Gold Technical Analysis: Rejected at 4H 200MA, hourly RSI diverges in favor of bears

By Omkar Godbole / March 14, 2019 / www.fxstreet.com / Article Link

Gold jumped to 4-hour 200-candle moving average (MA) of $1,311 earlier today, as expected, but failed to take out the key hurdle and is currently trading at $1,308.

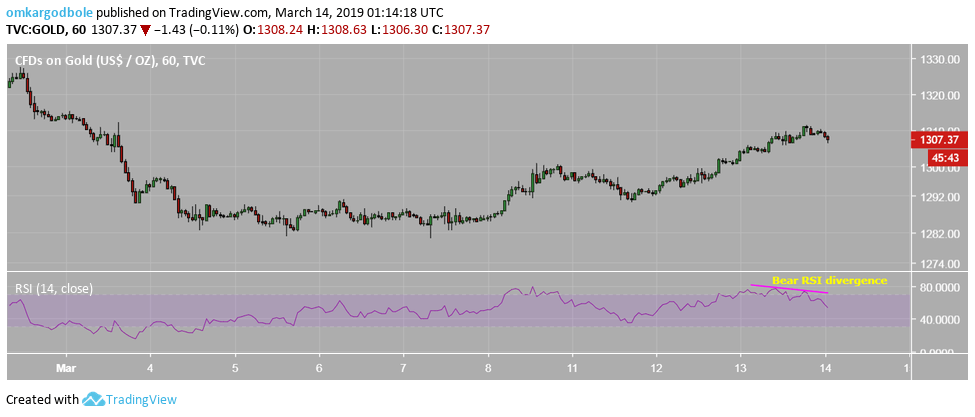

The hourly chart relative strength index (RSI) has rolled over from the overbought territory, creating lower highs in favor of the bears.

Meanwhile, rejection at the 200-candle MA has strengthened the bearish case put forward by the negative crossover of the 100- and 200-candle MAs on the 4H.

The yellow metal, therefore, could see a minor pullback to $1,303-$1,300 levels. A break above the 4H 200-candle MA of $1,311 is needed to revive the bullish view.

4-hour chart

Hourly chart

Trend: Pullback likely

R3 1326.55 R2 1319.67 R1 1314.4 PP 1307.52 S1 1302.25 S2 1295.37 S3 1290.1Recent News

Immediate trigger for crash was new Fed Chairman pick

February 02, 2026 / www.canadianminingreport.com

Gold stocks slump on metal price decline

February 02, 2026 / www.canadianminingreport.com

Is the gold market starting to turn 'irrationally exuberant'?

January 26, 2026 / www.canadianminingreport.com

Gold stocks explode up as equity markets languish

January 26, 2026 / www.canadianminingreport.com

Gold stocks outpace flat large caps

January 19, 2026 / www.canadianminingreport.com

-636881229404221043.png)