually visible what that relationship is in whatcould be called more or less real time.

When we do move to a longer termperspective, then what my research shows is that the relationships become notonly much more reliable, but also much more financially critical, with relativeadvantages or disadvantages that vastly exceed a "mere" 46% or 20%difference.

Seeing The Long Term Power

The graph above compares the advantagesor disadvantages in being to gold relative to stocks over 50 years, on aninflation-adjusted, rolling two year basis. For instance, January of 2000 toJanuary of 2002 would be one comparison, February of 2000 to February of 2002would be the next, and so forth.

As previously developed in the shorterterm analysis, if gold had gone from100% to 120% over the two years on aninflation-adjusted basis, while stocks had gone from 100% to 80%, there wouldhave been a 50% advantage to being in gold for that period (120/80 = 150%), andthat would show in the gold area above of advantages to gold. Conversely, ifgold had gone from 100% to 80%, while stocks went from 100% to 120%, thensomeone would had only 67% of the ending assets relative to the stock investorand that would show as a disadvantage in the green area.

Using this methodology allows one to plainlysee that the relationship between gold and stocks is not only contracyclical,but it is secular, with long term and almost entirely consistent advantages toowning one asset over the other.

With the first secular cycle, almostevery two year comparison favors gold, meaning the trend was sustained for overa decade. So it isn’t just that gold strongly outperformed stocks (price only)over the 11 years from 1969 to 1980, but there was a very strong consistency toit.

The advantage shifted to stocksstrongly outperforming gold with an almost equal degree of consistency from1980 to 2000. Then from 2000 to 2012 there was a sustained and highlyconsistent rolling two year advantage of holding gold over stocks. And from2012 through 2019, there was an almost completely consistent rolling two yearadvantage to holding stocks over gold.

When we look back over the last fiftyyears, and look at the full secular cycles, then we see a historicalrelationship that dwarfs what we have seen even in the dramatic changes of thelast few months.

This understanding of long term isessential, when it comes to properly understanding the recent short term.

Someone who is focused on short termdecisions might look at the chart repeated above, and say "whoops, missedit, but it is in the past now as the stock market improves based upon promisesof massive Federal Reserve monetary creation funding extraordinary levels ofasset purchases and stimulus spending." And for the short term, that couldvery well turn out to be true.

However, if this wild and crazyexperiment of shocking the whole world out of a government induced severerecession / potential depression simply through creating vast sums of money -which has never worked before, there is no precedent - were to not work out inpractice, then we could have a genuine secular turn in the cycles, as we haveseen four times in the last fifty years.

If this does turn out to be the case -missing the initial 20% is nothing.

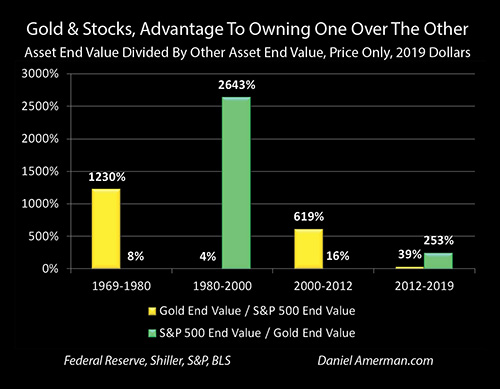

As can be seen in the "Gold &Stocks, Advantages To Owning One Over The Other" graph, the first cyclefavoring gold produced a 1230% advantage to owning gold over stocks (on a priceonly basis). This overwhelming advantage steadily built over the entire 11years, and the 20% advantage to gold we are seeing in the current market isonly 1.6% of what the long term advantage turned out to be. (And yes, there isa counterpoint that someone who had 20% more initially invested, would end upwith 20% more 11 years later, but the point is that the overwhelming majorityof the relative gains occurred over the long term and not on the front end.)

Another way of looking at it, as cannot quite be seen with the invisible green bar on the left, is that someone whohad stuck to their belief system of stocks being better than gold over thatsecular cycle would have ended up with 8% of the assets from price changes,that they otherwise would have.

If we look at the second secular cycleof buying stocks over gold that started in 2000 and lasted until 2012, which initiallyinvolved picking up gold at an annual average price of $279 an ounce in 2000,even as the tech stock bubble was reaching its peak, then the 12 year advantageof gold over stocks was 619%. The recent 20% advantage is only 3.2% of the 12year total advantage.

Conversely, someone who had stuck totheir guns on stocks over gold over the 12 years would have had 16% of theending assets relative to the opposite choice, on a price basis.

Now, it would be easy for someone todismiss this as mere cherry picking the best comparison period with 20/20hindsight, but that is not at all the case, and misses perhaps the mostinteresting - and practically usable - part of my research.

As covered in much more detail in ChapterNineteen, and as can be seen in the graph repeated above, the great majority ofthe relative advantage to gold over stocks was not produced in the first twoyears, but on a steady basis over time.

Most of the graph area above is goldthrough 1980, meaning a rolling two year advantage to gold over stocks. Therewere 234 two year relative price comparisons on a rolling basis over thoseyears, and 213 of those periods favored gold over stocks, while only 21 favoredstocks over gold. The advantage built, and built, and built with a remarkableconsistency over the long term, long after the initial two years had passed(let alone the first three months).

