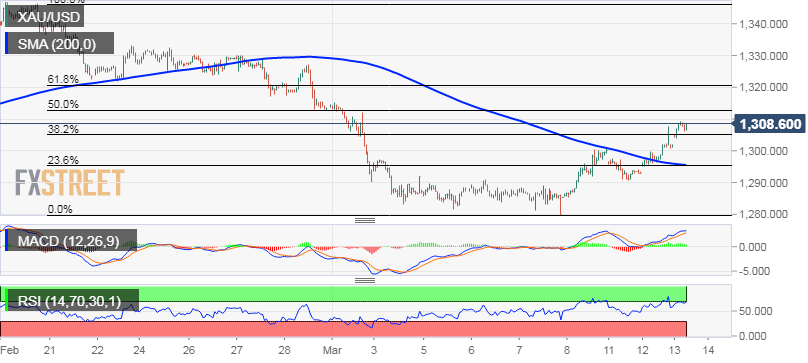

Gold Technical Analysis: Bulls remain in control, now targeting 50% Fibo. resistance around $1313 area

• The precious metal built on its recent bullish trajectory from six-week lows and continued gaining traction on Wednesday, marking the third day of positive momentum in the previous four.

• The overnight sustained move above a confluence resistance - comprising of 200-hour SMA and 23.6% Fibo. level of the $1347-$1280 recent downfall was seen as a key trigger for bullish traders.

• The fact that the commodity has found acceptance above 38.2% Fibo. level support prospects for further up-move, though slightly overbought conditions on hourly charts might cap gains.

• Meanwhile, oscillators on the daily chart have just started gaining positive momentum and might prompt dip-buying interest for a move towards 50% Fibo. level around the $1313-14 region.

XAU/USD

Overview: Today Last Price: 1308.16 Today Daily change %: 0.53% Today Daily Open: 1301.3Trends: Daily SMA20: 1311.59 Daily SMA50: 1303.15 Daily SMA100: 1269.06 Daily SMA200: 1238.14Levels: Previous Daily High: 1302.15 Previous Daily Low: 1292.97 Previous Weekly High: 1300.7 Previous Weekly Low: 1280.1 Previous Monthly High: 1346.85 Previous Monthly Low: 1300.1 Daily Fibonacci 38.2%: 1298.64 Daily Fibonacci 61.8%: 1296.48 Daily Pivot Point S1: 1295.46 Daily Pivot Point S2: 1289.63 Daily Pivot Point S3: 1286.28 Daily Pivot Point R1: 1304.64 Daily Pivot Point R2: 1307.99 Daily Pivot Point R3: 1313.82

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.