Gold Stocks Under Pressure, But Bulls Still In Charge

Gold mining stocks are subject to weakening internal momentum.

A stronger U.S. dollar is also putting pressure on the mining stocks.

Intermediate outlook for gold and gold stocks is still bullish, though.

Although the price of gold has stubbornly pushed higher in the face of a strong dollar, gold mining stocks are finally showing signs of weakness after a huge summer rally. Profit taking was clearly in evidence this week as the benchmark U.S. gold stock index pulled back sharply in the face of a temporary lull in the trade war, as well as a stronger U.S. currency. In today's report, I'll explain why some additional weakness will likely be seen among the gold stocks. I'll further make the case that this weakness should be greeted as a welcome sign by gold stock bulls since it cools off an overheated market and paves the way for higher prices this fall.

After hitting a 6-year peak earlier this week, gold prices have been subject to considerable volatility as news headlines alternate between positive and negative. President Trump announced an extension of his threatened tariff hike against Chinese imports and this led to a sharp intraday decline in gold futures prices on Aug. 13. However, fresh new fears over a global growth slowdown - along with a collapse of Argentina's currency - also served as support for gold prices on Aug. 14. Thus, gold has to contend with cross-currents in the immediate term which will likely limit its upside potential while also keeping its overall rising trend intact.

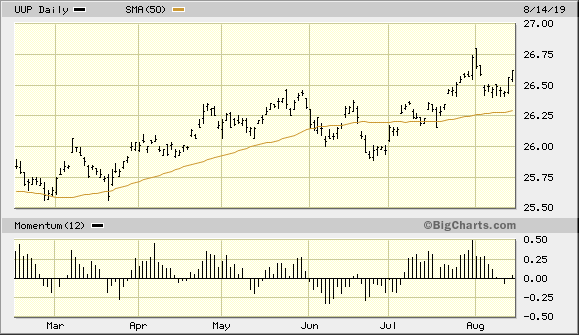

Another factor which will likely serve to limit gold's rallies in the very near term is the latest strength in the U.S. dollar index. The Invesco DB U.S. Dollar Index Bullish Fund is a clear reflection of what's happening in the dollar index right now. After teasing a test of its 50-day trend line last week, UUP has since firmed up and is very close to its yearly high. In days when the dollar has risen, gold prices have shown varying degrees of weakness but have largely ignored the dollar's strength. Gold mining stock prices have been much more sensitive to U.S. currency strength, however, a point I'll expand on later in this report.

Source: BigCharts

Unlike the dollar index, the gold price has clearly become over-extended from its 50-day moving average as of mid-August. This is an important consideration from both a technical and a psychological perspective since many traders and investors attach significance to this particular trend line. The following graph of the December gold price shows the extent to which the gold price has over-stretched from the 50-day MA.

Source: BarChart

Normally, whenever the gold price is $75-100 above the 50-day MA, a pullback in the gold price soon follows. Otherwise, gold prices will tend to go sideways and consolidate as the 50-day trend line "catches up" to gold's price line. If gold continues to rally from here, however, and become increasingly distended from the underlying 50-day MA, it will drastically increase the odds of a sharp decline due to the market becoming overheated. Ideally, gold's rate of ascent will at least slow down if not stop altogether before the "overbought" market condition becomes a serious problem for the yellow metal. This especially holds true now that gold has lost some of its immediate safe-haven demand due to the diminished threat of higher trade tariffs against China.

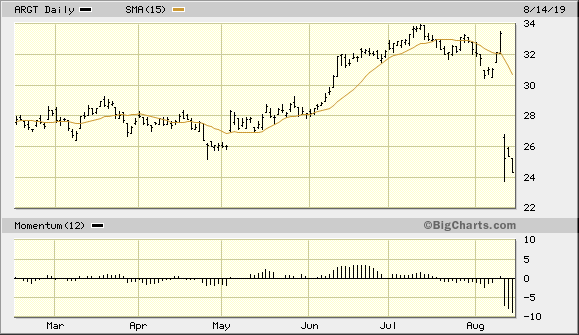

Despite the temporary reprieve for investors regarding the U.S.-China trade dispute, gold isn't completely without psychological support, however. In recent days, there have been protests and heightened tensions in Hong Kong which have served to bolster gold's flagging fear factor. As well, the aforementioned weakness in Argentina's currency has also kept gold's main uptrend intact despite the overbought nature of the gold price. Argentina's stock market has also come under serious selling pressure of late, as can be seen in the following graph of the Global X MSCI Argentina ETF (ARGT). This is another reason why gold will still likely retain its safety bid this summer despite the de-escalation of the U.S.-China trade dispute.