When we look at the second secularcycle favoring gold over stocks, there were 143 rolling two year pricecomparisons, 131 of those favored gold over stocks, and only 12 favored stocksover gold. Again, there was a remarkable degree of consistency in the way the619% total advantage built over the long term, with the great majority of therelative advantage occurring long after the tech stock bubble.

It is only when we understand thatlong term perspective, that we can properly place in context the initial graph inthis analysis (repeated above). This isn't about certainty, and it isn't aboutan opportunity that has already passed. What we have is a remarkable and boldlyvisible signal, to be evaluated, of what could be ahead for potentially manyyears to come.

We may be in the earliest stages of asecular change in the cycles. Some people consider the combination of thepandemic shutdowns, the government-ordered destruction of so many jobs andsmall businesses, along with the fantastic increase in government deficit spendingbeing funded by reserves based monetary creation - to be a once in a lifetimeevent, that will lead to once in a lifetime financial changes, something thatwill be just off the scale. That could be.

However, the bar isn't even close tobeing that high. What history unmistakably shows us is that it doesn't take aonce in a lifetime event for gold prices to dominate stock prices for a decadeor more. When we look at the secular cycles, my research shows that they havein practice favored gold prices for 23 of the last 50 years, or 46% of thetime. That means that a secular cycle favoring gold is not only reasonablynormal, but such cycles account for almost half of the last fifty years. Thisalso fits very well with the Chapter Two update (link here), that lookedback over the years and established that the purportedly impossible toanticipate events that no reasonable investors could have been invested for -are in fact the dominant theme of economic and financial history, and not theaberrations.

Opposition & Alignment

We are all going down an economic andfinancial path that we have never gone down before, and the chances are that weare just getting started - the largest price movements and the biggest gainsand losses are likely all still ahead of us in the coming years.

The critical component at this stageis monetary creation by the Federal Reserve. Succinctly put, if the Fed werenot using reserves based monetary creation - something they had never donebefore 2008 - to get the money to lend to the corporations and to fund thestimulus spending by the Federal government - the United States would currentlybe in a state of full blown economic collapse.

Without the "Fed put",stocks would likely be off 60% or more at this stage - as they naturally should be with a pandemic and economic shutdown, ifwe had a true free market that was not addicted to Federal Reserveinterventions. The United States government is already effectivelybankrupt, it doesn't even remotely have the money to send to taxpayers, or toincrease unemployment insurance payments or to lend to companies. Thegovernment can't raise taxes in the midst of a new recession, or it would makethe situation even worse - so it has to borrow, massively. For the governmentget the vast new sums of money to fund stimulus spending directly from theprivate sector, would require paying higher interest rates, which would itselfseverely damage stock prices, bond prices and real estate prices.

So, what investment prices in almostall categories are currently based upon is a cornered and desperate UnitedStates government and Federal Reserve creating trillions of new dollars - atartificially low interest rates - and effectively just throwing them atindividuals, companies and markets on a scale sufficient to keep the systemfrom falling apart. This has never been done before, not on this scale or in thismanner, and there is no precedent to show that it will work in preventingrecession - or pulling the economy out of recession. If they fail, then we haveoverwhelming historical evidence to support the belief that we will move to asecular counter-cycle, and that the contracyclical asset of gold will again stronglyoutperform stocks on an inflation-adjusted price basis, year, after year, afteryear.

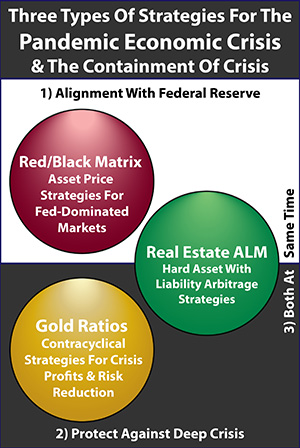

This well proven use of gold toeffectively hedge against Fed failure and secular bear markets in financialassets is represented by the golden circle in the dark bottom half of thegraphic above. One fundamental strategy for the pandemic economic crisis is toinvest a portion of one's assets to protect against a deepening of the crisis(ideally in a ratio and/or rebalancing strategy that that has historicallygreatly reduced the risks while still keeping much of the upside).

However, there is an entirelydifferent fundamental strategy - that interestingly enough has been almostexactly as effective as gold since the pandemic breakout occurred. Thisstrategy is represented by the lighter half, that of alignment with the FederalReserve, and the red circle.

The philosophy behind that strategy isthat if the financial system has moved to a place where all the markets aredominated by Federal Reserve interventions and monetary creation - as theyhave, even before the pandemic but particularly since then - then investorsshould seek to understand how asset prices move in response to Fed actions, andposition themselves accordingly. The objective here is to align one's assetswith the real situation, and to benefit from how the Fed distorts the markets.

This type of strategy is the main coreof the free book, and as I plan to explore in my next analysis, one aspect ofthat strategy of alignment - that is based on the direct opposite of agold-based strategy - has produced highly desirable results in recent monthsthat are remarkably close to those produced by gold.

Learn more about the rest of the freebook.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2020 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.