Source: BigCharts

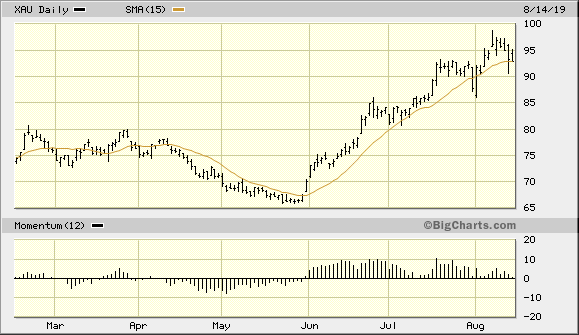

The stocks of the major U.S.-listed firms which mine and process gold are now experiencing selling pressure, however. This can be seen in the following graph of the PHLX Gold/Silver Index (XAU), which is the benchmark for U.S. precious metals mining companies. The XAU is now testing its 15-day moving average and may end up closing below this important immediate-term (1-4 week) trend indicator. A weekly close below the 15-day MA would tell us that the XAU's immediate-term uptrend has finally been broken after remaining inviolate on a weekly basis since early June.

Source: BigCharts

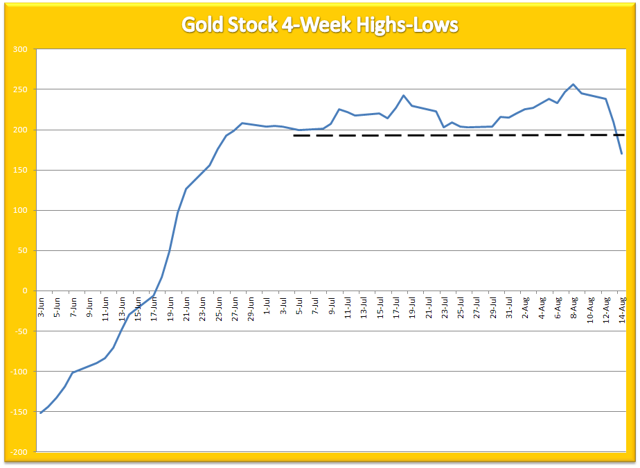

Meanwhile, the internal condition of the actively traded gold stocks continues to weaken on a near-term basis. Shown below is the 4-week rate of change (momentum) of the new highs and lows among the 50 most actively traded U.S.-listed mining shares. Not only has the rate of ascent in this indicator slowed significantly, but the indicator is also starting to diverge lower. What's more, the rising trend of this internal momentum indicator has been reversed as shown by the breakdown below the dashed horizontal line.

Source: NYSE

It's also worth pointing out that in recent days, the number of gold stocks making new quarterly highs has dried up while new lows have gradually increased. Examples of stocks making new quarterly lows - or on the verge of making new lows - include Buenaventura (BVN), Freeport-McMoRan Inc. (FCX), Teck Resources (TECK), and Polymet Mining (PLM). What these stocks have in common is a significant exposure to copper, zinc, and other base metals aside from gold mining operations. The weakness in the base metal/industrial metal component of the gold mining stocks is one reason for the latest slowdown in the precious metals mining sector.

Ideally, we should see some recovery in these aforementioned stocks before it's time to start initiating new long positions again in individual gold mining stocks. However, preliminary indications suggest that the latest pullback in the mining shares is merely corrective in nature and not the start of a new bear market. As long as the gold price can remain above its rising 50-day moving average, gold stocks should also ultimately follow gold's rising path in the coming months.

In summary, while gold will likely test its immediate-term trend line - specifically the 15-day moving average - in what I anticipate will be an important "fear factor" test for gold, the metal's dominant intermediate-term (3-6 month) trend should remain intact based on continuing global growth concerns. Gold mining stocks should also eventually benefit from continued safe-haven gold demand once the latest volatility in the mining shares has ended and late-arriving bulls have been shaken out of the market. This prognosis is based on the leverage factor which the mining shares enjoy when gold remains in demand as a safety hedge. Investors are, therefore, justified in maintaining intermediate-to-longer-term investment positions in gold and gold ETFs, as well as gold mining stocks.

On a strategic note, I'm currently long gold via the VanEck Vectors Gold Miners ETF (GDX). For this ETF, I'm using a level slightly under $27.00 as a stop-loss on an intraday basis. Participants who haven't done so should also book some profit in GDX after its impressive run of the last few weeks.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts